As promised, here is the first video of Iron Fly Simulation of Reverse buying and scalping in directional market

Expiry - 05 August 2021

Will upload daily one simulation in this week

Link to watch - https://t.co/Pp2nux2iU0 https://t.co/kbgpszLiiP

More from Optionslearnings

Don’t ask any question now just try to understand how I trade in live market

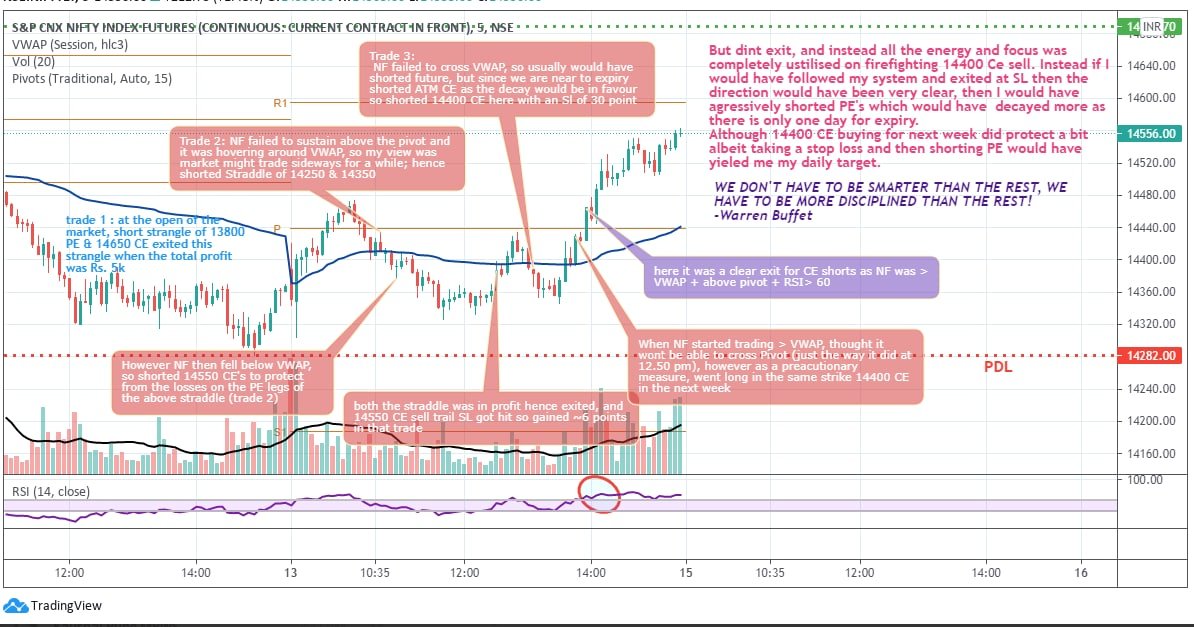

Yesterday sell 14700 than 14600 than 14800 market come down sell sell 15 k call going up sell 14400 put Getting some profit buy protection 14450 pe 14950 ce now u know ur max loss now wait or do adjustment with sell upar side ce or pe it\u2019s practical knowledge not books knowledge pic.twitter.com/J5sPGClVUZ

— itrade(DJ) (@ITRADE191) May 16, 2021

THREAD: 14 of the best resources/topics for anyone who wants to start option selling as a career. 🧵

Collaborated with @niki_poojary

1. Best Sources of knowledge for a beginner in option selling?

Zerodha Varsity from @Nithin0dha's team & the @tastytrade financial network.

Links:

2. Top YouTube Channel for Options Learning?

Power of Stocks - Subhasish Pani

What you'll learn:

1. How to form a trading plan.

2. How to scale an account with risk-reward in option selling.

3. Technical analysis logics you can use daily.

15

3. What are the preconditions to start option Selling:

You should know technical Analysis basics like:

- Support/Resistance

- Chart Patterns

- Candle Patterns

- Dow Theory (HH, LL)

This will help you start taking high probability trades.

4. Risk Management is a must for option selling

If you don't learn to manage your risk, making money in trading is going to be an extremely difficult endeavor

Have some rules:

1. Risk no more than 0.25% per trade as a beginner

2. Risk no more than 2% in a day for the first year

Collaborated with @niki_poojary

1. Best Sources of knowledge for a beginner in option selling?

Zerodha Varsity from @Nithin0dha's team & the @tastytrade financial network.

Links:

2. Top YouTube Channel for Options Learning?

Power of Stocks - Subhasish Pani

What you'll learn:

1. How to form a trading plan.

2. How to scale an account with risk-reward in option selling.

3. Technical analysis logics you can use daily.

15

15 Learnings from Power of Stocks: \U0001f9f5

— Aditya Todmal (@AdityaTodmal) January 23, 2022

Collaborated with @niki_poojary

3. What are the preconditions to start option Selling:

You should know technical Analysis basics like:

- Support/Resistance

- Chart Patterns

- Candle Patterns

- Dow Theory (HH, LL)

This will help you start taking high probability trades.

4. Risk Management is a must for option selling

If you don't learn to manage your risk, making money in trading is going to be an extremely difficult endeavor

Have some rules:

1. Risk no more than 0.25% per trade as a beginner

2. Risk no more than 2% in a day for the first year

You May Also Like

“We don’t negotiate salaries” is a negotiation tactic.

Always. No, your company is not an exception.

A tactic I don’t appreciate at all because of how unfairly it penalizes low-leverage, junior employees, and those loyal enough not to question it, but that’s negotiation for you after all. Weaponized information asymmetry.

Listen to Aditya

And by the way, you should never be worried that an offer would be withdrawn if you politely negotiate.

I have seen this happen *extremely* rarely, mostly to women, and anyway is a giant red flag. It suggests you probably didn’t want to work there.

You wish there was no negotiating so it would all be more fair? I feel you, but it’s not happening.

Instead, negotiate hard, use your privilege, and then go and share numbers with your underrepresented and underpaid colleagues. […]

Always. No, your company is not an exception.

A tactic I don’t appreciate at all because of how unfairly it penalizes low-leverage, junior employees, and those loyal enough not to question it, but that’s negotiation for you after all. Weaponized information asymmetry.

Listen to Aditya

"we don't negotiate salaries" really means "we'd prefer to negotiate massive signing bonuses and equity grants, but we'll negotiate salary if you REALLY insist" https://t.co/80k7nWAMoK

— Aditya Mukerjee, the Otterrific \U0001f3f3\ufe0f\u200d\U0001f308 (@chimeracoder) December 4, 2018

And by the way, you should never be worried that an offer would be withdrawn if you politely negotiate.

I have seen this happen *extremely* rarely, mostly to women, and anyway is a giant red flag. It suggests you probably didn’t want to work there.

You wish there was no negotiating so it would all be more fair? I feel you, but it’s not happening.

Instead, negotiate hard, use your privilege, and then go and share numbers with your underrepresented and underpaid colleagues. […]