Categories Market breadth

7 days

30 days

All time

Recent

Popular

🧵Market Breadth 101

It is a broad approach to overall market analysis that helps traders to realize the underlying strength or weakness associated with a market move

Thanks @PradeepBonde for the blogpost & @iManasArora for making breadth tool in context of Indian Market

(1/n)

(2/n)

Breadth will treat all stocks in an index equally. Stock with largest capitalization and the smallest are both equal in breadth analysis. It can be applied to any exchange or index of securities, any sector or industry group.

(3/n)

One may consider it "oscillating indicator", when reached a threshold level, either positive or negative, they tend to reverse or take a halt.

It is concerned with probability that market is approaching a major turning point, so it isn't helpful knowing everyday trends.

(4/n)

Breadth is based on the price of the variables, still it can offer leading indications based upon the identification and use of previous levels or thresholds that are consistent with similar market action.

(5/n)

Breadth directly indicates/represents the market, no matter what the indices are doing.

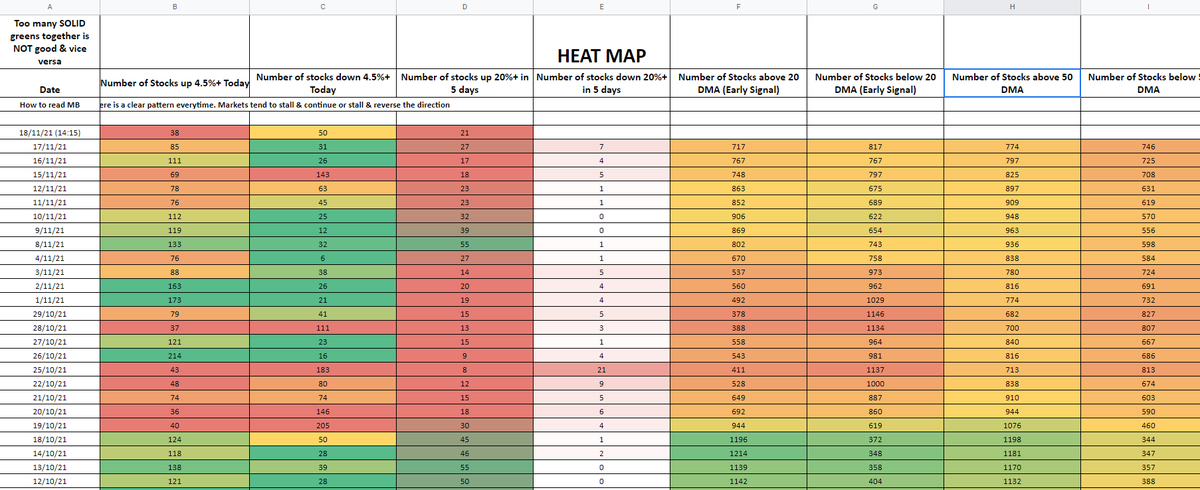

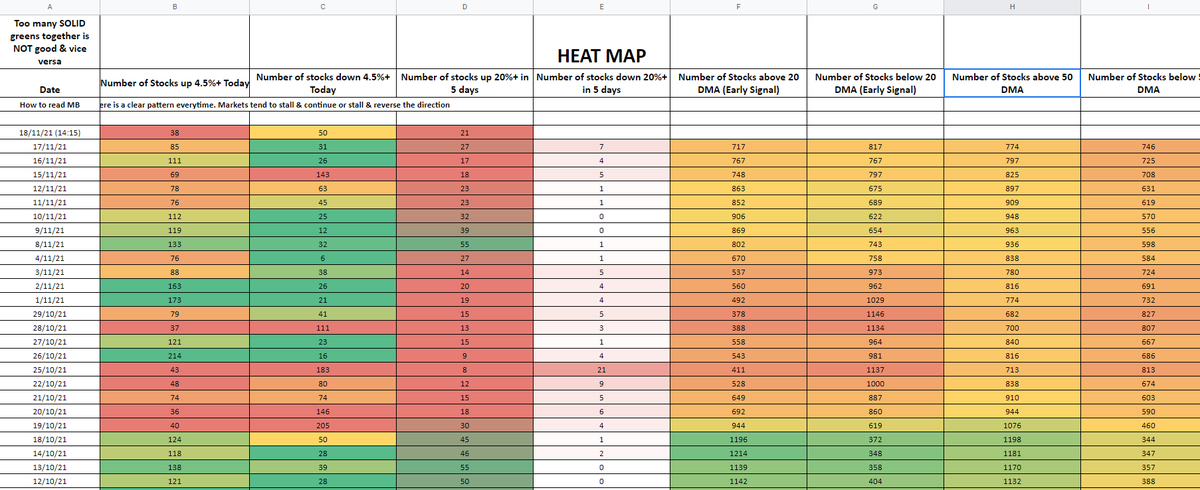

Might look complex to understand it at sight. Let's try to break it down.

Link: https://t.co/nvEuNXoiZ7

It is a broad approach to overall market analysis that helps traders to realize the underlying strength or weakness associated with a market move

Thanks @PradeepBonde for the blogpost & @iManasArora for making breadth tool in context of Indian Market

(1/n)

(2/n)

Breadth will treat all stocks in an index equally. Stock with largest capitalization and the smallest are both equal in breadth analysis. It can be applied to any exchange or index of securities, any sector or industry group.

(3/n)

One may consider it "oscillating indicator", when reached a threshold level, either positive or negative, they tend to reverse or take a halt.

It is concerned with probability that market is approaching a major turning point, so it isn't helpful knowing everyday trends.

(4/n)

Breadth is based on the price of the variables, still it can offer leading indications based upon the identification and use of previous levels or thresholds that are consistent with similar market action.

(5/n)

Breadth directly indicates/represents the market, no matter what the indices are doing.

Might look complex to understand it at sight. Let's try to break it down.

Link: https://t.co/nvEuNXoiZ7