#FREETIPS

For new followers ...

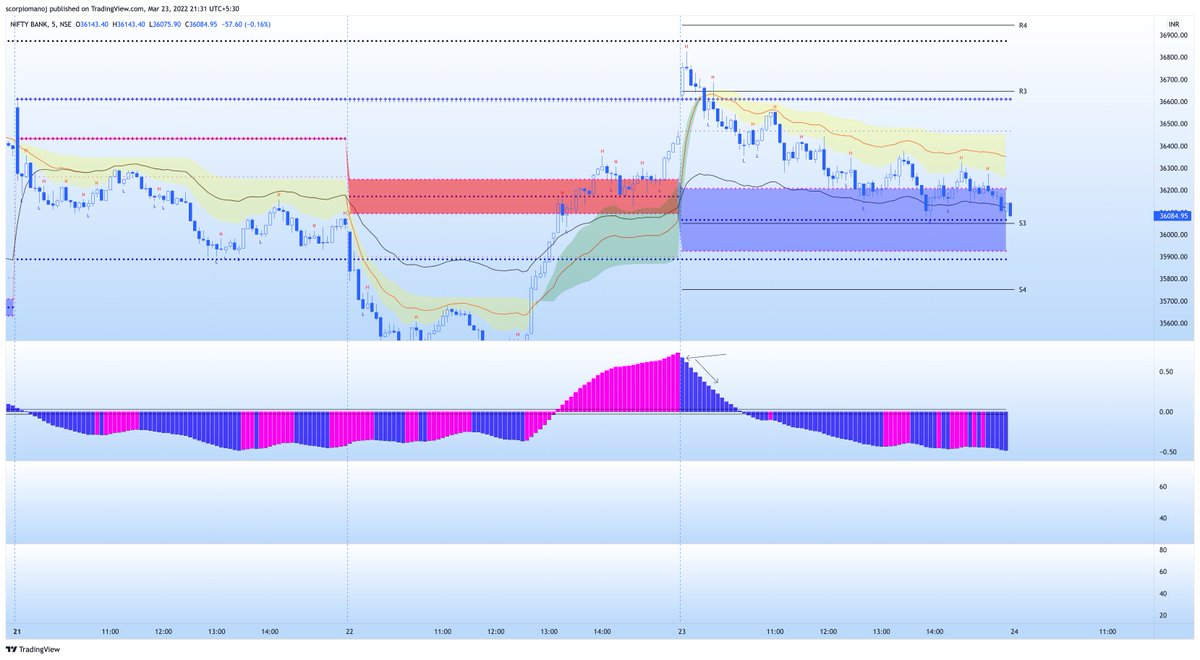

If u r a pivot based intraday trader, u should have this cheat sheet. Follow this and C. Your wrong trades will reduce considerably. Good luck.

#FREETIPS

— ScorpioManoj (@scorpiomanojFRM) April 1, 2022

Pivot Rules snapshot

A free one page cheat sheet for pivot based trading that could probably be sold for a hefty price ....

Rem: This is just a broad set of rules. There are many advance rules more than this. pic.twitter.com/FnzmGGKx0P

More from ScorpioManoj

More from Screeners

Covering one of the most unique set ups: Extended moves & Reversal plays

Time for a 🧵 to learn the above from @iManasArora

What qualifies for an extended move?

30-40% move in just 5-6 days is one example of extended move

How Manas used this info to book

The stock exploded & went up as much as 63% from my price.

— Manas Arora (@iManasArora) June 22, 2020

Closed my position entirely today!#BroTip pic.twitter.com/CRbQh3kvMM

Post that the plight of the

What an extended (away from averages) move looks like!!

— Manas Arora (@iManasArora) June 24, 2020

If you don't learn to sell into strength, be ready to give away the majority of your gains.#GLENMARK pic.twitter.com/5DsRTUaGO2

Example 2: Booking profits when the stock is extended from 10WMA

10WMA =

#HIKAL

— Manas Arora (@iManasArora) July 2, 2021

Closed remaining at 560

Reason: It is 40+% from 10wma. Super extended

Total revenue: 11R * 0.25 (size) = 2.75% on portfolio

Trade closed pic.twitter.com/YDDvhz8swT

Another hack to identify extended move in a stock:

Too many green days!

Read

When you see 15 green weeks in a row, that's the end of the move. *Extended*

— Manas Arora (@iManasArora) August 26, 2019

Simple price action analysis.#Seamecltd https://t.co/gR9xzgeb9K

What does it mean?

7 tweets that will teach you about its basics (and much more):🧵

Collaborated with @niki_poojary

1/ What is CPR?

The basics of CPR, how it's calculated, and TC and BC in CPR.

User: @ZerodhaVarsity.

One can also gauge the trend whether bullish or bearish.

Explained in very simple words

@ZerodhaVarsity 2/ What are the Uses of CPR?

User: @YMehta_

A thread that provides examples along with the concept.

Also includes an Intraday Trading Setup on 5 min

#CPR is an indicator which is used for #Intraday in Stock Market.

— Yash Mehta (@YMehta_) November 19, 2021

This learning thread would be on

"\U0001d650\U0001d668\U0001d65a\U0001d668 \U0001d664\U0001d65b \U0001d63e\U0001d64b\U0001d64d"

Like\u2764\ufe0f& Retweet\U0001f501for wider reach and for more such learning thread in the future.

Also, an investment strategy is shared using CPR in the end.

1/24

@ZerodhaVarsity @YMehta_ 3/ How to analyze trends with CPR?

User: @cprbykgs

How to interpret CPR based on the candles forming either above or below the daily and weekly CPR.

He is the most famous guy when it comes to CPR, so go through his Twitter and Youtube

CPR indicator trend analysis:

— Gomathi Shankar (@cprbykgs) January 25, 2022

Candles below daily & weekly CPR \U0001f43b

Candles above daily CPR but below weekly CPR early confirmation of \U0001f402

Candles above daily + weekly CPR strong confirmation of \U0001f402

Isn\u2019t it simple?#cprbykgs #cprindicator #nifty #banknifty

@ZerodhaVarsity @YMehta_ @cprbykgs 4/ Interpreting longer timeframes with CPR

User: @cprbykgs

Trend Reversals with CPR when the trend is bullish and it enters the daily CPR

#banknifty

— Gomathi Shankar (@cprbykgs) July 9, 2021

Candles above monthly CPR- Bullish

Candles above weekly CPR- Bullish

Now, whenever candles enter daily CPR range it indicates weakness of current trend & early signs of trend reversal.

So, wait for the candles to exit the daily CPR range then take the trade. (1/4) pic.twitter.com/7vaaLMCrV8

Do read it completely to understand the stance and the plan.

This thread will present a highly probable scenario of markets for the upcoming months. Will update the scenario too if there is a significant change in view in between.

— Aakash Gangwar (@akashgngwr823) May 15, 2022

1/n https://t.co/jfWOyEgZyd

1. The moving average structure - Many traders just look at the 200 ma test or closing above/below it regardless of its slope. Let's look at all the interactions with 200 ma where price met it for the first time after the trend change but with 200 ma slope against it

One can clearly sense that currently it is one of those scenarios only. I understand that I might get trolled for this, but an unbiased mind suggests that odds are highly against the bulls for making fresh investments.

But markets are good at giving surprises. What should be our stance if price kept on rising? Let's understand that through charts. The concept is still the same. Divergent 200 ma and price move results in 200 ma test atleast once which gives good investment opportunities.

2. Zig-Zag bear market- There are two types of fall in a bear market, the first one is vertical fall which usually ends with ending diagonals (falling wedges) and the second one is zig zag one which usually ends with parabolic down moves.