Best FREE website for FNO Heatmap - ICICI DIRECT

https://t.co/honvUA9lmx

Advantages:

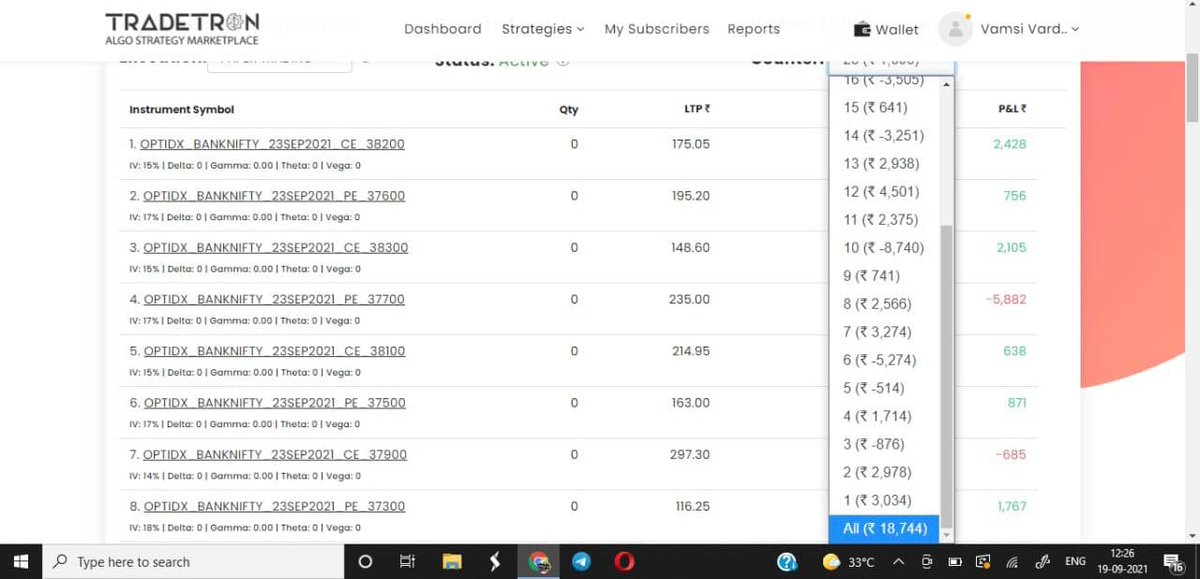

1. Quantitative Analysis in one place

2. Easy to find stocks where action taking place

3. Find the exact price levels at which OI is being added.

(1/5)

For example, Nifty Heatmap Can easily scan for

1. Long Build up (Price up and OI up)

2. Long Unwinding (Price down and OI down)

3. Short Buildup (Price down and OI up)

4. Short Covering (Price up and OI down)

(2/5)

1. 15 mins Built up can check in any stock

2. Easy to find Intraday Bullish and bearish trend

3. Eg of Bajaj Auto who was up 9% on Friday. Long Built up had started in the morning itself.

4. Shows the quantities also which are being traded in those intervals.

(3/5)

5. There are 25 time intervals available everyday.

6. If a stock has to go up or down a lot it will be heavily dominated in these time intervals.

7. Bajaj Auto had 14 times long built up on Friday.

8. IndusInd Bank had 13 short built ups on Friday. IndusInd fell 3.5%.

(4/5)

Some people5 check the last 45 mins data of the day too to predict the gap opening for the next day.

Data gives them additional conviction, especially if huge contracts addition is taking place.

(5/5)

---------------------------------------------------------