Which cos according to you have highest probability of tripling revenue in next 4 years (~30% cagr)?

FY26 revenue is 3x FY22 revenue ?

My guess among cos I track: Sona comstar, saregama, mastek, dynemic products, sastasundar, angel one

More from Sahil Sharma

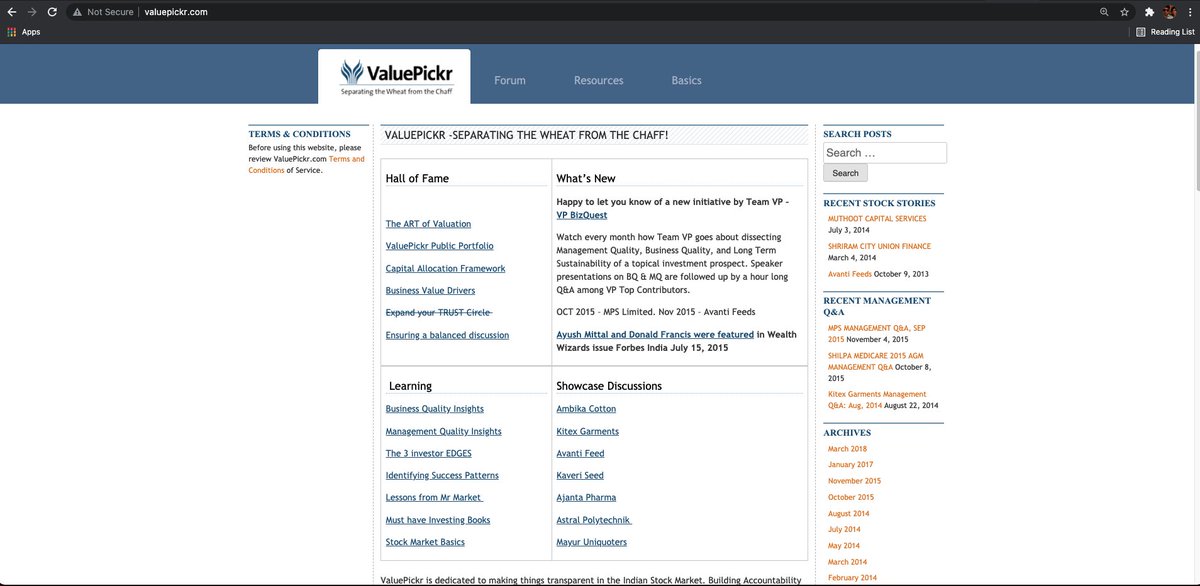

This thread is to create awareness on how to use

https://t.co/3jeqlXO0QH

Please note that i am not officially associated with website. Only an active contributor & hope to benefit from network effects of interested investors actively contributing on platform.

https://t.co/64yVScplqi is above all else a community of like minded investors who wants to actively engage in understandin at a fundamental level & separate wheat from the chaff.

Develop an understanding of the biz, industry, competitive intensity, management, valuation

Website was created > 10 years ago. Early users are seasoned investors & i personally look to learn greatly by following their footprints across the website.

There are broadly speaking 4-5 types of "threads" or discussion places across the website.

1. Featured discussions (hall of fame, showcase discussions, learning).

These enable investor to level up the most. These discussions are a showcase for the website itself.

These are also a great starting point. Since VP is not a course, feel free to traverse them in any order

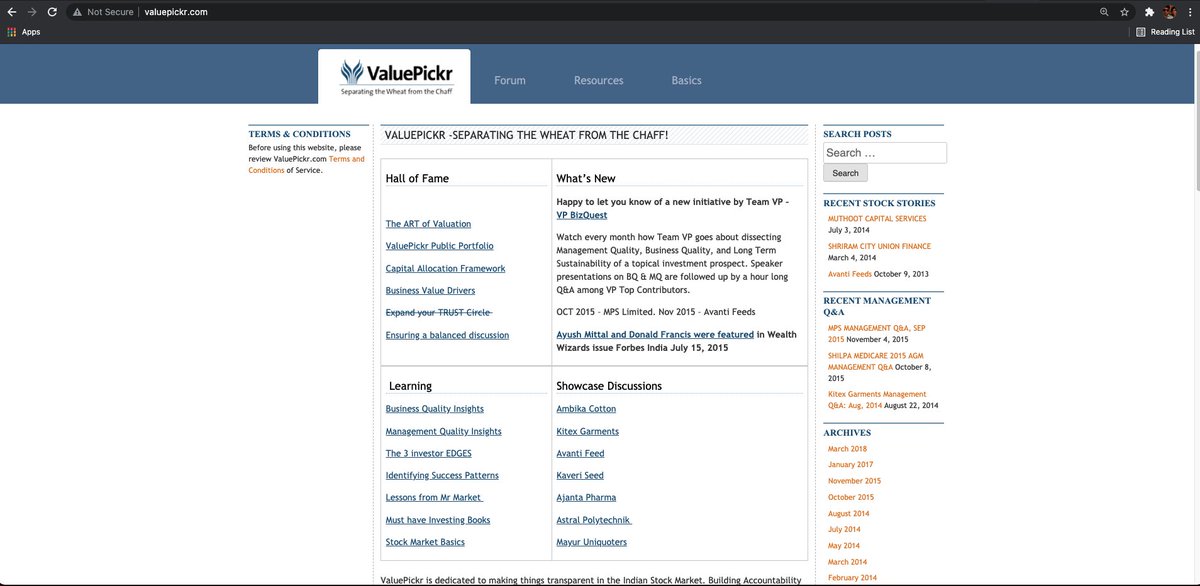

https://t.co/3jeqlXO0QH

Please note that i am not officially associated with website. Only an active contributor & hope to benefit from network effects of interested investors actively contributing on platform.

https://t.co/64yVScplqi is above all else a community of like minded investors who wants to actively engage in understandin at a fundamental level & separate wheat from the chaff.

Develop an understanding of the biz, industry, competitive intensity, management, valuation

Website was created > 10 years ago. Early users are seasoned investors & i personally look to learn greatly by following their footprints across the website.

There are broadly speaking 4-5 types of "threads" or discussion places across the website.

1. Featured discussions (hall of fame, showcase discussions, learning).

These enable investor to level up the most. These discussions are a showcase for the website itself.

These are also a great starting point. Since VP is not a course, feel free to traverse them in any order

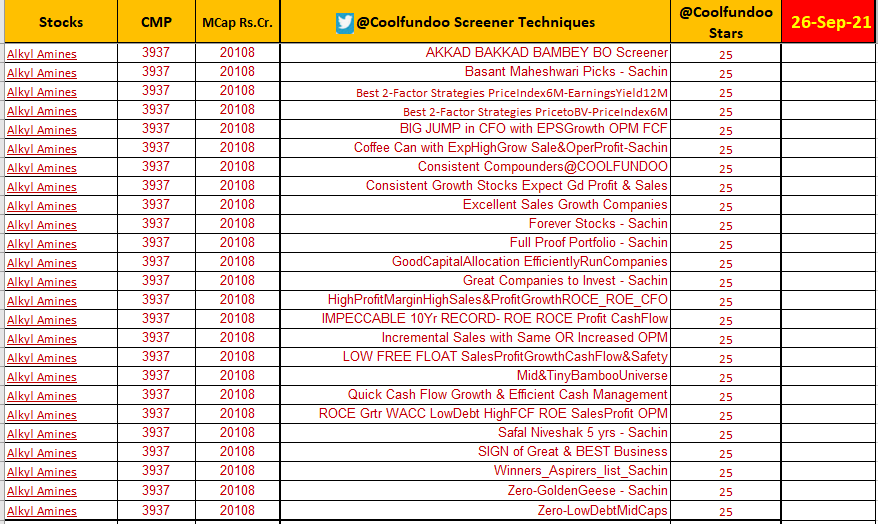

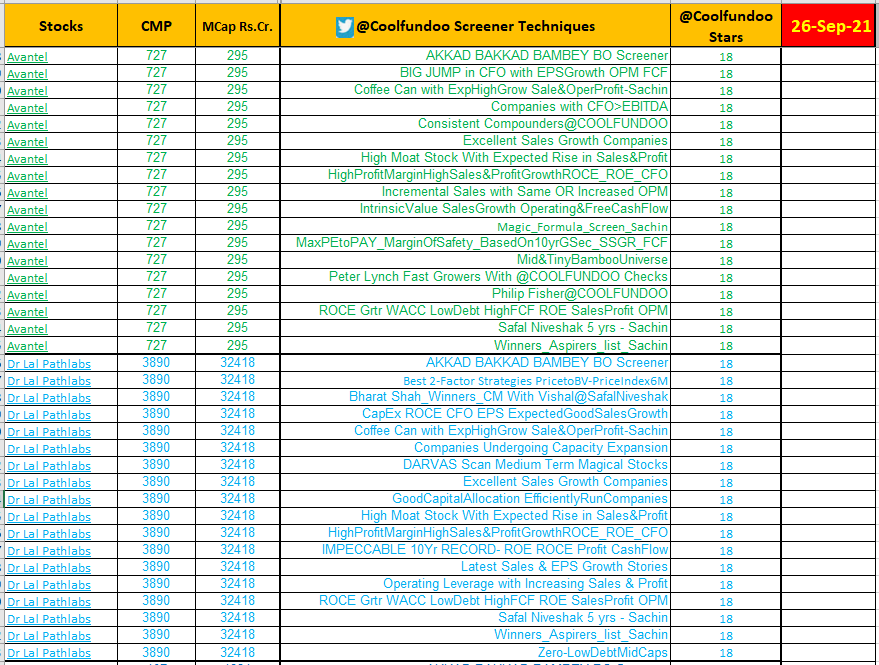

More from Screeners

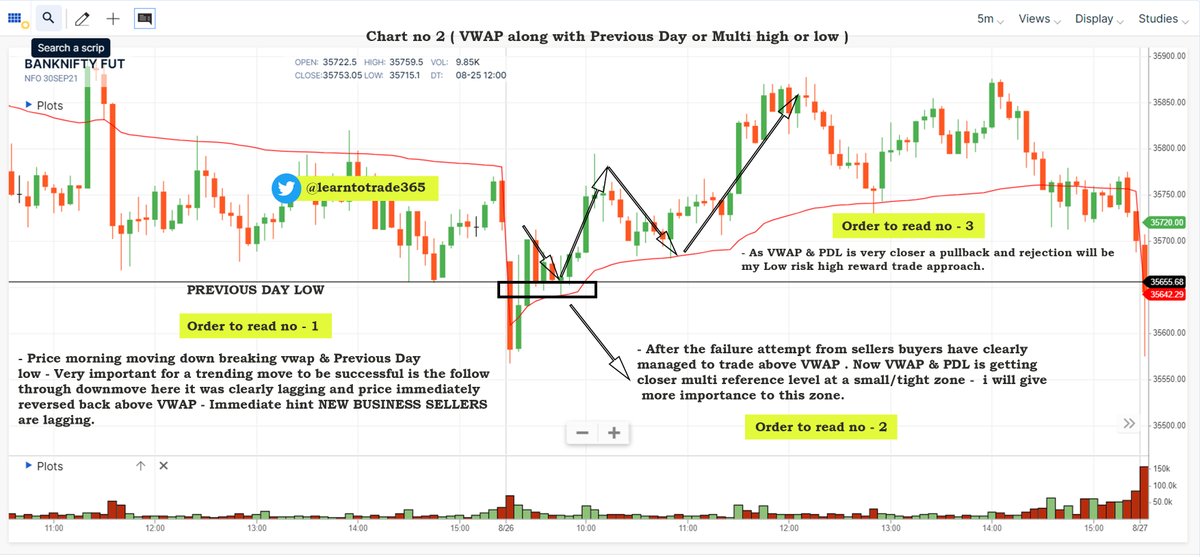

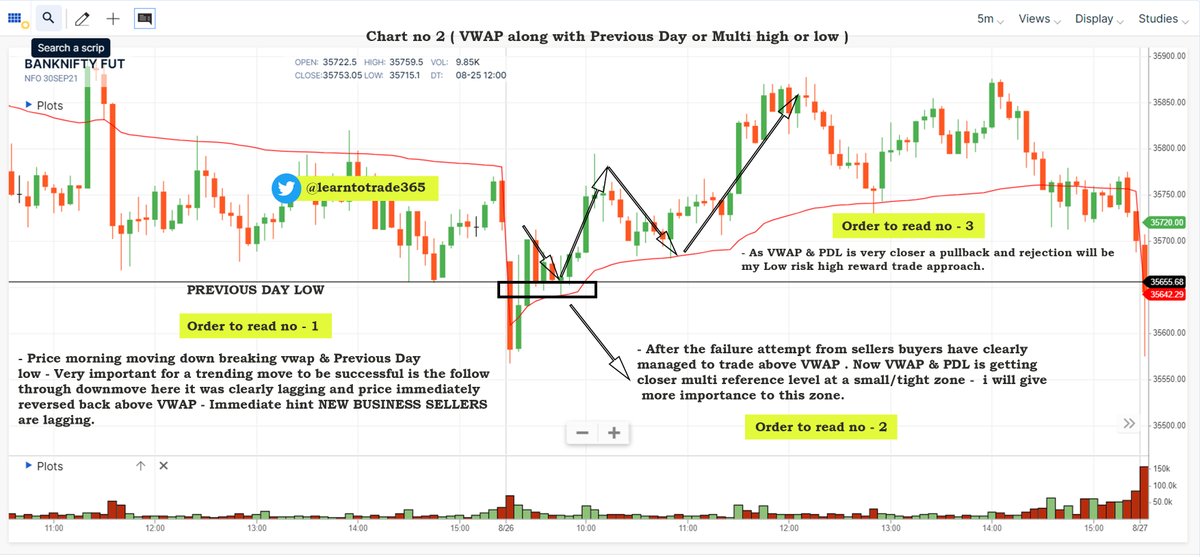

VWAP for intraday Trading Part -2

A small thread.

PART 1 - https://t.co/ooxepHpYKL

Traders show your support by like & retweet to benefit all

@Mitesh_Engr @ITRADE191 @ProdigalTrader @nakulvibhor @RajarshitaS @Puretechnicals9 @AnandableAnand @Anshi_________ @ca_mehtaravi

Chart 1

Chart 2

Chart 3

Chart 4

A small thread.

PART 1 - https://t.co/ooxepHpYKL

Traders show your support by like & retweet to benefit all

@Mitesh_Engr @ITRADE191 @ProdigalTrader @nakulvibhor @RajarshitaS @Puretechnicals9 @AnandableAnand @Anshi_________ @ca_mehtaravi

VWAP for intraday Trading Part -1

— Learn to Trade (@learntotrade365) August 28, 2021

A small thread PART -2 will be released tomorrow

Traders show your support by like & retweet to benefit all@Mitesh_Engr @ITRADE191 @ProdigalTrader @nakulvibhor @ArjunB9591 @CAPratik_INDIAN @RajarshitaS @Stockstudy8 @vivbajaj @Prakashplutus pic.twitter.com/y8bwisM4hB

Chart 1

Chart 2

Chart 3

Chart 4