#MNM (M&M) futures on short term charts

Bullish continuation patterns

@ChartingG we discussed Thar yesterday :-) https://t.co/qscPp1LtlZ

Excellent move in M&M #MNM CMP 954 in futures https://t.co/R1NtYj8C0Y

— DTBhat (@dtbhat) May 27, 2022

More from DTBhat

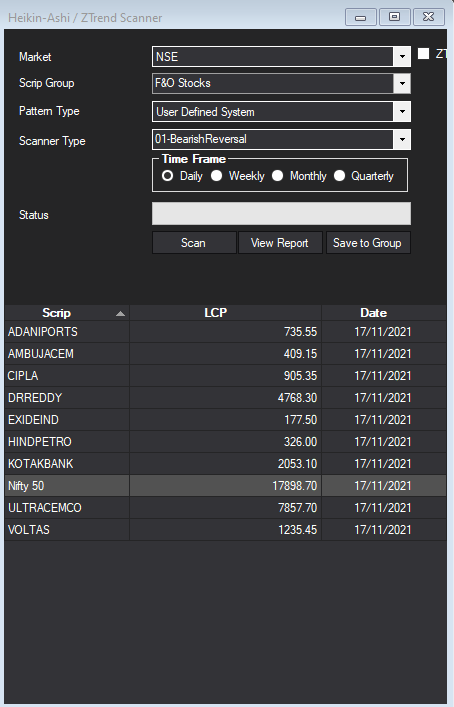

some recent highs taken out - watching for a close above 774

Also daily chart on 0.25% box size https://t.co/zjVX8UIXBq

#ICICIBANK chart is interesting.

— DTBhat (@dtbhat) July 10, 2022

On Renko charts - probable multi brick breakout on higher box size (3%) above 774 (on closing basis)

On P&F charts (3% boxsize) a probable triple top buy above 774

On shorter TF closing above 774 gives a close above 45 degree TL https://t.co/2xq4xumRgz pic.twitter.com/mULPwYdkv7

More from Mnm

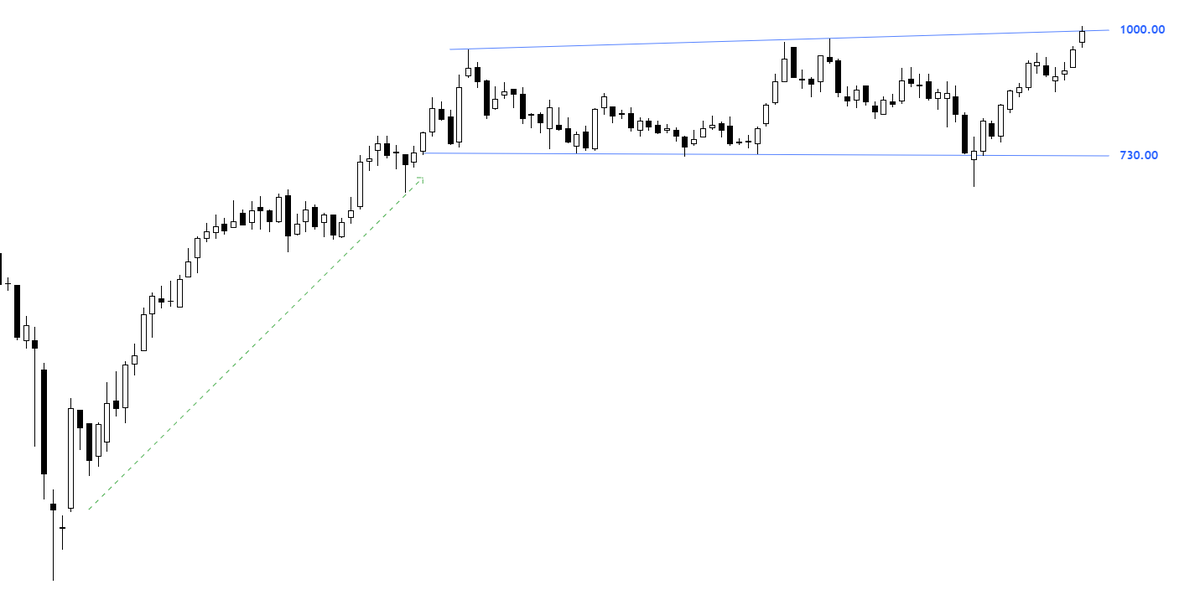

A bullish flag pattern right after the breakout. Although the broader rectangle target of 1190 is way more than this bullish flag target https://t.co/wdAzb7SS7L

Interesting chart of Mahindra & Mahindra consolidating in a rectangle pattern & the price not falling back to the lower support. pic.twitter.com/GJ7rCfkB9f

— The_Chartist \U0001f4c8 (@charts_zone) May 26, 2022

You May Also Like

These setups I found from the following 4 accounts:

1. @Pathik_Trader

2. @sourabhsiso19

3. @ITRADE191

4. @DillikiBiili

Share for the benefit of everyone.

Here are the setups from @Pathik_Trader Sir first.

1. Open Drive (Intraday Setup explained)

#OpenDrive#intradaySetup

— Pathik (@Pathik_Trader) April 16, 2019

Sharing one high probability trending setup for intraday.

Few conditions needs to be met

1. Opening should be above/below previous day high/low for buy/sell setup.

2. Open=low (for buy)

Open=high (for sell)

(1/n)

Bactesting results of Open Drive

Already explained strategy of #opendrive

— Pathik (@Pathik_Trader) May 27, 2020

Backtested results in 30 stocks and nifty, banknifty.

Success ratio : approx 40-45%

RR average 1:2

Entry as per strategy

Stoploss = Open level

Exit 3:15 PM Or SL

39 months 14 months -ve, 25 +ve

Yearly all 4 years +ve performance. pic.twitter.com/nGqhzMKGVy

2. Two Price Action setups to get good long side trade for intraday.

1. PDC Acts as Support

2. PDH Acts as

So today we will discuss two more price action setups to get good long side trade for intraday.

— Pathik (@Pathik_Trader) June 20, 2020

1. PDC Acts as Support

2. PDH Acts as Support

Example of PDC/PDH Setup given

#nifty

— Pathik (@Pathik_Trader) June 23, 2020

This is how it created long setup by taking support at PDC.

hopefully shared setup on last weekend helped. pic.twitter.com/2mduSUpMn5