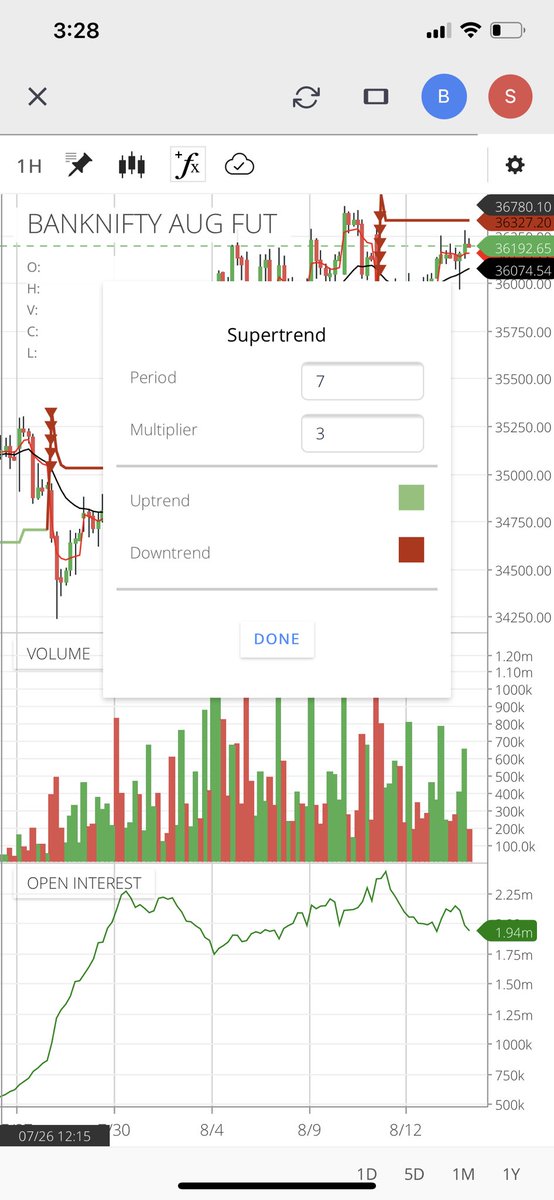

If u are a pullback trader u get to take an entry very close to the end of a counter trend move which offer a very tight SL.

In case for a trend follower, the candle size near to the trend phase he is aiming at is way too larger and hence offer a much wider SL

More from Aneesh Philomina Antony (ProdigalTrader)

Parameters

1.Price structure - higher swing highs & swing lows

2. Momentum - doubled in last 250 days & trade close to recent highs

3. Demand - Higher volume on green bars

4. Volatility - Bigger bars on upside & shorter on downside

5. Relative strength - Outperforming market

1.Price structure - higher swing highs & swing lows

2. Momentum - doubled in last 250 days & trade close to recent highs

3. Demand - Higher volume on green bars

4. Volatility - Bigger bars on upside & shorter on downside

5. Relative strength - Outperforming market

Hello Aneesh, (1) apart from the volume supported HH-HL formation in ATH or 52 weeks high stocks, what other data point u see to shortlist scrip? (2) How do u estimate the holding period for the scrip? Plz guide

— Rohit Khanna\U0001f1ee\U0001f1f3 (@Rohit_MktWale) March 26, 2022

More from Screeners

Most of the indices are entering oversold territories

Take small cap index for example

Whenever Monthly RSI is below or around 40, the index bottoms out

We are getting there.

If I had 50% cash, I would have deployed some in beaten down stocks where earnings growth is intact. https://t.co/t5WwgH1V5o

Take small cap index for example

Whenever Monthly RSI is below or around 40, the index bottoms out

We are getting there.

If I had 50% cash, I would have deployed some in beaten down stocks where earnings growth is intact. https://t.co/t5WwgH1V5o

I have more than 50% cash but still worried if this is a good time. Will invest 20% by EoY

— Tamil Metaverse (@TamilMetaverse) June 21, 2022