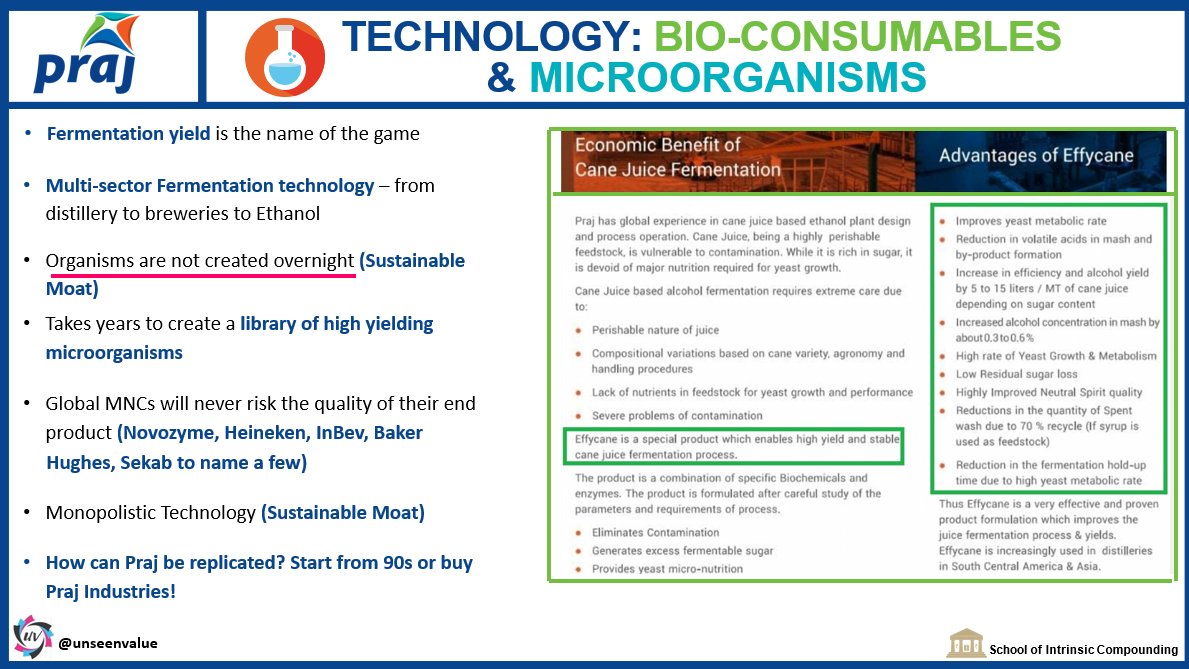

Most Indian businesses are locally competitive. You take them outside India, and they struggle. Very few businesses (IT, Pharma/API, Chemicals/CDMO) are fit to compete and beat global competition. These rare gems tend to survive over long time periods and thrive over all cycles.

More from Sajal Kapoor

Tail-events generate the biggest panic and upside. If you survive the panic w/o jumping off the train, you deserve the 100x in few stocks.

Temperament + Business Analysis = ⤴️

@unseenvalue Hats off Sir. I compared an equal weighted portfolio of your stocks above to the 2 Coffee Can stocks Abbott & Divis and your portfolio has delivered significant upside since then

— ML4TradingDoctor (@DrKRIndia) May 16, 2021

Key has to be conviction and equal weighting pic.twitter.com/6dJ1LDMSYr

[Free CDMO Masterclass #18] https://t.co/208eQbYKEF

— Conviction | Patience (@unseenvalue) July 25, 2021

[Free Art of Investing] https://t.co/bHvUqnpiTE

[Paid IIC Dec 2020 on SeQuent] https://t.co/3iDO438Et9

[Charity fund raise on Unseen Trends in Biotechnology] https://t.co/eNi1x1qwhH

[Q&A on APIs] https://t.co/EQGz007a9S

It's amazing \U0001f60a 25% NP

— Avinash (@Aviral_Bharat) February 17, 2022

$8b revenue

$2b Profit

$92b MCap

At 11 times revenue, it seems to be cheap compared to\U0001f609

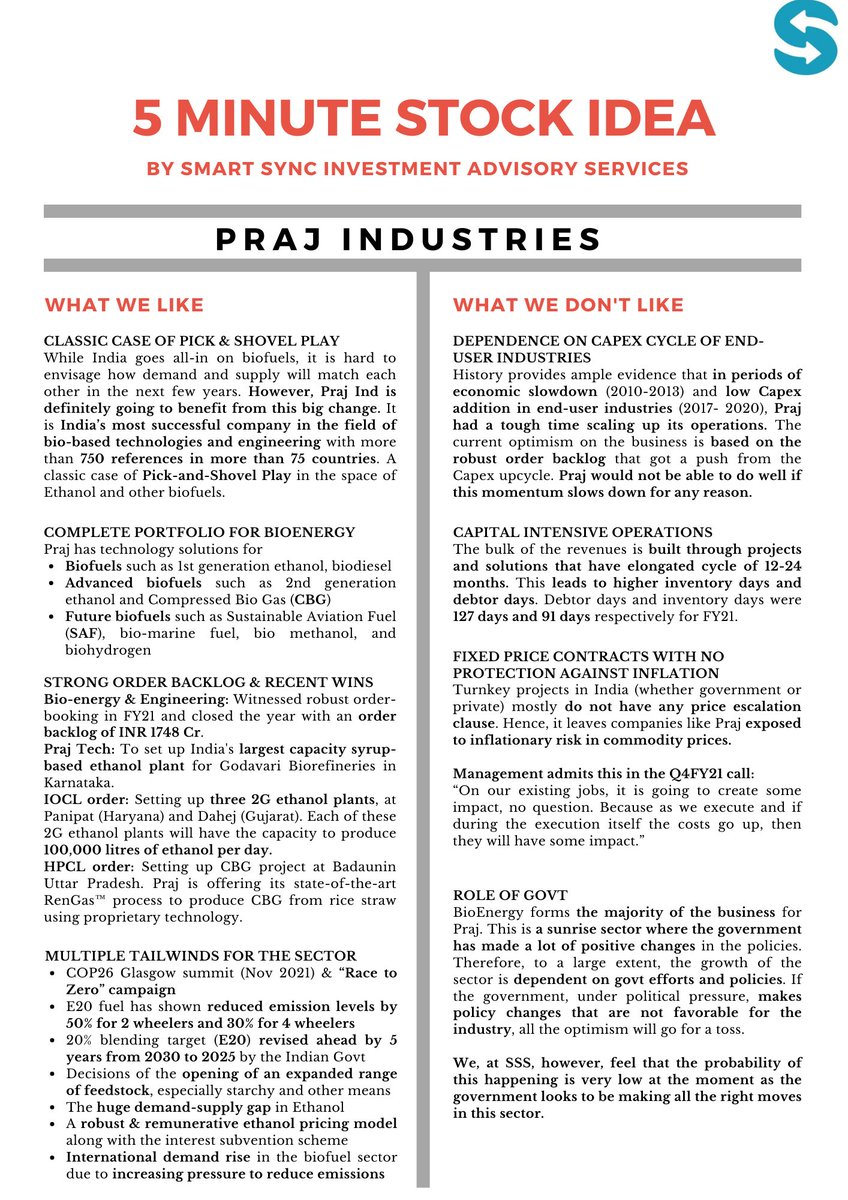

More from Praj

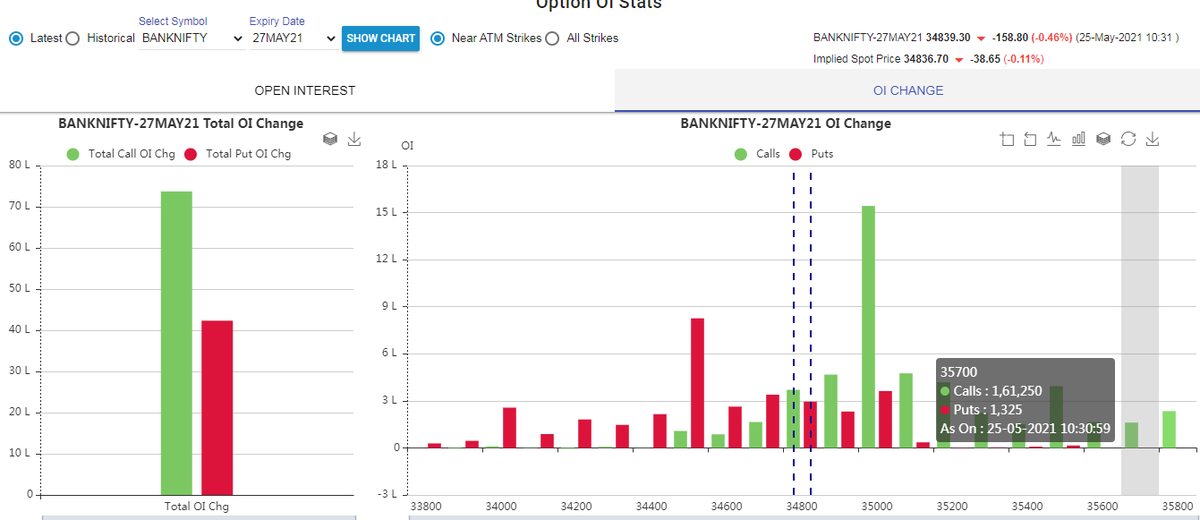

Below 336 I see 275 in few months as long as its trading below 388 on closing basis CMP 351. https://t.co/iMRpbTfOpU

Your analysis and sl saved my time and some bucks otherwise I would've lost much bigger amount,

— lavish gadia (@gadia_lavish) August 10, 2021

Can you share your views on praj industry @shivaji_1983