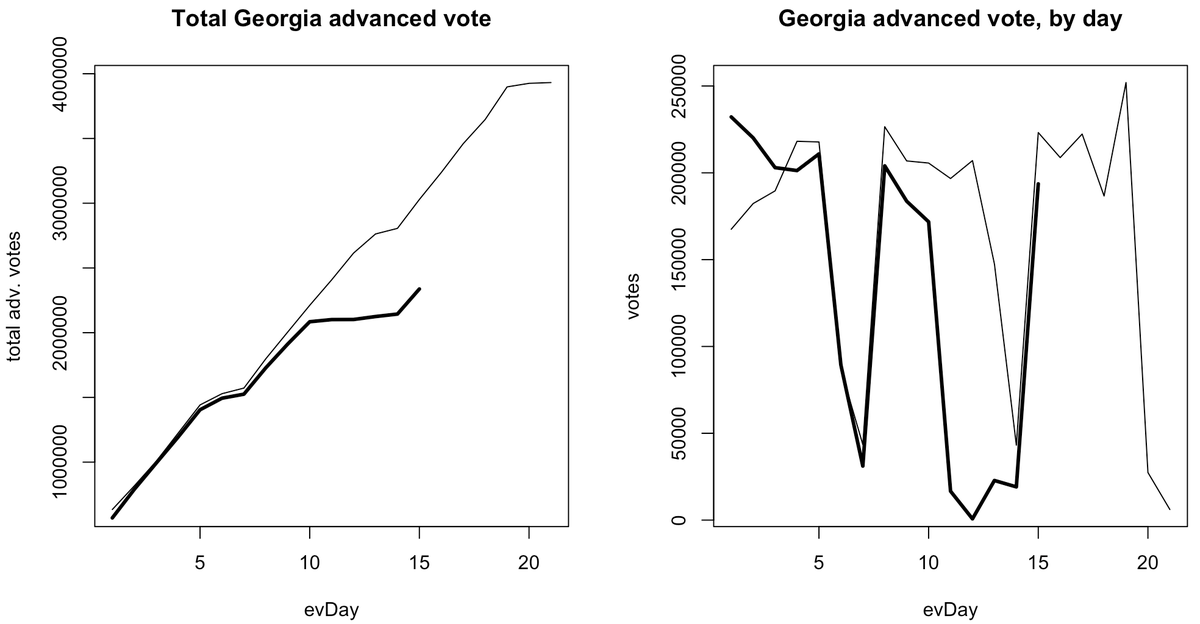

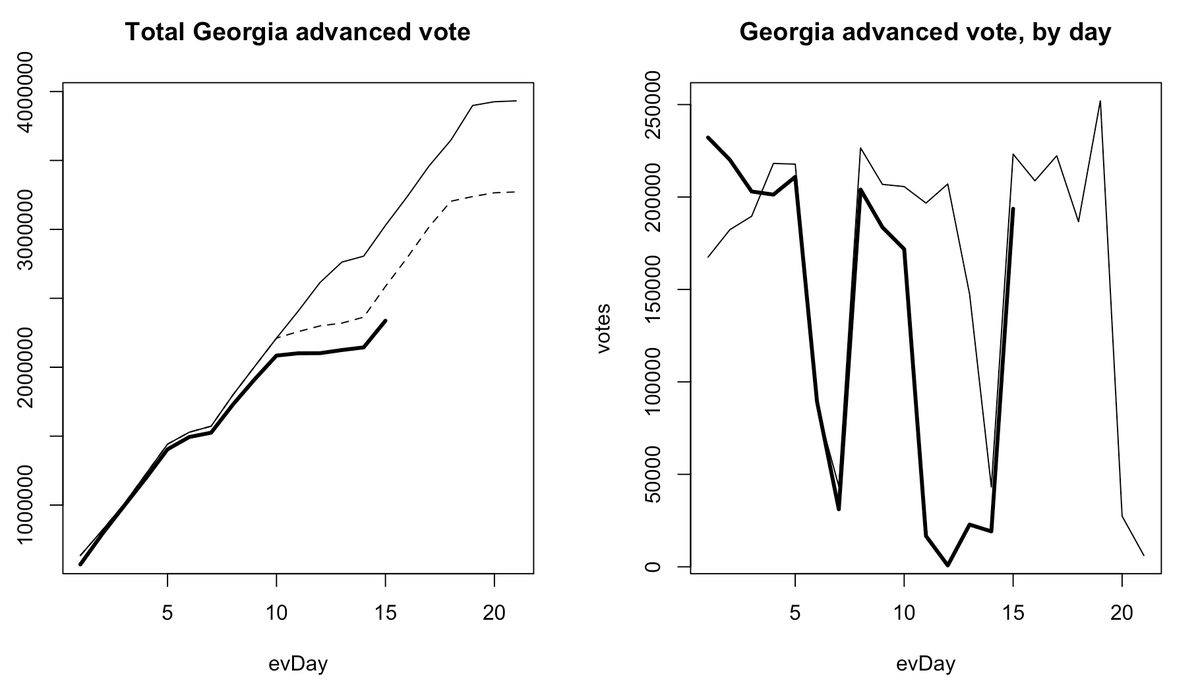

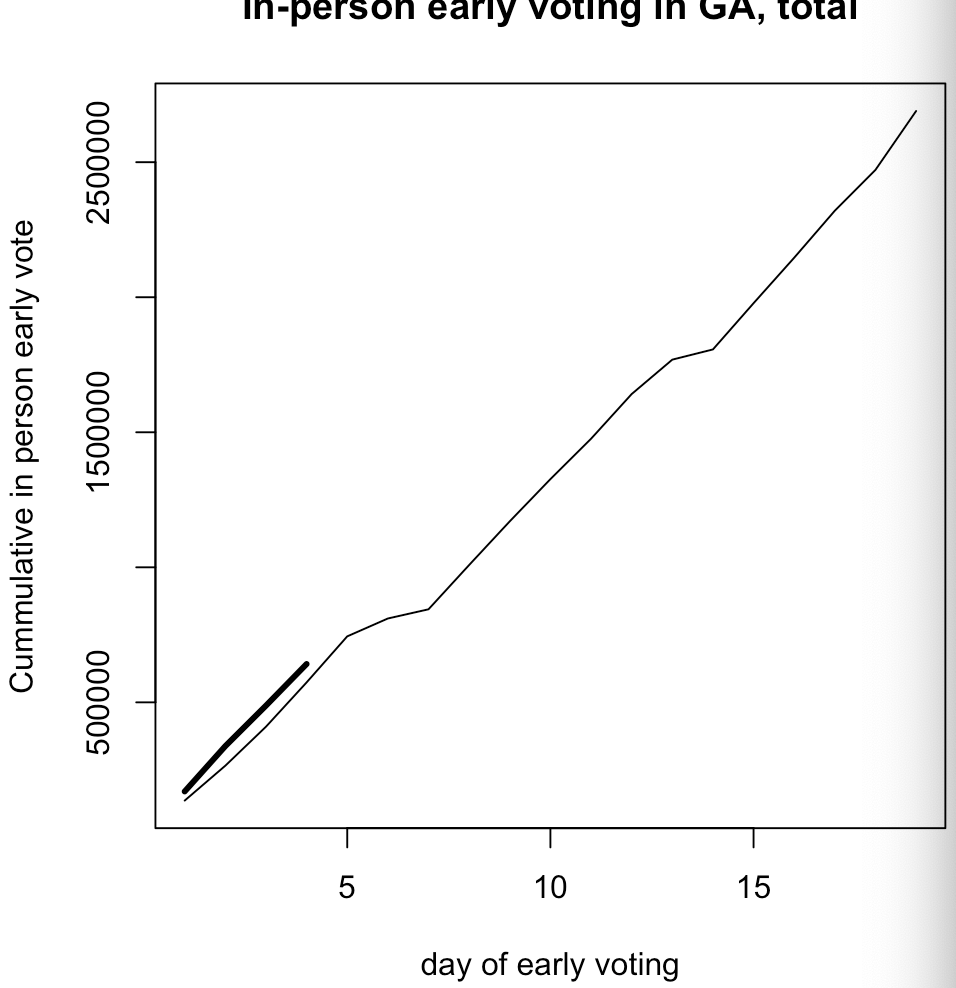

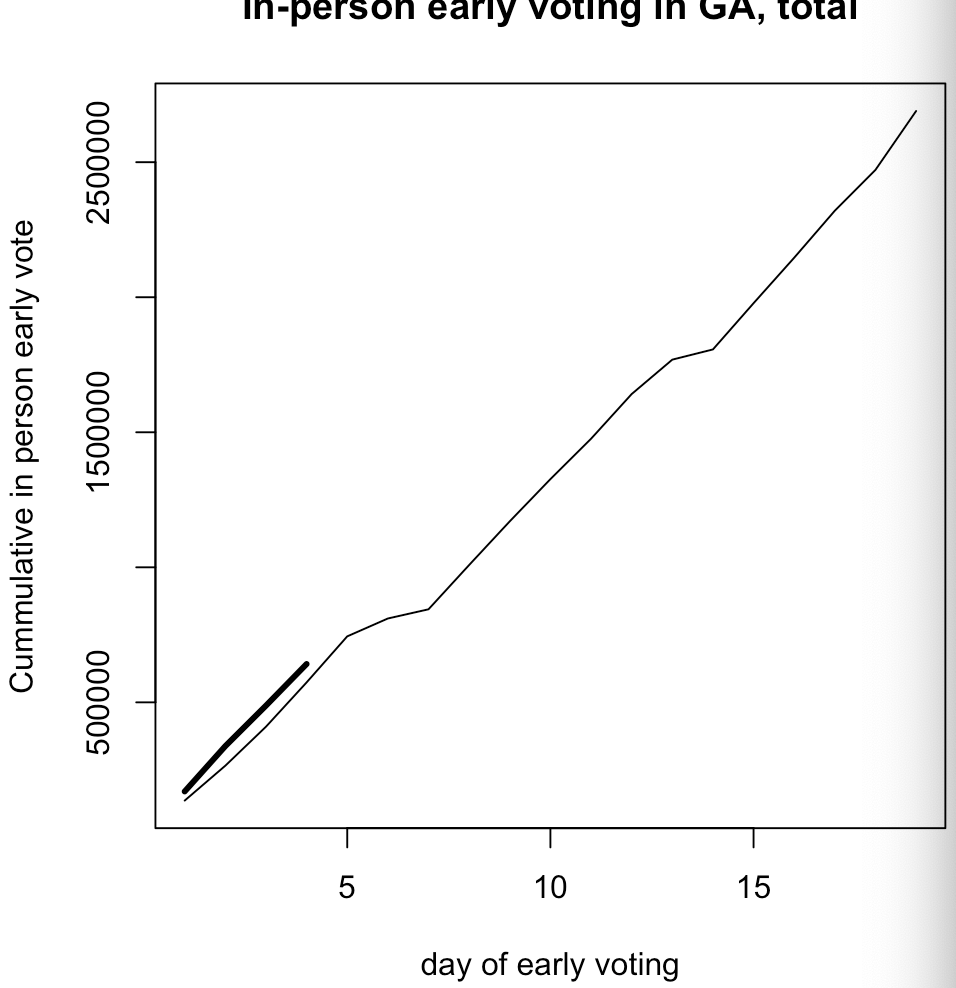

Another day of strong early voting in Georgia, with another 154k voters turning out in person yesterday. That's similar to but slightly behind the fourth day of early voting in the general, which was at 164k

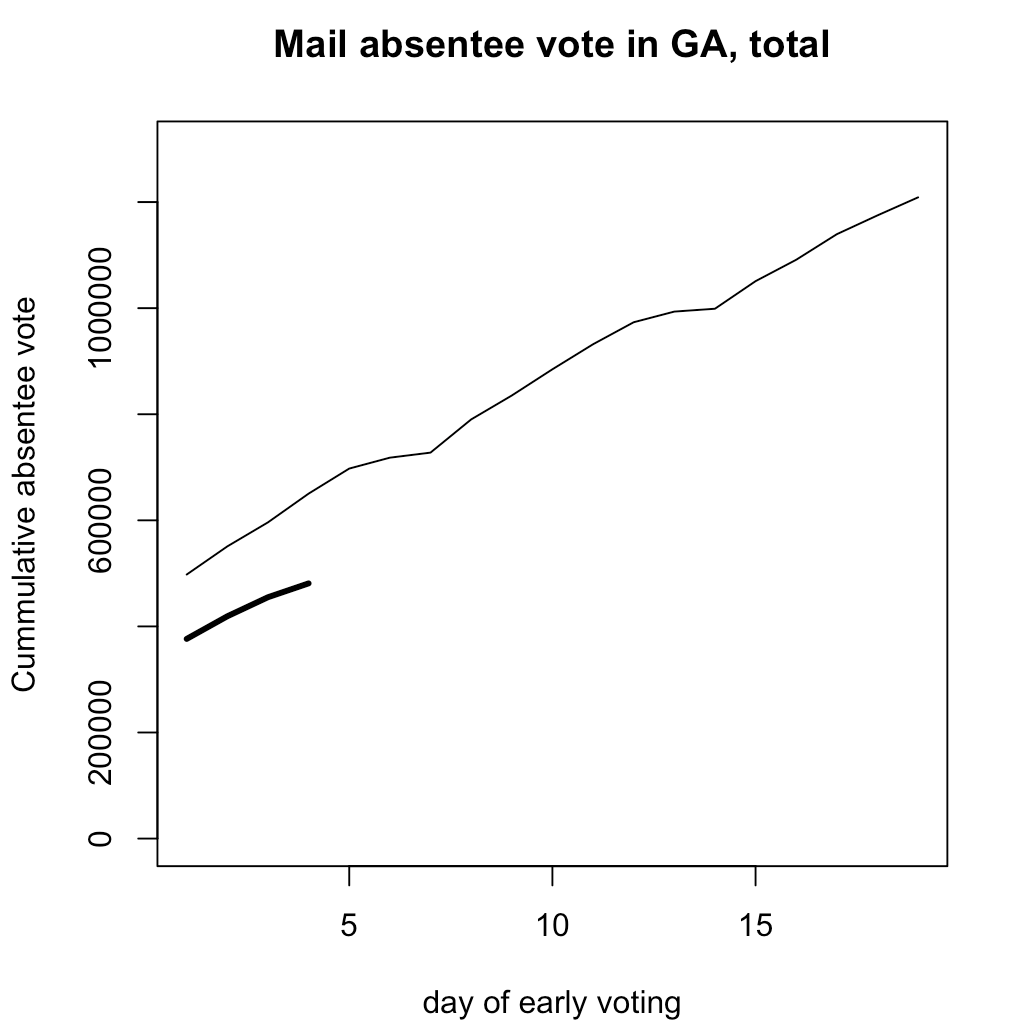

This is expected: far fewer realistic opportunities for voters to request a ballot for this special than the general. And some counties may be behind

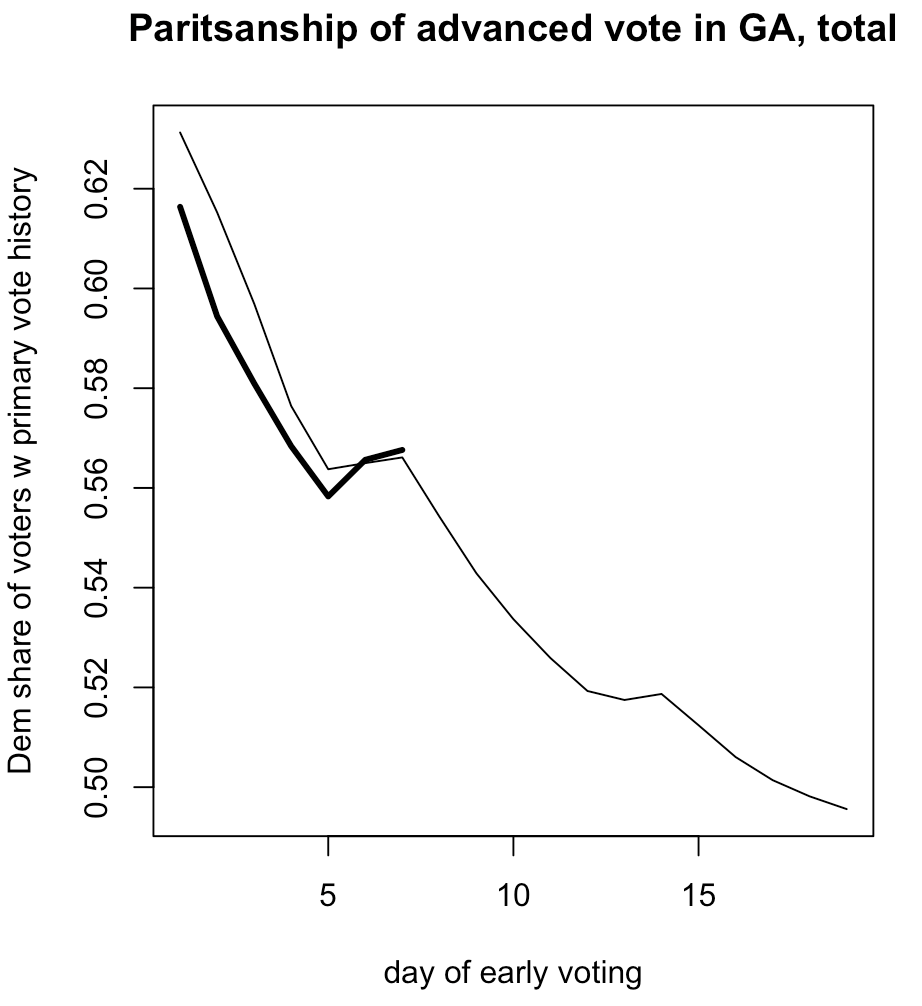

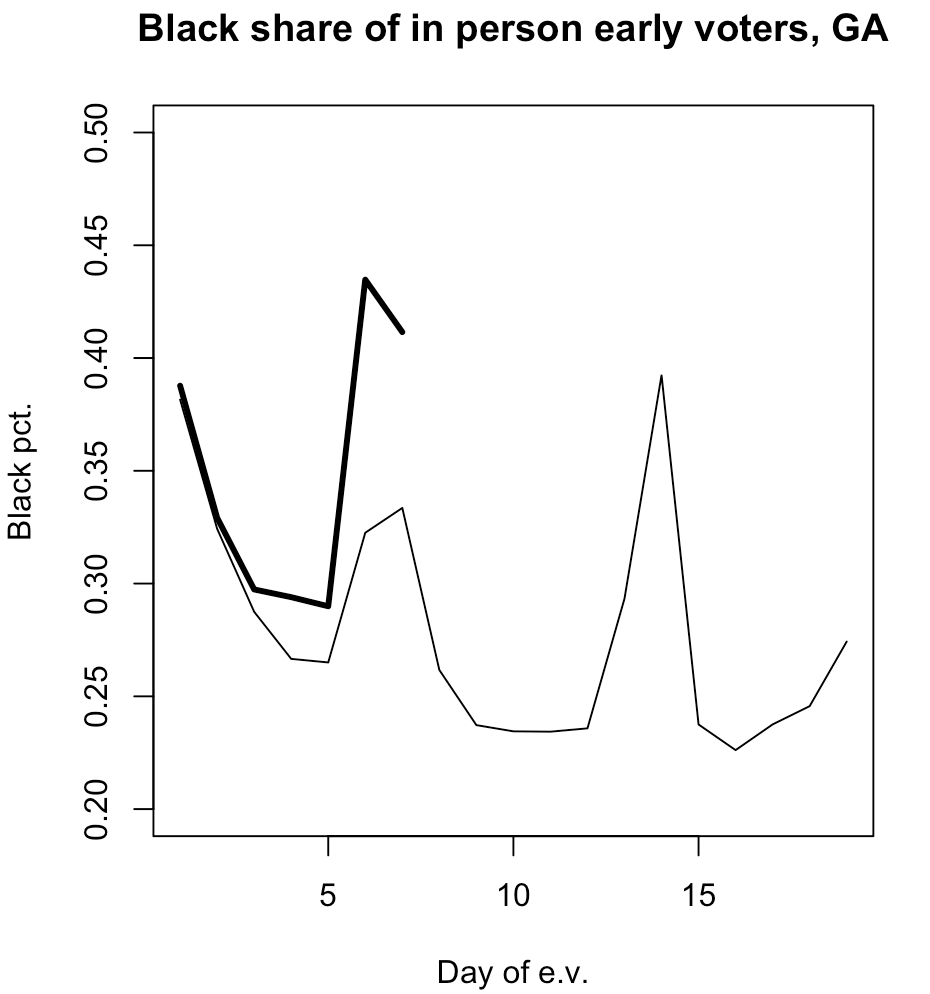

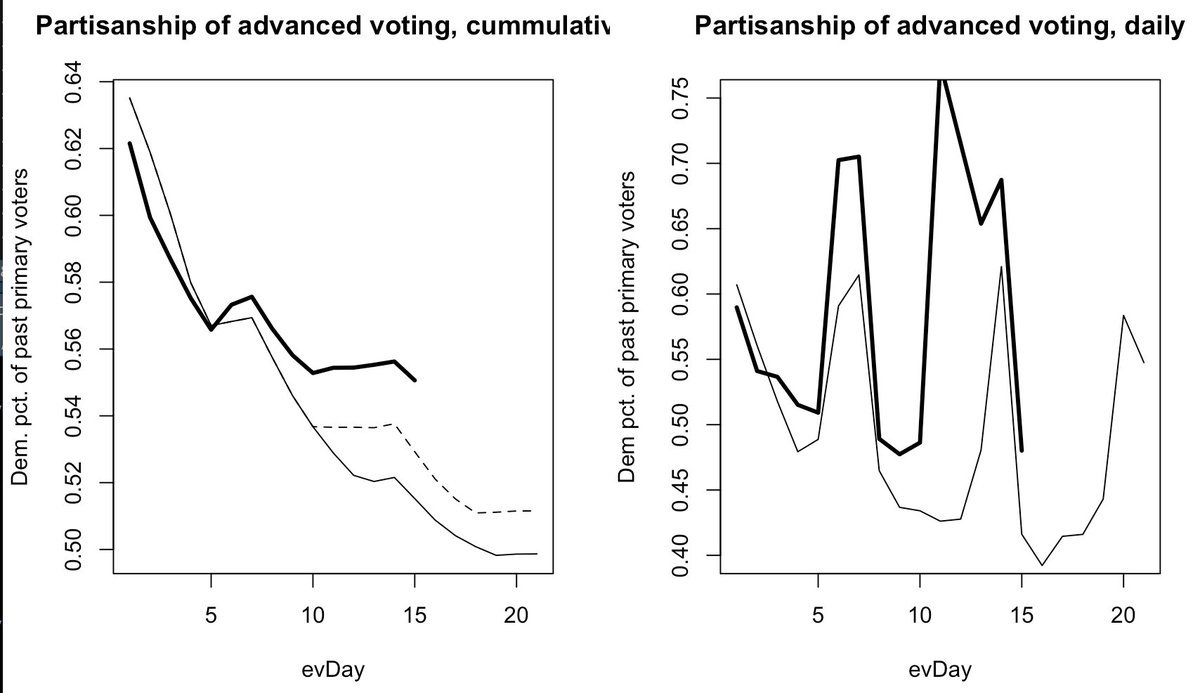

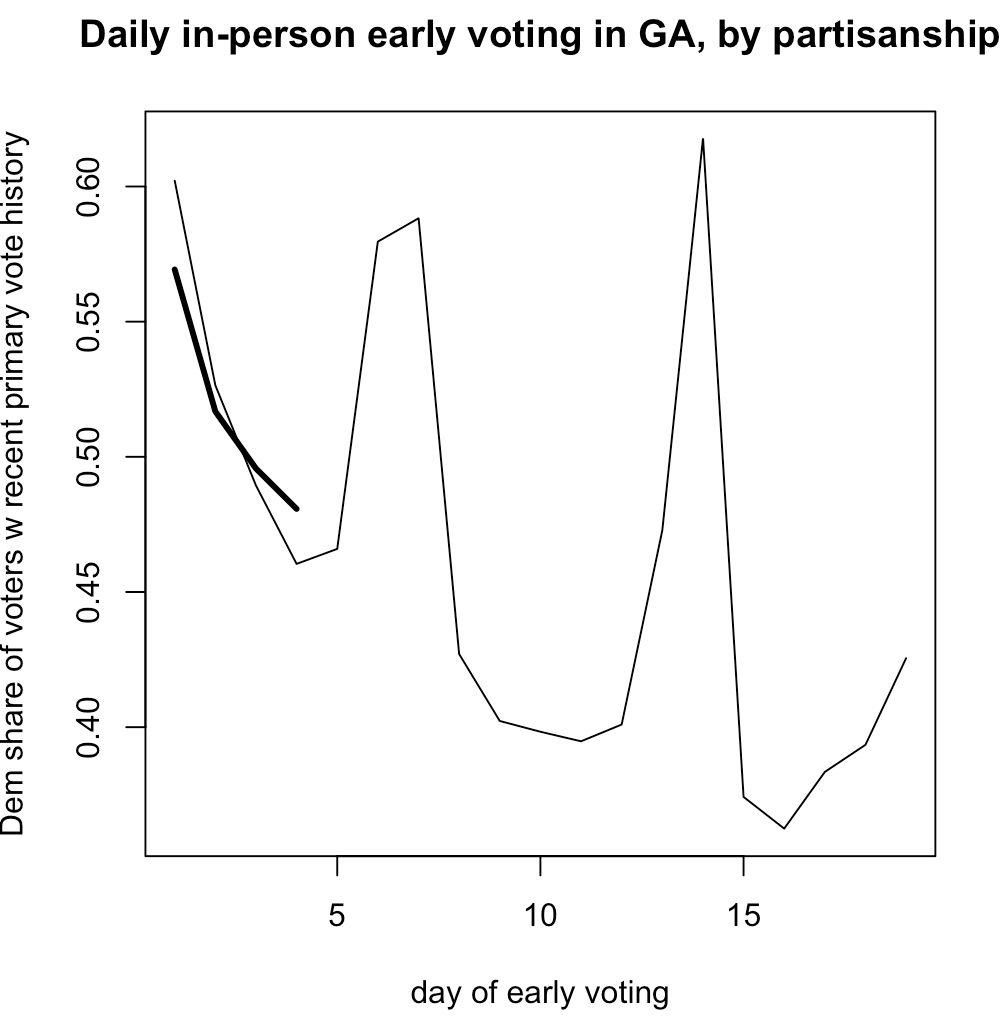

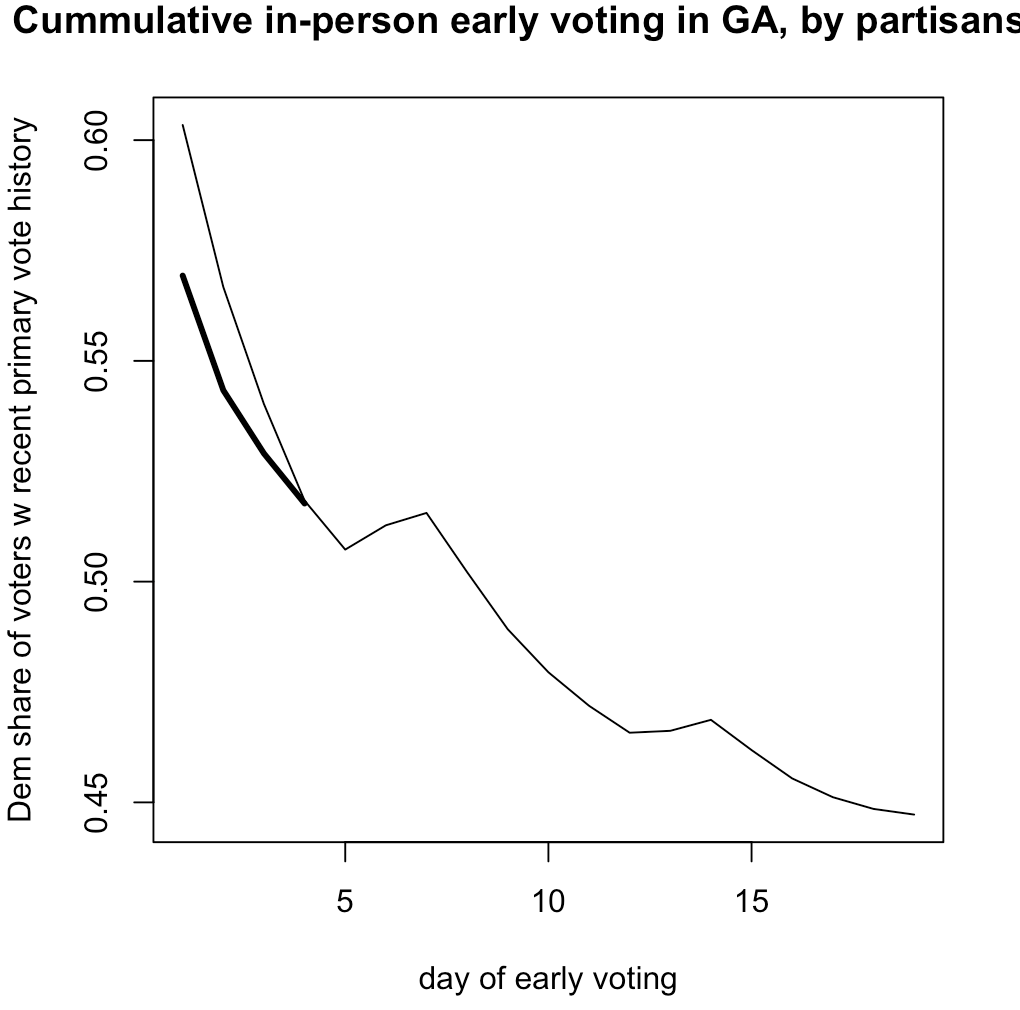

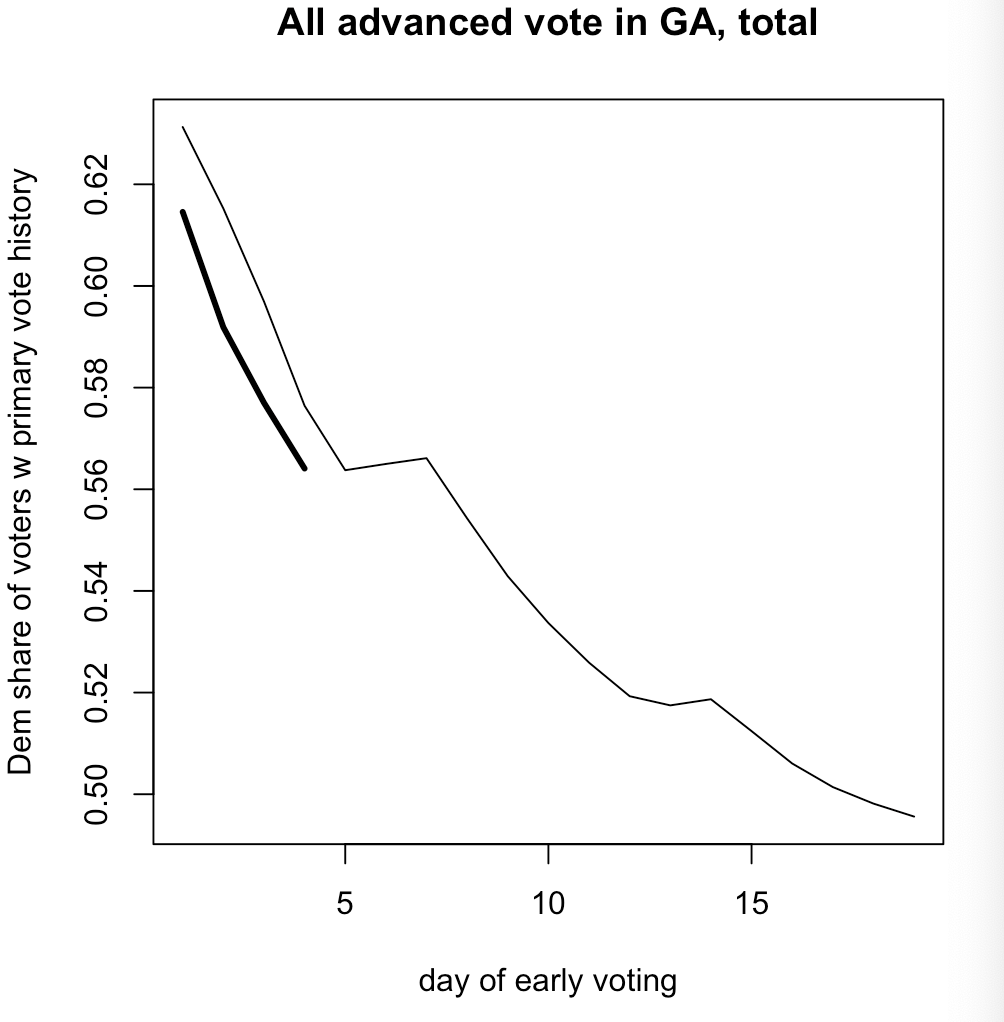

And this week, there's been a bit of a trend toward Dems v. the ge, with yesterday Dems plainly faring better for the first time

And again, if the absentee vote drops off more than early vote, Dems will want to compensate by finishing better in early than they did in the general

More from Nate Cohn

One question I keep getting about the Georgia early voting is about age: isn't the electorate older, and how much does it hurt the Democrats?

So far the answer is 'not really' and 'not at all.'

The first question is easy enough. As of today, youth turnout is basically keeping pace with the general, controlling for the slightly reduced opportunities to vote. This augurs for an unusually young

The second question is more interesting: are the Democrats hurt by lower youth turnout? So far the answer is no, and there are two reasons.

One reason: there's not a *huge* gen. gap. Maybe young voters are D+20 while >65 are R+15. You need a big gap for modest changes to matter.

The second reason is maybe more interesting: the young voters who have voted are just a lot more Democratic than the young voters who turned out at this stage of the general election

By party primary vote history, the 18-29 year olds who have voted so far are D 38, R 12. They were D 33, R 14 in the general at this stage.

So far the answer is 'not really' and 'not at all.'

The first question is easy enough. As of today, youth turnout is basically keeping pace with the general, controlling for the slightly reduced opportunities to vote. This augurs for an unusually young

it's not a very material difference pic.twitter.com/ygdD3hb8b7

— Nate Cohn (@Nate_Cohn) December 29, 2020

The second question is more interesting: are the Democrats hurt by lower youth turnout? So far the answer is no, and there are two reasons.

One reason: there's not a *huge* gen. gap. Maybe young voters are D+20 while >65 are R+15. You need a big gap for modest changes to matter.

The second reason is maybe more interesting: the young voters who have voted are just a lot more Democratic than the young voters who turned out at this stage of the general election

By party primary vote history, the 18-29 year olds who have voted so far are D 38, R 12. They were D 33, R 14 in the general at this stage.

More from Politics

You May Also Like

So the cryptocurrency industry has basically two products, one which is relatively benign and doesn't have product market fit, and one which is malignant and does. The industry has a weird superposition of understanding this fact and (strategically?) not understanding it.

The benign product is sovereign programmable money, which is historically a niche interest of folks with a relatively clustered set of beliefs about the state, the literary merit of Snow Crash, and the utility of gold to the modern economy.

This product has narrow appeal and, accordingly, is worth about as much as everything else on a 486 sitting in someone's basement is worth.

The other product is investment scams, which have approximately the best product market fit of anything produced by humans. In no age, in no country, in no city, at no level of sophistication do people consistently say "Actually I would prefer not to get money for nothing."

This product needs the exchanges like they need oxygen, because the value of it is directly tied to having payment rails to move real currency into the ecosystem and some jurisdictional and regulatory legerdemain to stay one step ahead of the banhammer.

If everyone was holding bitcoin on the old x86 in their parents basement, we would be finding a price bottom. The problem is the risk is all pooled at a few brokerages and a network of rotten exchanges with counter party risk that makes AIG circa 2008 look like a good credit.

— Greg Wester (@gwestr) November 25, 2018

The benign product is sovereign programmable money, which is historically a niche interest of folks with a relatively clustered set of beliefs about the state, the literary merit of Snow Crash, and the utility of gold to the modern economy.

This product has narrow appeal and, accordingly, is worth about as much as everything else on a 486 sitting in someone's basement is worth.

The other product is investment scams, which have approximately the best product market fit of anything produced by humans. In no age, in no country, in no city, at no level of sophistication do people consistently say "Actually I would prefer not to get money for nothing."

This product needs the exchanges like they need oxygen, because the value of it is directly tied to having payment rails to move real currency into the ecosystem and some jurisdictional and regulatory legerdemain to stay one step ahead of the banhammer.