It takes 5 justices to hear this case, rather than the usual 4.

I'm still seeing a lot of concern about the Texas Supreme Court filing, which is understandable. From a certain angle, it looks imposing.

So here, in sum, is why there's no need for alarm (thread):

It takes 5 justices to hear this case, rather than the usual 4.

The TX case is something else entirely and could have been heard in lower courts (many have rejected similar claims).

First, The Constitution specifically gives each state the right to run its elections as it sees fit. Done and done.

The Court won't countenance that.

More from Law

The 'Freeports' in at least 10 locations in Britain will evolve into Charter Cities with their own laws. They will NOT be legally bound to ANY of the trade agreements between the UK and EU or any other country. They will be used to bypass all International scrutiny

'Sovereign UK' makes deal with Charter city (physically but NOT legally part of the UK) which then trades to other countries OUTSIDE of the constraints of International laws

Thus bypassing all restrictions , tariff, tax, human rights, climate change legislation - everything

https://t.co/f35zFvkCHQ

The Michigan case in the US Supreme Court originally filed by Sidney Powell and Lin Wood was just distributed today for Conference on 02/19/2021!

— Truth (@1foreverseeking) February 4, 2021

Feb 03 2021 DISTRIBUTED for Conference of 2/19/2021. https://t.co/jZO624pf7j

Wisconsin

The Wisconsin case in the US Supreme Court is also

— Truth (@1foreverseeking) February 4, 2021

distributed for Conference on 02/19/2021!https://t.co/zkpTubcG1C

Georgia

This Georgia case, originally filed by Lin Wood, is alo distributed for conference on February 21, 2021!https://t.co/l7j43v5pfD

— Truth (@1foreverseeking) February 4, 2021

Arizona

This Arizona case is also distributed for conference on Febraury 21, 2021!https://t.co/56g1Fphg2l

— Truth (@1foreverseeking) February 4, 2021

Another Pennsylvania case. This is the most important one in my opinion. It shows the Republican Legislature broke the law when they created a mail-in ballot law in October, 2019, which they knew was against the state

Another Pennsylvania case distributed for conference February 21, 2021.

— Truth (@1foreverseeking) February 4, 2021

Filed by a Republican Congressman who lost his seat because PA Republican Legislature illegally created a mail in ballot law October, 2019, against the Constitution of PA.https://t.co/RYJE6ENZGk

You May Also Like

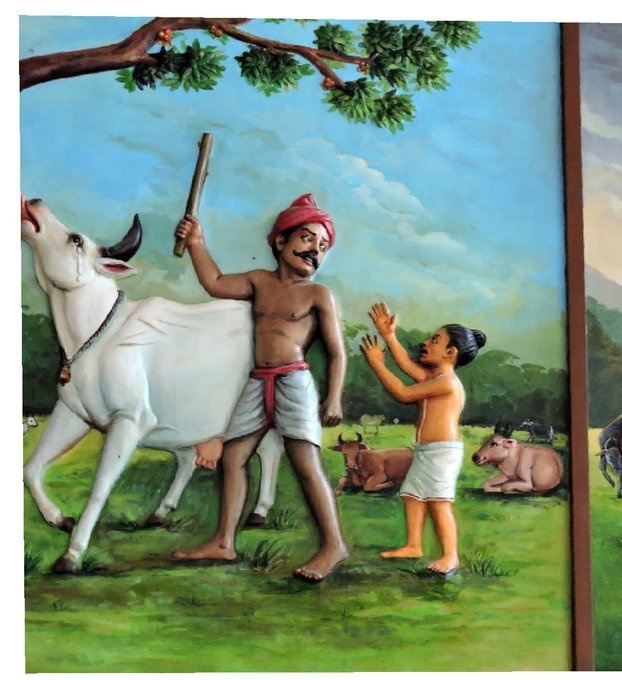

Chandesha-Anugraha Murti - One of the Sculpture in Brihadeshwara Temple at Gangaikonda Cholapuram - built by Raja Rajendra Chola I

This Sculpture depicts Bhagwan Shiva along with Devi Paravathi blessing Chandeshwara - one of the 63 Nayanmars.

#Thread

Chandeshwara/Chandikeshwara is regarded as custodian of Shiva Temple's wealth&most of Shiva temples in South India has separate sannathi for him.

His bhakti for Bhagwan Shiva elevated him as one of foremost among Nayanmars.

He gave importance to Shiva Pooja&protection of cows.

There are series of paintings, illustrating the #story of Chandikeshwar in the premises of

Sri Sathiyagireeswarar #Temple at Seinganur,near Kumbakonam,TN

Chandikeshwara's birth name

is Vichara sarman.He was born in the village of Senganur on the banks of River Manni.

His Parent names were Yajnathatan and Pavithrai.

Vichara Sarman was a gifted child and he learnt Vedas and Agamas at a very young age.

He was very devout and would always think about Bhagwan Shiva.

One day he saw a cowherd man brutally assaulting a cow,Vichara Sarman could not tolerate this. He spoke to cowherd: ‘Do you not know that the cow is worshipful & divine? All gods & Devas reside in https://t.co/ElLcI5ppsK it is our duty to protect cows &we should not to harm them.