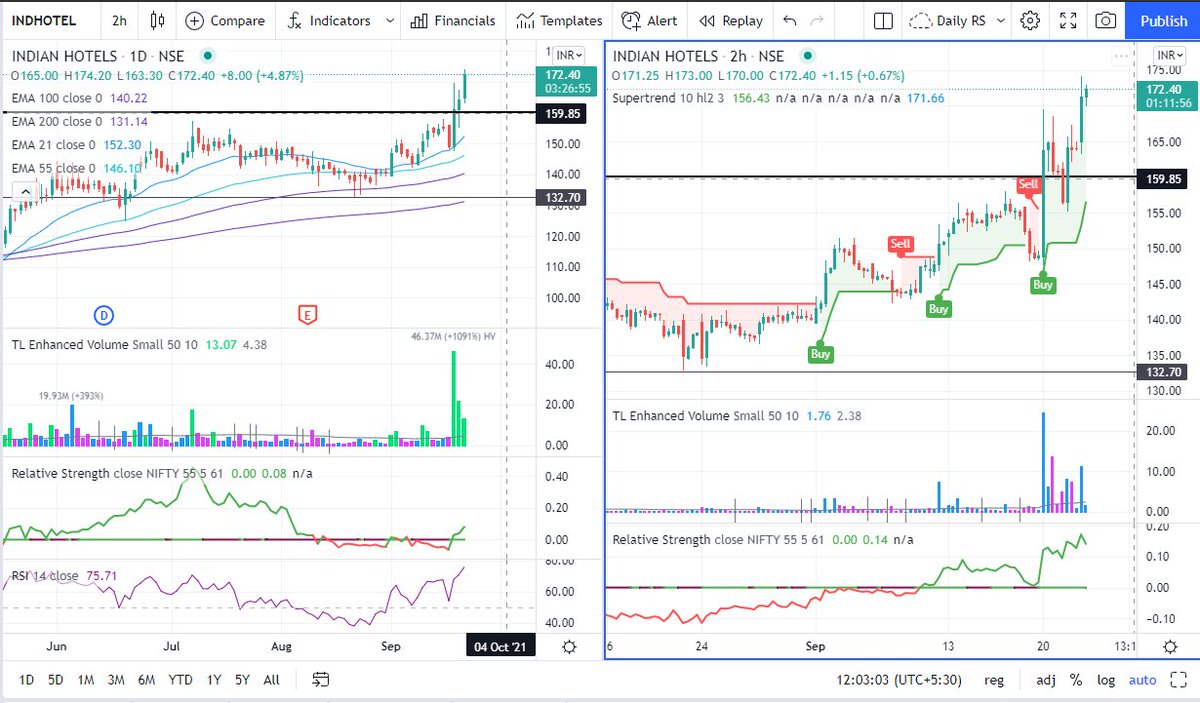

OMG you made a killing Akshay

I am so happy for u

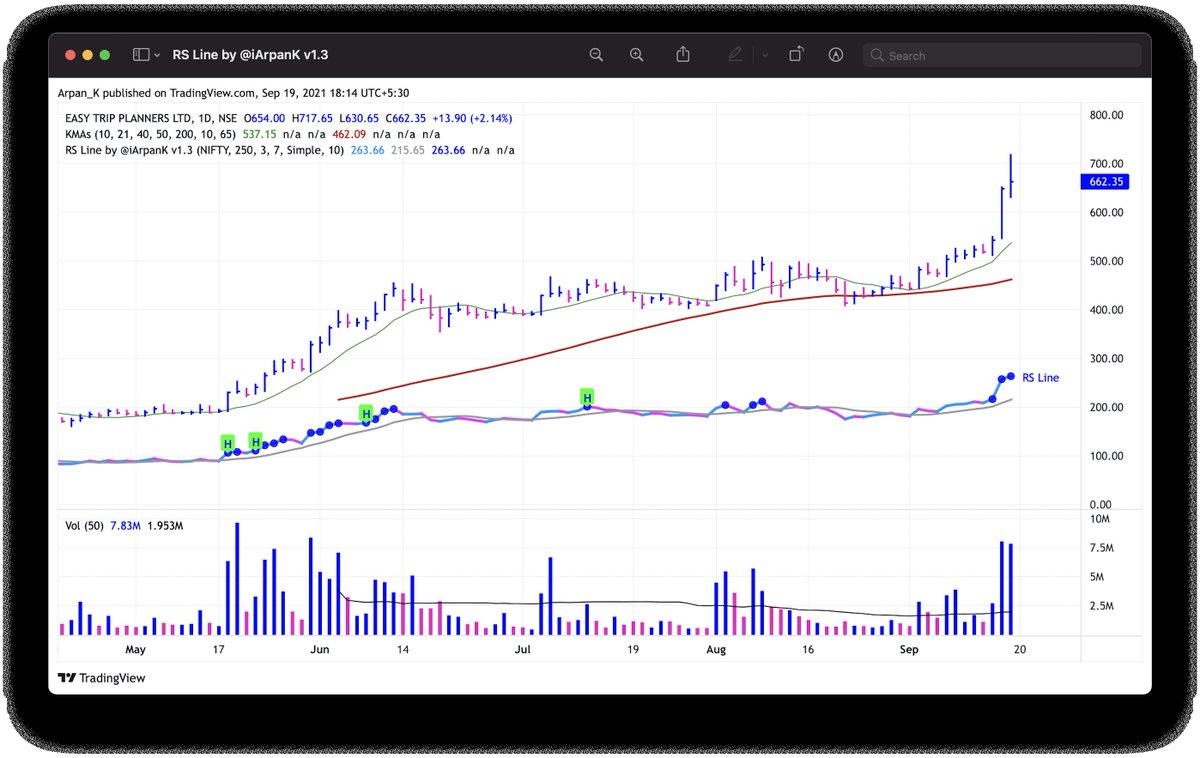

Power of RS @vivbajaj. pic.twitter.com/CwjowRmRd7

— Akshay Trambake (@trambake_akshay) January 12, 2022

More from Learner Vivek Bajaj

More from Rs

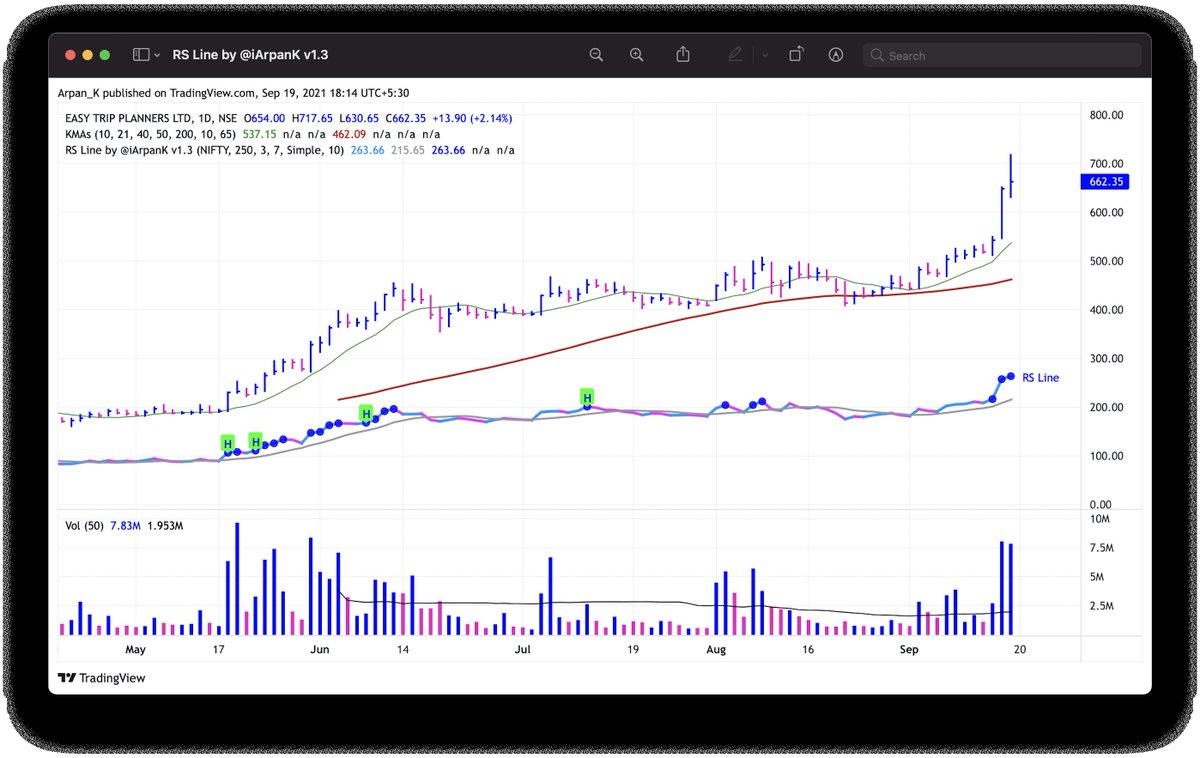

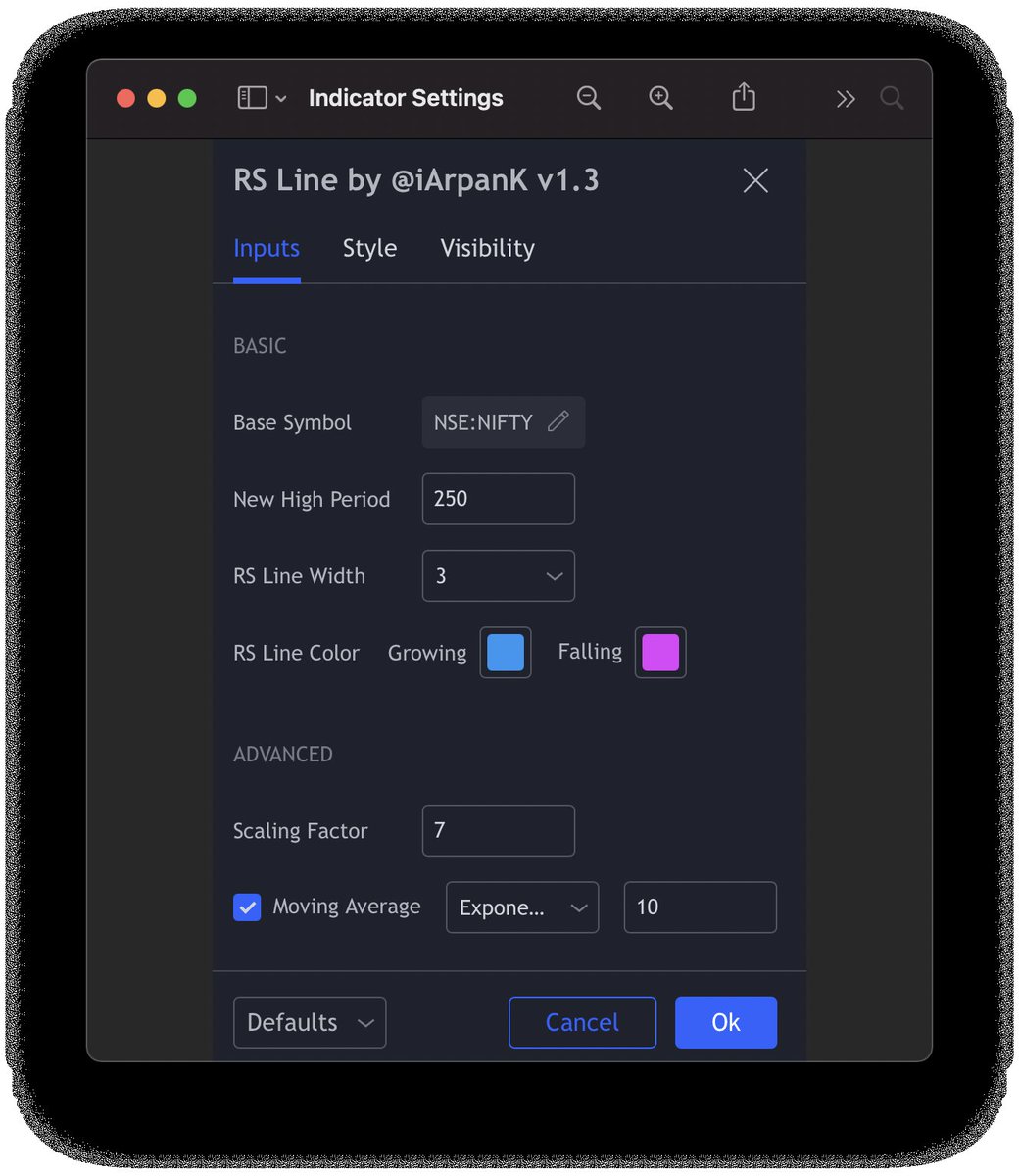

Relative Strength Line by @iArpanK v1.3

https://t.co/3q9UOn5GF7

This update enables adding a Moving Average to the indicator, as requested by several users.

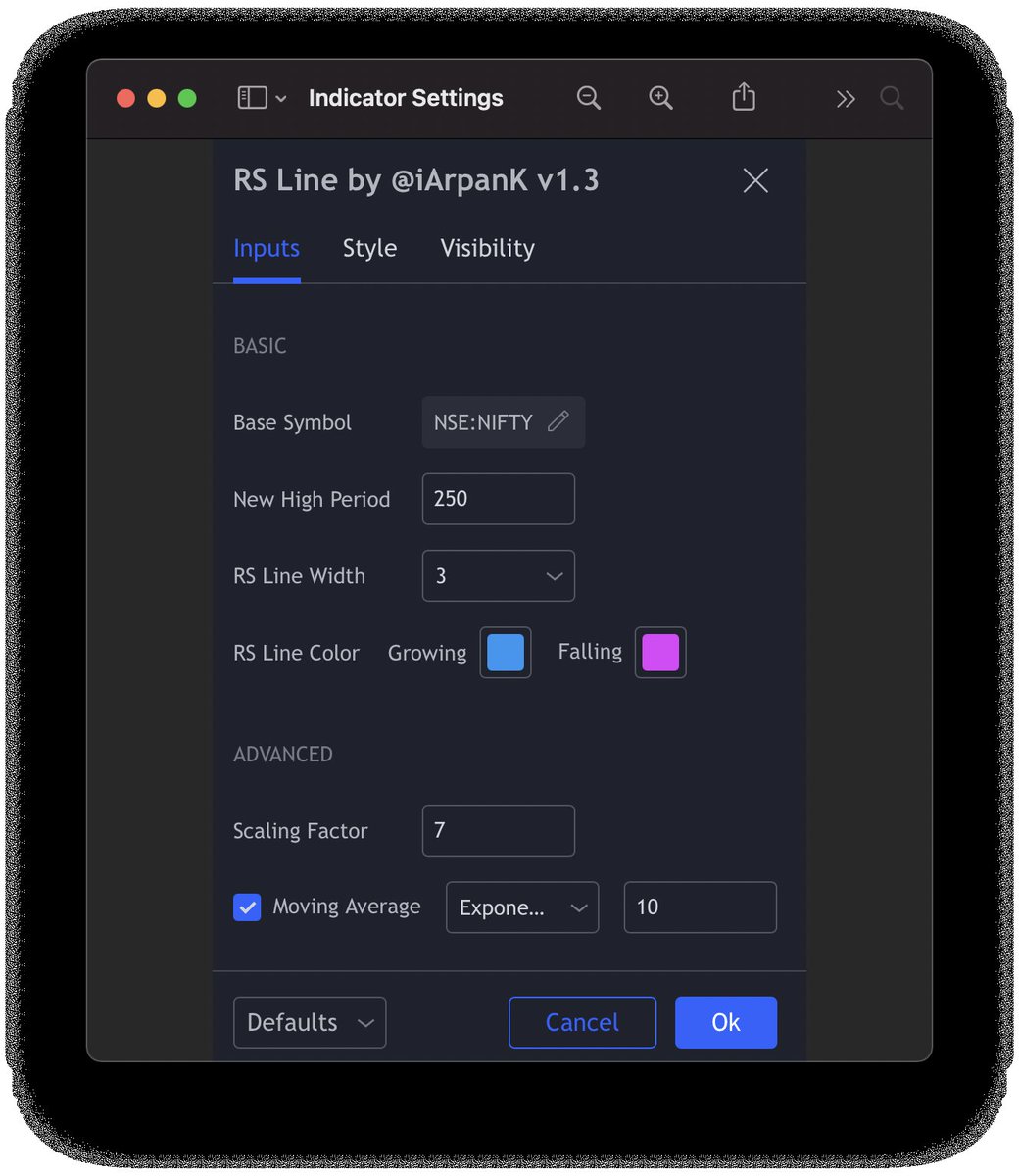

Indicator settings (ADVANCED section)

- Toggle moving average on/off using the checkbox

- Change indicator type (Simple/Exponential/Weighted)

- Change indicator period

Project (now open source) : https://t.co/xHpPUU4ZdN

Change indicator pane : https://t.co/u0BqraiFce

All users are requested to remove and add the indicator again to their chart, in order to utilise the new v1.3.

Thanks!

https://t.co/3q9UOn5GF7

This update enables adding a Moving Average to the indicator, as requested by several users.

Indicator settings (ADVANCED section)

- Toggle moving average on/off using the checkbox

- Change indicator type (Simple/Exponential/Weighted)

- Change indicator period

Project (now open source) : https://t.co/xHpPUU4ZdN

Change indicator pane : https://t.co/u0BqraiFce

All users are requested to remove and add the indicator again to their chart, in order to utilise the new v1.3.

Thanks!

You May Also Like

Recently, the @CNIL issued a decision regarding the GDPR compliance of an unknown French adtech company named "Vectaury". It may seem like small fry, but the decision has potential wide-ranging impacts for Google, the IAB framework, and today's adtech. It's thread time! 👇

It's all in French, but if you're up for it you can read:

• Their blog post (lacks the most interesting details): https://t.co/PHkDcOT1hy

• Their high-level legal decision: https://t.co/hwpiEvjodt

• The full notification: https://t.co/QQB7rfynha

I've read it so you needn't!

Vectaury was collecting geolocation data in order to create profiles (eg. people who often go to this or that type of shop) so as to power ad targeting. They operate through embedded SDKs and ad bidding, making them invisible to users.

The @CNIL notes that profiling based off of geolocation presents particular risks since it reveals people's movements and habits. As risky, the processing requires consent — this will be the heart of their assessment.

Interesting point: they justify the decision in part because of how many people COULD be targeted in this way (rather than how many have — though they note that too). Because it's on a phone, and many have phones, it is considered large-scale processing no matter what.

It's all in French, but if you're up for it you can read:

• Their blog post (lacks the most interesting details): https://t.co/PHkDcOT1hy

• Their high-level legal decision: https://t.co/hwpiEvjodt

• The full notification: https://t.co/QQB7rfynha

I've read it so you needn't!

Vectaury was collecting geolocation data in order to create profiles (eg. people who often go to this or that type of shop) so as to power ad targeting. They operate through embedded SDKs and ad bidding, making them invisible to users.

The @CNIL notes that profiling based off of geolocation presents particular risks since it reveals people's movements and habits. As risky, the processing requires consent — this will be the heart of their assessment.

Interesting point: they justify the decision in part because of how many people COULD be targeted in this way (rather than how many have — though they note that too). Because it's on a phone, and many have phones, it is considered large-scale processing no matter what.