4th consecutive month of Negative returns on Nifty has Always been Major Bottom for Nifty.

We already had 3 mnt -ve so far

(Mar 20: 3rd consecutive -ve mnth)

Feb-19: 3rd

Dec-16: 4th

Feb-16: 4th

Aug-13: 3rd

Nov-08:3rd

Nov-01:4th

Just see the bounce from there !

Wats your view?

More from Kunal Bothra

Interesting Derivatives Data…

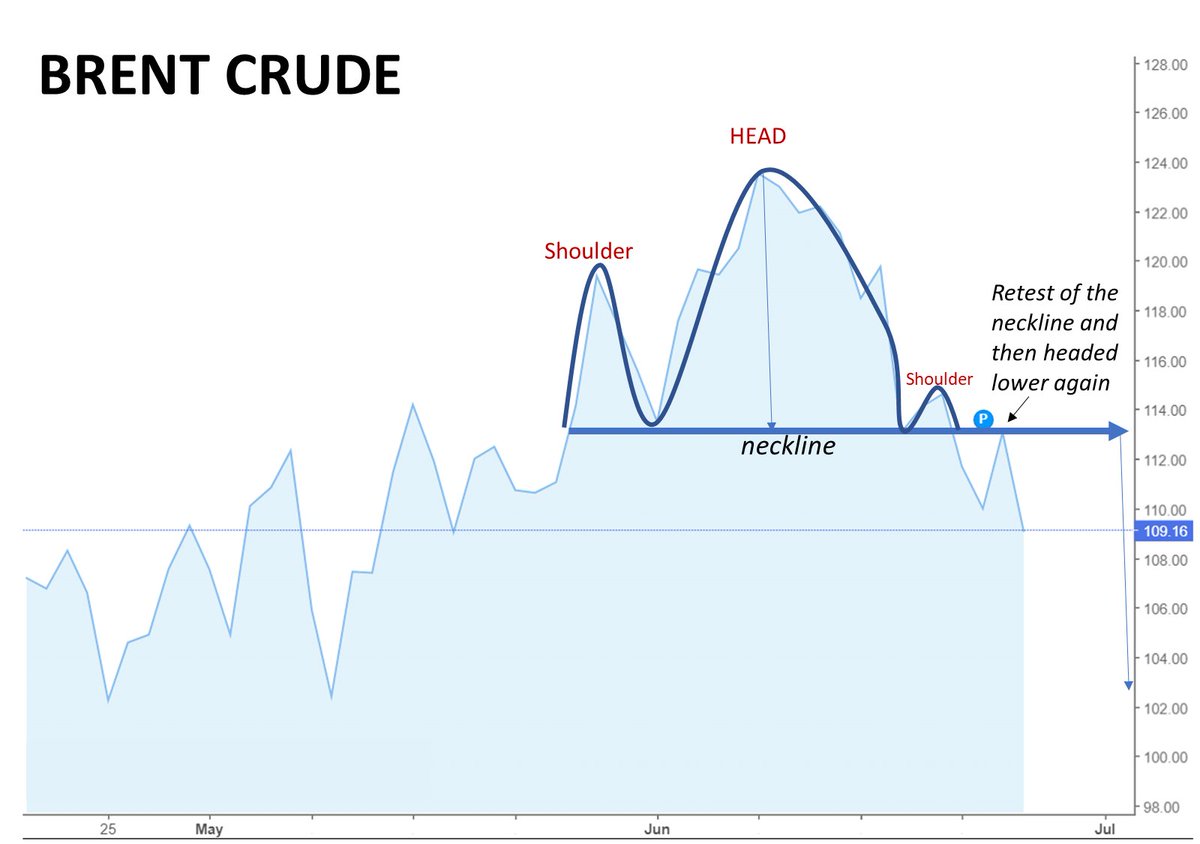

#MarketsWithETNOW | Is the #crude concern overblown? What do the charts indicate? What will be the trend going forward? Watch to find out as @kbbothra analyses #Brent #Crude #Oil #StockMarket pic.twitter.com/4SBSfpiKmd

— ET NOW (@ETNOWlive) June 1, 2022

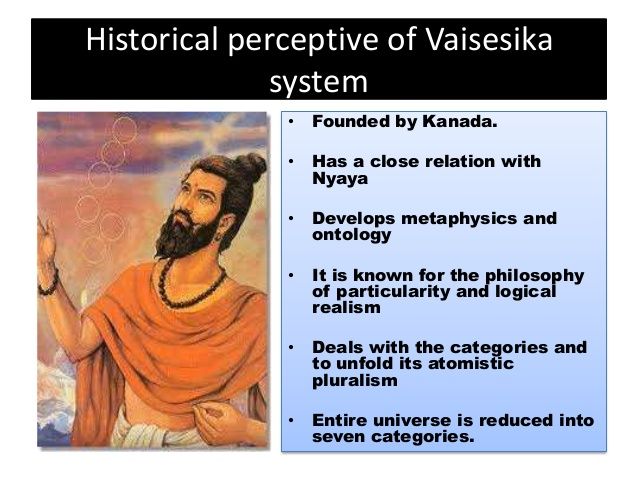

A basic and compressed learning on Fibonacci Ratios

It's called the #Fibonacci sequence, but its origin was in India around 200 BC! Here's how you can use it in the equity market@kbbothra #BNSNPathshala #StockMarket #Nifty50 #StocksToWatch pic.twitter.com/OuGbU4DgrC

— ET NOW (@ETNOWlive) June 3, 2022

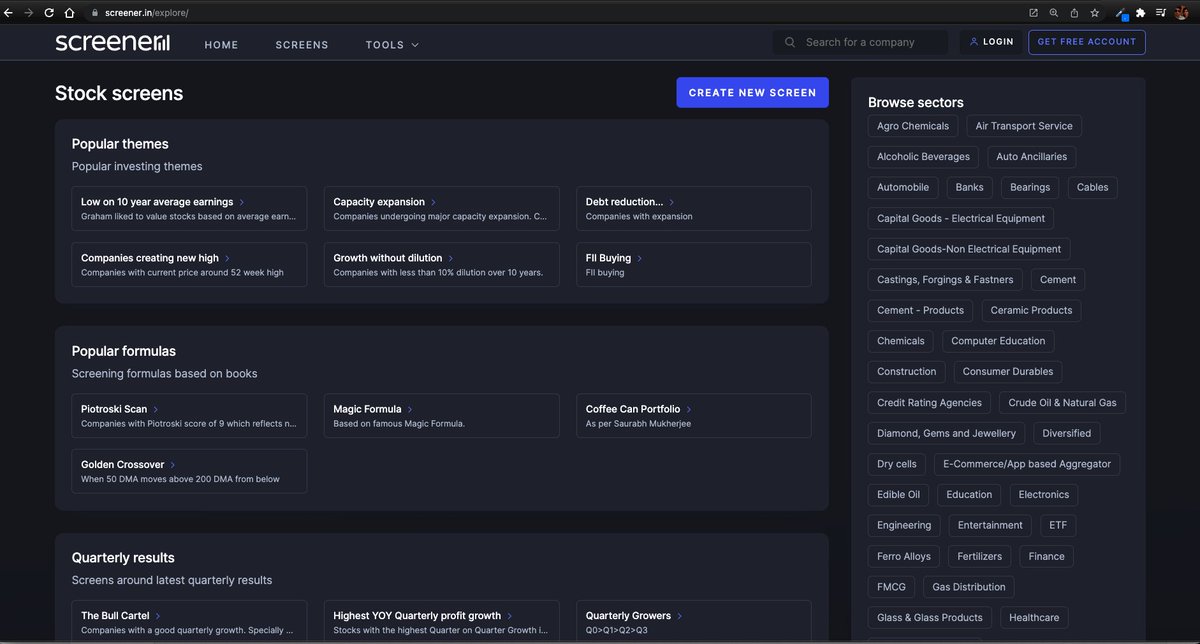

More from Screeners

Do Share the above tweet 👆

These are going to be very simple yet effective pure price action based scanners, no fancy indicators nothing - hope you liked it.

https://t.co/JU0MJIbpRV

52 Week High

One of the classic scanners very you will get strong stocks to Bet on.

https://t.co/V69th0jwBr

Hourly Breakout

This scanner will give you short term bet breakouts like hourly or 2Hr breakout

Volume shocker

Volume spurt in a stock with massive X times

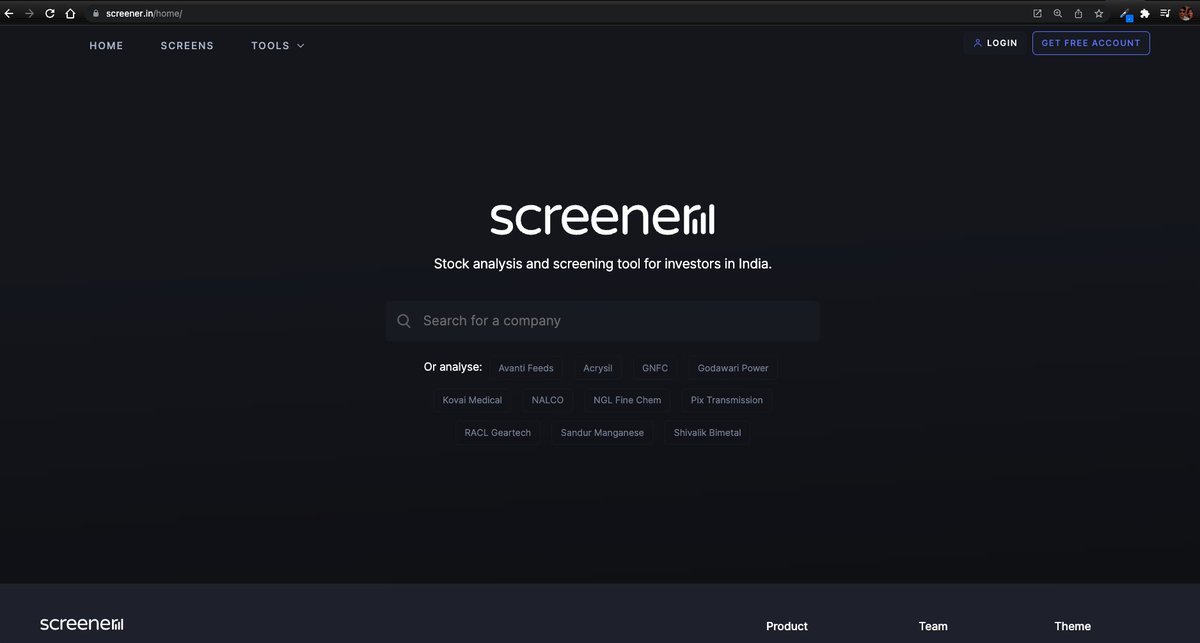

Step-by-step: how to use (the free) @screener_in to generate investment ideas.

Do retweet if you find it useful to benefit max investors. 🙏🙏

Ready or not, 🧵🧵⤵️

I will use the free screener version so that everyone can follow along.

Outline

1. Stepwise Guide

2. Practical Example: CoffeeCan Companies

3. Practical Example: Smallcap Consistent compounders

4. Practical Example: Smallcap turnaround

5. Key Takeaway

1. Stepwise Guide

Step1

Go to https://t.co/jtOL2Bpoys

Step2

Go to "SCREENS" tab

Step3

Go to "CREATE NEW SCREEN"

At this point you need to register. No charges. I did that with my brother's email id. This is what you see after that.

A small thread.

PART 1 - https://t.co/ooxepHpYKL

Traders show your support by like & retweet to benefit all

@Mitesh_Engr @ITRADE191 @ProdigalTrader @nakulvibhor @RajarshitaS @Puretechnicals9 @AnandableAnand @Anshi_________ @ca_mehtaravi

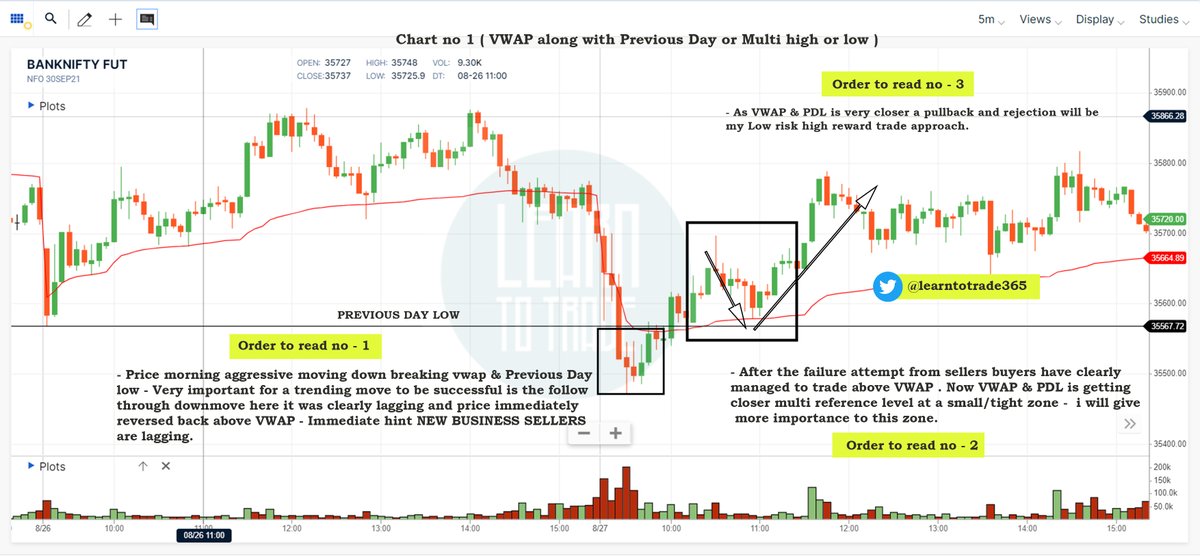

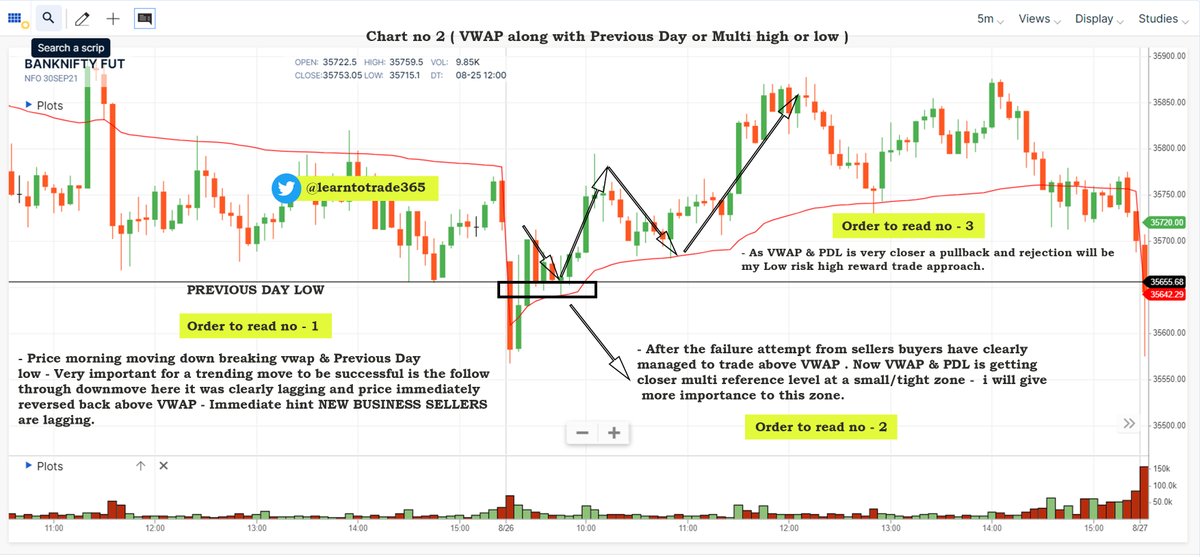

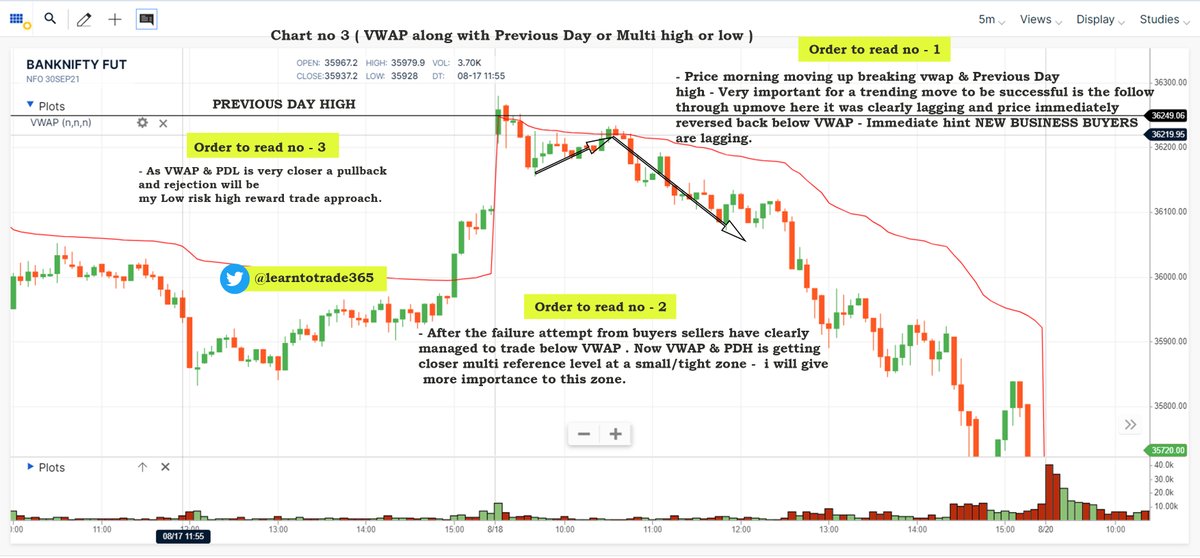

VWAP for intraday Trading Part -1

— Learn to Trade (@learntotrade365) August 28, 2021

A small thread PART -2 will be released tomorrow

Traders show your support by like & retweet to benefit all@Mitesh_Engr @ITRADE191 @ProdigalTrader @nakulvibhor @ArjunB9591 @CAPratik_INDIAN @RajarshitaS @Stockstudy8 @vivbajaj @Prakashplutus pic.twitter.com/y8bwisM4hB

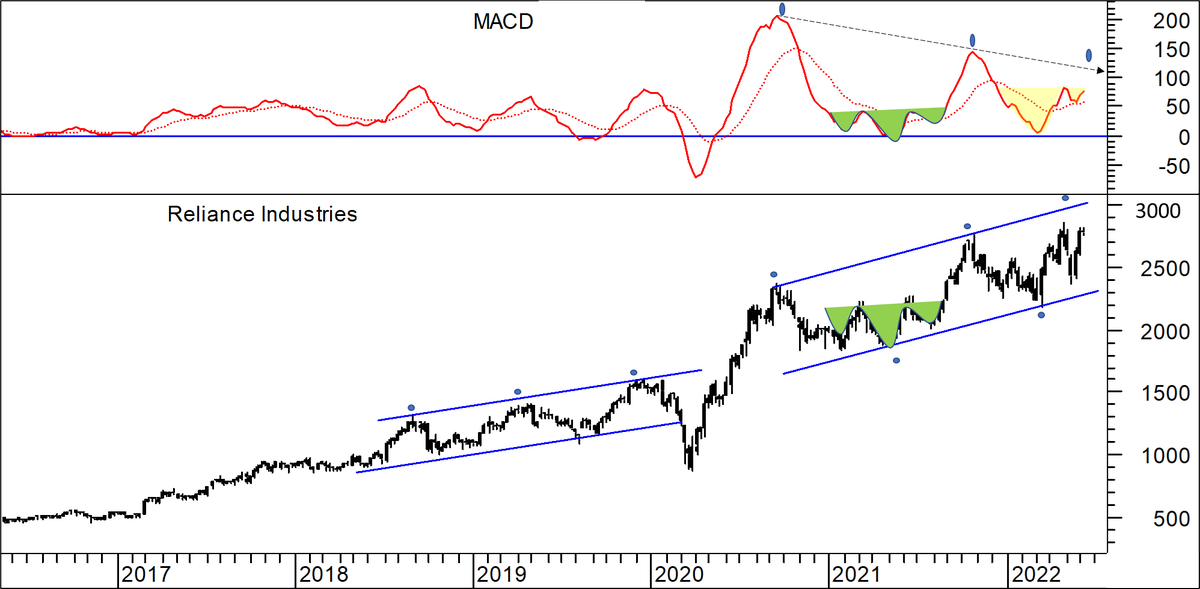

Chart 1

Chart 2

Chart 3

Chart 4

You May Also Like

Curated the best tweets from the best traders who are exceptional at managing strangles.

• Positional Strangles

• Intraday Strangles

• Position Sizing

• How to do Adjustments

• Plenty of Examples

• When to avoid

• Exit Criteria

How to sell Strangles in weekly expiry as explained by boss himself. @Mitesh_Engr

• When to sell

• How to do Adjustments

• Exit

1. Let's start option selling learning.

— Mitesh Patel (@Mitesh_Engr) February 10, 2019

Strangle selling. ( I am doing mostly in weekly Bank Nifty)

When to sell? When VIX is below 15

Assume spot is at 27500

Sell 27100 PE & 27900 CE

say premium for both 50-50

If bank nifty will move in narrow range u will get profit from both.

Beautiful explanation on positional option selling by @Mitesh_Engr

Sir on how to sell low premium strangles yourself without paying anyone. This is a free mini course in

Few are selling 20-25 Rs positional option selling course.

— Mitesh Patel (@Mitesh_Engr) November 3, 2019

Nothing big deal in that.

For selling weekly option just identify last week low and high.

Now from that low and high keep 1-1.5% distance from strike.

And sell option on both side.

1/n

1st Live example of managing a strangle by Mitesh Sir. @Mitesh_Engr

• Sold Strangles 20% cap used

• Added 20% cap more when in profit

• Booked profitable leg and rolled up

• Kept rolling up profitable leg

• Booked loss in calls

• Sold only

Sold 29200 put and 30500 call

— Mitesh Patel (@Mitesh_Engr) April 12, 2019

Used 20% capital@44 each

2nd example by @Mitesh_Engr Sir on converting a directional trade into strangles. Option Sellers can use this for consistent profit.

• Identified a reversal and sold puts

• Puts decayed a lot

• When achieved 2% profit through puts then sold

Already giving more than 2% return in a week. Now I will prefer to sell 32500 call at 74 to make it strangle in equal ratio.

— Mitesh Patel (@Mitesh_Engr) February 7, 2020

To all. This is free learning for you. How to play option to make consistent return.

Stay tuned and learn it here free of cost. https://t.co/7J7LC86oW0