1/ Basics about the IPO

Issue Dates: 4 - 6 August

Issue Size: ₹ 1,211 Crore (400crs Fresh Issue & 811crs OFS)

Mcap at the upper band: 2994crs

Price Band: ₹ 933 - 954

Retail Quota: 10%

Promoter stake to go from 32% to 27% post IPO.

2/ About the company.

Krsnaa Diagnostics provides technology-enabled services such as imaging (including radiology), pathology/clinical laboratory, and teleradiology

to public and private hospitals, medical colleges and community health centres across India.

3/ They focus on the public-private partnership (“PPP”) diagnostics segment and have the largest presence in the diagnostic PPP segment.

Contracts are typical of long-term in nature.

Won 77.6% of all tenders since inception & have thus deployed 1823 diagnostic centers.

4/ Operational performance indicators

5/ Strengths

- Cost Competitive: Radiology tests are priced 45%-60% below market rates & pathology tests are 40%-80% below

- Extensive footprint & Infra: Among the few cos. in India to have MRI machines ranging from 0.2-3 Tesla machines & multi-slice CT to 128 slice CT scanners

6/

- High revenue visibility (Non-Covid rev) due to 2-10 year long govt. PPP contracts

- Experienced promoters & management team supported by a strong employee base

7/ Services they offer & the distribution.

8/ Objective of the issue

Plans to use Rs 150 crore to set up 29 diagnostic centres across multiple states.

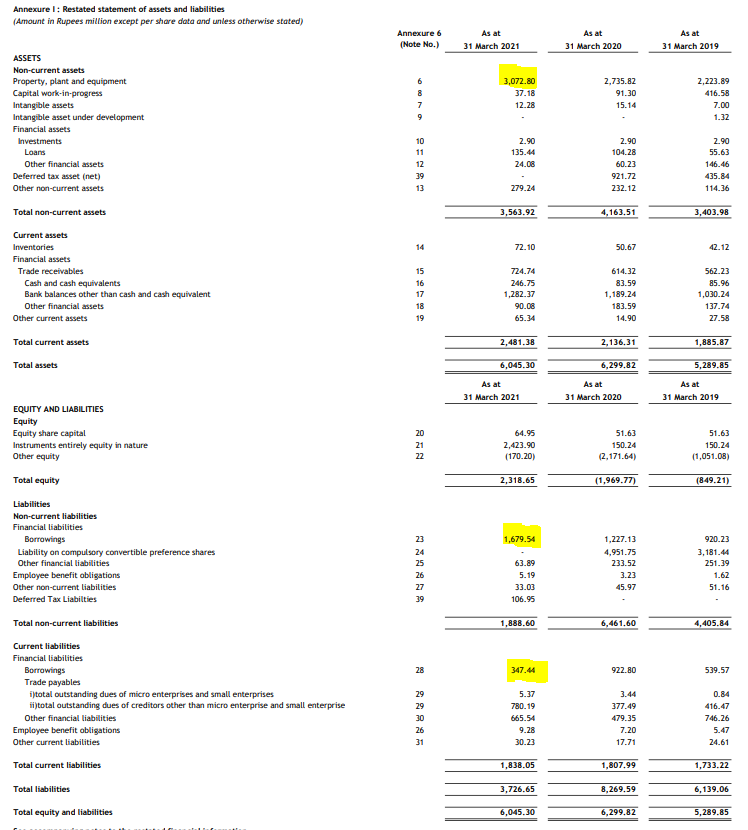

It also plans to repay/ pre-pay debt worth Rs 146 crore to the lenders in FY22. The company’s total borrowings stood at Rs 231.7 crore as of March 2021.

9/ Financials

- Good Cashflow conversion (80%+ EBITDA)

- Capex heavy business, Working Capital under control

- Strong Margins at 25-30% & gross margins of 80-85%

- COVID benefited the revenues in FY21, Non-COVID rev back to pre-COVID

10/ Risks

- 70% of rev from government agencies: Could lead to payment delays

- Competitive tender bidding process to get in: cost competitiveness could be challenged by some new entrant

- Contracts are based on fixed price arrangements: margins are not under their control.

11/

- 70% of rev from 3 states; Maharashtra, Rajasthan & Karnataka.

- Delays in the establishment of diagnostic centres could lead to termination of the agreements or cost overruns.

- Failure to establish and comply with appropriate quality standards could result in litigations.

12/

At 8x EV/Sales, 32x EV/ EBITDA & more than 90 times earnings, plus the commoditized nature of the industry due to high competition & also the boost in sales from COVID-19, we would rather wait & watch this company face an increasing RM cost scenario.