Preparing watchlist:

If a stock #Price makes a bullish reversal Candle/Patterns (Spinning top/ Hammer/ Even doji) at impt MA's (21/50/100/200) especially after a fall & u c #Volume build up around that zone - Voila

Mostly, Harmonics & Fibs will co-incide for further confirmation

More from Kool Aggarwal

More from Screeners

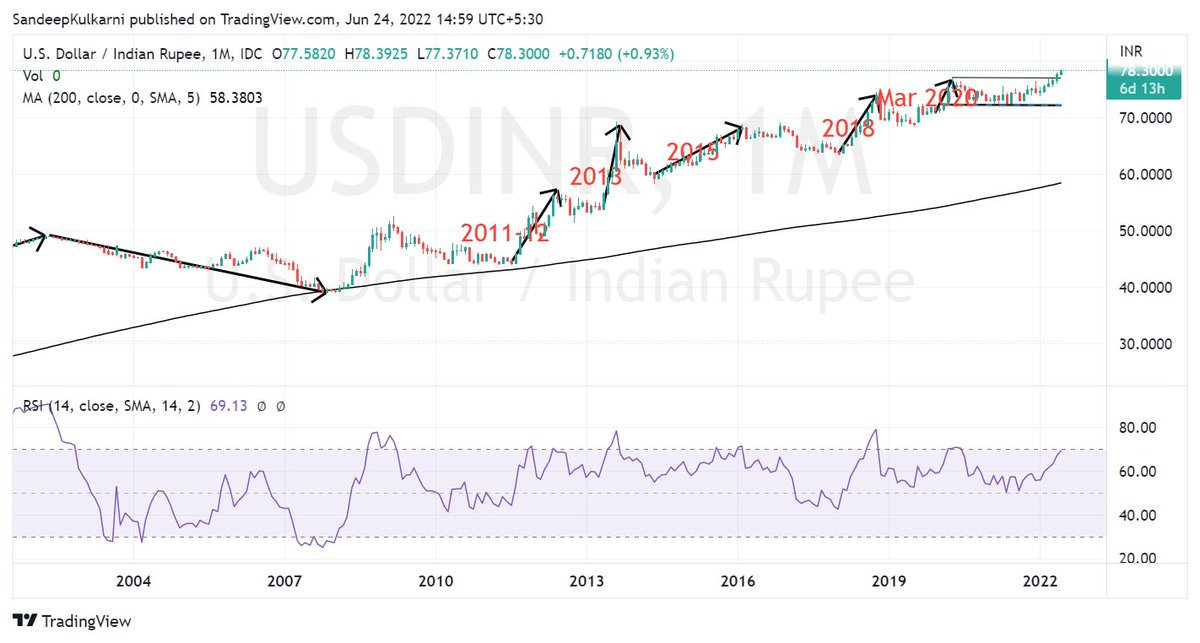

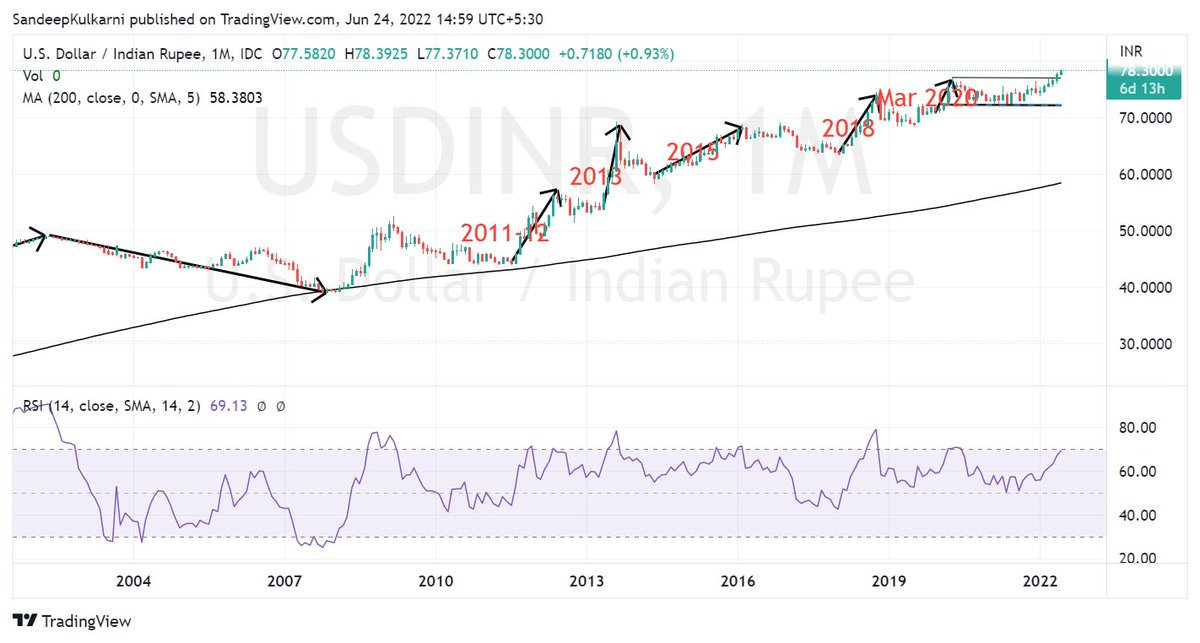

History tells us when #USDINR moves it moves a lot. In that context it has been remarkably resilient with just 8% depreciation. It looks like we are very close to the point from where Rupee will start to appreciating again.

BTW Nifty Metal has inverse correlation with USDINR. https://t.co/X6cqVcYF3V

BTW Nifty Metal has inverse correlation with USDINR. https://t.co/X6cqVcYF3V

We know how our stock market has weathered the FII selling.

— Sandeep Kulkarni (@moneyworks4u_fa) June 10, 2022

But the equally big story is how Rupee has weathered $50bn+ outflows since Oct 2021. Hats off to RBI Governor Das & his team for having the vision of building huge reserves in his tenure. pic.twitter.com/CVuF9dM361