In a strong counter, always wait for a candle to stop breaching the previous candle's low and look to increase your allocation as the risk is limited.

NIIT - a new high https://t.co/o9Sv2yT5m5

One application of Fibonacci is to look for the retracement level in the strongest stocks. A strong stock must not retrace below 38%.

— The_Chartist \U0001f4c8 (@charts_zone) March 28, 2022

NIIT Limited. That often helps in timing our SIP purchases/swing trades. pic.twitter.com/6lB7zNJOFI

More from The_Chartist 📈

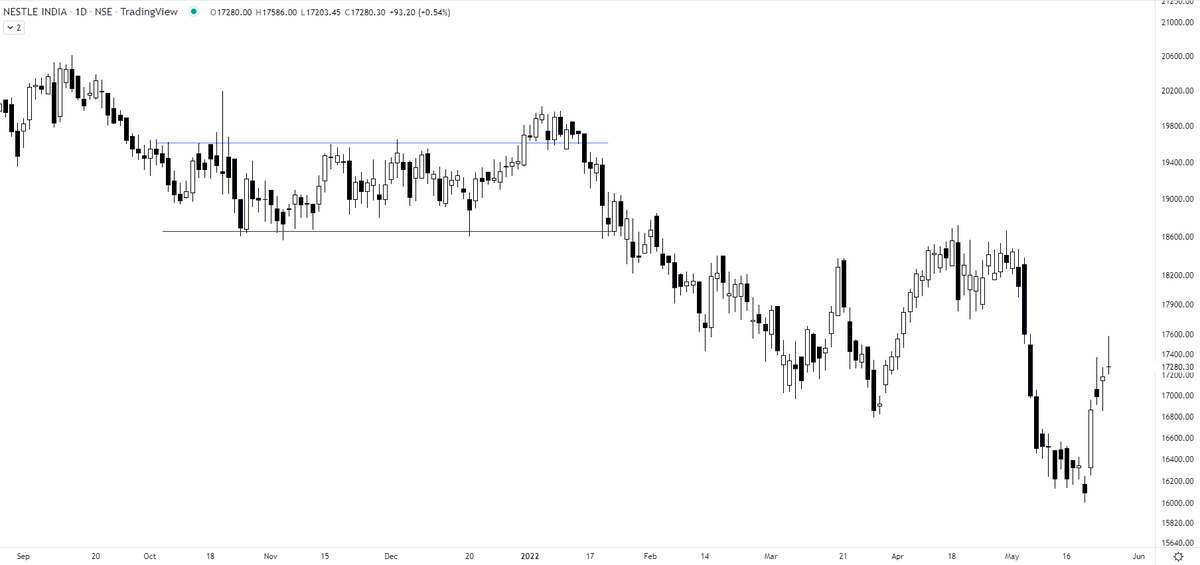

although a must-have portfolio stock. Faced resistance right at the upper channel boundary. Volumes high. Any retracement back to the lower boundary will be an opportunity to accumulate. https://t.co/5uDsUXsbPP

IEX - the resistance turning support. Kindly review, please. @nishkumar1977 @suru27 @rohanshah619 @indian_stockss @sanstocktrader @BissaGauravB @RajarshitaS @PAVLeader @Rishikesh_ADX @VijayThk @Investor_Mohit @TrendTrader85 pic.twitter.com/7CCzmee5If

— Steve Nison (@nison_steve) December 18, 2020

I believe 5-10 stocks are enough for a retail investor to achieve super performance. And with small capital, there is no point in buying 20/30 names which doesn't even get appropriate initial capital.

Stock: CDSL

— Steve Nison (@nison_steve) December 16, 2020

CMP - 516.95. Low risk setup. Weak below 500. Target open. Stock retesting the ascending triangle BO line. Kindly check please. @nishkumar1977 @Rishikesh_ADX @VijayThk @kuttrapali @Thekalal @PAVLeader pic.twitter.com/PlcpOMsdnz

AWL - look at the ranges of contraction on the chart https://t.co/2XMhqZQu8X

Borosil Renewables - Patterns like these must be looked at carefully and must be kept on the radar. Herein price is contracting which generally signifies shifting of hands (from weak to strong). If you go wrong, the risk is limited in these. pic.twitter.com/iqyoeslZjy

— The_Chartist \U0001f4c8 (@charts_zone) July 12, 2021

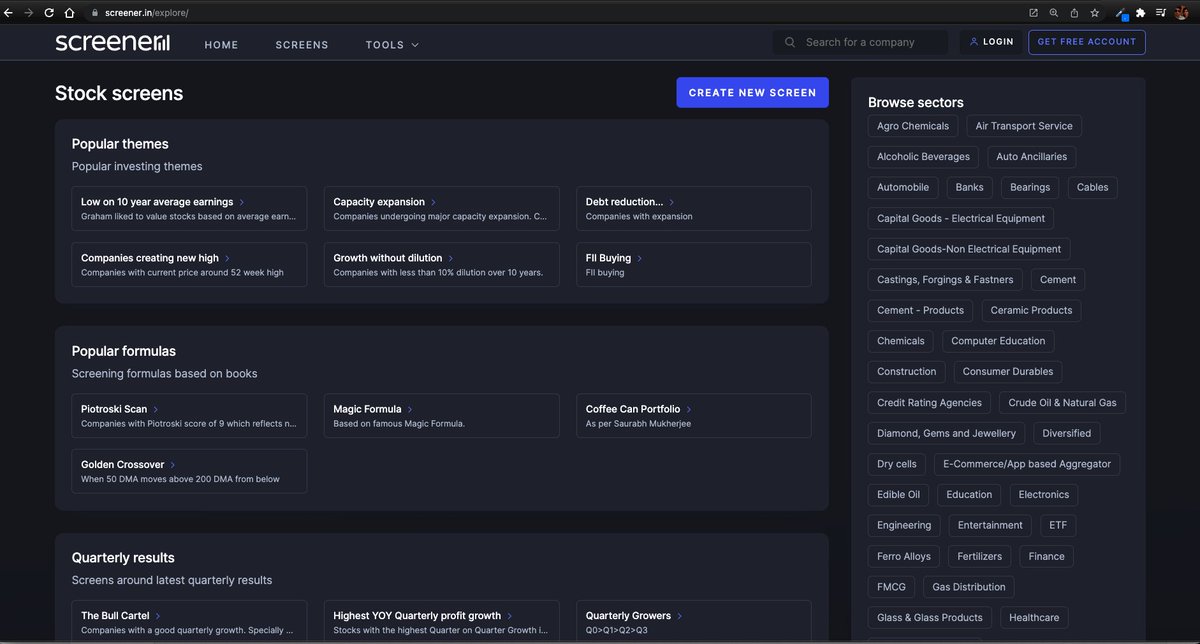

More from Screeners

Do Share the above tweet 👆

These are going to be very simple yet effective pure price action based scanners, no fancy indicators nothing - hope you liked it.

https://t.co/JU0MJIbpRV

52 Week High

One of the classic scanners very you will get strong stocks to Bet on.

https://t.co/V69th0jwBr

Hourly Breakout

This scanner will give you short term bet breakouts like hourly or 2Hr breakout

Volume shocker

Volume spurt in a stock with massive X times

Step-by-step: how to use (the free) @screener_in to generate investment ideas.

Do retweet if you find it useful to benefit max investors. 🙏🙏

Ready or not, 🧵🧵⤵️

I will use the free screener version so that everyone can follow along.

Outline

1. Stepwise Guide

2. Practical Example: CoffeeCan Companies

3. Practical Example: Smallcap Consistent compounders

4. Practical Example: Smallcap turnaround

5. Key Takeaway

1. Stepwise Guide

Step1

Go to https://t.co/jtOL2Bpoys

Step2

Go to "SCREENS" tab

Step3

Go to "CREATE NEW SCREEN"

At this point you need to register. No charges. I did that with my brother's email id. This is what you see after that.

You May Also Like

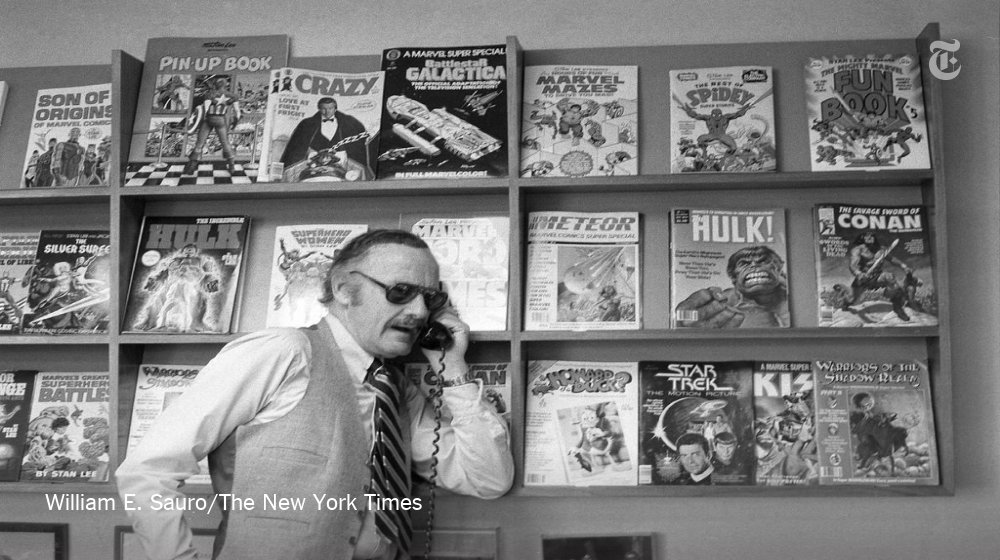

Stan Lee, who died Monday at 95, was born in Manhattan and graduated from DeWitt Clinton High School in the Bronx. His pulp-fiction heroes have come to define much of popular culture in the early 21st century.

Tying Marvel’s stable of pulp-fiction heroes to a real place — New York — served a counterbalance to the sometimes gravity-challenged action and the improbability of the stories. That was just what Stan Lee wanted. https://t.co/rDosqzpP8i

The New York universe hooked readers. And the artists drew what they were familiar with, which made the Marvel universe authentic-looking, down to the water towers atop many of the buildings. https://t.co/rDosqzpP8i

The Avengers Mansion was a Beaux-Arts palace. Fans know it as 890 Fifth Avenue. The Frick Collection, which now occupies the place, uses the address of the front door: 1 East 70th Street.

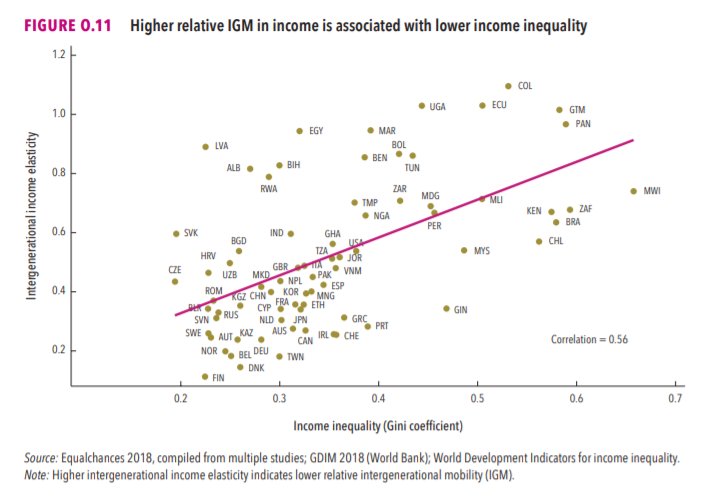

This New York Times feature shows China with a Gini Index of less than 30, which would make it more equal than Canada, France, or the Netherlands. https://t.co/g3Sv6DZTDE

That's weird. Income inequality in China is legendary.

Let's check this number.

2/The New York Times cites the World Bank's recent report, "Fair Progress? Economic Mobility across Generations Around the World".

The report is available here:

3/The World Bank report has a graph in which it appears to show the same value for China's Gini - under 0.3.

The graph cites the World Development Indicators as its source for the income inequality data.

4/The World Development Indicators are available at the World Bank's website.

Here's the Gini index: https://t.co/MvylQzpX6A

It looks as if the latest estimate for China's Gini is 42.2.

That estimate is from 2012.

5/A Gini of 42.2 would put China in the same neighborhood as the U.S., whose Gini was estimated at 41 in 2013.

I can't find the <30 number anywhere. The only other estimate in the tables for China is from 2008, when it was estimated at 42.8.