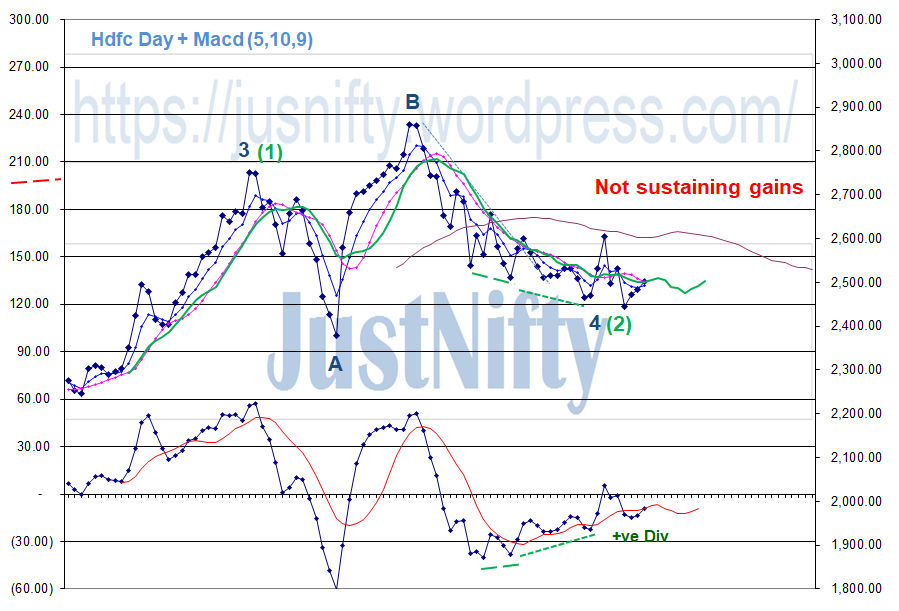

When trending, especially above #movingaverage, ignore this behaviour of #MACD .

I use MACD for reversal points only.

Do not follow it at every 5 minute.

Yesterday and today both we had MACD divergence . Yet market was just continuing in the opposite direction . Can you please what to do in such case ? . For eg - today I was unable to go long because there was divergence . Same case was for yesterday . Can you please guide .\U0001f64f pic.twitter.com/vfqy8dRAU2

— Mehul (@MehulGarodia9) May 20, 2022

More from Van Ilango (JustNifty)

#Hdfc (3190++)

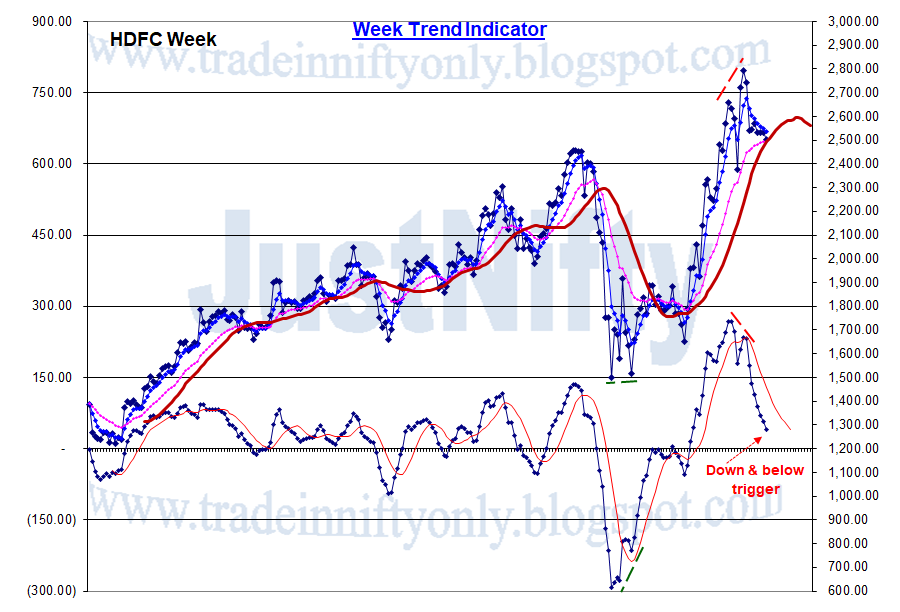

#Hdfcbank (1724++)

#Reliance (2834++)

#ITC (274++) these are "just min. targets"

& many more would move up significantly

@rlnarayanan https://t.co/iVYE1F7l6v

#Nifty 3rd is sub-dividing as in chart:

— Van Ilango (JustNifty) (@JustNifty) October 13, 2021

[1]st: 16396 - 17793 = 1397

[2]nd: 17793-17948-17453 - Irregular flat

[3]rd: 17453+1397=18850 OR

: 17453+1928=19381 OR

: 17453+2096=19549 OR

: 17453+2260=19713 OR

Nothing wrong in projecting till holds "17990"

Read again till you understand the logic fully of a "Moving avg (13Sma) & its upper & lower band" mechanism and then,

Apply on charts of your short listed stocks and understand how the trades/ investments would have worked -back testing

Bollinger band has been a trusted guide with the settings of 13sma & 2 std deviation. Add to it 5 & 8 smas and it works in all time frames.

— Van Ilango (JustNifty) (@JustNifty) September 29, 2020

Start from week & Day for investments; Hour & 5 minute for intraday.

Experiment initially; you'll still need other tools to read the mkt\U0001f600\U0001f64f pic.twitter.com/yEkHiDHiha

More from Screeners

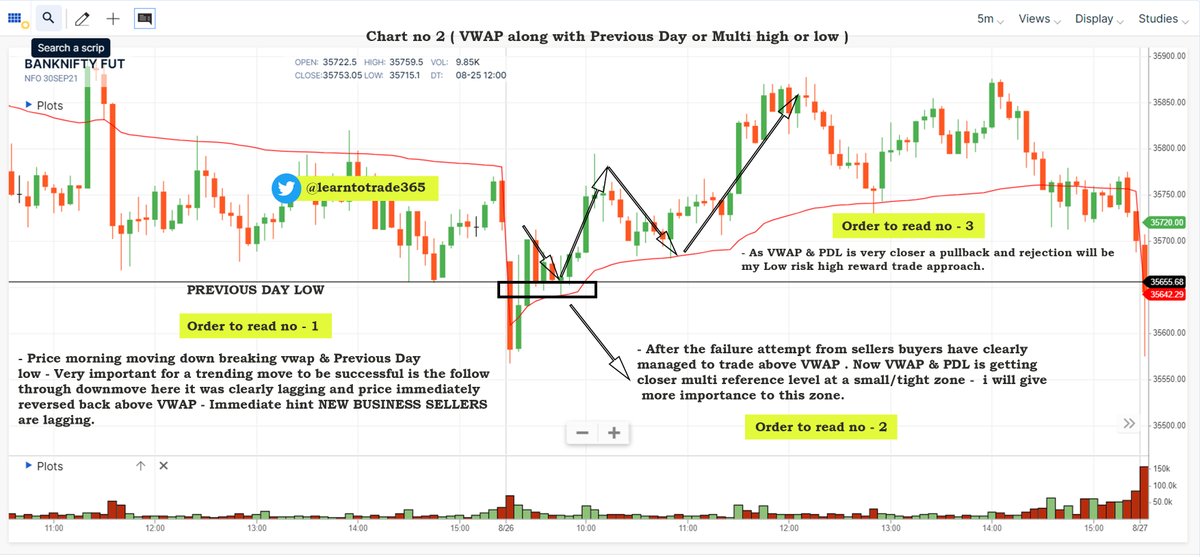

A small thread.

PART 1 - https://t.co/ooxepHpYKL

Traders show your support by like & retweet to benefit all

@Mitesh_Engr @ITRADE191 @ProdigalTrader @nakulvibhor @RajarshitaS @Puretechnicals9 @AnandableAnand @Anshi_________ @ca_mehtaravi

VWAP for intraday Trading Part -1

— Learn to Trade (@learntotrade365) August 28, 2021

A small thread PART -2 will be released tomorrow

Traders show your support by like & retweet to benefit all@Mitesh_Engr @ITRADE191 @ProdigalTrader @nakulvibhor @ArjunB9591 @CAPratik_INDIAN @RajarshitaS @Stockstudy8 @vivbajaj @Prakashplutus pic.twitter.com/y8bwisM4hB

Chart 1

Chart 2

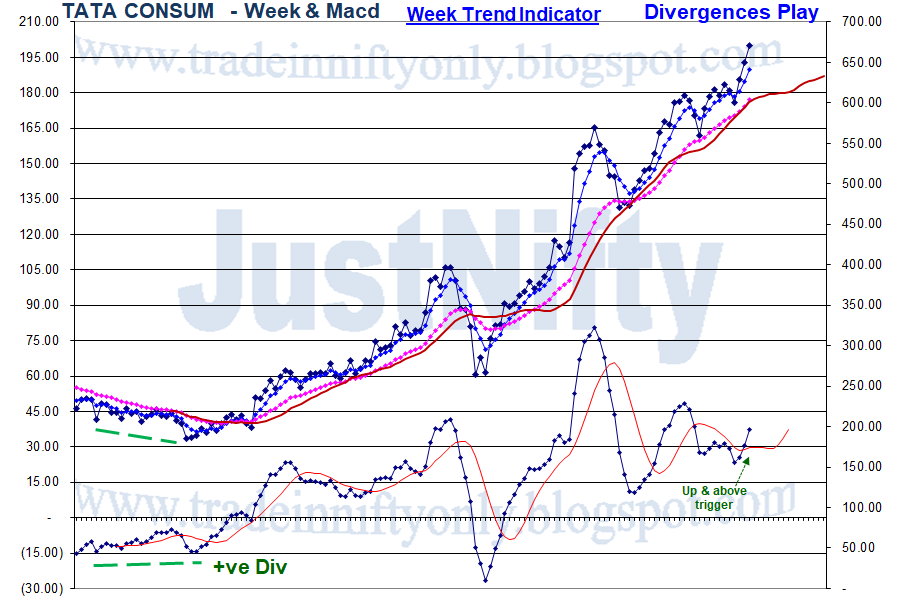

Chart 3

Chart 4

Sir Edwards & Magee discussed sloping necklines in H&S in their classical work. I am considering this breakdown by Affle as an H&S top breakdown with a target open of 770.

— The_Chartist \U0001f4c8 (@charts_zone) May 25, 2022

The target also coincides with support at the exact same level. pic.twitter.com/n84kSgkg4q