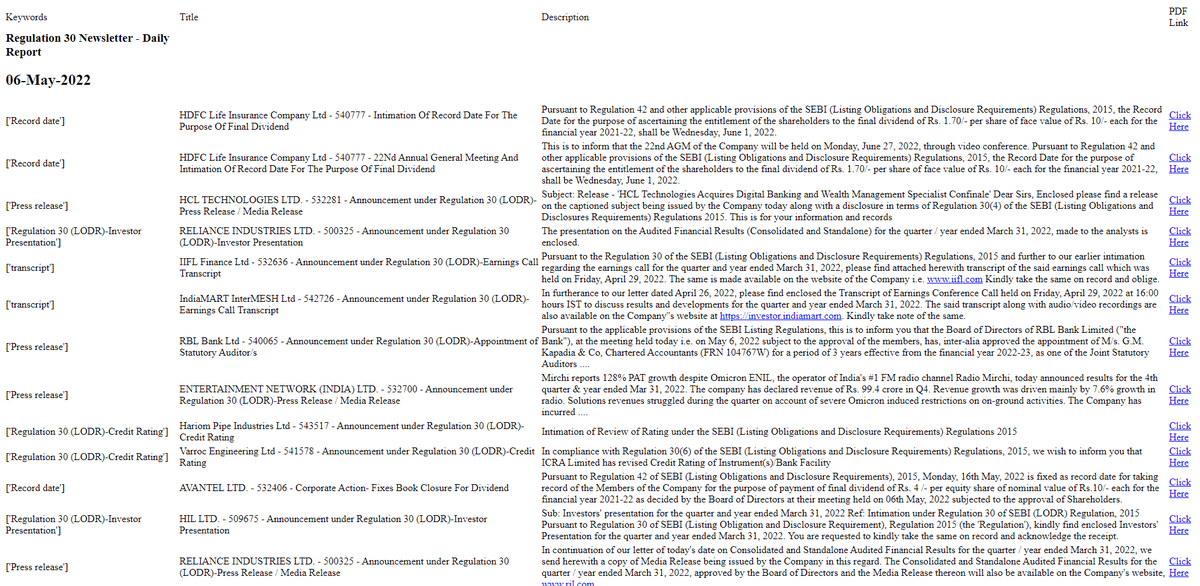

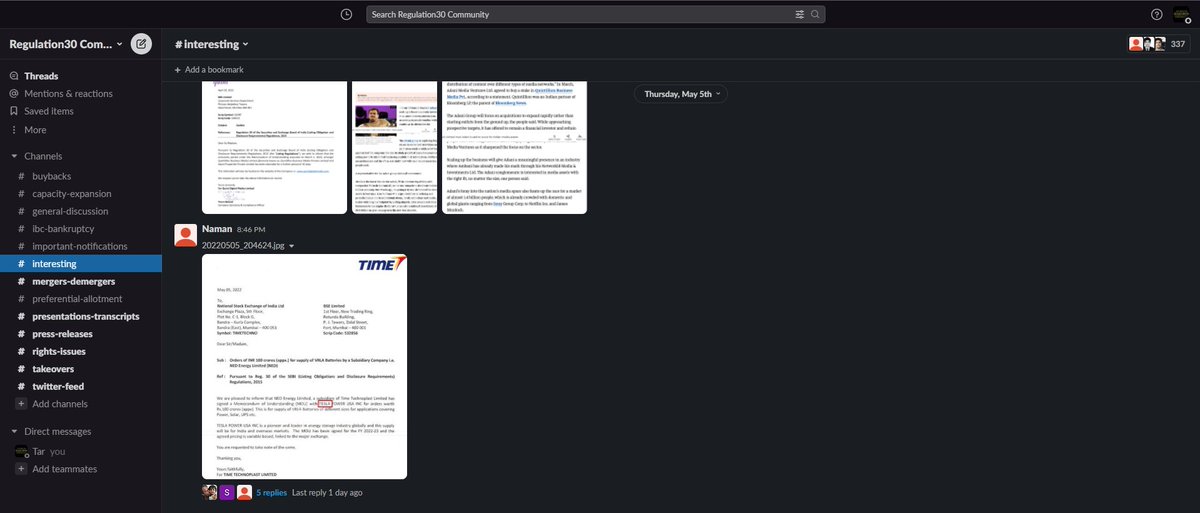

Name: @Regulation30

Type: Paid

Regulation30 is my go to source to hunt for exchange filings that are worth studying further

This is also the source where I get lot of special situation ideas that aren't that widely known

Its the weekend!

— Tar \u26a1 (@itsTarH) May 7, 2022

Grab a cup of coffee, today I will tell you about all the tools and services I use in my investing journey

Some are free, some are paid but all of them are guaranteed to deliver value

Lets dive right in! pic.twitter.com/Rr2pW7bboE

Homework for all the interested participants here:

— Intrinsic Compounding (@soicfinance) June 27, 2021

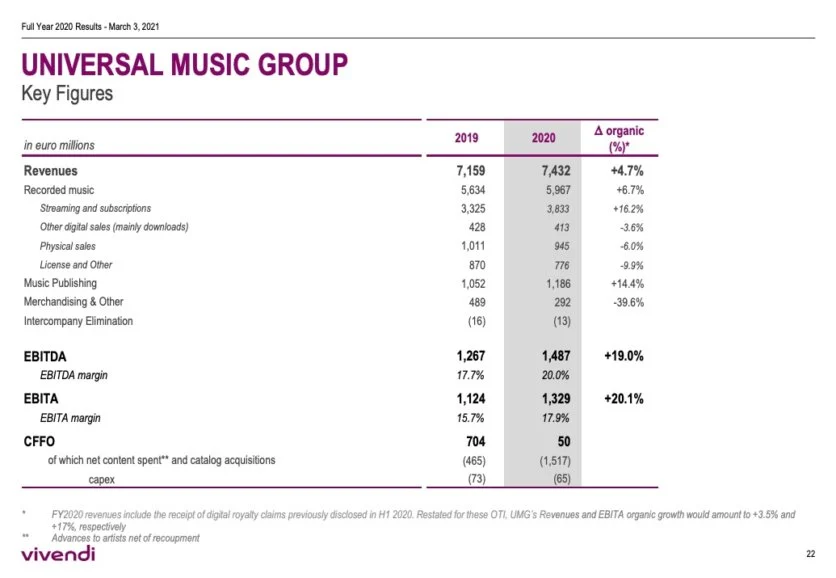

Q1.Why 20% and not 50%+ Margins for UMG

Q2. Differences in dynamics between Western&Indian cos?

Q3. Trends in West vs Trends in India in the industry.

Research and find the answers. My job is done \U0001f601\U0001f64f

If you see the ebitda of universal music its low 20% compared to our saregama 30% or tips 50%. So when you compare earnings saregama is 40x and tips is 30x and universal music is 30x. Also these type of companies are less( low or no capex with excellent and growinh cashflows)

— Srikanth V (@mynameisnani75) June 27, 2021

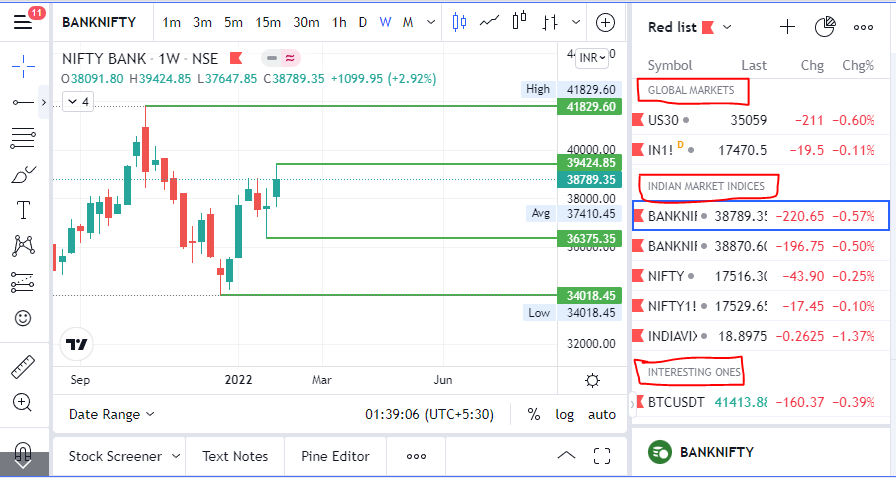

\U0001d5e0\U0001d602\U0001d5f9\U0001d601\U0001d5f6\U0001d5fd\U0001d5f9\U0001d5f2 \U0001d600\U0001d5f2\U0001d5f0\U0001d601\U0001d5fc\U0001d5ff \U0001d604\U0001d5ee\U0001d601\U0001d5f0\U0001d5f5\U0001d5f9\U0001d5f6\U0001d600\U0001d601 \U0001d5fc\U0001d5fb \U0001d5e7\U0001d5ff\U0001d5ee\U0001d5f1\U0001d5f6\U0001d5fb\U0001d5f4\U0001d603\U0001d5f6\U0001d5f2\U0001d604 \U0001d602\U0001d600\U0001d5f6\U0001d5fb\U0001d5f4 \U0001d601\U0001d5f5\U0001d5f2 \U0001d5d9\U0001d5e5\U0001d5d8\U0001d5d8 \U0001d603\U0001d5f2\U0001d5ff\U0001d600\U0001d5f6\U0001d5fc\U0001d5fb!

— Sarosij Ghosh (@sarosijghosh) September 18, 2021

A THREAD \U0001f9f5

Please Like and Re-Tweet. It took a lot of effort to put this together. #StockMarket #TradingView #trading #watchlist #Nifty500 #stockstowatch