I will do either

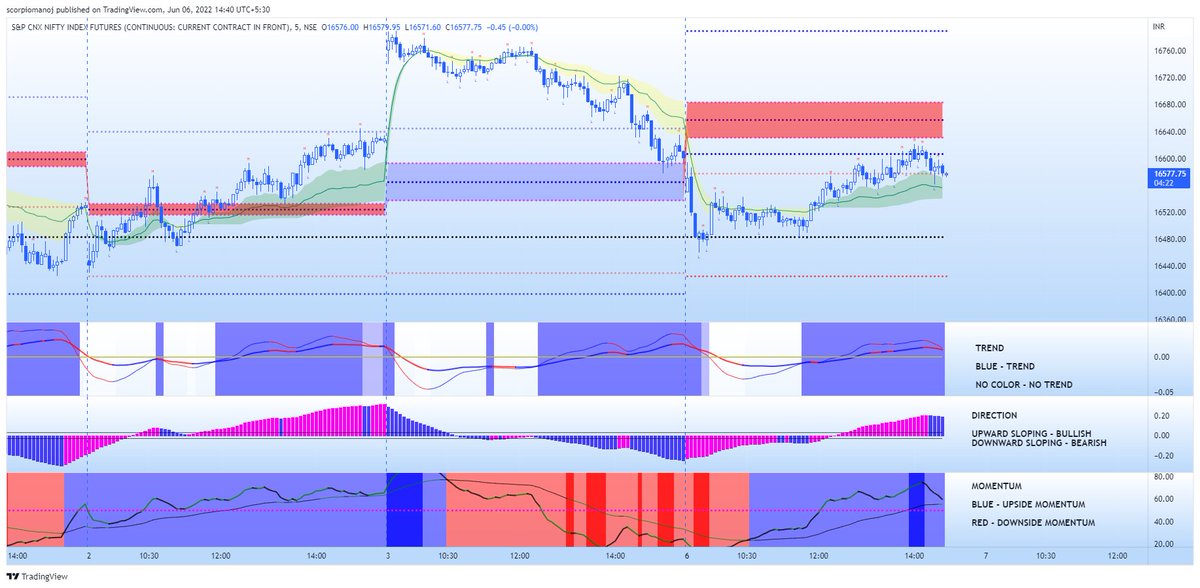

1.Monthly RSI near 40 ( presently 58)..Did nearly 20 yr backtesting

Or

2 A close above 17350 ( monthly)..This will confirm HH Structure

Levels r as of now

More from Discipline TrendFollower😀

As per classical tech analysis

Whenever daily RSI starts trading above weekly RSI. Consider it as short term bottom

When weekly RSI, above monthly RSI midium term bottom

Now daily RSI 30

Weekly 37

Monthly 59

@bankniftydoctor ..RSI king.view pl

I will do either

— Discipline TrendFollower\U0001f600 (@SouravSenguptaI) March 7, 2022

1.Monthly RSI near 40 ( presently 58)..Did nearly 20 yr backtesting

Or

2 A close above 17350 ( monthly)..This will confirm HH Structure

Levels r as of now

I am following very simple trading plan based mainly on RSI and ADX.

— Dr.Jignesh Shah (@bankniftydoctor) January 27, 2019

Now whenever we wants to initiate trade then firstly we have to decide BIAS for direction.

BIAS based on RSI as follows-

RSI Above 55-Long.

RSI below 45-short.

RSI between 45-55\u2014- neutral.

Continue

Pl find enclosed a general FAQ prepared earlier & I hope it could be useful

Any query is welcome

#trendfollowing

I have tried to prepare (best of my knowledge) a small FAQ on Trendfollowing. For more details you may read https://t.co/E5JE81huNA by @Covel

— Discipline TrendFollower\U0001f600 (@SouravSenguptaI) July 12, 2020

Also liberty of tagging @WeekendInvestng

& @Trendmyfriends whome, I consider as best TF in India

Slightly length..But do read it

More from Screeners

You May Also Like

Ironies of Luck https://t.co/5BPWGbAxFi

— Morgan Housel (@morganhousel) March 14, 2018

"Luck is the flip side of risk. They are mirrored cousins, driven by the same thing: You are one person in a 7 billion player game, and the accidental impact of other people\u2019s actions can be more consequential than your own."

I’ve always felt that the luckiest people I know had a talent for recognizing circumstances, not of their own making, that were conducive to a favorable outcome and their ability to quickly take advantage of them.

In other words, dumb luck was just that, it required no awareness on the person’s part, whereas “smart” luck involved awareness followed by action before the circumstances changed.

So, was I “lucky” to be born when I was—nothing I had any control over—and that I came of age just as huge databases and computers were advancing to the point where I could use those tools to write “What Works on Wall Street?” Absolutely.

Was I lucky to start my stock market investments near the peak of interest rates which allowed me to spend the majority of my adult life in a falling rate environment? Yup.