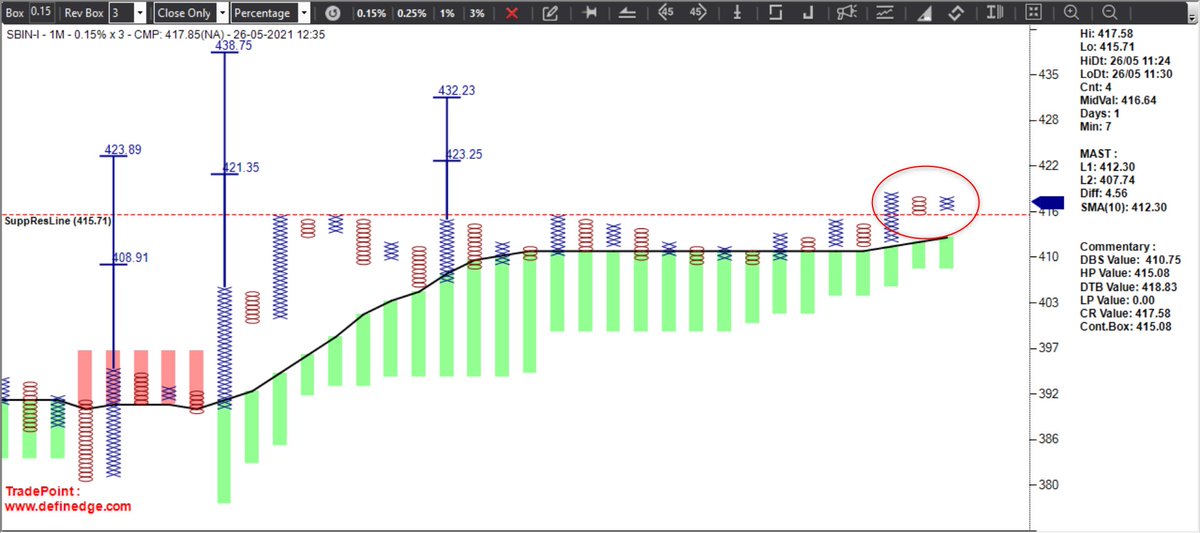

#SBIN looks set for target 600.. Should keep above 421 now.. https://t.co/zqLzWoXg9g

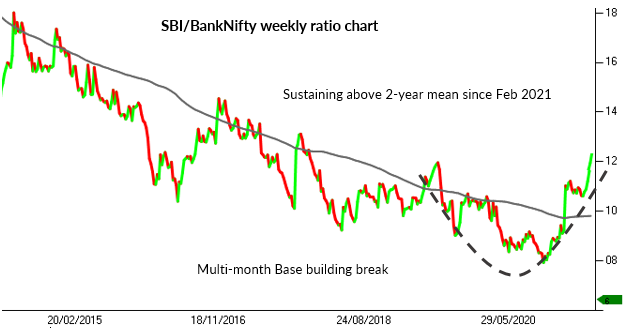

#SBI #SBIN - possible path on charts#Nifty #Banknifty https://t.co/rLQsriNx2g pic.twitter.com/CrNDuXbuSP

— Harsh / \ud5c8\uc26c (@_Harsh_Mehta_) January 13, 2021

More from Harsh / 허쉬

Invalidation level can be brought up to 4900 also.. #BajajFinance

Was looking at #BajajFinance chart once again. I am not able to complete 5 waves yet...hmmm...\U0001f928

— Harsh / \ud5c8\uc26c (@_Harsh_Mehta_) June 17, 2022

As posted earlier, the drop is still 4th (invalidation below 4500).

And target still remains open for 10K+ https://t.co/DozJzNhuuI pic.twitter.com/jPRaEQoPH3

More from Sbin

You May Also Like

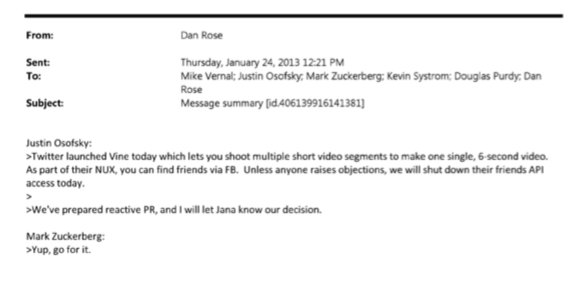

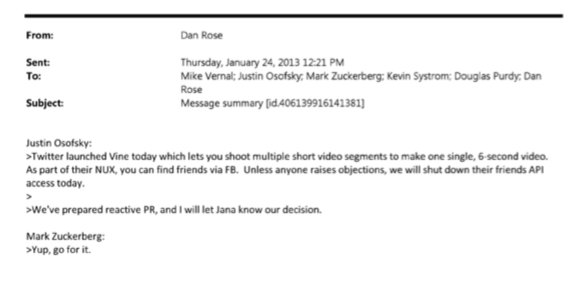

BREAKING: @CommonsCMS @DamianCollins just released previously sealed #Six4Three @Facebook documents:

Some random interesting tidbits:

1) Zuck approves shutting down platform API access for Twitter's when Vine is released #competition

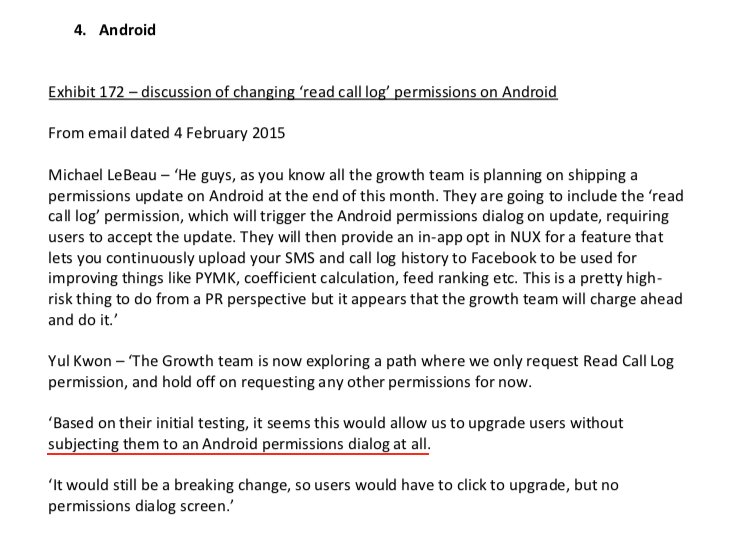

2) Facebook engineered ways to access user's call history w/o alerting users:

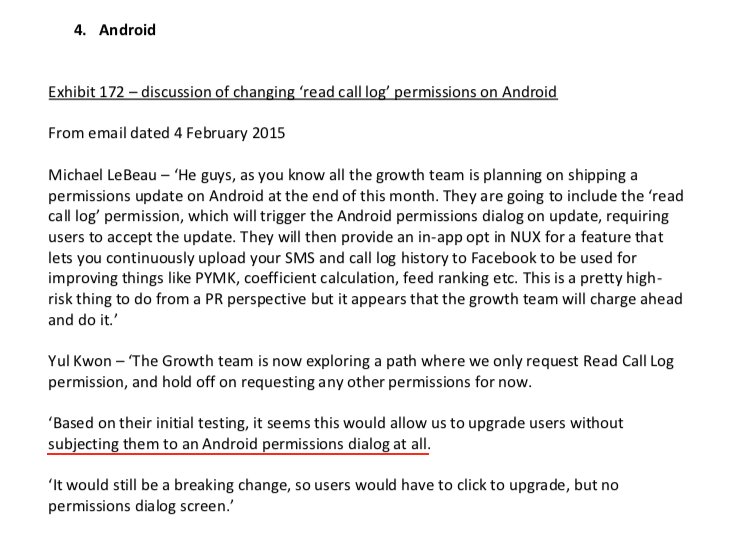

Team considered access to call history considered 'high PR risk' but 'growth team will charge ahead'. @Facebook created upgrade path to access data w/o subjecting users to Android permissions dialogue.

3) The above also confirms @kashhill and other's suspicion that call history was used to improve PYMK (People You May Know) suggestions and newsfeed rankings.

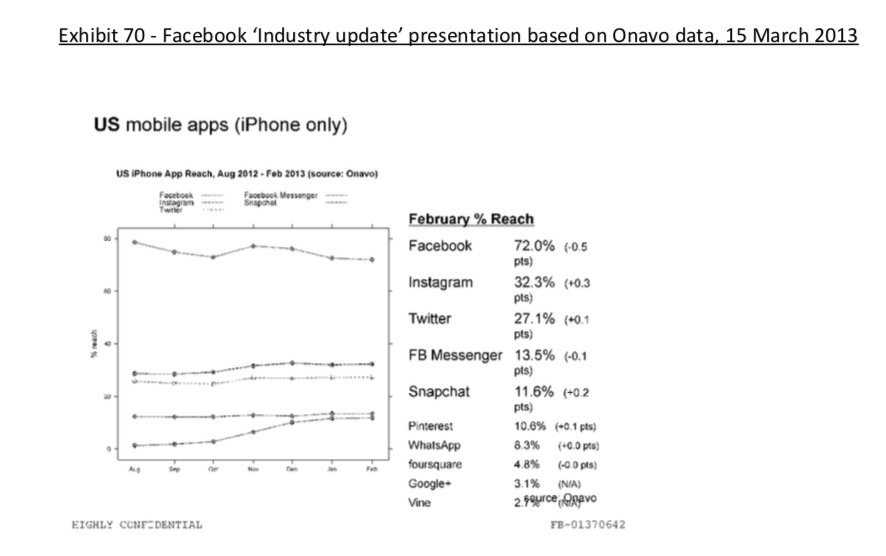

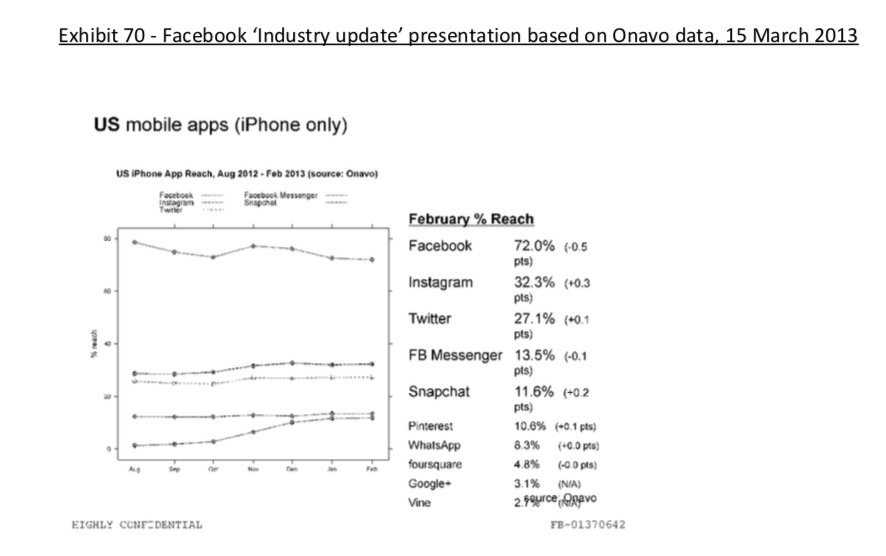

4) Docs also shed more light into @dseetharaman's story on @Facebook monitoring users' @Onavo VPN activity to determine what competitors to mimic or acquire in 2013.

https://t.co/PwiRIL3v9x

Some random interesting tidbits:

1) Zuck approves shutting down platform API access for Twitter's when Vine is released #competition

2) Facebook engineered ways to access user's call history w/o alerting users:

Team considered access to call history considered 'high PR risk' but 'growth team will charge ahead'. @Facebook created upgrade path to access data w/o subjecting users to Android permissions dialogue.

3) The above also confirms @kashhill and other's suspicion that call history was used to improve PYMK (People You May Know) suggestions and newsfeed rankings.

4) Docs also shed more light into @dseetharaman's story on @Facebook monitoring users' @Onavo VPN activity to determine what competitors to mimic or acquire in 2013.

https://t.co/PwiRIL3v9x