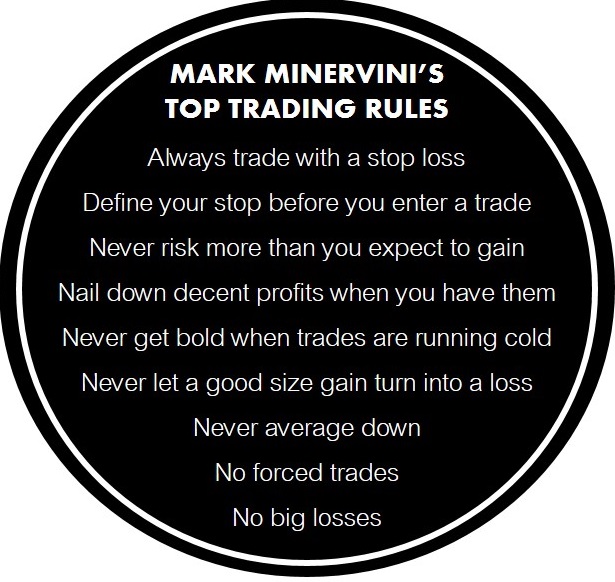

I make mistakes all the time. But what's important and key is I avoid the big mistakes. And when I'm wrong, I don't stay wrong for long. Flexibility or the willingness to admit you've made a mistake and correct it is how you stay in the game and succeed for as long as I have.

More from Mark Minervini

Stay in your own lane and perfect what you know. Realize that every strategy has strengths and weaknesses; there is no perfect strategy. But once you know all the pros and cons you can perfectly execute your strategy... and that's the goal.

I don't know shit about 99% of the stock trading strategies out there... but I know everything about my strategy. And that's all I need to know. I realized long ago, you can't be good at everything. I'm an expert because I chose to specialize. pic.twitter.com/uG7gWwhsjs

— Mark Minervini (@markminervini) March 28, 2021

More from Markminervinilearnings

The word is sacrifice. You are not going to be the best at day trading, swing, value and growth investing. It will be amazing if you can master just one. And you only need one. So pick one and sacrifice the rest! There is no other way unless you want to suck at a bunch of things.

What is the single unavoidable thing you must do to be the best or great at one thing? One word?

— Mark Minervini (@markminervini) April 14, 2021

You May Also Like

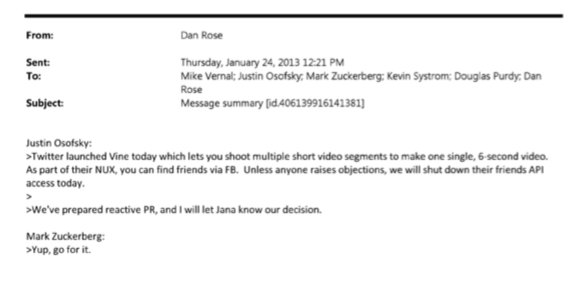

BREAKING: @CommonsCMS @DamianCollins just released previously sealed #Six4Three @Facebook documents:

Some random interesting tidbits:

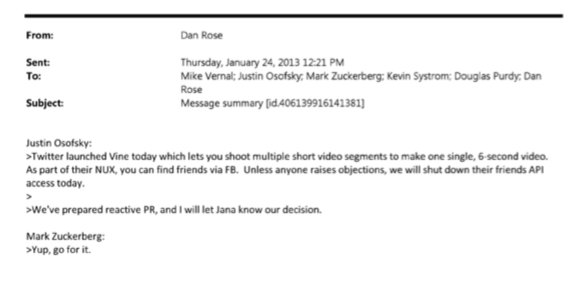

1) Zuck approves shutting down platform API access for Twitter's when Vine is released #competition

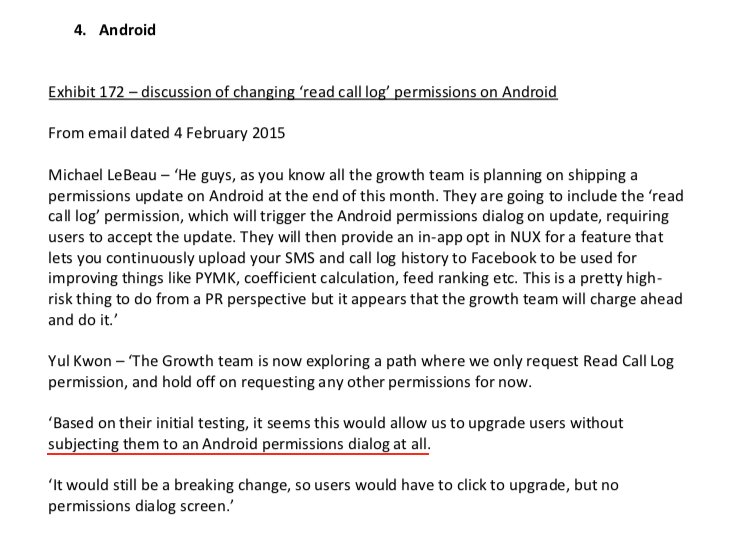

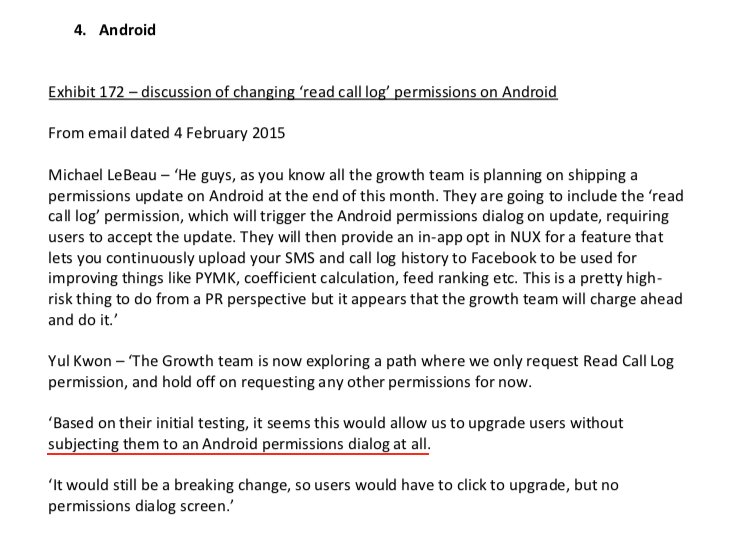

2) Facebook engineered ways to access user's call history w/o alerting users:

Team considered access to call history considered 'high PR risk' but 'growth team will charge ahead'. @Facebook created upgrade path to access data w/o subjecting users to Android permissions dialogue.

3) The above also confirms @kashhill and other's suspicion that call history was used to improve PYMK (People You May Know) suggestions and newsfeed rankings.

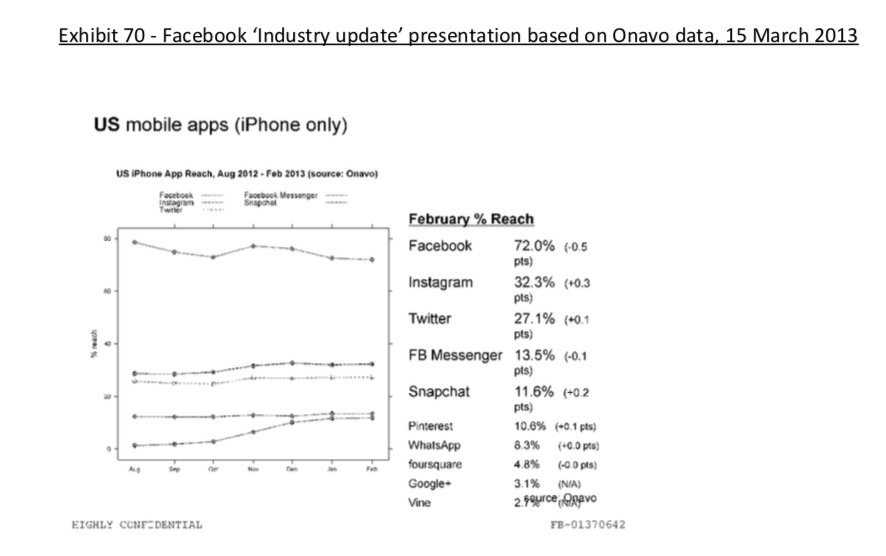

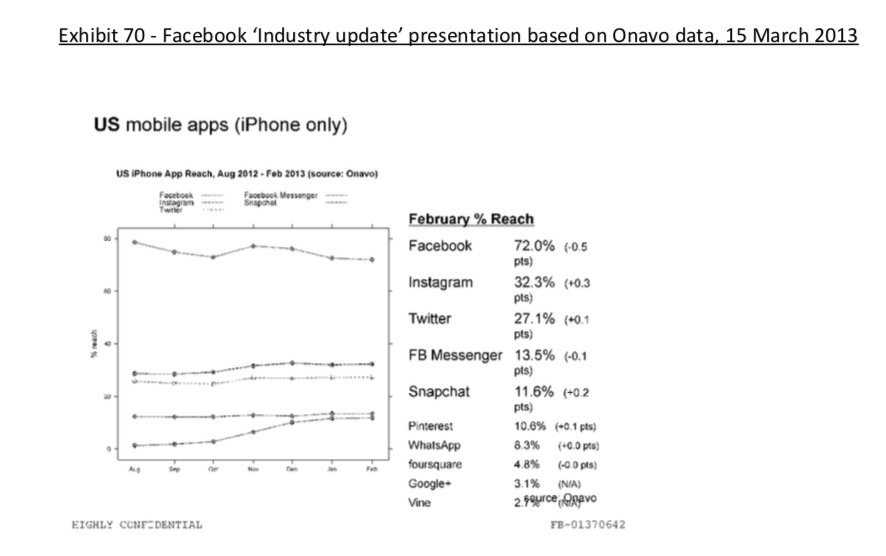

4) Docs also shed more light into @dseetharaman's story on @Facebook monitoring users' @Onavo VPN activity to determine what competitors to mimic or acquire in 2013.

https://t.co/PwiRIL3v9x

Some random interesting tidbits:

1) Zuck approves shutting down platform API access for Twitter's when Vine is released #competition

2) Facebook engineered ways to access user's call history w/o alerting users:

Team considered access to call history considered 'high PR risk' but 'growth team will charge ahead'. @Facebook created upgrade path to access data w/o subjecting users to Android permissions dialogue.

3) The above also confirms @kashhill and other's suspicion that call history was used to improve PYMK (People You May Know) suggestions and newsfeed rankings.

4) Docs also shed more light into @dseetharaman's story on @Facebook monitoring users' @Onavo VPN activity to determine what competitors to mimic or acquire in 2013.

https://t.co/PwiRIL3v9x

There are many strategies in market 📉and it's possible to get monthly 4% return consistently if you master 💪in one strategy .

One of those strategies which I like is Iron Fly✈️

Few important points on Iron fly stategy

This is fixed loss🔴 defined stategy ,so you are aware of your losses . You know your risk ⚠️and breakeven points to exit the positions.

Risk is defined , so at psychological🧠 level you are at peace🙋♀️

How to implement

1. Should be done on Tuesday or Wednesday for next week expiry after 1-2 pm

2. Take view of the market ,looking at daily chart

3. Then do weekly iron fly.

4. No need to hold this till expiry day .

5.Exit it one day before expiry or when you see more than 2% within the week.

5. High vix is preferred for iron fly

6. Can be executed with less capital of 3-5 lakhs .

https://t.co/MYDgWkjYo8 have R:2R so over all it should be good.

8. If you are able to get 6% return monthly ,it means close to 100% return on your capital per annum.

One of those strategies which I like is Iron Fly✈️

Few important points on Iron fly stategy

This is fixed loss🔴 defined stategy ,so you are aware of your losses . You know your risk ⚠️and breakeven points to exit the positions.

Risk is defined , so at psychological🧠 level you are at peace🙋♀️

How to implement

1. Should be done on Tuesday or Wednesday for next week expiry after 1-2 pm

2. Take view of the market ,looking at daily chart

3. Then do weekly iron fly.

4. No need to hold this till expiry day .

5.Exit it one day before expiry or when you see more than 2% within the week.

5. High vix is preferred for iron fly

6. Can be executed with less capital of 3-5 lakhs .

https://t.co/MYDgWkjYo8 have R:2R so over all it should be good.

8. If you are able to get 6% return monthly ,it means close to 100% return on your capital per annum.

✨📱 iOS 12.1 📱✨

🗓 Release date: October 30, 2018

📝 New Emojis: 158

https://t.co/bx8XjhiCiB

New in iOS 12.1: 🥰 Smiling Face With 3 Hearts https://t.co/6eajdvueip

New in iOS 12.1: 🥵 Hot Face https://t.co/jhTv1elltB

New in iOS 12.1: 🥶 Cold Face https://t.co/EIjyl6yZrF

New in iOS 12.1: 🥳 Partying Face https://t.co/p8FDNEQ3LJ

🗓 Release date: October 30, 2018

📝 New Emojis: 158

https://t.co/bx8XjhiCiB

New in iOS 12.1: 🥰 Smiling Face With 3 Hearts https://t.co/6eajdvueip

New in iOS 12.1: 🥵 Hot Face https://t.co/jhTv1elltB

New in iOS 12.1: 🥶 Cold Face https://t.co/EIjyl6yZrF

New in iOS 12.1: 🥳 Partying Face https://t.co/p8FDNEQ3LJ