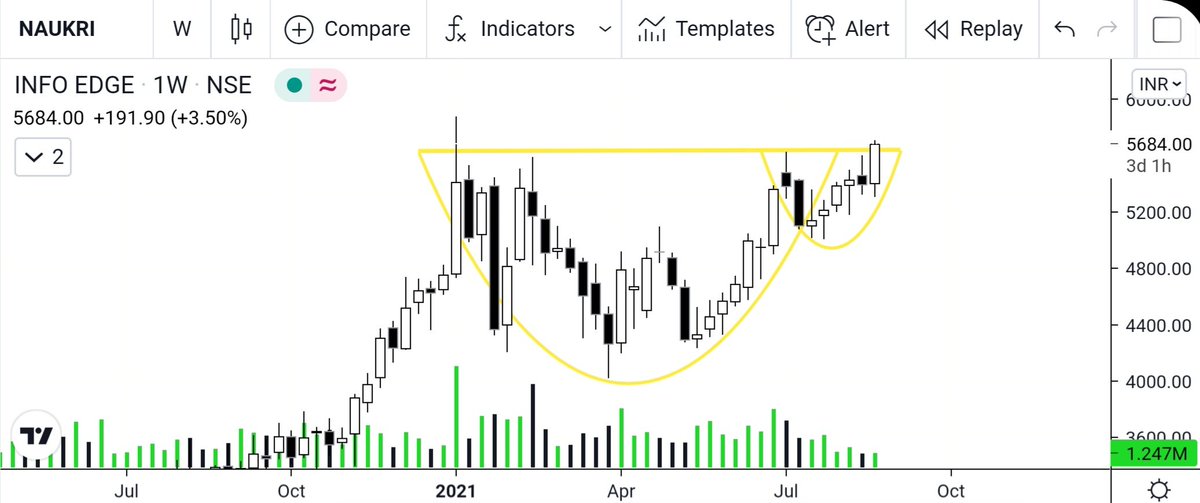

#NAUKRI-6610

What a classic price behaviour around Fibonacci extension.

And still continue. Near term base

case 6384.

#Probability

More from MaRkET WaVES (DINESH PATEL ) Stock Market FARMER

Probability towards 4.618% and beyond..

#Possibility

#LTI -4145

— MaRkET WaVES (DINESH PATEL ) Stock Market FARMER (@idineshptl) July 14, 2021

Near term base Case (4024)

Look for 4.618% and 6.857%

Long term perspective Fibonacci extension shown in chart. #Perspective pic.twitter.com/Pyl0aGYIuS

More from Naukri

#Naukri

— NISHSHKUMAR JAANI (@NishshkumarJaan) August 24, 2021

8 months of consolidation with 25% price range close abv 5500 will confirm breakout keep 10% SL from entry for 25% upmove#AhmedabadNest #investingstrategies #India pic.twitter.com/BYrZf4aTKX

Deepak Nitrite -

— The_Chartist \U0001f4c8 (@nison_steve) September 9, 2021

Doji Candles - Textbook - Indecision/Confusion amongst bulls and bears.

Practically - no bulls and bears - only smart money and retail investors

Few back to back doji - price being kept in a tight range to accumulate/distribute before an upcoming news pic.twitter.com/GckekXtgDu

Broken past the stiff resistance of 5640.

Sustenance above the same would bring in 5800 followed by 6000.

#StockMarket #StocksInFocus https://t.co/Pex4mVNKS5

#NAUKRI

— Gurleen (@GurleenKaur_19) August 18, 2021

Slow and gradual turn from down to sideways to up.

Might be offing for a breakout above 5640 towards 5800 followed by 6000. #StockMarket #StocksToWatch pic.twitter.com/3rAUGA7V99

6718.35📍

Three white soldiers with strong closing's one above the other.

The pattern target lies at 7200 levels.

#stockmarkets https://t.co/Pex4mVNKS5

#NAUKRI

— Gurleen (@GurleenKaur_19) August 18, 2021

Slow and gradual turn from down to sideways to up.

Might be offing for a breakout above 5640 towards 5800 followed by 6000. #StockMarket #StocksToWatch pic.twitter.com/3rAUGA7V99