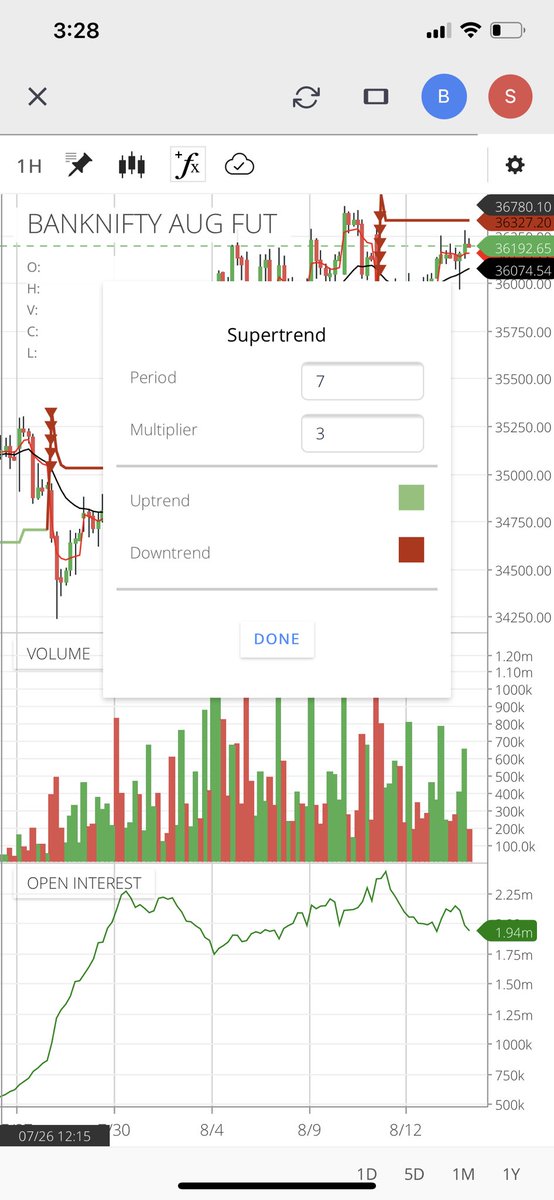

I will remember this upmove in bank nifty on 30th Nov ( Tuesday ) in my life.

@_GauravVashisth

@ITRADE191

More from Mitesh Patel

Once again a thread on breakout trades.

Future trading I am recommending to only those who have at least 25L capital to control risk management.

If less capital then do with cash or option writing.

Future trading I am recommending to only those who have at least 25L capital to control risk management.

If less capital then do with cash or option writing.

Boss is always Boss @Mitesh_Engr

— Aditya Todmal (@AdityaTodmal) July 31, 2021

Mitesh Sir's FUTURES BREAKOUT TRADES 101:

\u2022 How to pick stocks at right time?

\u2022 What to look for?

\u2022 Importance of BO post consolidation

\u2022 How to manage SL

\u2022 How to get huge profits

\u2022 Multiple Examples

In collaboration with @niki_poojary pic.twitter.com/7uXRgsLgtN

New follower can go through my old tweets through this link to learn about my trading style.

https://t.co/YqesIdZDQ2\u2026

— Naveen sharma (@learner_naveen) June 14, 2021

Here is the link to the book aka copiled tweets of @Mitesh_Engr sir @_GauravVashisth @ITRADE191 Sir

Anyone can download and use it for free.

You May Also Like

Speech Delay is most common in children nowadays

In ancient times, our grandparents used to follow typical natural way of caring the needs of a child. All they used were more of natural products than chemical based for the growth of child.

One of major step followed was to feed Gurbach Jadd/ Vasa Kommu/ Acorus Calamus for initiating good speech ability in a child. This stem was needed to babies on Tuesdays and Sundays in mother's milk.

Vasa is feed to baby after the 1st bath on 12th day in week. Weekly only thrice it is fed and named as :

Budhwar - Budhi Vasa

Mangalwar - Vaak Vasa

Ravi Vaar - Aayush Vasa

This stem is burnt and rubbed against the grinding stone in mother's milk or warm water to get a paste

The procedure to make it is in the link

https://t.co/uo4sGp7mUm

It should not be given daily to the child. Other main benefits are

1. It clears the phlegm in child's throat caused due to continuous milk intake. It clears the tracts and breathing is effortless.

2. Digestion

For children who haven't got their speech and is delayed than usual should feed this vasa on these days in week atleast for 6months. Don't get carried away with this dialogue

"Some gain speech little late"

In ancient times, our grandparents used to follow typical natural way of caring the needs of a child. All they used were more of natural products than chemical based for the growth of child.

One of major step followed was to feed Gurbach Jadd/ Vasa Kommu/ Acorus Calamus for initiating good speech ability in a child. This stem was needed to babies on Tuesdays and Sundays in mother's milk.

Vasa is feed to baby after the 1st bath on 12th day in week. Weekly only thrice it is fed and named as :

Budhwar - Budhi Vasa

Mangalwar - Vaak Vasa

Ravi Vaar - Aayush Vasa

This stem is burnt and rubbed against the grinding stone in mother's milk or warm water to get a paste

The procedure to make it is in the link

https://t.co/uo4sGp7mUm

It should not be given daily to the child. Other main benefits are

1. It clears the phlegm in child's throat caused due to continuous milk intake. It clears the tracts and breathing is effortless.

2. Digestion

For children who haven't got their speech and is delayed than usual should feed this vasa on these days in week atleast for 6months. Don't get carried away with this dialogue

"Some gain speech little late"