#MASTEK is setting up for an up move.

🎯Setting up good near Line of Least Resistance.

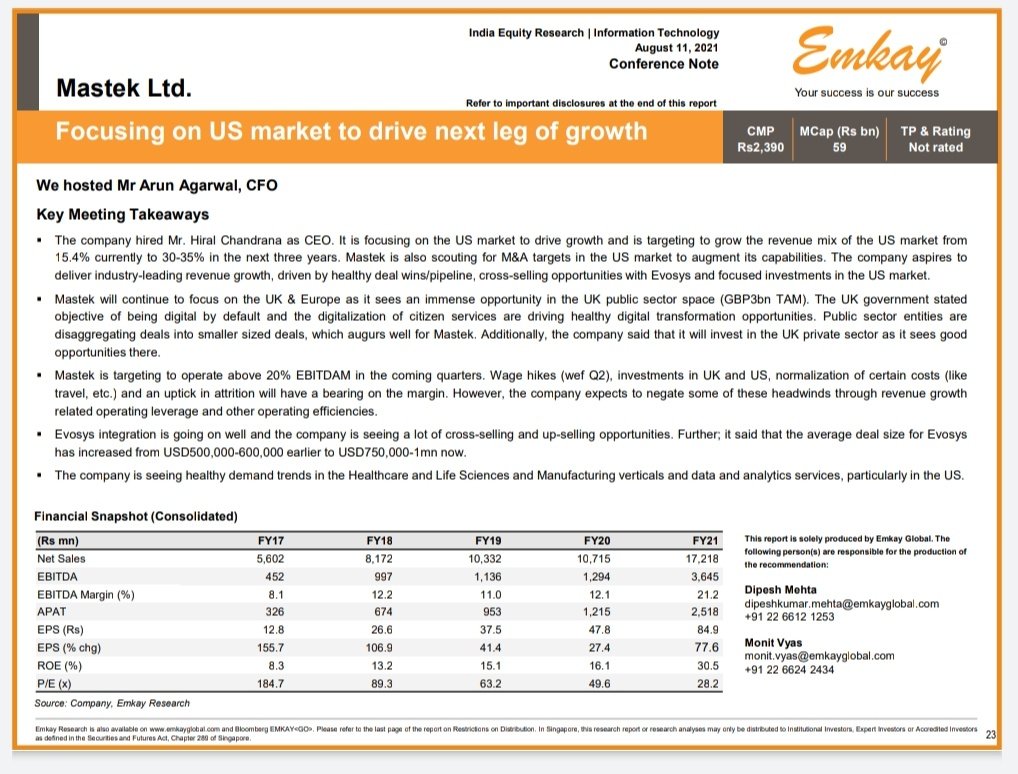

🎯Qty Earnings & Sales have been growing since last year.

🎯Healthy growth in annual EPS, Sales & Operating Profit.

🎯Low Debt to Equity.

🎯ROE: 24%

🎯Excellent CANLSIM ratings.

Tracking it!

More from Ravi Sharma

I have made some minor tweakings to this timing model since this tweet but it still will give you an idea and primer 👇

Trading 101 with SmallCap Index

— Ravi Sharma (@StocksNerd) August 20, 2019

1. Swing trades when bullish divergence in MACD-H forms

2. Breakout trades if Index closes above 22-Day high

3. Pullback/Pocket Pivot trades if Index consolidates constructively while13-EMA>22-EMA

4. Sell, go cash if Index breaches 10-Day low, NQA pic.twitter.com/u8VjXrU0Re

For my trading strategy, 13-day & 22-day EMAs are more suitable.

If SmallCap dips below these MAs & they get into the bearish sync, I get cautious & reduce my position size.

Sir as you follow the smallcap index,do you take full positions when it\u2019s trading below its key moving averages or wait for some confirmation? pic.twitter.com/ph6HTJ9rbD

— Dhanesh Gianani (@dhanesh500) November 30, 2021

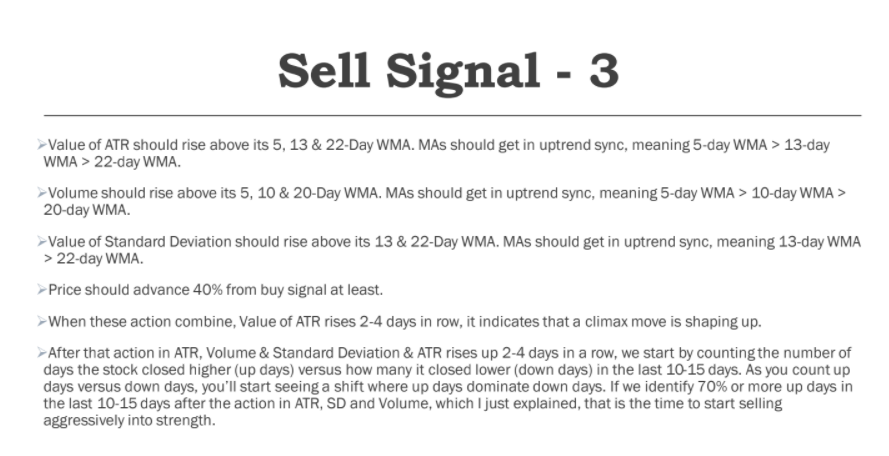

Since market cap of IRCTC is good, I reduced the move rule from 40% to 30% in this case. https://t.co/qzL5rgmtg8

Just a small doubt . I sold Yesterday thinking it was a climax 6% move . How did you decide to sell today ?

— Volatility and Volume Trader (@VolVolatTrader) September 7, 2021

Any rules where you sell positions . Just to learn

While buying breakouts, your odds will improve a lot when you prefer the following:

1. Strong Relative Strength.

2. Tight price range on low Volume and a pattern which is easy on eyes. https://t.co/CprKpAfgtj

#BAJAJFINSV

— Ravi Sharma (@StocksNerd) August 14, 2021

Setting up in a tight base. Volume has been drying up.

Waiting for the breakout. pic.twitter.com/KWoGZAwkLO

Signs are all over the place, you just needed to read them. https://t.co/17bwpa1psj

#TATAPOWER is consolidating nicely around 50 & 10-DMA.

— Ravi Sharma (@StocksNerd) April 1, 2022

3 Pocket Pivot days in the last couple of weeks are signaling the interest of buyers.

4 months long base.

Steady growth in Earnings & Sales in the last 3 quarters.

Relative Strength: 77

Group Rank: 22 pic.twitter.com/2WFeUGiV1z

More from Mastek

#MASTEK

Adding 40+ customers every quarter from an year

650+ active clients

Met 150+ customers/partners virtually in last 40days

Focus to accelerate US growth-have strategy in place

960cr cash on books

Looking for organic+inorganic growth

#CNBCTV18Exclusive | Catch @_anujsinghal, @_soniashenoy & @SurabhiUpadhyay in conversation with @HiralChandrana who was appointed as global CEO of #Mastek last month. He says that a big part of their strategy is to grow in the US. @Reematendulkar pic.twitter.com/nRnfGoGHTp

— CNBC-TV18 (@CNBCTV18News) August 18, 2021

TSL hit 📉

Though at CMP; Time to stack in 📈 for targets of 2620 followed by 2720.

#StockMarket https://t.co/IHHpv2bU2w

#MASTEK Update

— Gurleen (@GurleenKaur_19) July 23, 2021

2800 Hit; 70% Booked and rest Holding for a target of 2900.

#StockMarket #StockToWatch https://t.co/gQTyzf4IUS pic.twitter.com/fp9hrZyv7d