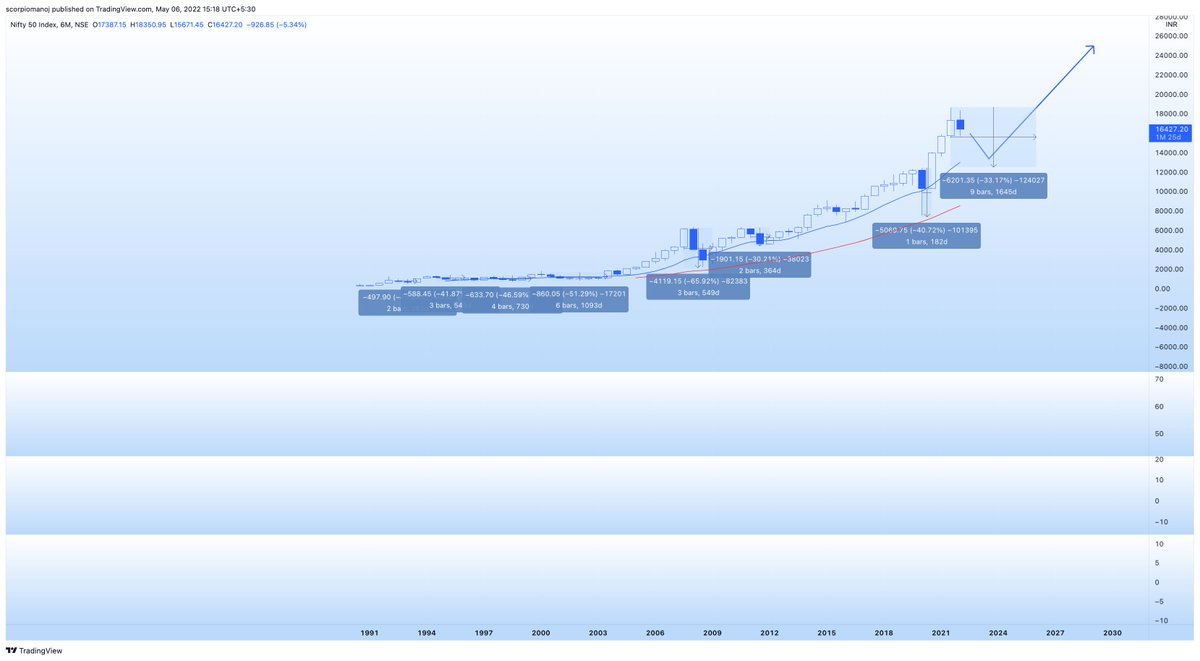

Nifty 50-Until 16600 is crossed then there is every chance of one more leg downwards (Wave5)

If it closes below 15700 then we can see 15500/15160

5th wave-can get truncated,

Get rid of kachra!!

Good opportunity to accumulate quality companies

chart👇

cheers https://t.co/b0M5QRcq7e

Please use the opportunity to move out of the low-quality companies into high-quality companies.

— Moneyspinners - Work Hard, Dream Big!! (@Jai0409) May 18, 2022

More from Moneyspinners - Work Hard, Dream Big!!

will post an updated chart later in the week

Long from 288

ISGEC-A leader in heavy industries

— Moneyspinners-Work 4UR Dreams (@Jai0409) March 13, 2021

A quality company's mgmt possess character to fight out headwinds faced by business&market for a long period of time.

PLI scheme to boost India's production by $520 bn in next 5yr

It is the time now to benefit from upcycle

Disc-invested@289 https://t.co/BhK9i5JE01 pic.twitter.com/vNeABDtVd5

ISGEC - Sugar/Ethanol theme - Along the side of Praj one can consider this company too.

Here is the ISGEC sugar mills Client list

Looking for max another 100 to 150 fall in smallcap before it reverses from mid diagonal unless we don't hear any bad news from external and internal geographies.

correction is a good time to shuffle laggards, incorrect allocation with performers https://t.co/7HLlfDSHtM

Small-cap and Midcap Index's are in wave 4 correction,

— Moneyspinners-Work 4UR Dreams (@Jai0409) August 10, 2021

Overall structure is not changed

Continue to hold quality stocks & add in the lower level's periodically

Sell strechted valuations

Shuffle laggard with performer those who have given good results in tough times

cheers

Whenever international prices shot up commodity stocks start soaring, previously it went up from 73 to 165!!

Now can it give move to 200/230+!!

Chart👇 https://t.co/1TJRP7rj0P

Good for Hindustan copper and Rain Industries!!

— Moneyspinners-Work 4UR Dreams (@Jai0409) January 18, 2021

Disc - Invested!! https://t.co/xfJKSWMeyw

https://t.co/3An8uq0e3G

Is copper leading the commodity supercycle? @Manisha3005 explains on #CommodityCorner https://t.co/nZ5FT4FsZ2

— CNBC-TV18 (@CNBCTV18News) April 16, 2021

More from Niftylongterm

You May Also Like

இது சூரிய குலத்தில் உதித்த இராமபிரானுக்கு தமிழ் முனிவர் அகத்தியர் உபதேசித்ததாக வால்மீகி இராமாயணத்தில் வருகிறது. ஆதித்ய ஹ்ருதயத்தைத் தினமும் ஓதினால் பெரும் பயன் பெறலாம் என மகான்களும் ஞானிகளும் காலம் காலமாகக் கூறி வருகின்றனர். ராம-ராவண யுத்தத்தை

தேவர்களுடன் சேர்ந்து பார்க்க வந்திருந்த அகத்தியர், அப்போது போரினால் களைத்து, கவலையுடன் காணப்பட்ட ராமபிரானை அணுகி, மனிதர்களிலேயே சிறந்தவனான ராமா போரில் எந்த மந்திரத்தைப் பாராயணம் செய்தால் எல்லா பகைவர்களையும் வெல்ல முடியுமோ அந்த ரகசிய மந்திரத்தை, வேதத்தில் சொல்லப்பட்டுள்ளதை உனக்கு

நான் உபதேசிக்கிறேன், கேள் என்று கூறி உபதேசித்தார். முதல் இரு சுலோகங்கள் சூழ்நிலையை விவரிக்கின்றன. மூன்றாவது சுலோகம் அகத்தியர் இராமபிரானை விளித்துக் கூறுவதாக அமைந்திருக்கிறது. நான்காவது சுலோகம் முதல் முப்பதாம் சுலோகம் வரை ஆதித்ய ஹ்ருதயம் என்னும் நூல். முப்பத்தி ஒன்றாம் சுலோகம்

இந்தத் துதியால் மகிழ்ந்த சூரியன் இராமனை வாழ்த்துவதைக் கூறுவதாக அமைந்திருக்கிறது.

ஐந்தாவது ஸ்லோகம்:

ஸர்வ மங்கள் மாங்கல்யம் ஸர்வ பாப ப்ரநாசனம்

சிந்தா சோக ப்ரசமனம் ஆயுர் வர்த்தனம் உத்தமம்

பொருள்: இந்த அதித்ய ஹ்ருதயம் என்ற துதி மங்களங்களில் சிறந்தது, பாவங்களையும் கவலைகளையும்

குழப்பங்களையும் நீக்குவது, வாழ்நாளை நீட்டிப்பது, மிகவும் சிறந்தது. இதயத்தில் வசிக்கும் பகவானுடைய அனுக்ரகத்தை அளிப்பதாகும்.

முழு ஸ்லோக லிங்க் பொருளுடன் இங்கே உள்ளது https://t.co/Q3qm1TfPmk

சூரியன் உலக இயக்கத்திற்கு மிக முக்கியமானவர். சூரிய சக்தியால்தான் ஜீவராசிகள், பயிர்கள்

Five billionaires share their top lessons on startups, life and entrepreneurship (1/10)

I interviewed 5 billionaires this week

— GREG ISENBERG (@gregisenberg) January 23, 2021

I asked them to share their lessons learned on startups, life and entrepreneurship:

Here's what they told me:

10 competitive advantages that will trump talent (2/10)

To outperform, you need serious competitive advantages.

— Sahil Bloom (@SahilBloom) March 20, 2021

But contrary to what you have been told, most of them don't require talent.

10 competitive advantages that you can start developing today:

Some harsh truths you probably don’t want to hear (3/10)

I\u2019ve gotten a lot of bad advice in my career and I see even more of it here on Twitter.

— Nick Huber (@sweatystartup) January 3, 2021

Time for a stiff drink and some truth you probably dont want to hear.

\U0001f447\U0001f447

10 significant lies you’re told about the world (4/10)

THREAD: 10 significant lies you're told about the world.

— Julian Shapiro (@Julian) January 9, 2021

On startups, writing, and your career: