NAVINFLUOR

Double Top Buy triggered above 3704.66 daily close on 3% Box Size chart. https://t.co/b5KkTmtjl5

NAVINFLUOR

— Saket Reddy (@saketreddy) March 2, 2021

Double Top Buy above 2839.32 daily close on 3% Box Size Chart and Double Top Buy active on 1% Box size chart. https://t.co/HiLu17wobZ pic.twitter.com/6JIStAhaSO

More from Saket Reddy

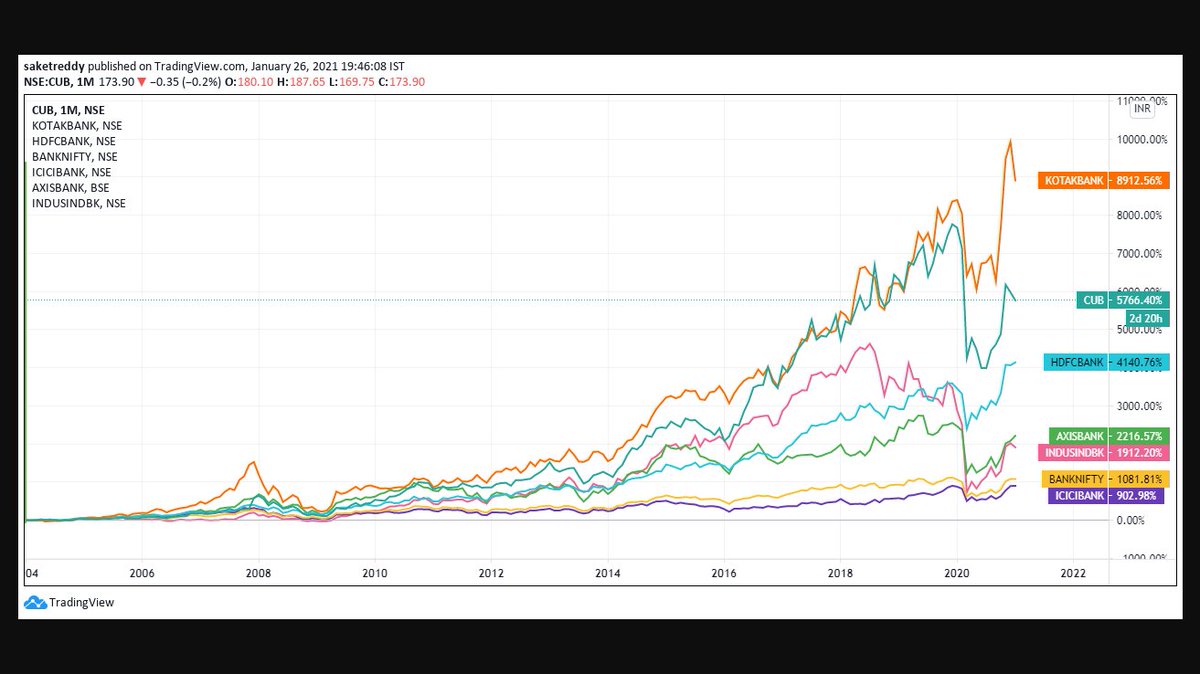

They are the real compounders, they've created massive wealth compared to others! https://t.co/PluVwU5OXG

Hope Everyone saw BANDHANBNK Numbers. I feel many such banks will go through a massive NPA Cycle followed by depleted Tier 1.

— Saket Reddy (@saketreddy) January 24, 2021

Hence, stay with the Top 3 banks :-

HDFCBANK

KOTAKBANK

CUB

They've low cost of funding, well provisioned Moratorium book, high ROEs & high Tier 1 CAR.

Double Top Buy above 2864.83 daily close on 1% Box Size chart. https://t.co/oP7KnYn7R8

HDFC

— Saket Reddy (@saketreddy) February 2, 2021

High Quality standalone business, Holds double digit stakes in High quality group companies like HDFCBANK & HDFCLIFE.

Double Top buy & ABC Pattern breakout above 2698.8 daily close on 1% box size chart & Double top buy above 2756.62 on 3% box size chart. https://t.co/6ozyrPMgIG pic.twitter.com/fXRcAI9Kws

More from Navinflourine

#NavinFluorine A breakout above 3566, this one could head next to 4100/4200 levels. Long term levels have shared already. #Dare2DRM https://t.co/FvexrxG0T8 pic.twitter.com/DHYAiEZ1j9

— Dare2Dream (@Dare2Dr10109801) May 1, 2021

You May Also Like

1 - open trading view in your browser and select stock scanner in left corner down side .

2 - touch the percentage% gain change ( and u can see higest gainer of today)

Making thread \U0001f9f5 on trading view scanner by which you can select intraday and btst stocks .

— Vikrant (@Trading0secrets) October 22, 2021

In just few hours (Without any watchlist)

Some manual efforts u have to put on it.

Soon going to share the process with u whenever it will be ready .

"How's the josh?"guys \U0001f57a\U0001f3b7\U0001f483

3. Then, start with 6% gainer to 20% gainer and look charts of everyone in daily Timeframe . (For fno selection u can choose 1% to 4% )

4. Then manually select the stocks which are going to give all time high BO or 52 high BO or already given.

5. U can also select those stocks which are going to give range breakout or already given range BO

6 . If in 15 min chart📊 any stock sustaing near BO zone or after BO then select it on your watchlist

7 . Now next day if any stock show momentum u can take trade in it with RM

This looks very easy & simple but,

U will amazed to see it's result if you follow proper risk management.

I did 4x my capital by trading in only momentum stocks.

I will keep sharing such learning thread 🧵 for you 🙏💞🙏

Keep learning / keep sharing 🙏

@AdityaTodmal

Imagine for a moment the most obscurantist, jargon-filled, po-mo article the politically correct academy might produce. Pure SJW nonsense. Got it? Chances are you're imagining something like the infamous "Feminist Glaciology" article from a few years back.https://t.co/NRaWNREBvR pic.twitter.com/qtSFBYY80S

— Jeffrey Sachs (@JeffreyASachs) October 13, 2018

The article is, at heart, deeply weird, even essentialist. Here, for example, is the claim that proposing climate engineering is a "man" thing. Also a "man" thing: attempting to get distance from a topic, approaching it in a disinterested fashion.

Also a "man" thing—physical courage. (I guess, not quite: physical courage "co-constitutes" masculinist glaciology along with nationalism and colonialism.)

There's criticism of a New York Times article that talks about glaciology adventures, which makes a similar point.

At the heart of this chunk is the claim that glaciology excludes women because of a narrative of scientific objectivity and physical adventure. This is a strong claim! It's not enough to say, hey, sure, sounds good. Is it true?

I'll begin with the ancient history ... and it goes way back. Because modern humans - and before that, the ancestors of humans - almost certainly originated in Ethiopia. 🇪🇹 (sub-thread):

The famous \u201cLucy\u201d, an early ancestor of modern humans (Australopithecus) that lived 3.2 million years ago, and was discovered in 1974 in Ethiopia, displayed in the national museum in Addis Ababa \U0001f1ea\U0001f1f9 pic.twitter.com/N3oWqk1SW2

— Patrick Chovanec (@prchovanec) November 9, 2018

The first likely historical reference to Ethiopia is ancient Egyptian records of trade expeditions to the "Land of Punt" in search of gold, ebony, ivory, incense, and wild animals, starting in c 2500 BC 🇪🇹

Ethiopians themselves believe that the Queen of Sheba, who visited Israel's King Solomon in the Bible (c 950 BC), came from Ethiopia (not Yemen, as others believe). Here she is meeting Solomon in a stain-glassed window in Addis Ababa's Holy Trinity Church. 🇪🇹

References to the Queen of Sheba are everywhere in Ethiopia. The national airline's frequent flier miles are even called "ShebaMiles". 🇪🇹