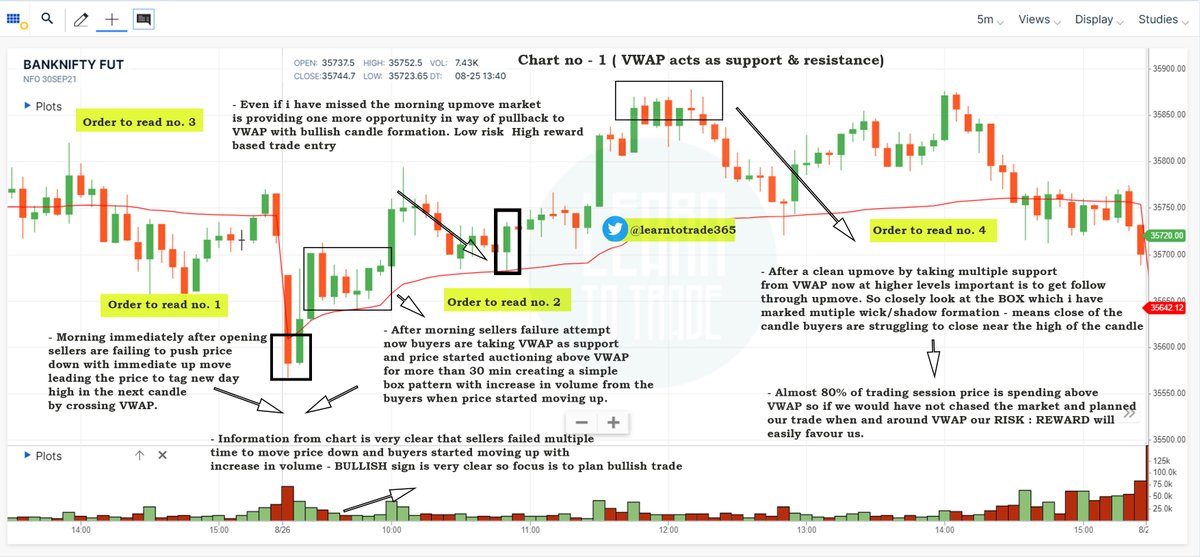

VWAP for intraday Trading Part -1

A small thread PART -2 will be released tomorrow

Traders show your support by like & retweet to benefit all

@Mitesh_Engr @ITRADE191 @ProdigalTrader @nakulvibhor @ArjunB9591 @CAPratik_INDIAN @RajarshitaS @Stockstudy8 @vivbajaj @Prakashplutus

More from Learn to Trade

After more than 8 years of market experience i am sharing these effective intraday strategies.

Spend few minutes of your time to understand

Thread 🧵 RT for wider reach

Scroll down👇

1/8

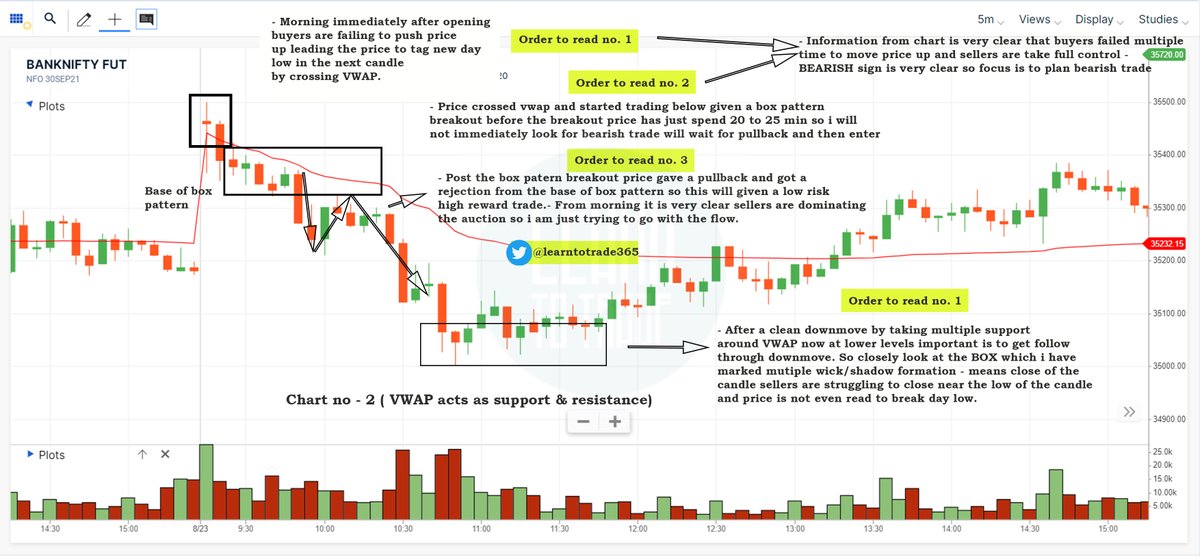

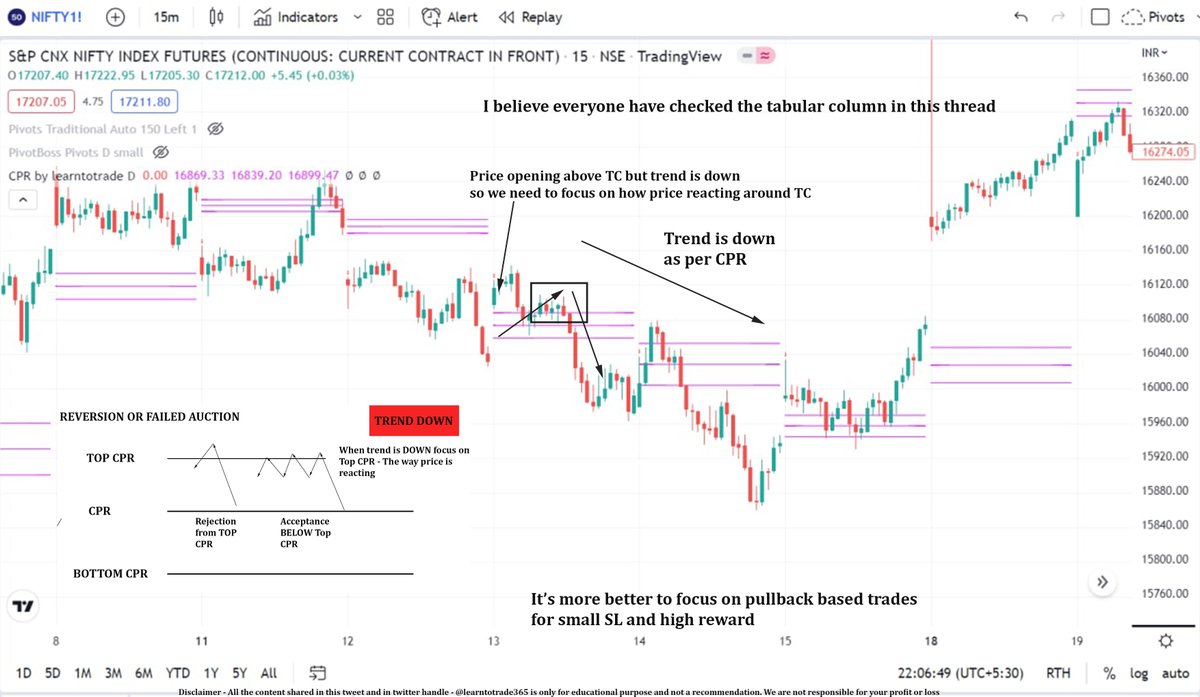

Intraday Strategy 1 - VWAP & Pivot Based

Vwap & Pivot Points - Trading Zones for intraday directional traders

— Learn to Trade (@learntotrade365) September 10, 2022

Intraday Trading strategy for Trend followers \U0001f9f5

Support us by RETWEET this tweet to reach and benefit most traders so it can help them to gain knowledge

Scroll down \U0001f447 pic.twitter.com/L6HHsXQZpV

Intraday Strategy 2 - Price Action strategy without

Price Action Trading ( Without Indicators)

— Learn to Trade (@learntotrade365) August 20, 2022

Intraday Trading strategy for all Directional traders.

Intraday Trading Strategy Thread \U0001f9f5

Support us by RETWEET to reach and benefit maximum traders

Scroll down \U0001f447 pic.twitter.com/AVsKmWroMc

Intraday Strategy 3 - Price Based

Highly effective Trading strategy which can help to follow the trend & ride the direction in BANKNIFTY ( Without Indicators)

— Learn to Trade (@learntotrade365) October 1, 2022

For Option Buyers, Option Sellers & all Directional traders

Simple strategy help to make more profits

Retweet this thread \U0001f9f5 to reach many traders pic.twitter.com/dKxVmgntz3

Intraday Strategy 4 - Open Interest based

Whether OI works for intraday trading ?

— Learn to Trade (@learntotrade365) September 25, 2022

Whether OI useful ?

No one has a exact answer. But one effective way to make use OI in a very different perspective - OUT OF THE BOX from Traditional method

Read the full thread \U0001f9f5

Kindly RETWEET & share so it can reach many traders pic.twitter.com/IFx13oISRW

Topic - Data Points to check as a Option seller

Mega Thread 🧵 of all the data points to check as a option seller shared by Mr. Kapil Dhama is complied

Retweet to reach wider -Learning should never stop

#StockMarketindia

1/18 https://t.co/m0NXToSU1p

\U0001f50a Twitter Space with @kapildhama for the first time

— Learn to Trade (@learntotrade365) January 15, 2022

Topic - Data points to check as a option seller

Sunday ( 16/01/22 ) evening 06:00 p.m

Link - https://t.co/XMaoRfOWp4

Click on the link and set reminder #stockmarkets #trading #StockMarketindia pic.twitter.com/HRPEooa5H2

2/18

-Make your own trading system

- First identify what suits you ?

Trend Following

Directional or Non-directional option selling

9:20straddle

Naked option buying/selling

-Never take more than 1% loss in intraday

-There is no specific trick in market only important is process

3/18

-Chart & Data plays a important role ( Understand to combine to identify trades/direction )

-In all trades knowing exit point is very important

Simple target for Kapil sir in straddle is 100 points in a week on BNF & Loss exit point is 50 points after adjustment (R:R 1:2)

4/18

- Simple target for Kapil sir in straddle is 50 points in a week on NF & Loss exit point is 25 points after adjustment (R:R 1:2)

Check data after 3:00 p.m Chart + Data ?

Check how is the closing ( Location of closing - Near Day high or Day low or mid of the day )

5/18

Example:

-If market is near high ( Check in data whether Near ATM PE has more writing & in CE writing whether is less at higher strike price) - It is a Probability

Once Data is bullish along with the close he choose

Strangle- Rs.70 PE & Rs.40 CE or scroll down

A mega thread 🧵on various content related to trading

1/11 🧵

Retweet and share to benefit maximum traders

Checklist for Option buying thread by ( @asitbaran )

2/11

A thread on Basic Checklist while going Long Options.

— Asit Baran Pati \U0001f1ee\U0001f1f3 (@asitbaran) May 24, 2021

Thought of writing this post for people who are doing Option Buying and losing money. It can be very basic, so Pros please may give a skip.

Just a checklist so that you don\u2019t lose big money by Long Option strategies

Trading via spread by @Ronak_Unadkat complied by @AdityaTodmal

3/11

The best spreads trader on Twitter: @Ronak_Unadkat

— Aditya Todmal (@AdityaTodmal) March 6, 2022

He trades in Nifty & Bank Nifty via spreads majorly.

In the Jainam Broking Speech, he shared how he trades debit and credit spreads:

Here's a breakdown of his 10 step method: \U0001f9f5

Collaborated with @niki_poojary

Option strike price selection by @ITRADE191 complied by @AdityaTodmal

4/11

A THREAD on . . . .

— Aditya Todmal (@AdityaTodmal) March 29, 2021

How @ITRADE191 selects strikes to trade in and how he follows risk management.

Short thread explained via pictures with the help of @niki_poojary.

Data points to check as a option sellers by @kapildhama

5/11

2 hours of non-stop Twitter space by @kapildhama

— Learn to Trade (@learntotrade365) January 17, 2022

Topic - Data Points to check as a Option seller

Mega Thread \U0001f9f5 of all the data points to check as a option seller shared by Mr. Kapil Dhama is complied

Retweet to reach wider -Learning should never stop#StockMarketindia

1/18 https://t.co/m0NXToSU1p pic.twitter.com/GkjArctHsR

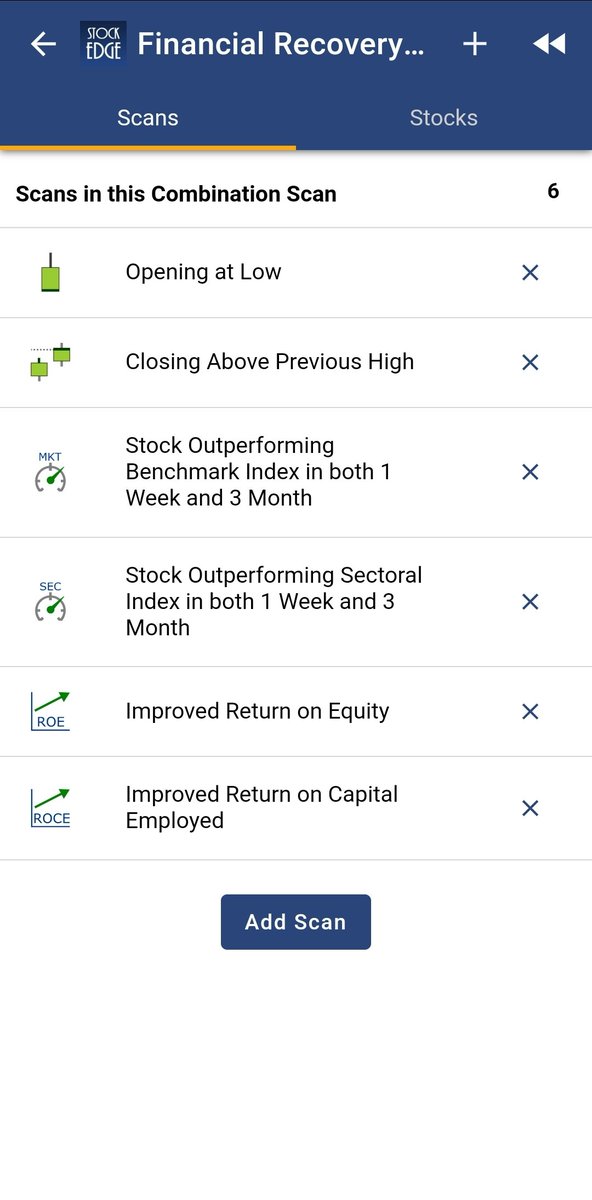

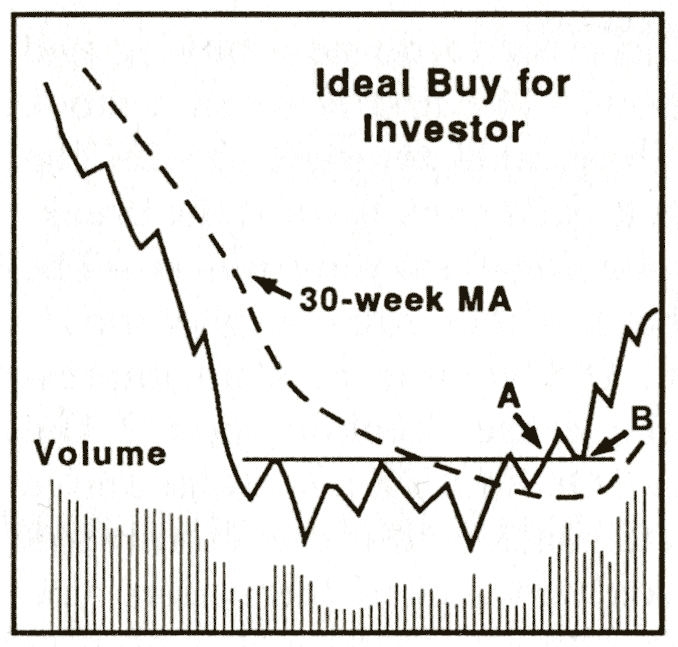

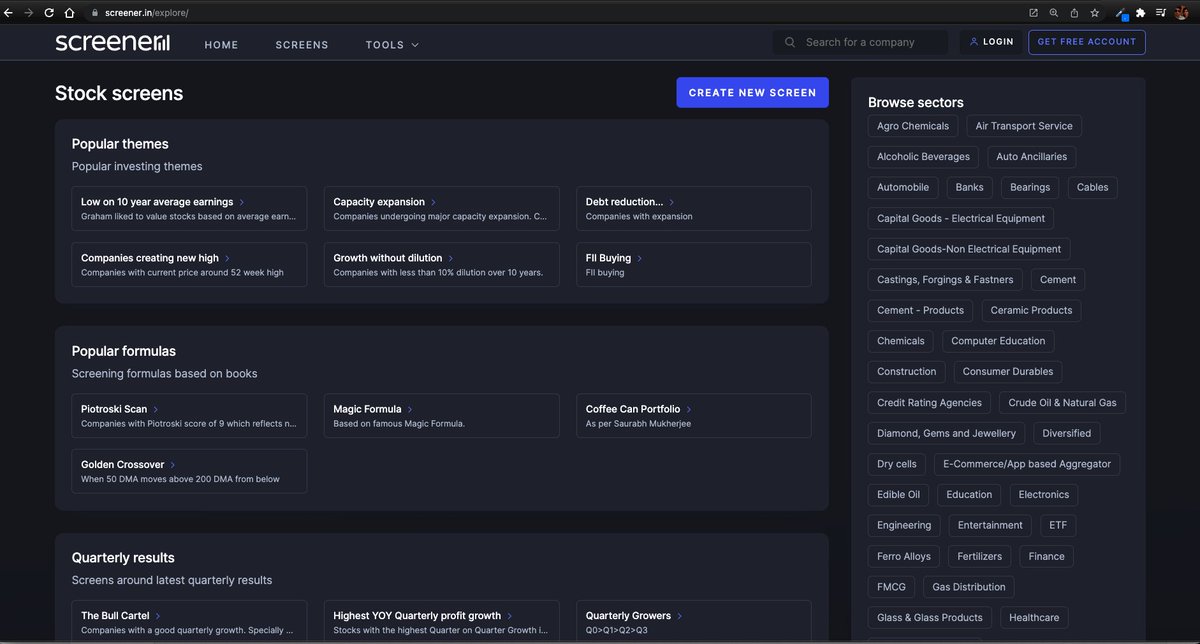

More from Screeners

Step-by-step: how to use (the free) @screener_in to generate investment ideas.

Do retweet if you find it useful to benefit max investors. 🙏🙏

Ready or not, 🧵🧵⤵️

I will use the free screener version so that everyone can follow along.

Outline

1. Stepwise Guide

2. Practical Example: CoffeeCan Companies

3. Practical Example: Smallcap Consistent compounders

4. Practical Example: Smallcap turnaround

5. Key Takeaway

1. Stepwise Guide

Step1

Go to https://t.co/jtOL2Bpoys

Step2

Go to "SCREENS" tab

Step3

Go to "CREATE NEW SCREEN"

At this point you need to register. No charges. I did that with my brother's email id. This is what you see after that.

You May Also Like

Decoded his way of analysis/logics for everyone to easily understand.

Have covered:

1. Analysis of volatility, how to foresee/signs.

2. Workbook

3. When to sell options

4. Diff category of days

5. How movement of option prices tell us what will happen

1. Keeps following volatility super closely.

Makes 7-8 different strategies to give him a sense of what's going on.

Whichever gives highest profit he trades in.

I am quite different from your style. I follow the market's volatility very closely. I have mock positions in 7-8 different strategies which allows me to stay connected. Whichever gives best profit is usually the one i trade in.

— Sarang Sood (@SarangSood) August 13, 2019

2. Theta falls when market moves.

Falls where market is headed towards not on our original position.

Anilji most of the time these days Theta only falls when market moves. So the Theta actually falls where market has moved to, not where our position was in the first place. By shifting we can come close to capturing the Theta fall but not always.

— Sarang Sood (@SarangSood) June 24, 2019

3. If you're an options seller then sell only when volatility is dropping, there is a high probability of you making the right trade and getting profit as a result

He believes in a market operator, if market mover sells volatility Sarang Sir joins him.

This week has been great so far. The main aim is to be in the right side of the volatility, rest the market will reward.

— Sarang Sood (@SarangSood) July 3, 2019

4. Theta decay vs Fall in vega

Sell when Vega is falling rather than for theta decay. You won't be trapped and higher probability of making profit.

There is a difference between theta decay & fall in vega. Decay is certain but there is no guaranteed profit as delta moves can increase cost. Fall in vega on the other hand is backed by a powerful force that sells options and gives handsome returns. Our job is to identify them.

— Sarang Sood (@SarangSood) February 12, 2020

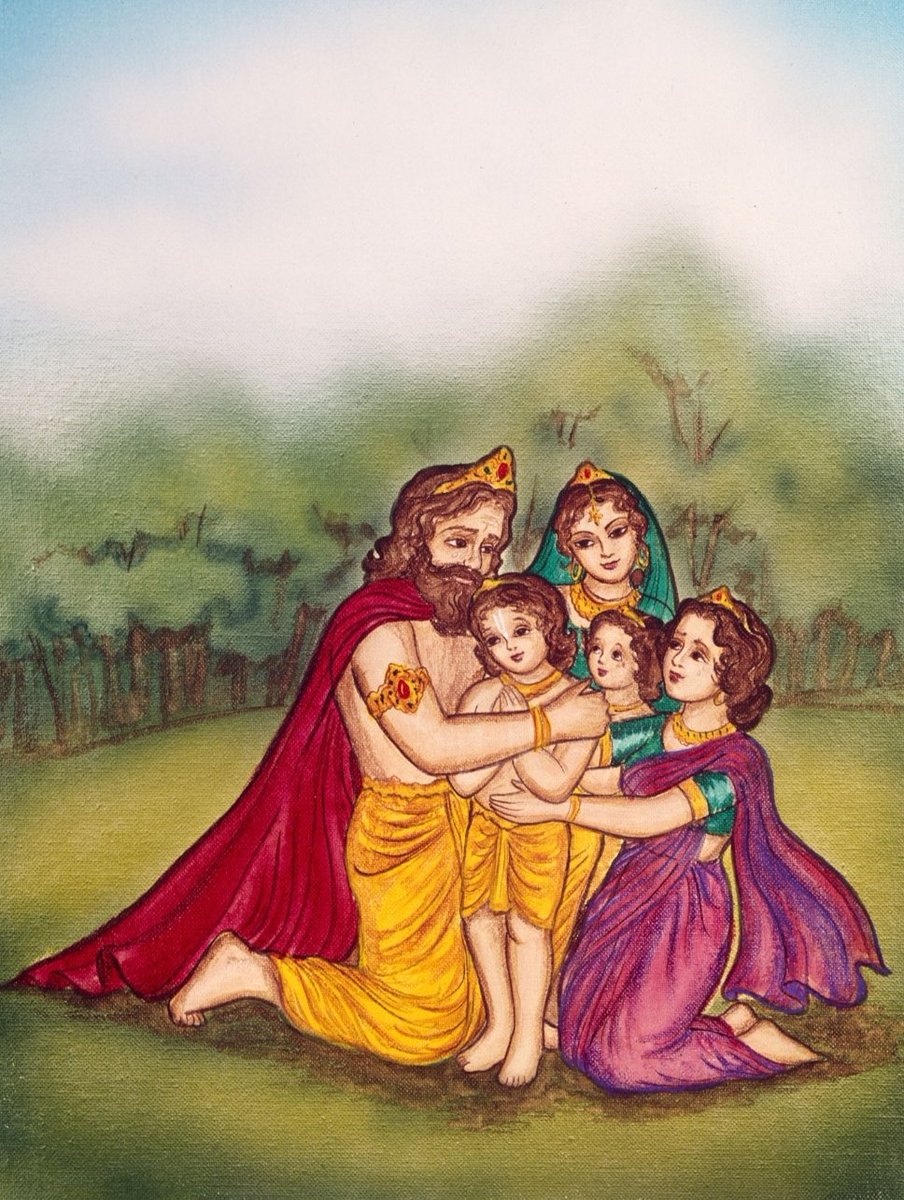

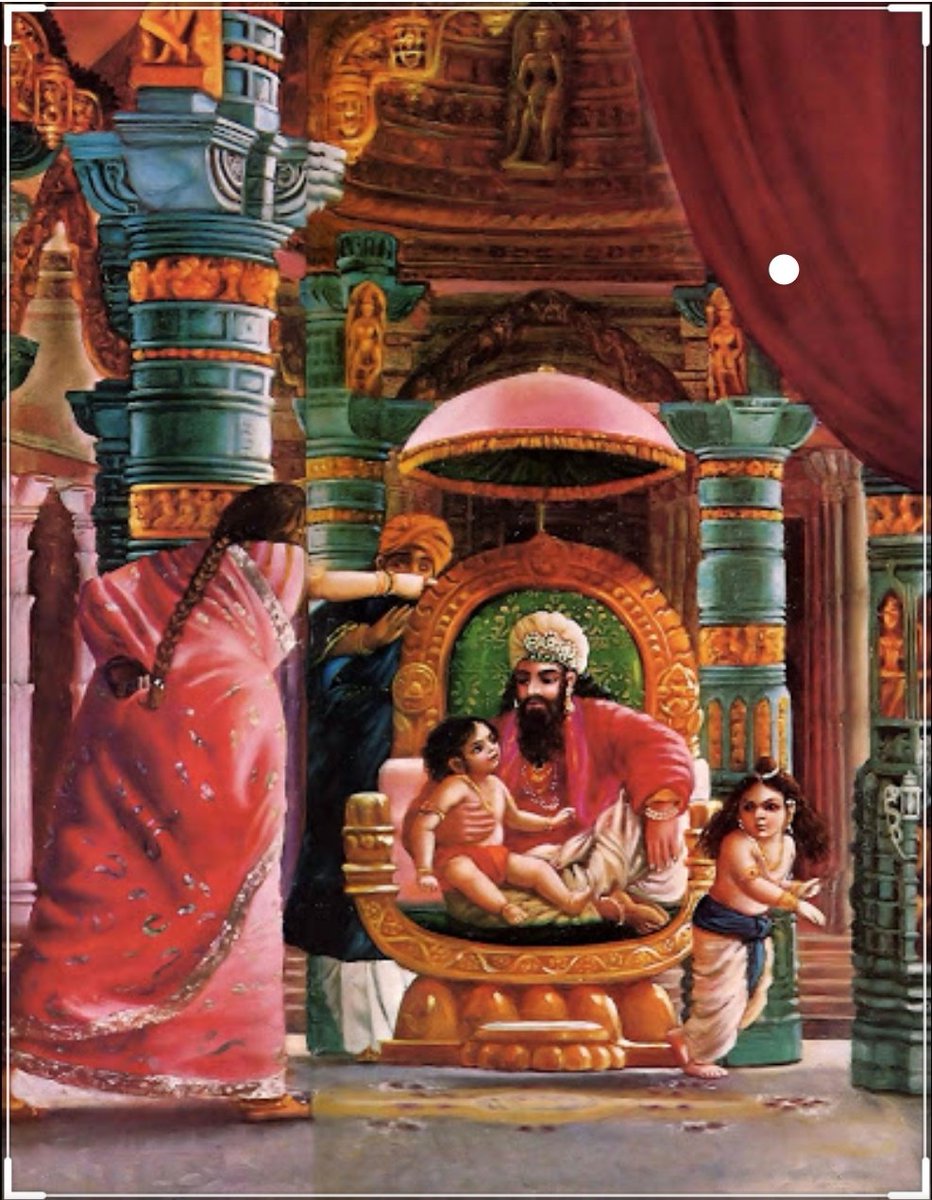

Once upon a time there was a Raja named Uttānapāda born of Svayambhuva Manu,1st man on earth.He had 2 beautiful wives - Suniti & Suruchi & two sons were born of them Dhruva & Uttama respectively.

#talesofkrishna https://t.co/E85MTPkF9W

Prabhu says i reside in the heart of my bhakt.

— Right Singh (@rightwingchora) December 21, 2020

Guess the event. pic.twitter.com/yFUmbfe5KL

Now Suniti was the daughter of a tribal chief while Suruchi was the daughter of a rich king. Hence Suruchi was always favored the most by Raja while Suniti was ignored. But while Suniti was gentle & kind hearted by nature Suruchi was venomous inside.

#KrishnaLeela

The story is of a time when ideally the eldest son of the king becomes the heir to the throne. Hence the sinhasan of the Raja belonged to Dhruva.This is why Suruchi who was the 2nd wife nourished poison in her heart for Dhruva as she knew her son will never get the throne.

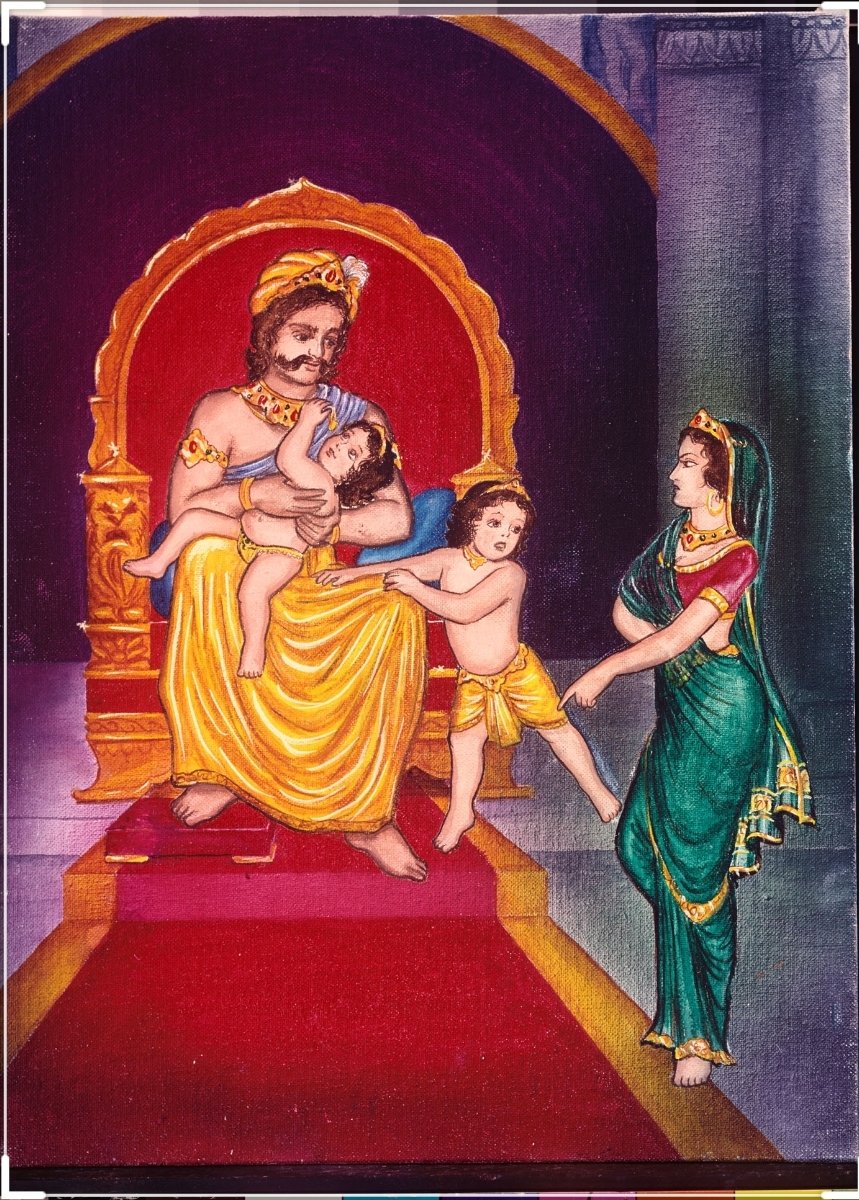

One day when Dhruva was just 5 years old he went on to sit on his father's lap. Suruchi, the jealous queen, got enraged and shoved him away from Raja as she never wanted Raja to shower Dhruva with his fatherly affection.

Dhruva protested questioning his step mother "why can't i sit on my own father's lap?" A furious Suruchi berated him saying "only God can allow him that privilege. Go ask him"

It's all in French, but if you're up for it you can read:

• Their blog post (lacks the most interesting details): https://t.co/PHkDcOT1hy

• Their high-level legal decision: https://t.co/hwpiEvjodt

• The full notification: https://t.co/QQB7rfynha

I've read it so you needn't!

Vectaury was collecting geolocation data in order to create profiles (eg. people who often go to this or that type of shop) so as to power ad targeting. They operate through embedded SDKs and ad bidding, making them invisible to users.

The @CNIL notes that profiling based off of geolocation presents particular risks since it reveals people's movements and habits. As risky, the processing requires consent — this will be the heart of their assessment.

Interesting point: they justify the decision in part because of how many people COULD be targeted in this way (rather than how many have — though they note that too). Because it's on a phone, and many have phones, it is considered large-scale processing no matter what.