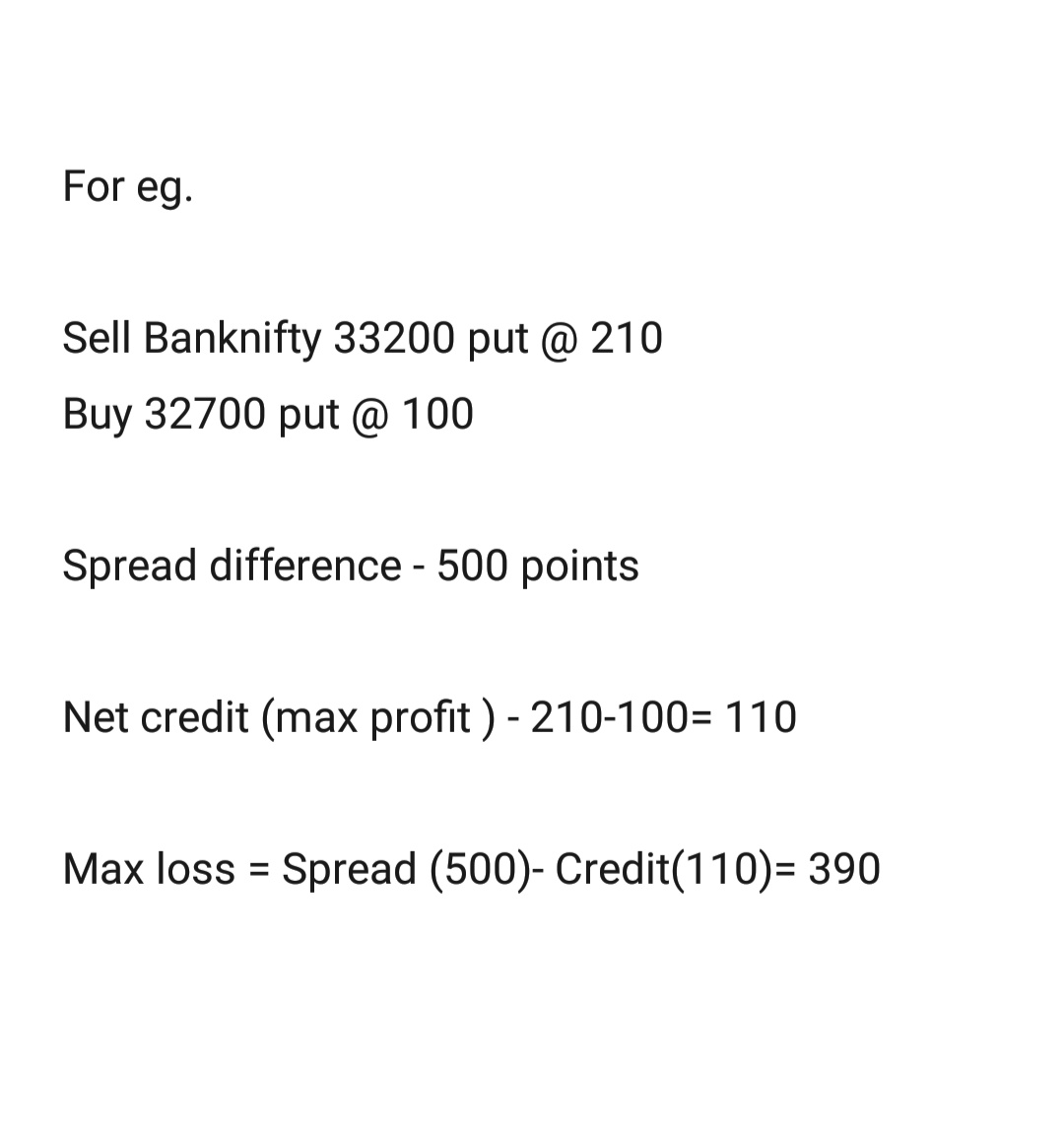

If you are new to F&O, you can start with Vertical Spreads (Debit and Credit spreads) instead of buying options in Stocks and Indices.

Here are some ways how you can do it, when you can do it and the right position sizing for doing it... 🧵 (1/25)

1. Bull call spread (Debit spread)

2. Bull put spread (Credit spread)

3. Bear call spread (Credit spread)

4. Bear put spread (Debit spread)

Read about these strategies in the below articles. (4/25)

While going through these strategies, you must have thought you have to wait till expiry for profits/loss. (5/25)

Let's understand how, when and what strategy to use with a few examples:

(you should have knowledge of price action for this) (7/25)

A recent example - since Oct 21 markets started falling, initially we assumed that it could be a pullback but many stocks started falling with good volumes, started making tops and giving false breakouts. (8/25)

In options, you got to be mindful of choosing stocks with good liquidity in options.(9/25)

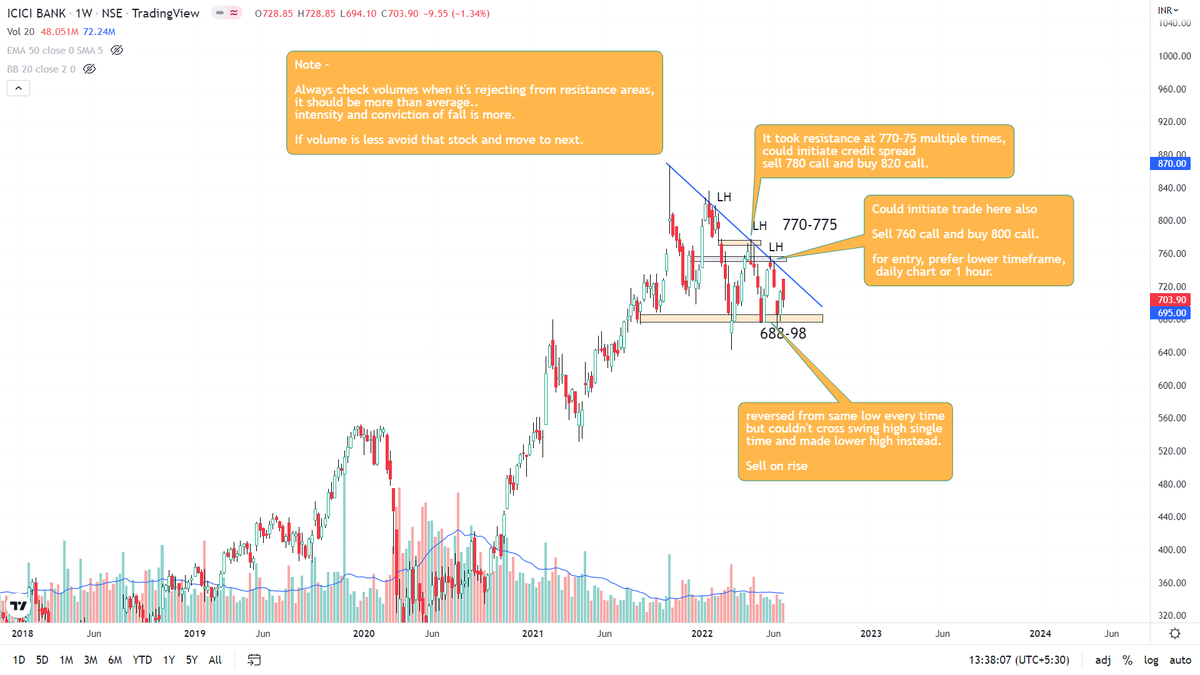

When stocks/Index started rejecting from their major resistance areas.. mark that level. In reversal trades, you can trade via Credit Spread.

Sell ATM call and buy OTM call. (10/25)

When any stock/Index breaks support and give a breakout, we can trade via Debit Spread as the move is fast in breakouts.

Buy ATM/ITM put and Sell OTM put

In TechM, we could buy 1650 put and sell 1550 put. (13/25)

Check the chart for reference. (14/25)

When you should initiate a trade?

First, you need to find out the major trend of instrument you are trading either Index or stocks.

At present, we know it's a bearish trend or sell on rise market.. (16/25)

Every week you need to check the large cap stocks (if you are trading in stocks) and Index charts if you are trading Nifty/Banknifty. (17/25)

2. Check if it's near any resistance area

3. If it gave a rejection candle near imp. resistance (mark the level)

4. Or if it's breaking any imp. support

For entry, check the daily chart next day. (18/25)

Check the chart for your reference: (19/25)

If stock/Index is near major support, don't sell call, as chances of reversal will be more from there. Even if it closes below resistance strike at expiry, in reversal, premiums will spike. You will see immediate loss which is tough to handle. (20/25)

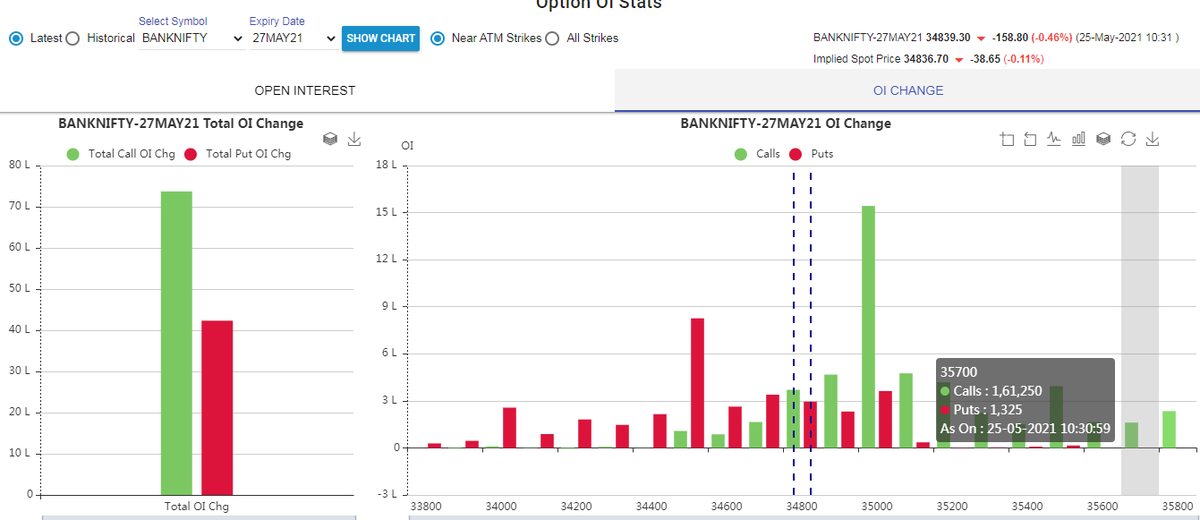

Let's check the charts of Nifty/Banknifty for trading weekly expiries(directional trading) via spreads: (21/25)

Vertical spreads are risk defined strategies. Keep sizing such that you don't lose over 3-4% in max loss or use 2L for 1 lot.

I think one should have at least 15L-20L for F&O.

In naked selling or in futures, the sizing should be fixed on notional exposure.(22/25)

Initially, you must not take more than 2x exposure.

Suppose the Notional value is 6L, you can take 1 lot using 3L or in simple language if you carry a naked selling option or futures, use 3-4L for one lot initially.. (23/25)

https://t.co/TVesQ0xnDe (24/25)

More from Sheetal Rijhwani

Read and follow this.. he has aptly explained about various methods to trail.

2. TRAILING METHODS-

— Trader knight (@Traderknight007) December 24, 2020

1. SWING POINT METHOD-

In this method we use the swing points or the HH- HL OR LH-LL points for placing sl,

In this method we trail our sl when the stock make a Higher low after our entry and keep Trailing the sl till it hits. pic.twitter.com/CqzCkLdWmC

It's practically impossible to check all charts. However, you can use multiple scanners as per your setups to make things easy.

In trending market, even junk stocks give a good move. But in sideways and falling markets, you have to be very selective. (2/21)

One imp. filter for me is trading in strong fundamental stocks. Every quarter, I check results of companies and filter the list. I keep checking the charts and set an alert on the levels. Many good handles on Twitter post good results lists, you can save that as well. (3/21)

This time, I did the same on my telegram channel.

https://t.co/C3eS9PSncG

Second filter for me is Current Performing Sectors/Themes. Keep your eyes and ears open. Being a good observer helps you big time. Make good use of news in your analysis. (4/21)

For Eg: Textiles are performing well for a while now. It has strong consumer interest due to many global retailers, diversifying their outsourcing and reducing their dependence on China. Order booking from India has increased rapidly. (5/21)

Target - 6400+

Stop loss - 4650 https://t.co/DD6pFtSvMI

#AffleIndia

— Sheetal Rijhwani (@RijhwaniSheetal) August 8, 2021

It's at retest of weekly breakout level.. we can get a good entry with favourable risk/reward. Have a look at chart! #stockmarket #stockstowatch pic.twitter.com/cS9EOIoWJl

More from Optionslearnings

How many are believing only in simple trading system?

— Mitesh Patel (@Mitesh_Engr) April 3, 2021

This is my simple trading.

I don\u2019t have any magic.

— Mitesh Patel (@Mitesh_Engr) January 7, 2021

Next week I will prefer to sell put in between strike 30500-31000 as shown in pic. Will manage upto 31000.

If breaks 31000 as first down support then will exit put nearby 31000 strike and will sell

31500 call ( will act as resistance again )

Simple hai na pic.twitter.com/hPLIMq3tSe

You May Also Like

(I am forced to do this due to continuous hounding of Sikh Extremists since yesterday)

Rani Jindan Kaur, wife of Maharaja Ranjit Singh had illegitimate relations with Lal Singh (PM of Ranjit Singh). Along with Lal Singh, she attacked Jammu, burnt - https://t.co/EfjAq59AyI

Tomorrow again same thing happens bcoz fudus like you are creating a narrative oh Khalistan. when farmers are asking MSP. (RSS ki tatti khane wale Kerni sena ke kutte).

— Ancient Economist (@_stock_tips) December 5, 2020

U kill sikhs in 1984 just politics. To BC low IQ fudu Saale entire history was politics.

Hindu villages of Jasrota, caused rebellion in Jammu, attacked Kishtwar.

Ancestors of Raja Ranjit Singh, The Sansi Tribe used to give daughters as concubines to Jahangir.

The Ludhiana Political Agency (Later NW Fronties Prov) was formed by less than 4000 British soldiers who advanced from Delhi and reached Ludhiana, receiving submissions of all sikh chiefs along the way. The submission of the troops of Raja of Lahore (Ranjit Singh) at Ambala.

Dabistan a contemporary book on Sikh History tells us that Guru Hargobind broke Naina devi Idol Same source describes Guru Hargobind serving a eunuch

YarKhan. (ref was proudly shared by a sikh on twitter)

Gobind Singh followed Bahadur Shah to Deccan to fight for him.

In Zafarnama, Guru Gobind Singh states that the reason he was in conflict with the Hill Rajas was that while they were worshiping idols, while he was an idol-breaker.

And idiot Hindus place him along Maharana, Prithviraj and Shivaji as saviours of Dharma.