This book on Market Breadth is from 2005. This led me to move in this direction and I improvised with day to day REAL trades experience and observations.

By your logic, anyone using this concept after 2005 is stealing from here. https://t.co/vWx8GaqrRp

just to be clear he is referring @iManasArora who stole work of @PradeepBonde and did not gave any credit

— Long-Term Equity Trading\U0001f4c8 (@LTE_Trading) April 25, 2022

More from Manas Arora

Notice how strong the trend was, volume pre & post-breakout etc. They have so much in common. This is my bread & butter. I just repeat this day-in & day-out. No rocket science

#BroTip

1/2

https://t.co/AeUkzgVM7S

https://t.co/1znMi5Cjgk

https://t.co/5R1i8ijiUY

https://t.co/VOVTxOdPCv

https://t.co/vhBIwLuk8q

https://t.co/3xcKeJtmYe

https://t.co/PXjWVPVsLz

https://t.co/SBkSALkL3U

https://t.co/NBNSLTaD5O

https://t.co/JS08fLd4PI

2/2

#BroTip

If you want to trade only stocks with established trend/momentum, then you can look for stocks which have never(or barely did) closed below a certain MA (say 50MA) in the last say 50 days.

— Manas Arora (@iManasArora) November 8, 2021

There are countless ways to run scans. Just have to get creative. #BroTip

More from Screeners

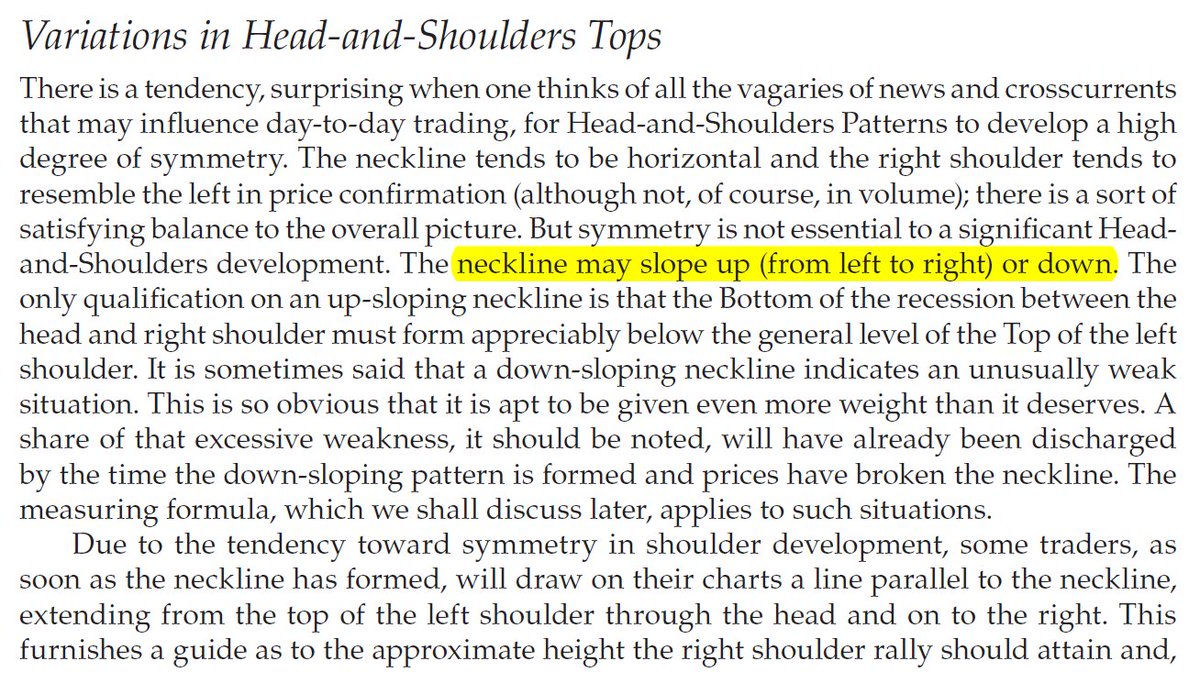

Sir Edwards & Magee discussed sloping necklines in H&S in their classical work. I am considering this breakdown by Affle as an H&S top breakdown with a target open of 770.

— The_Chartist \U0001f4c8 (@charts_zone) May 25, 2022

The target also coincides with support at the exact same level. pic.twitter.com/n84kSgkg4q

USDINR - a breakout that will not bode well for the equities

78+ https://t.co/AWqZxF5B1L

Can you anticipate a breakout? Yes

— The_Chartist \U0001f4c8 (@charts_zone) June 10, 2022

the attached tweet.

now the chart is for USDINR https://t.co/Vb2wKaCvTB pic.twitter.com/INo0GC4fGY

You May Also Like

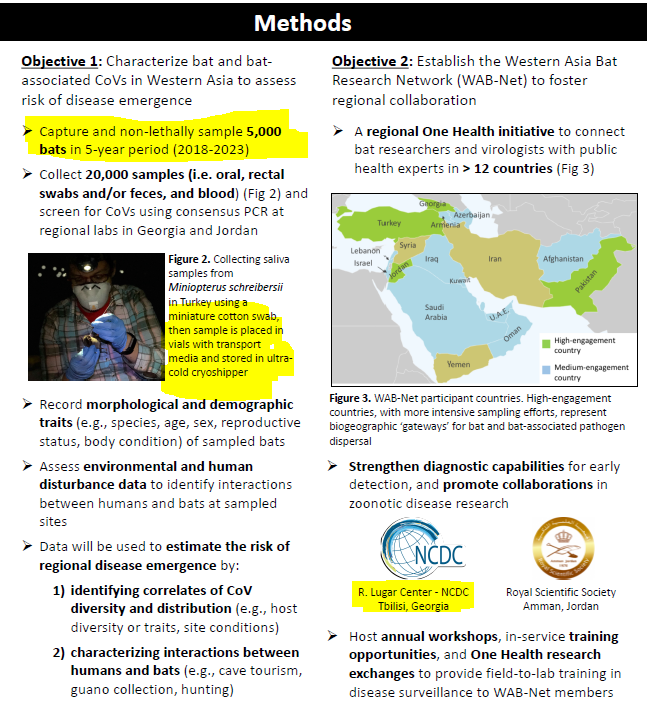

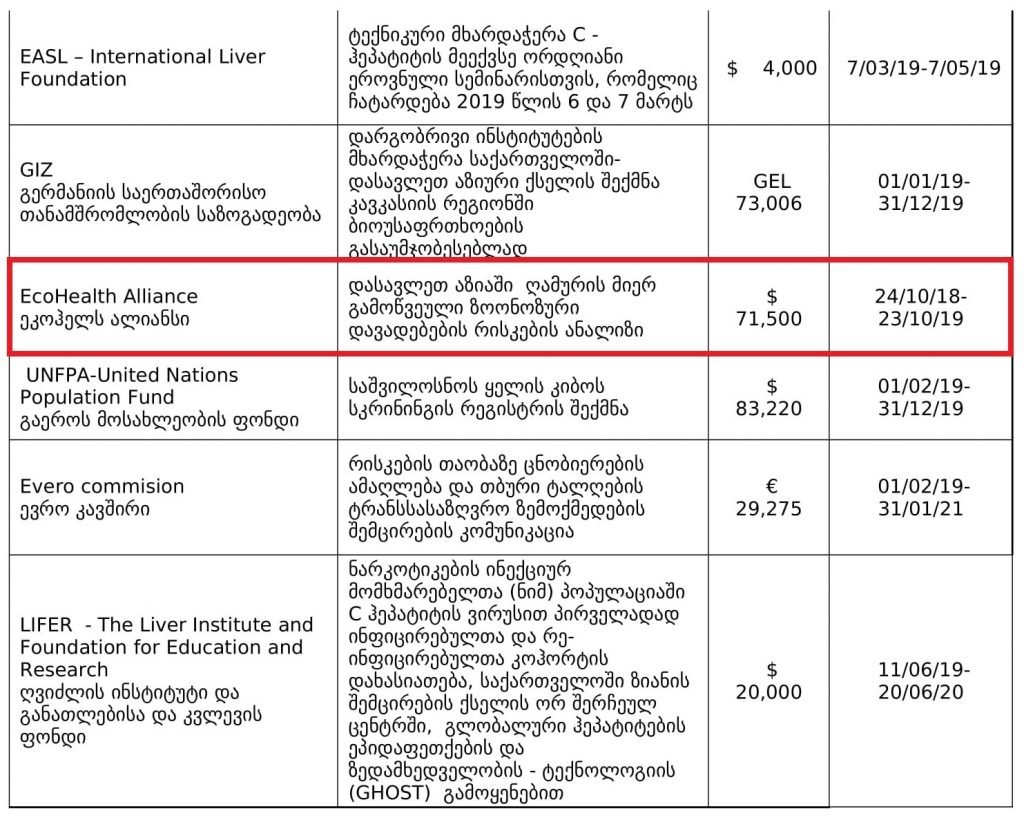

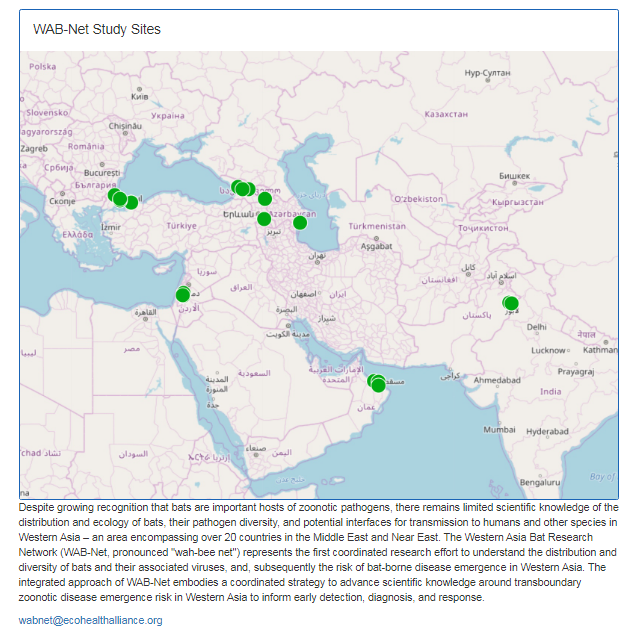

Risks of bat-borne zoonotic diseases in Western Asia

Duration: 24/10/2018-23 /10/2019

Funding: $71,500

@dgaytandzhieva

https://t.co/680CdD8uug

2. Bat Virus Database

Access to the database is limited only to those scientists participating in our ‘Bats and Coronaviruses’ project

Our intention is to eventually open up this database to the larger scientific community

https://t.co/mPn7b9HM48

3. EcoHealth Alliance & DTRA Asking for Trouble

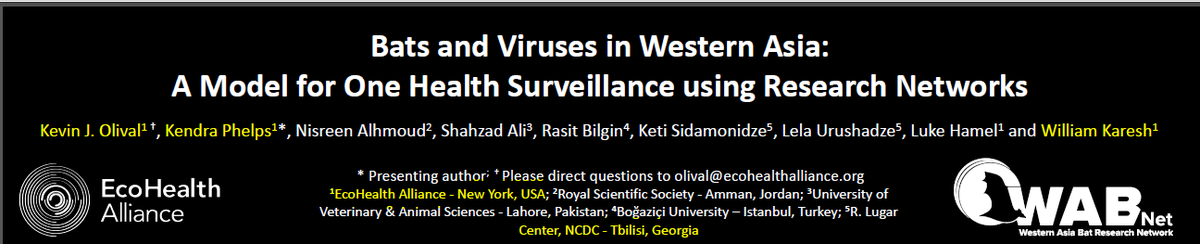

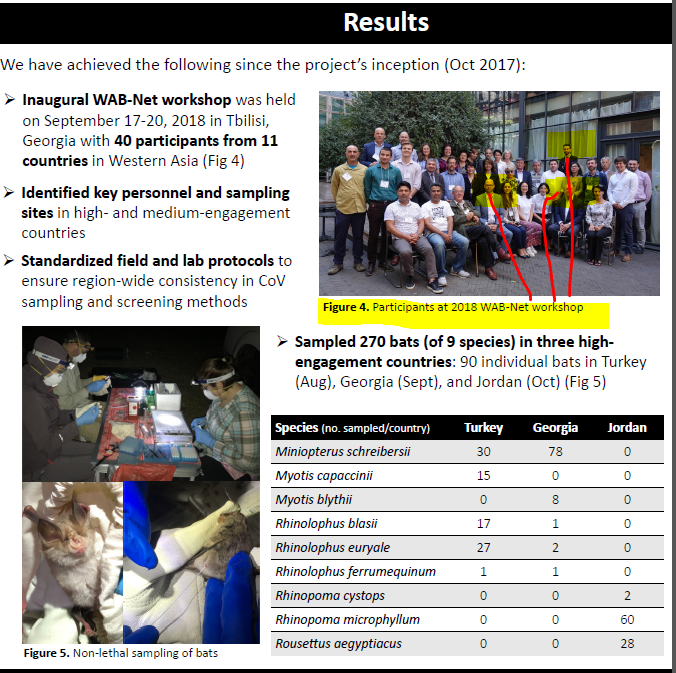

One Health research project focused on characterizing bat diversity, bat coronavirus diversity and the risk of bat-borne zoonotic disease emergence in the region.

https://t.co/u6aUeWBGEN

4. Phelps, Olival, Epstein, Karesh - EcoHealth/DTRA

5, Methods and Expected Outcomes

(Unexpected Outcome = New Coronavirus Pandemic)