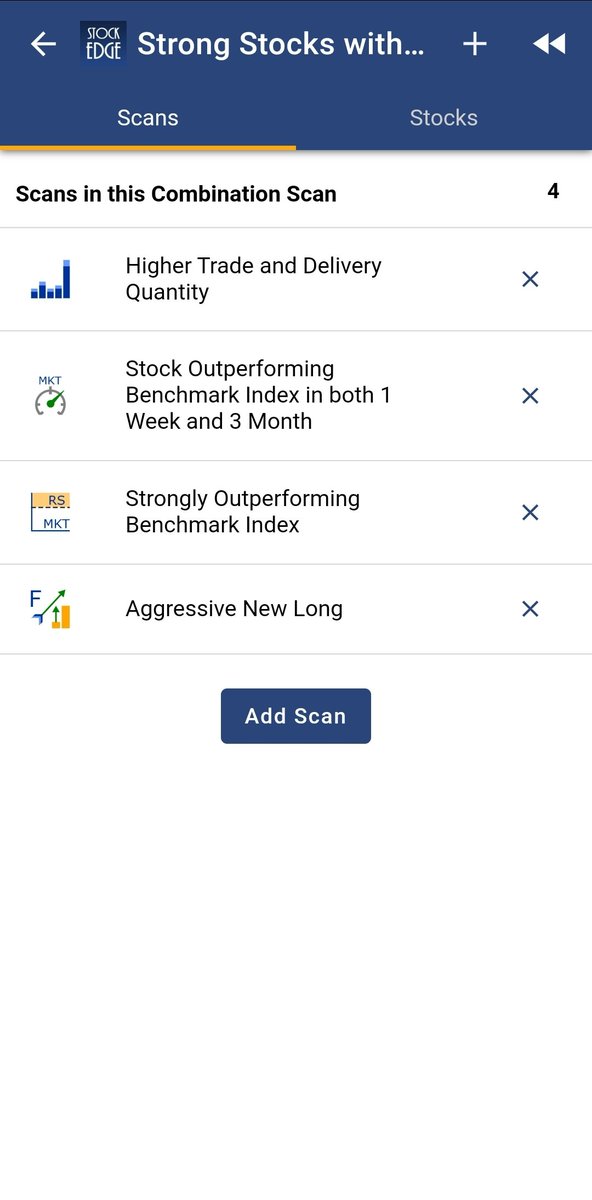

Parameters

1.Price structure - higher swing highs & swing lows

2. Momentum - doubled in last 250 days & trade close to recent highs

3. Demand - Higher volume on green bars

4. Volatility - Bigger bars on upside & shorter on downside

5. Relative strength - Outperforming market

Hello Aneesh, (1) apart from the volume supported HH-HL formation in ATH or 52 weeks high stocks, what other data point u see to shortlist scrip? (2) How do u estimate the holding period for the scrip? Plz guide

— Rohit Khanna\U0001f1ee\U0001f1f3 (@Rohit_MktWale) March 26, 2022

More from Aneesh Philomina Antony (ProdigalTrader)

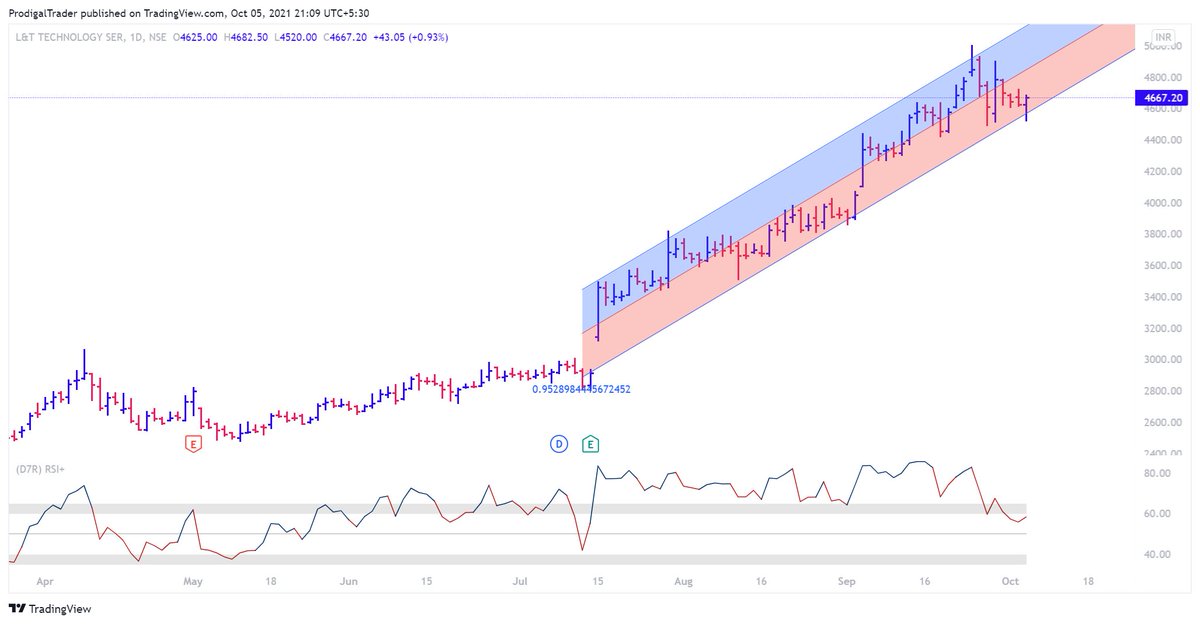

Never trust a slow mover

if demand is enough, it should go up fast

if not, a small increase in supply can trigger substantial fall

#coforge https://t.co/2yJRCUFMIO

if demand is enough, it should go up fast

if not, a small increase in supply can trigger substantial fall

#coforge https://t.co/2yJRCUFMIO

failing to find momentum

— Aneesh Philomina Antony (ProdigalTrader) (@ProdigalTrader) April 6, 2022

too slow for my liking

4408 - 4508 (0.7R)

cutting it off#coforge https://t.co/NtN2ECRSA4 pic.twitter.com/sz1kH8LPI7

More from Screeners

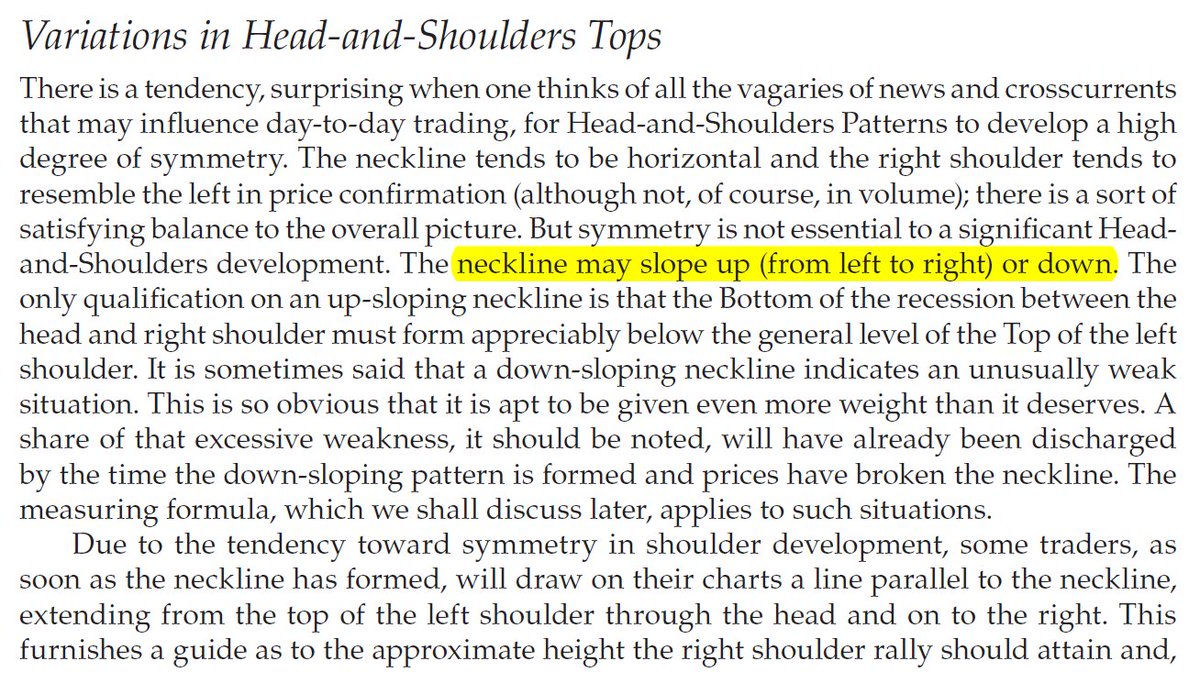

H&S tops with ascending/descending necklines https://t.co/cmRRHp5rlh

Sir Edwards & Magee discussed sloping necklines in H&S in their classical work. I am considering this breakdown by Affle as an H&S top breakdown with a target open of 770.

— The_Chartist \U0001f4c8 (@charts_zone) May 25, 2022

The target also coincides with support at the exact same level. pic.twitter.com/n84kSgkg4q