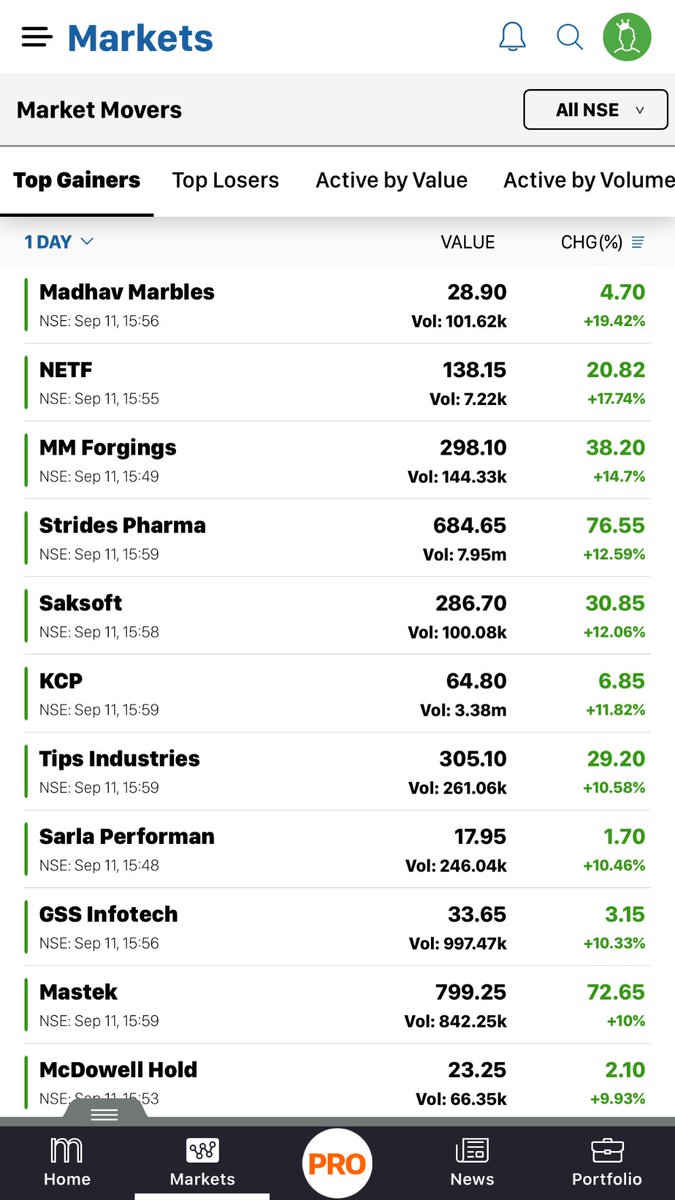

Commodity stocks like Cement, Most PSU, Most Textiles, Leather, Most capital goods, Liquor, Road EPC, Jewelry etc

Price < 50, MktCap < 250, [ add more per your rules ]

Add your likes to watchlist

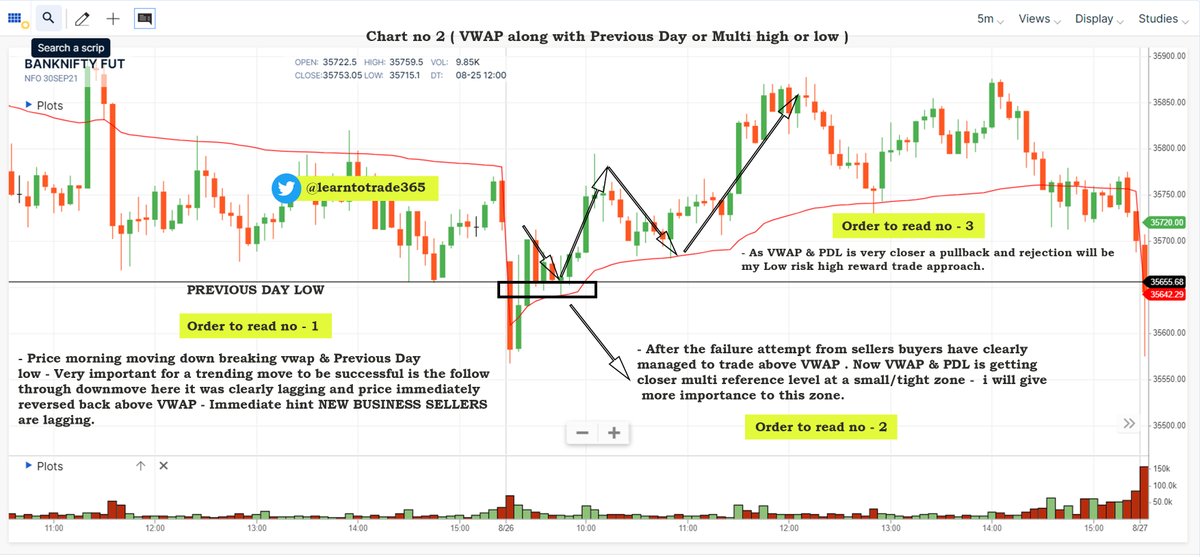

VWAP for intraday Trading Part -1

— Learn to Trade (@learntotrade365) August 28, 2021

A small thread PART -2 will be released tomorrow

Traders show your support by like & retweet to benefit all@Mitesh_Engr @ITRADE191 @ProdigalTrader @nakulvibhor @ArjunB9591 @CAPratik_INDIAN @RajarshitaS @Stockstudy8 @vivbajaj @Prakashplutus pic.twitter.com/y8bwisM4hB

This thread will present a highly probable scenario of markets for the upcoming months. Will update the scenario too if there is a significant change in view in between.

— Aakash Gangwar (@akashgngwr823) May 15, 2022

1/n https://t.co/jfWOyEgZyd