"Quote Retweet" ur mail ID

if u want free scanner for the strategy posted below.

I will send separate Scanners for

1. EOD analysis for preparing trade plan

2. Live Trading with entry signals

Bullish scanner for day/swing trading

— Aneesh Philomina Antony (ProdigalTrader) (@ProdigalTrader) March 3, 2022

Stocks which made new 52 week high in last 1 month, today closed at day high & abv previous day range.

Bearish scanner for day/ swing trading

Stocks made new 52 week low in last 1 month, today closed below previous day low & near day low.

More from Aneesh Philomina Antony (ProdigalTrader)

Few concepts upon which day trading systems can be built upon

https://t.co/3eAoEqM7QQ up trending market look for pin bar with good volume

2.Rsi divergence and macd histogram divergence both at the same time on 3 min chart

https://t.co/qrAH9PZ6D3 = Low (15min)

1/7

4.ORB with 15 min candle stick along with support and resistance of previous 5 days

5.Pullbacks in Strong momentum (wide range candles + Volume) stocks

6.ORB with volatility contraction and then wide range candle breakout with volume expansion

2/7

7.Fakeout like spring and Upthrust for entry pullback with low volume

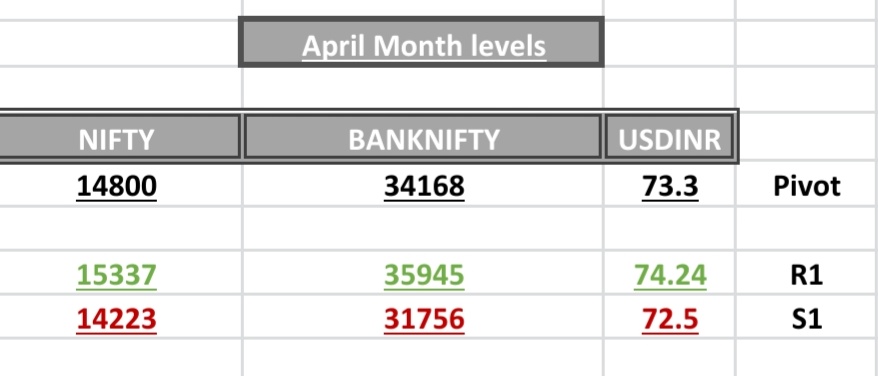

8.CPR analysis with standard pivots

9.PDH/PDL breakout with volume, vwap and RSI confirmation

3/7

10.Horizontal support/resistance from HTF and confirmation of acceptance or rejection in lower timeframe as reversal candlestick patterns with volume confirmation

https://t.co/75kykbExlg writing data and Put Writing data in correlation with price action

4/7

12.Pivots (Fibonacci) and Price action with volume activity

13.Ichimoku set ups with previous day NR4/NR7 scrips with pivots and volume as trading tools

https://t.co/JcwqOZS5L4 and rejections on 100/200 ema

15.EMA20 and rsi divergence with daily trend structure

5/7

https://t.co/3eAoEqM7QQ up trending market look for pin bar with good volume

2.Rsi divergence and macd histogram divergence both at the same time on 3 min chart

https://t.co/qrAH9PZ6D3 = Low (15min)

1/7

4.ORB with 15 min candle stick along with support and resistance of previous 5 days

5.Pullbacks in Strong momentum (wide range candles + Volume) stocks

6.ORB with volatility contraction and then wide range candle breakout with volume expansion

2/7

7.Fakeout like spring and Upthrust for entry pullback with low volume

8.CPR analysis with standard pivots

9.PDH/PDL breakout with volume, vwap and RSI confirmation

3/7

10.Horizontal support/resistance from HTF and confirmation of acceptance or rejection in lower timeframe as reversal candlestick patterns with volume confirmation

https://t.co/75kykbExlg writing data and Put Writing data in correlation with price action

4/7

12.Pivots (Fibonacci) and Price action with volume activity

13.Ichimoku set ups with previous day NR4/NR7 scrips with pivots and volume as trading tools

https://t.co/JcwqOZS5L4 and rejections on 100/200 ema

15.EMA20 and rsi divergence with daily trend structure

5/7

Parameters

1.Price structure - higher swing highs & swing lows

2. Momentum - doubled in last 250 days & trade close to recent highs

3. Demand - Higher volume on green bars

4. Volatility - Bigger bars on upside & shorter on downside

5. Relative strength - Outperforming market

1.Price structure - higher swing highs & swing lows

2. Momentum - doubled in last 250 days & trade close to recent highs

3. Demand - Higher volume on green bars

4. Volatility - Bigger bars on upside & shorter on downside

5. Relative strength - Outperforming market

Hello Aneesh, (1) apart from the volume supported HH-HL formation in ATH or 52 weeks high stocks, what other data point u see to shortlist scrip? (2) How do u estimate the holding period for the scrip? Plz guide

— Rohit Khanna\U0001f1ee\U0001f1f3 (@Rohit_MktWale) March 26, 2022

More from Screeners

On the occasion of youtube 20k and Twitter 70k members

A small tribute/gift to members

Screeners

technical screeners - intraday and positional both

before proceeding - i have helped you , can i ask you so that it can help someone else too

thank you

positional one

run - find #stock - draw chart - find levels

1- Stocks closing daily 2% up from 5 days

https://t.co/gTZrYY3Nht

2- Weekly breakout

https://t.co/1f4ahEolYB

3- Breakouts in short term

https://t.co/BI4h0CdgO2

4- Bullish from last 5

intraday screeners

5- 15 minute Stock Breakouts

https://t.co/9eAo82iuNv

6- Intraday Buying seen in the past 15 minutes

https://t.co/XqAJKhLB5G

7- Stocks trading near day's high on 5 min chart with volume BO intraday

https://t.co/flHmm6QXmo

Thank you

A small tribute/gift to members

Screeners

technical screeners - intraday and positional both

before proceeding - i have helped you , can i ask you so that it can help someone else too

thank you

positional one

run - find #stock - draw chart - find levels

1- Stocks closing daily 2% up from 5 days

https://t.co/gTZrYY3Nht

2- Weekly breakout

https://t.co/1f4ahEolYB

3- Breakouts in short term

https://t.co/BI4h0CdgO2

4- Bullish from last 5

intraday screeners

5- 15 minute Stock Breakouts

https://t.co/9eAo82iuNv

6- Intraday Buying seen in the past 15 minutes

https://t.co/XqAJKhLB5G

7- Stocks trading near day's high on 5 min chart with volume BO intraday

https://t.co/flHmm6QXmo

Thank you