https://t.co/Rbw9wtJNPi

Full technical analysis courses in one thread 🧵

For free which is Worth ₹80k 👇

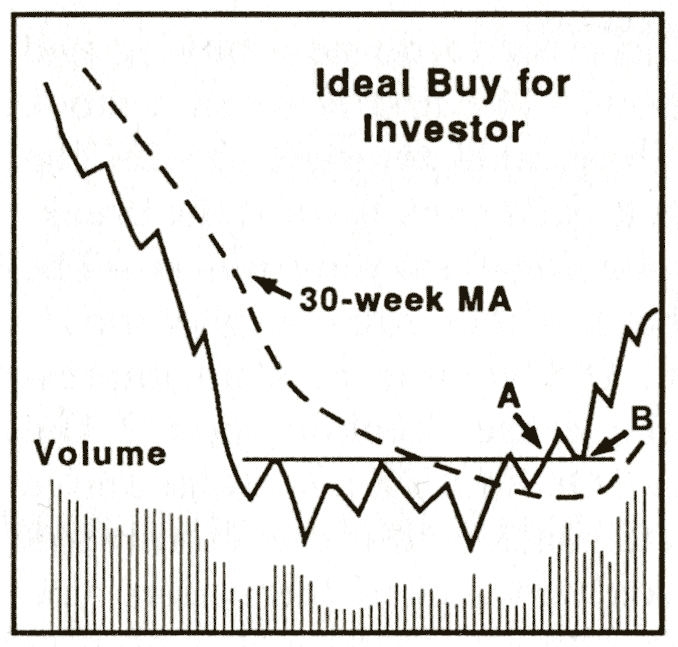

If you wanna learn how market behave in long term & short term

You must watch full video 🎥 👇

https://t.co/vf8KZSpR7u

https://t.co/oC4cEOnSNu

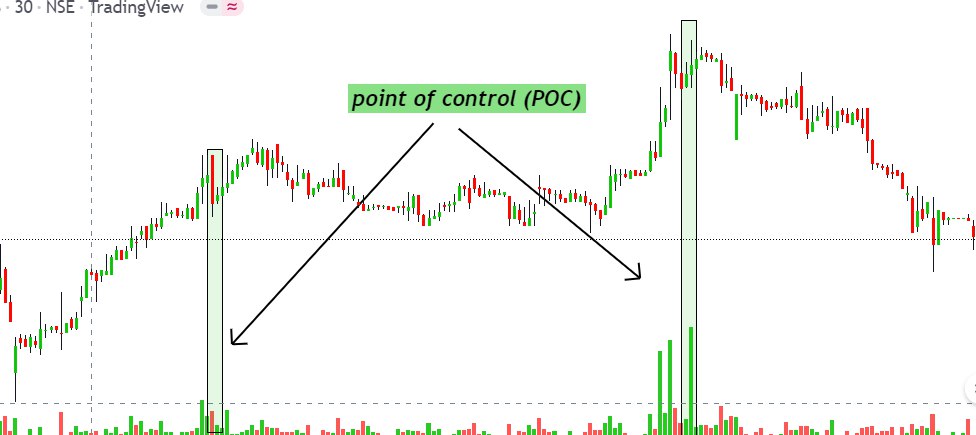

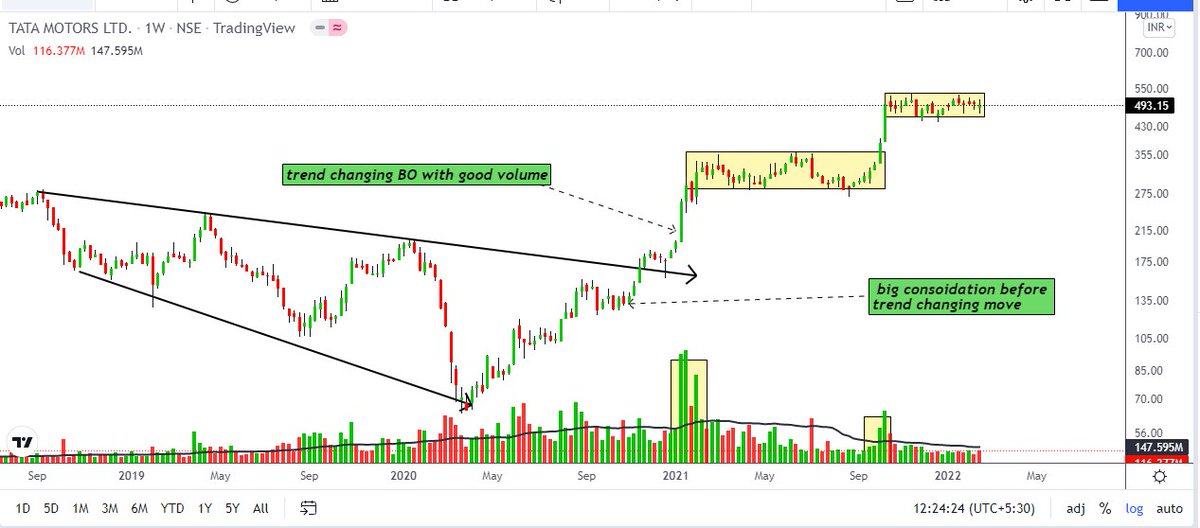

Trendline is basically use for majoring trend \U0001f4c8 of any stock.

— Vikrant (@Trading0secrets) February 10, 2022

It is also useful for indentify demand & supply ....

Here it's applications \U0001f447

https://t.co/eJ6btIs57Q

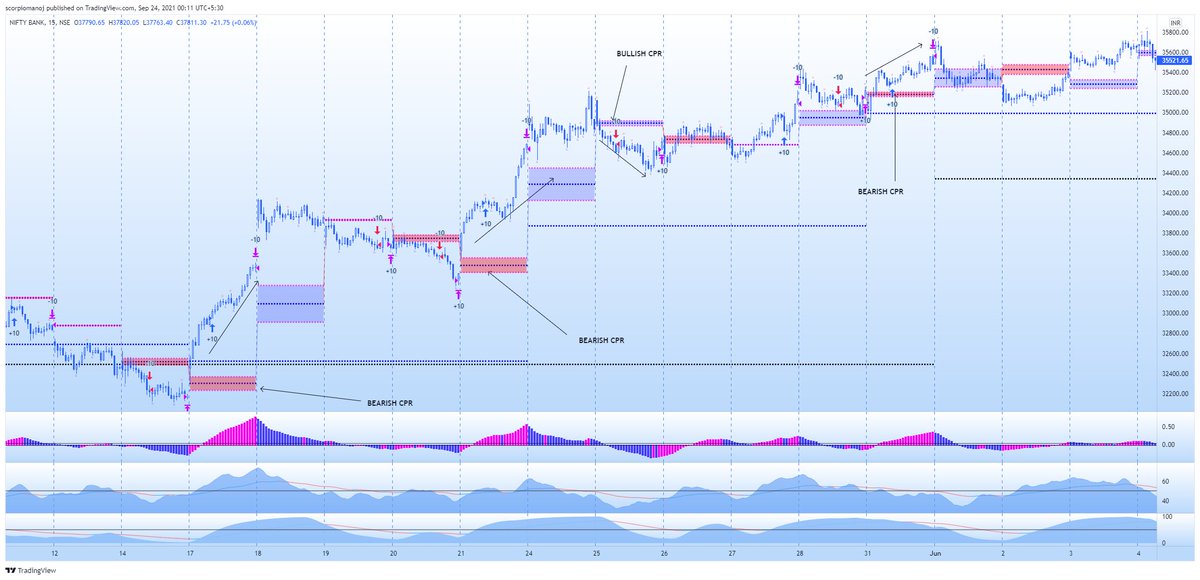

The Trader biggest dilemma is when to book profit

— Vikrant (@Trading0secrets) January 12, 2022

Here is simple solution which I m using from many years.

This not based on any indicators .

( Based on pure price action & days low)

I am swing breakout trader so I will tell you this thread \U0001f9f5 how I book profit \U0001f447

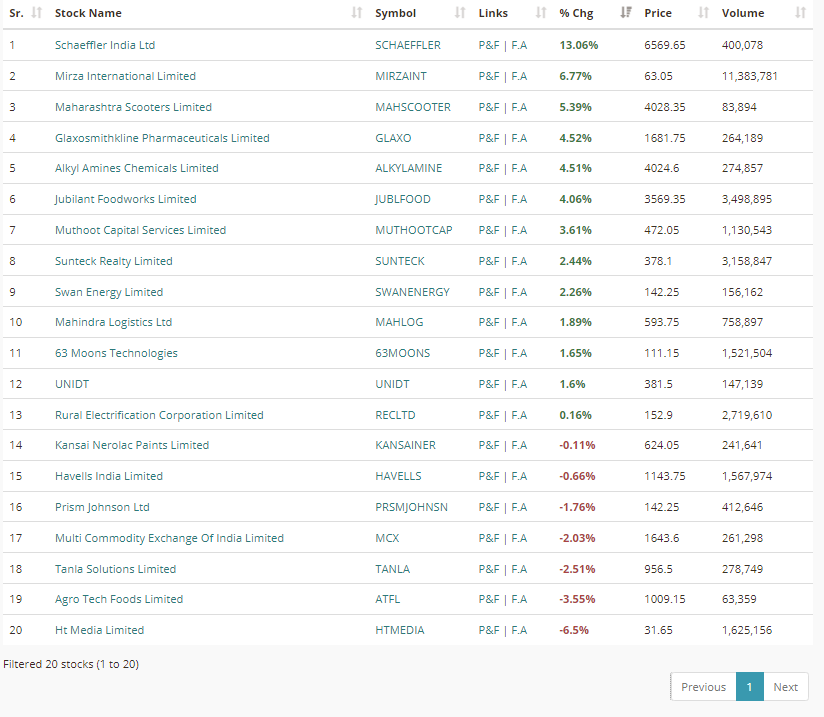

1⃣ potential breakout scanner -

https://t.co/3VJpQHdBxl

2⃣ Short term breakout scanner -

https://t.co/PqFxbAcILk

3️⃣ long term breakout scanner -

https://t.co/OcKDkkyxmP

More from Vikrant

Based on my experience , these are the best time to trade breakouts intraday 👇

1⃣ When stock is doing small consolidation near major resistance & support

Here risk is very low,

Ex- #khaitanchem https://t.co/uGTZrfQOm4

In such volatile market I mainly trading intraday with low risk breakout setup .

— Vikrant (@Trading0secrets) February 18, 2022

Making thread \U0001f9f5 on Intraday breakout strategy.

And how I play & when you should avoid intraday.

Try to explain full BO intraday strategy

With examples

Will share thread \U0001f9f5 after completed\U0001f4af

2⃣ When previous BO of stock are very strong with high volume.

#geecee

3️⃣ When stock is accumulating in very tight range with low volume & BO with very high volume.

Ex - #jagsonpal

4⃣ When major trend of stock & market must match each other.

And that time their sector must be strong 💪

#tatamotors

5⃣ Recent example of intraday tight range setup for next week which is fullfilling all that criteria 👆👇

Ex - #NDTV

Here risk is 2/3% & reward is 8/15%

But out them 5 are incredible 👍

Which are also summary of his book.

Here are that five 5⃣ tweets 👇

https://t.co/vKMVxF137t

Ignore the naysayers. They will always be here and they will always be skeptical of your dreams and try to discourage you. Success is the best revenge. And now I'll hear the excuses for my 2021 USIC performance as well. LOL! pic.twitter.com/2hziplVEzf

— Mark Minervini (@markminervini) September 29, 2021

https://t.co/nGrDHlRkuA

Rules I built a 38-year career on...

— Mark Minervini (@markminervini) December 23, 2021

1. always use a stop loss

2. define your stop before you enter

3. never risk more than you expect to gain

4. nail down decent profits

5. never let a good size gain turn into a loss

6. never average down

7. never get bold when running cold

https://t.co/8DtxnJf0Bo

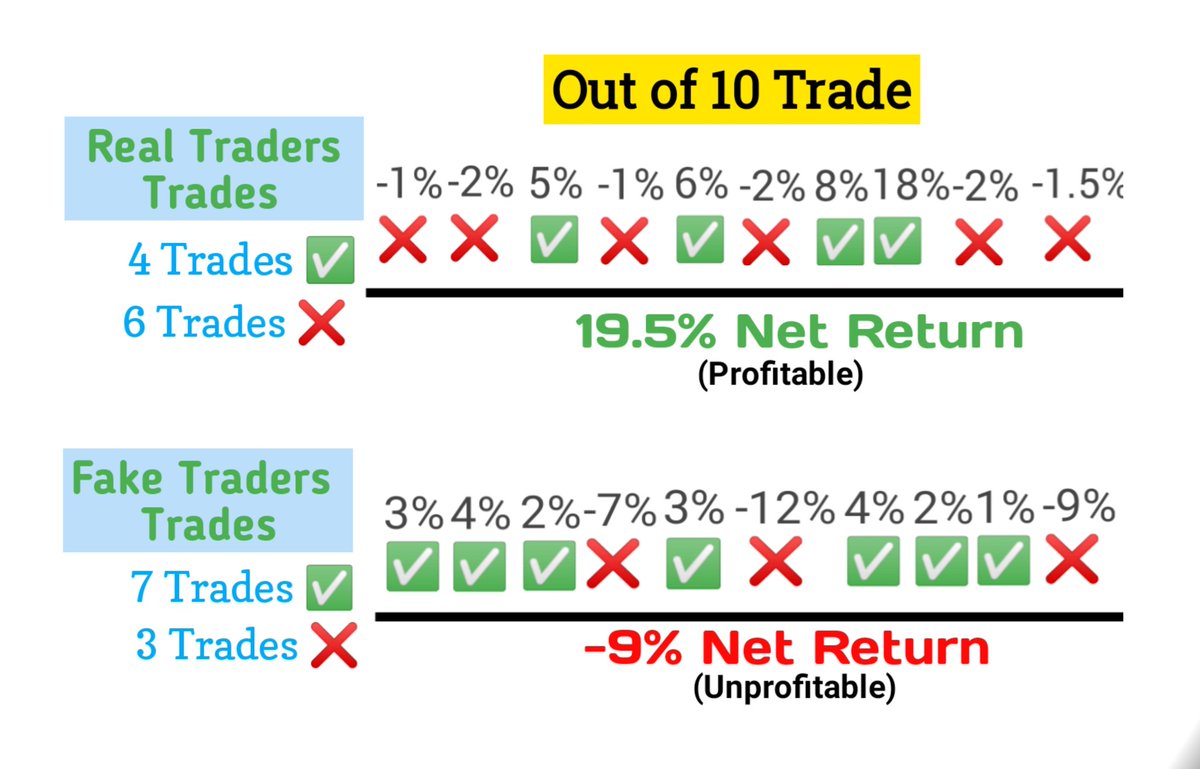

If you want to make great returns consistently and do it w/ minimal drawdown, you must get off the idea of being right or wrong and instead learn how to lose much less when you're wrong than you make when you're right. I'm wrong just as much as I'm right. That's why I use stops.

— Mark Minervini (@markminervini) July 20, 2021

https://t.co/ROihOUjesI

I dedicated 37 years to learning and perfecting the craft of stock trading. If there was a way around risk management, I probably would have found it. PhDs, Nobel prize winners and geniuses haven't been able to do it. Your losses must be managed smaller than your gains.. period.

— Mark Minervini (@markminervini) July 5, 2021