More from Van Ilango (JustNifty)

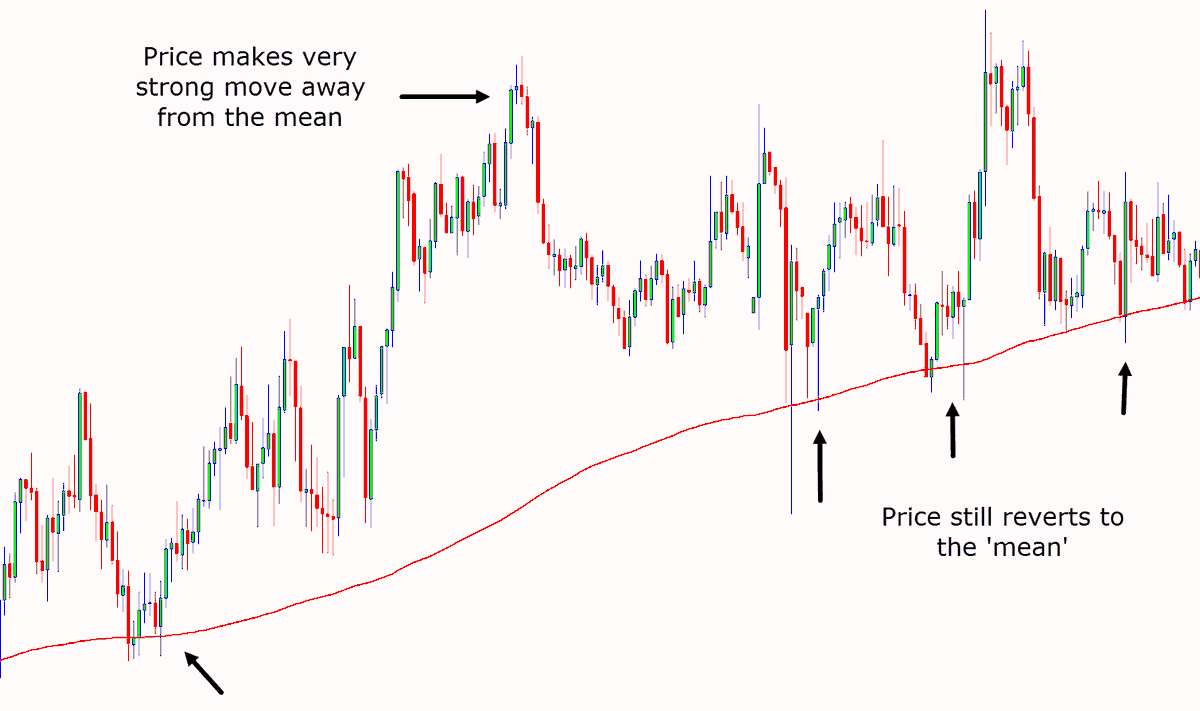

You could follow "#Movingaverages Trading system with 2 MA (13 & 21Sma)" in simple way or add 1 or 2 additional strategies

Simple: When 13 moves above 21 in "15 Minute t/f for Intraday only", BUY

When 13 moves below 21 in "15 Minute t/f for Intraday only", SELL as in a SAR system

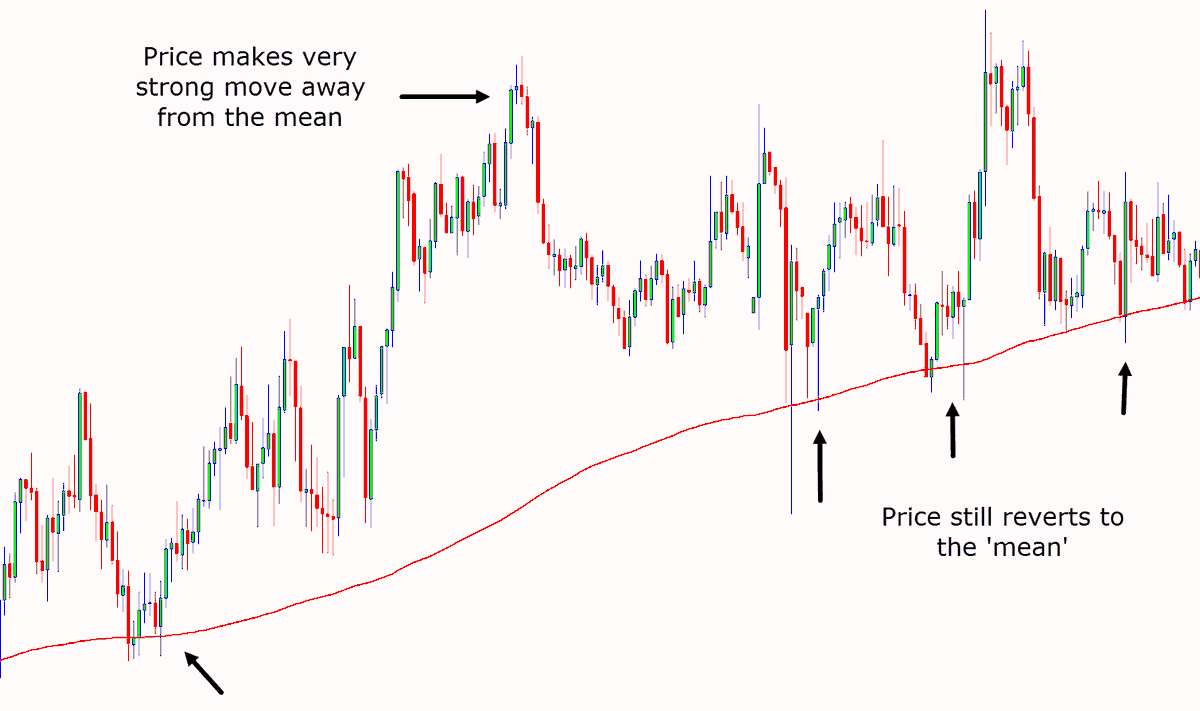

Addl.strategy: When prices move far from MA, say 150 to 200 pts, "Part book" & re-enter when prices pull back to MA

Choose to do this way 1 or 2 times only for intraday

Idea is "Mean Reversion" - Prices tend to move back to MA IF they move far away from MA in a trending phase.🙏

Simple: When 13 moves above 21 in "15 Minute t/f for Intraday only", BUY

When 13 moves below 21 in "15 Minute t/f for Intraday only", SELL as in a SAR system

Master just one doubt about the re-entry part

— Sunny Singh (@SurendraSinghJi) February 10, 2022

You mentioned to re-enter at 17430 levels.

How to initiate the trade at the lowest point when the candle is in the formation mode.

Is it that when the price touches 21ma we should entry longs till 13ma is above 21ma.

Show path \U0001f64f

Addl.strategy: When prices move far from MA, say 150 to 200 pts, "Part book" & re-enter when prices pull back to MA

Choose to do this way 1 or 2 times only for intraday

Idea is "Mean Reversion" - Prices tend to move back to MA IF they move far away from MA in a trending phase.🙏