Narendradkd's Categories

Narendradkd's Authors

Latest Saves

But 98.8% forget 20% of what they read.

Here are 10 threads you must re-read:

Topic: Reversals in Option Selling via

Few weeks ago @Ronak_Unadkat Sir conducted an exclusive session for me & @adityatodmal to explain how he trades.

— Nikita Poojary (@niki_poojary) November 14, 2021

He was kind enough to share all his trade strategies and was patient enough to answer our doubts.

Thought of making a \U0001f9f5for the benefit of the larger audience here.

@niki_poojary Topic: 2 Setups for Trending Days & 2 Setups for Reversal

For intraday trader all v need is either TRENDING Day/Reversal Day 2 get a good move wid more conviction

— Pathik (@Pathik_Trader) May 16, 2019

So i shared 2 setups 2 identify Trending Day & Reversal Day on particular underlying

Make best use of these, practise 50 trades on both setup u ll not search 4 anything else

@niki_poojary @Pathik_Trader Topic: Mistakes not to be repeated by a Pro Option

10 mistakes in my 14 years of trading as an option seller \U0001f9f5

— Sarang Sood (@SarangSood) March 19, 2022

@niki_poojary @Pathik_Trader @SarangSood Topic: How Mitesh Sir does Positional Option

A Thread on the Boss himself @Mitesh_Engr

— Aditya Todmal (@AdityaTodmal) July 4, 2021

Mitesh Sir's Positional Option Selling 101:

\u2022 How to find direction

\u2022 Which options to sell

\u2022 How to deploy capital

\u2022 Exit criteria

\u2022 What ROI he targets weekly

\u2022 What % risk he takes

Done with the help of @niki_poojary pic.twitter.com/tcTKV02oO2

But 98.8% forget 20% of what they read.

Here are 10 threads you must re-read:

Topic: Mitesh Sir's Expiry Trading

Catch me if you can @Mitesh_Engr

— Nikita Poojary (@niki_poojary) July 17, 2021

Time for a\U0001f9f5

Mitesh Sir's EXPIRY Option Selling 101:

\u2022 What to look for?

\u2022 Strike Selection & Ratios

\u2022 SL mgmt

\u2022 Avoiding freezes

\u2022 Monthy Expiry

\u2022 Event days

\u2022 How he would have traded last expiry?

In collaboration with @AdityaTodmal pic.twitter.com/9uN2vQQ4hc

Topic: Where to start learning about

Thread for Novice traders.

— Pathik (@Pathik_Trader) September 26, 2020

Many people asks from where do i start learning about trading?

1. Start from learning candlestick pattern.

2. Learn theories behind how demand and supply works.

3. Learn how support and resistance works.

(1/n)

Topic: How to filter stocks for Intraday

How you can filter stocks for Intraday trades - \U0001f9f5

— Sheetal Rijhwani (@RijhwaniSheetal) August 15, 2021

As a kid, we would do homework before school the next day - you have to do homework here too. A specific sector performs on a particular day and studying things a day before will help you spot that particular sector. (1/11)

Topic: How to trade in rising

A THREAD

— Sarang Sood (@SarangSood) June 18, 2021

Topic: HOW TO TRADE IN RISING PREMIUMS SCENARIO

Option sellers specially Straddle sellers feel that rising premiums give them excellent opportunity to make easy money. So what they are seeing is the theta aspect of options & ignoring the delta/gamma/vega forces.

1/

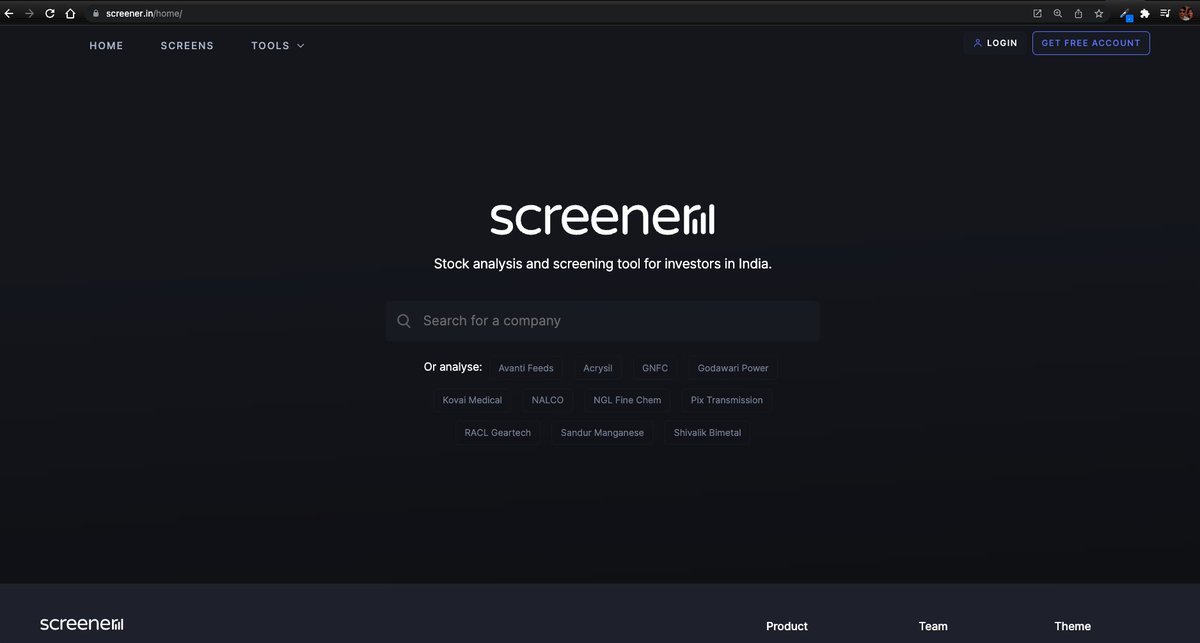

Step-by-step: how to use (the free) @screener_in to generate investment ideas.

Do retweet if you find it useful to benefit max investors. 🙏🙏

Ready or not, 🧵🧵⤵️

I will use the free screener version so that everyone can follow along.

Outline

1. Stepwise Guide

2. Practical Example: CoffeeCan Companies

3. Practical Example: Smallcap Consistent compounders

4. Practical Example: Smallcap turnaround

5. Key Takeaway

1. Stepwise Guide

Step1

Go to https://t.co/jtOL2Bpoys

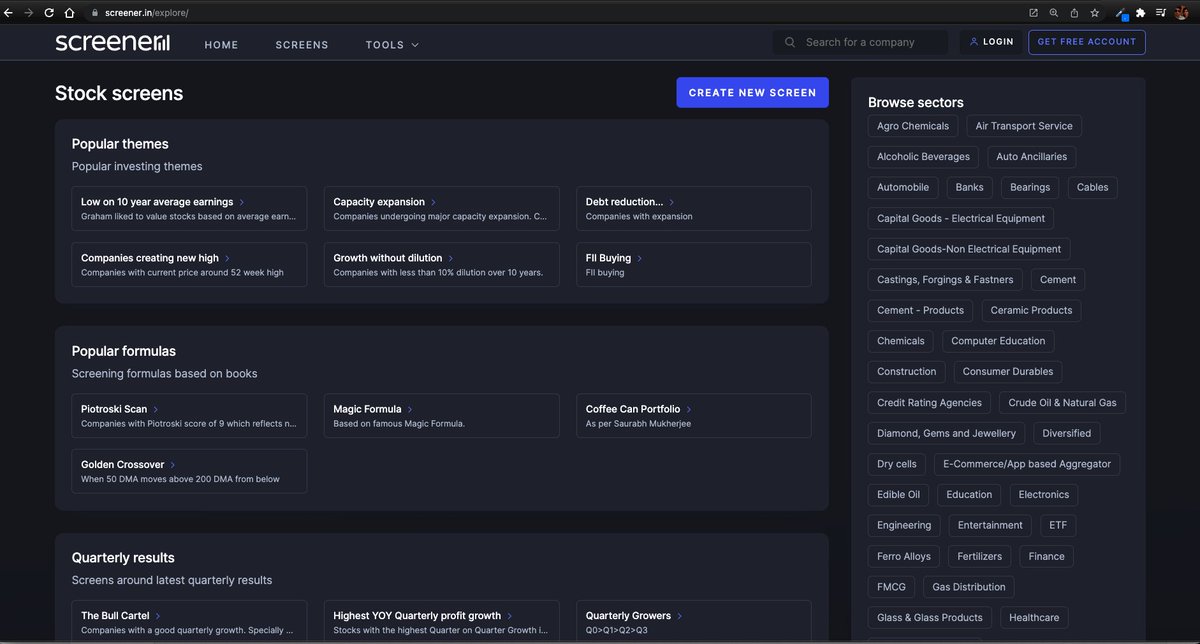

Step2

Go to "SCREENS" tab

Step3

Go to "CREATE NEW SCREEN"

At this point you need to register. No charges. I did that with my brother's email id. This is what you see after that.