First attempt to make a video by @niki_poojary

Covered weekly analysis of Bank Nifty.

Kindly give it a watch.

#BANKNIFTY

— Nikita Poojary (@niki_poojary) October 10, 2021

Outlook for the week Oct 11 - Oct 14, 2021

Compiled here\U0001f447

More from Aditya Todmal

Decoded his way of analysis/logics for everyone to easily understand.

Have covered:

1. Analysis of volatility, how to foresee/signs.

2. Workbook

3. When to sell options

4. Diff category of days

5. How movement of option prices tell us what will happen

1. Keeps following volatility super closely.

Makes 7-8 different strategies to give him a sense of what's going on.

Whichever gives highest profit he trades in.

I am quite different from your style. I follow the market's volatility very closely. I have mock positions in 7-8 different strategies which allows me to stay connected. Whichever gives best profit is usually the one i trade in.

— Sarang Sood (@SarangSood) August 13, 2019

2. Theta falls when market moves.

Falls where market is headed towards not on our original position.

Anilji most of the time these days Theta only falls when market moves. So the Theta actually falls where market has moved to, not where our position was in the first place. By shifting we can come close to capturing the Theta fall but not always.

— Sarang Sood (@SarangSood) June 24, 2019

3. If you're an options seller then sell only when volatility is dropping, there is a high probability of you making the right trade and getting profit as a result

He believes in a market operator, if market mover sells volatility Sarang Sir joins him.

This week has been great so far. The main aim is to be in the right side of the volatility, rest the market will reward.

— Sarang Sood (@SarangSood) July 3, 2019

4. Theta decay vs Fall in vega

Sell when Vega is falling rather than for theta decay. You won't be trapped and higher probability of making profit.

There is a difference between theta decay & fall in vega. Decay is certain but there is no guaranteed profit as delta moves can increase cost. Fall in vega on the other hand is backed by a powerful force that sells options and gives handsome returns. Our job is to identify them.

— Sarang Sood (@SarangSood) February 12, 2020

1. Core setup

2. Pivot points trades

3. PDH/PDL trades

4. Open interest addictions combined with rejections on charts.

5. Website to confirm bias

Very quick read.

Share if you liked for the benefit of everyone.

•Main setup of @ITRADE191

He used this setup daily for all trades.

1. EMA crossover 10/20

2. Supertrend 10/3

3. Vwap

4. RSI >

@MiteshFan @Mitesh_Engr @Abhishekkar_ MY TRADING SETUP .... I've been using it for a long time .. result good try it \U0001f607 pic.twitter.com/XThUD0ftbl

— itrade(DJ) (@ITRADE191) June 13, 2020

•Volume always greater than

Volume Should always be above 20 pic.twitter.com/CPgxLgpPKF

— itrade(DJ) (@ITRADE191) June 13, 2020

•Candle Rejecting from

— itrade(DJ) (@ITRADE191) August 25, 2020

•Pivot settings

— itrade(DJ) (@ITRADE191) October 20, 2020

@niki_poojary is a pro trader and is sitting with an ROI of about 60% for the year.

Here are 7 of her best threads from 2022 to make you a pro today (completely free):

By the end of this thread, you'll learn 5 lessons:

1. 10 most Powerful Intraday Setups with Screeners

2. Systematically become a good trader

3. Bollinger band set-up

4. Fibonacci retracements

5. Create a Trading Plan using only Price Action

...and a few more

Let's go ↓

Create a Trading Plan using only Price

Do you want to know how to create a Trading Plan using only Price Action?

— Nikita Poojary (@niki_poojary) October 26, 2022

Here's a breakdown of 11 simple yet powerful steps to create one: \U0001f9f5

Collaborated with @AdityaTodmal

10 Powerful Intraday Setups with

10 most Powerful Intraday Setups with Screeners: \U0001f9f5

— Nikita Poojary (@niki_poojary) November 8, 2022

Collaborated with @AdityaTodmal

1:4 RR Bollinger band

A set up which has a minimum Risk/Reward (R/R) of 1:4

— Nikita Poojary (@niki_poojary) October 2, 2022

This set up can be used for intraday, option selling, option buying, as well as investing.

Maximum profit strategy by Subasish Pani.

Bollinger band set-up: \U0001f9f5!

Collaborated with @AdityaTodmal pic.twitter.com/aEIUVQF2XY

But 95% of Traders are unaware of the best extensions for trading.

10 Google Chrome Extensions that will accelerate your trading ( all free ): 🧵

Collaborated with @niki_poojary

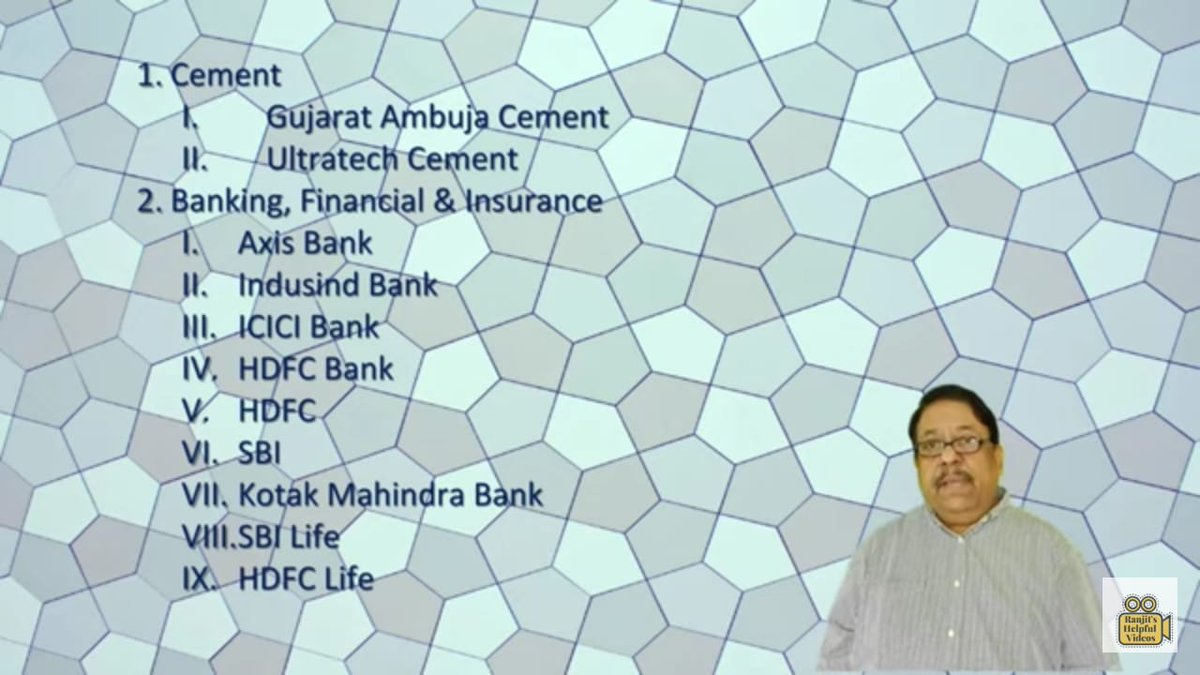

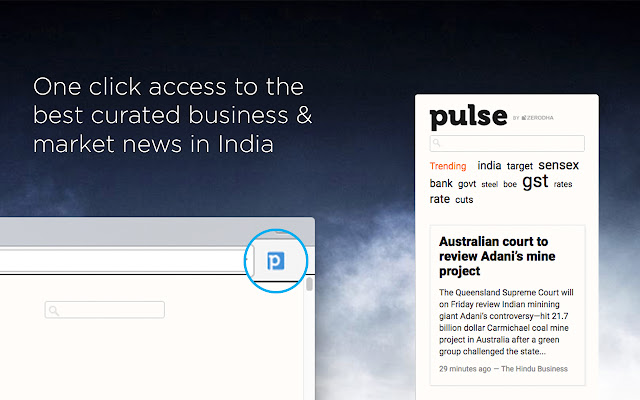

1. Pulse by Zerodha

Latest financial and market news from all major Indian news sources are aggregated in one place.

🔗 https://t.co/jQ5Lu1P1r3

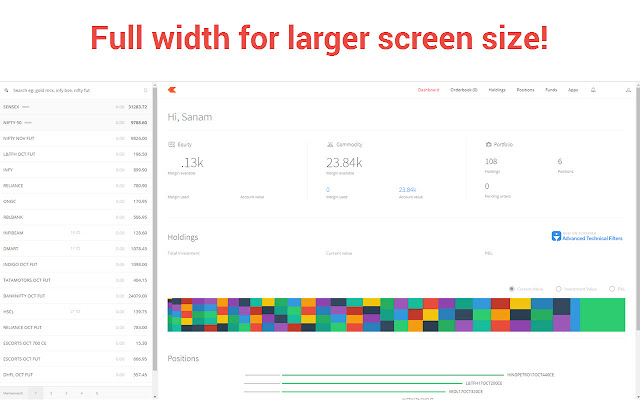

2. Full Width Zerodha Kite Trading Platform

This extension will make your Zerodha kite trading app full-width for large-screen desktops and laptops.

Also adding some tweaks will help you stay more focused on trading.

🔗 https://t.co/HSmVxLxPNv

3. Zerodha Scrip Plus

Zerodha fullscreen trading with brokerage calculator and analysis options

- Brokerage Calculator

- Full screen trading

- Marketwatch and Holdings scrips analysis

🔗 https://t.co/ZOmAcvamRh

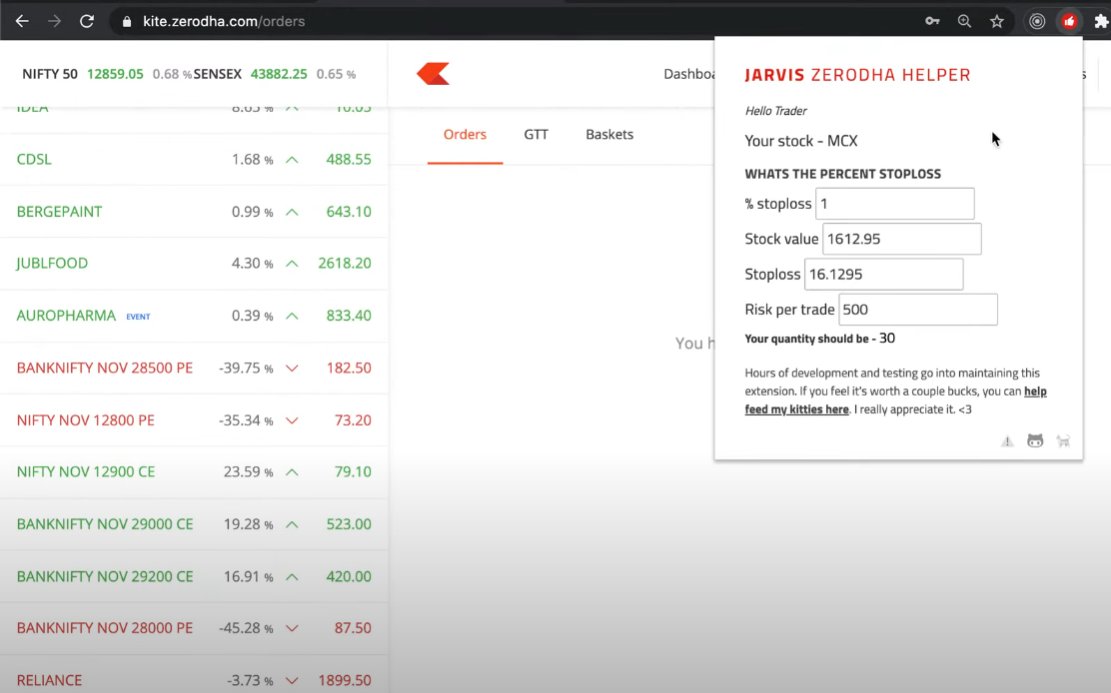

4. Jarvis - Zerodha Trading helper

Jarvis helps in managing your risk by giving you a consistency of pre-determined stop loss % and risk per trade.

Once you set these values in the plugin then it automatically sets the quantity of the trade.

🔗 https://t.co/qn2MvDkCdR

More from Optionslearnings

Curated the best tweets from the best traders who are exceptional at managing strangles.

• Positional Strangles

• Intraday Strangles

• Position Sizing

• How to do Adjustments

• Plenty of Examples

• When to avoid

• Exit Criteria

How to sell Strangles in weekly expiry as explained by boss himself. @Mitesh_Engr

• When to sell

• How to do Adjustments

• Exit

1. Let's start option selling learning.

— Mitesh Patel (@Mitesh_Engr) February 10, 2019

Strangle selling. ( I am doing mostly in weekly Bank Nifty)

When to sell? When VIX is below 15

Assume spot is at 27500

Sell 27100 PE & 27900 CE

say premium for both 50-50

If bank nifty will move in narrow range u will get profit from both.

Beautiful explanation on positional option selling by @Mitesh_Engr

Sir on how to sell low premium strangles yourself without paying anyone. This is a free mini course in

Few are selling 20-25 Rs positional option selling course.

— Mitesh Patel (@Mitesh_Engr) November 3, 2019

Nothing big deal in that.

For selling weekly option just identify last week low and high.

Now from that low and high keep 1-1.5% distance from strike.

And sell option on both side.

1/n

1st Live example of managing a strangle by Mitesh Sir. @Mitesh_Engr

• Sold Strangles 20% cap used

• Added 20% cap more when in profit

• Booked profitable leg and rolled up

• Kept rolling up profitable leg

• Booked loss in calls

• Sold only

Sold 29200 put and 30500 call

— Mitesh Patel (@Mitesh_Engr) April 12, 2019

Used 20% capital@44 each

2nd example by @Mitesh_Engr Sir on converting a directional trade into strangles. Option Sellers can use this for consistent profit.

• Identified a reversal and sold puts

• Puts decayed a lot

• When achieved 2% profit through puts then sold

Already giving more than 2% return in a week. Now I will prefer to sell 32500 call at 74 to make it strangle in equal ratio.

— Mitesh Patel (@Mitesh_Engr) February 7, 2020

To all. This is free learning for you. How to play option to make consistent return.

Stay tuned and learn it here free of cost. https://t.co/7J7LC86oW0

You May Also Like

make products.

"If only someone would tell me how I can get a startup to notice me."

Make Products.

"I guess it's impossible and I'll never break into the industry."

MAKE PRODUCTS.

Courtesy of @edbrisson's wonderful thread on breaking into comics – https://t.co/TgNblNSCBj – here is why the same applies to Product Management, too.

"I really want to break into comics"

— Ed Brisson (@edbrisson) December 4, 2018

make comics.

"If only someone would tell me how I can get an editor to notice me."

Make Comics.

"I guess it's impossible and I'll never break into the industry."

MAKE COMICS.

There is no better way of learning the craft of product, or proving your potential to employers, than just doing it.

You do not need anybody's permission. We don't have diplomas, nor doctorates. We can barely agree on a single standard of what a Product Manager is supposed to do.

But – there is at least one blindingly obvious industry consensus – a Product Manager makes Products.

And they don't need to be kept at the exact right temperature, given endless resource, or carefully protected in order to do this.

They find their own way.