Simple trading system on such a Gap down day.

"5 Minute t/f"

with #supertrend

In this ocean, all kinds survive.

Only the egotist come out & yaps all day, how he/ she is the best.

Come to Madurai market & see the beehive of activity.

Everyone minds their own business

"Make Money"

More from Van Ilango (JustNifty)

Holding 660 & 680, poised for big run in the days, weeks & months ahead.

Volume goes with rises

Thank you.\U0001f64f

— Van Ilango (JustNifty) (@JustNifty) August 18, 2021

A fresh input for you. #McDowell

A major triangle break out in the coming months.

Presently poised to move out of recent consolidation pic.twitter.com/J15F06ODUq

An "ABC" correction ended & "C" wave's "12345" ended in this highly traded stock.

#Elliottwave captures Nature's law, human actions in a collective way

and,

in Top gainers' https://t.co/9bw8A0tgUp

#bajfinance is almost @ sloping channel bottom & has entered the demand zone.

— Van ilango (JustNifty) (@JustNifty) June 22, 2022

One of few stocks that are displaying +ve #Divergence in "Day t/f"

"ABC" correction "almost" done.

Above 5650, mild strength. https://t.co/IJlQ0GKtN3 pic.twitter.com/4uqY0DRqiW

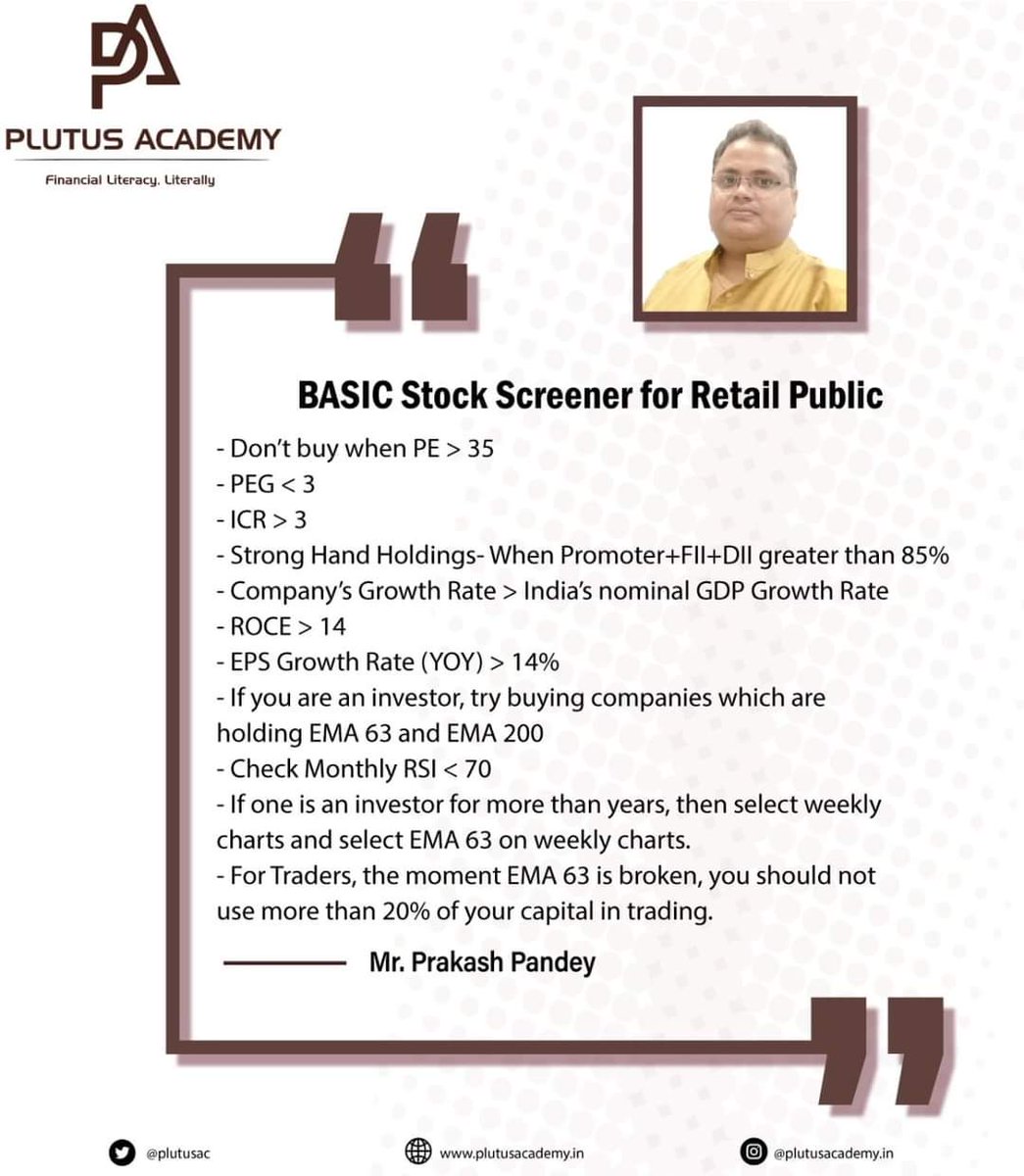

More from Screeners

Covering one of the most unique set ups: Extended moves & Reversal plays

Time for a 🧵 to learn the above from @iManasArora

What qualifies for an extended move?

30-40% move in just 5-6 days is one example of extended move

How Manas used this info to book

The stock exploded & went up as much as 63% from my price.

— Manas Arora (@iManasArora) June 22, 2020

Closed my position entirely today!#BroTip pic.twitter.com/CRbQh3kvMM

Post that the plight of the

What an extended (away from averages) move looks like!!

— Manas Arora (@iManasArora) June 24, 2020

If you don't learn to sell into strength, be ready to give away the majority of your gains.#GLENMARK pic.twitter.com/5DsRTUaGO2

Example 2: Booking profits when the stock is extended from 10WMA

10WMA =

#HIKAL

— Manas Arora (@iManasArora) July 2, 2021

Closed remaining at 560

Reason: It is 40+% from 10wma. Super extended

Total revenue: 11R * 0.25 (size) = 2.75% on portfolio

Trade closed pic.twitter.com/YDDvhz8swT

Another hack to identify extended move in a stock:

Too many green days!

Read

When you see 15 green weeks in a row, that's the end of the move. *Extended*

— Manas Arora (@iManasArora) August 26, 2019

Simple price action analysis.#Seamecltd https://t.co/gR9xzgeb9K

Do read it completely to understand the stance and the plan.

This thread will present a highly probable scenario of markets for the upcoming months. Will update the scenario too if there is a significant change in view in between.

— Aakash Gangwar (@akashgngwr823) May 15, 2022

1/n https://t.co/jfWOyEgZyd

1. The moving average structure - Many traders just look at the 200 ma test or closing above/below it regardless of its slope. Let's look at all the interactions with 200 ma where price met it for the first time after the trend change but with 200 ma slope against it

One can clearly sense that currently it is one of those scenarios only. I understand that I might get trolled for this, but an unbiased mind suggests that odds are highly against the bulls for making fresh investments.

But markets are good at giving surprises. What should be our stance if price kept on rising? Let's understand that through charts. The concept is still the same. Divergent 200 ma and price move results in 200 ma test atleast once which gives good investment opportunities.

2. Zig-Zag bear market- There are two types of fall in a bear market, the first one is vertical fall which usually ends with ending diagonals (falling wedges) and the second one is zig zag one which usually ends with parabolic down moves.