One of the best tools for Options Traders is @iChartsIndia

9 things Icharts can do, you'll wish you knew yesterday:

Collaborated with @niki_poojary

🧵

By the end of this thread, you'll learn 7 features with uses:

1. Option Chain (Advanced) features

2. Total PE - CE OI

3. Options Intraday OI Breakup

4. Cumulative OI change

5. Backtesting historical Data

6. Data in different intervals

7. Straddle/Strangle Charts

Let's go ↓

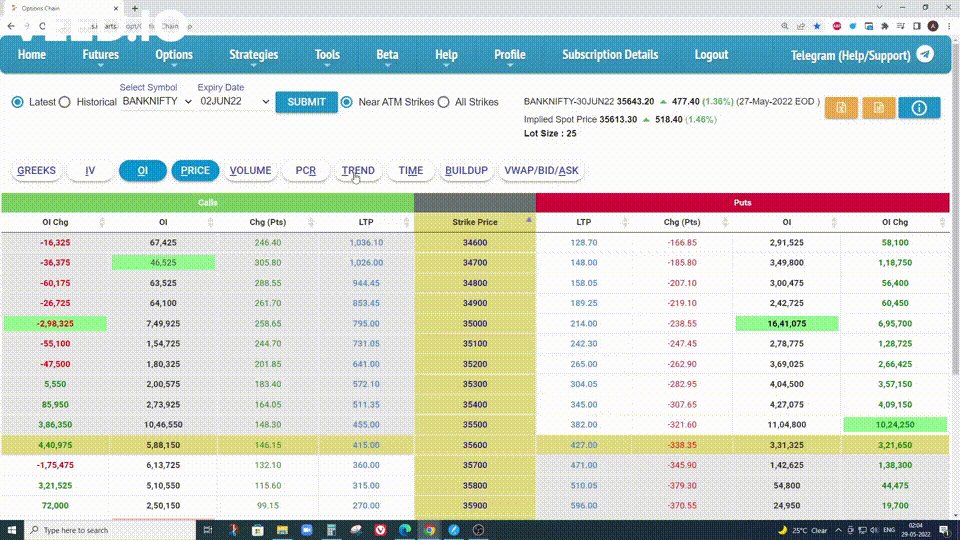

1. Option Chain (Advanced):

Uses:

• Understand the options chain better

• Know the correct market direction and

• Sell the right options with a higher probability of success.

Open Option Chain on Icharts and then click on:

• Trend

• Buildup

• Vwap

Like this:

2. Total PE - CE OI

Most popular and powerful feature, even used by experts like @nitinmurarkasmc heavily.

Observe the intraday Change in OI difference and align your trades with where writing is happening.

Can check it only for nearer strikes, or all strikes.

Here's how:

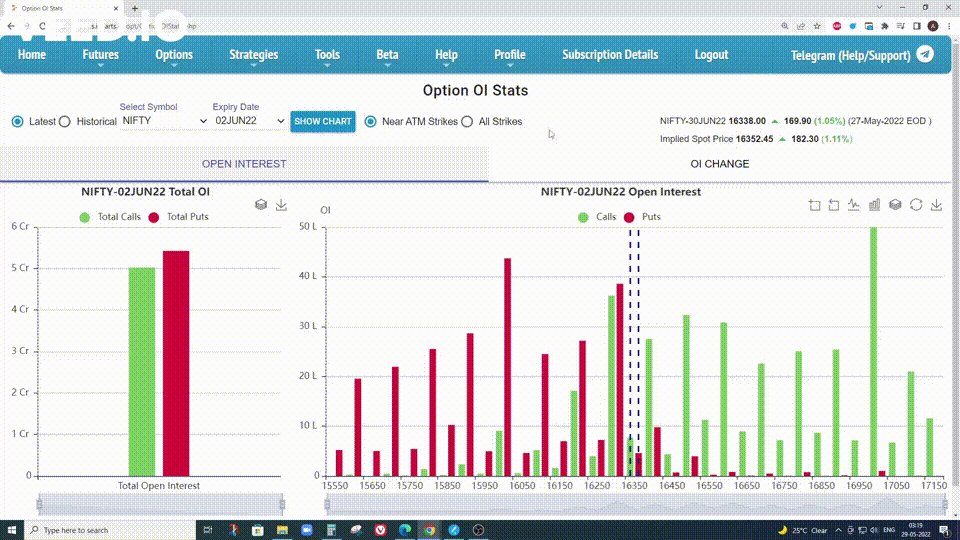

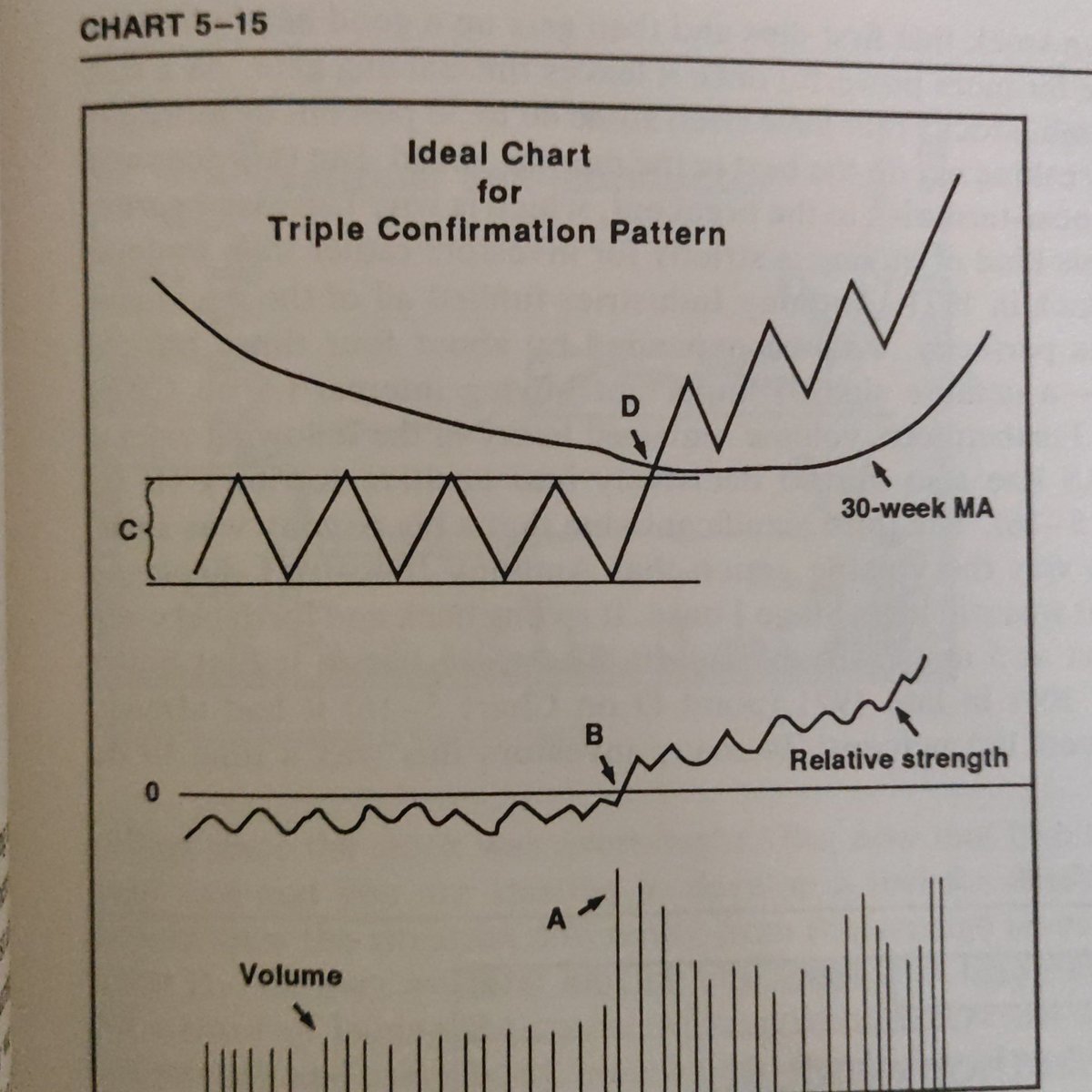

3. Option OI stats

Shows you Total OI and Change in OI in bar chart format.

Can segregate from Near Atm strikes to all strikes.

Historical Data of past expiries is also available to make backtesting easier.