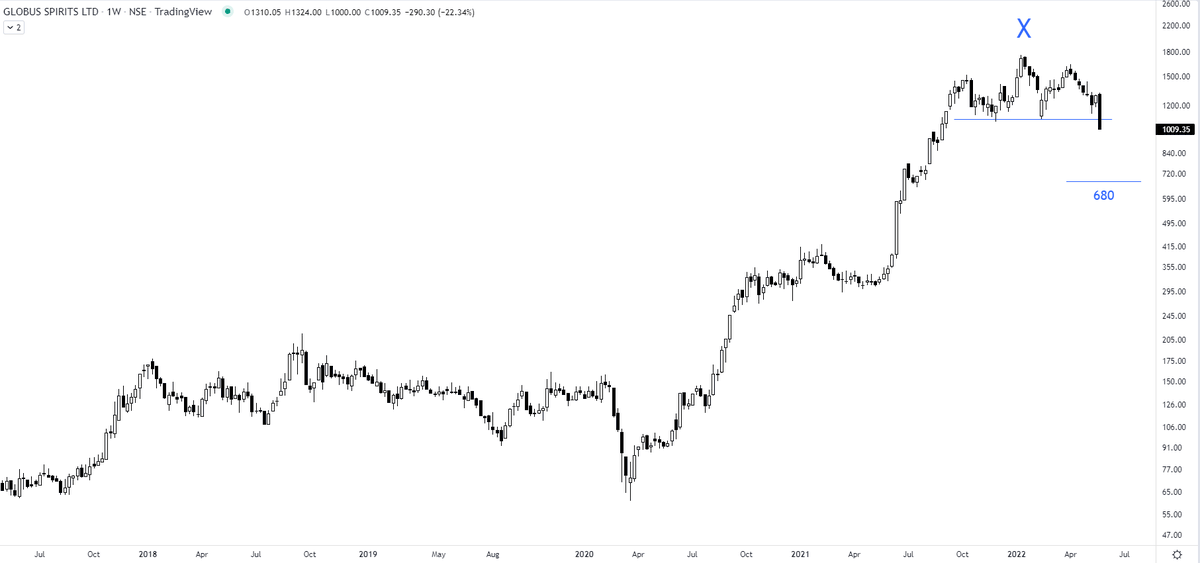

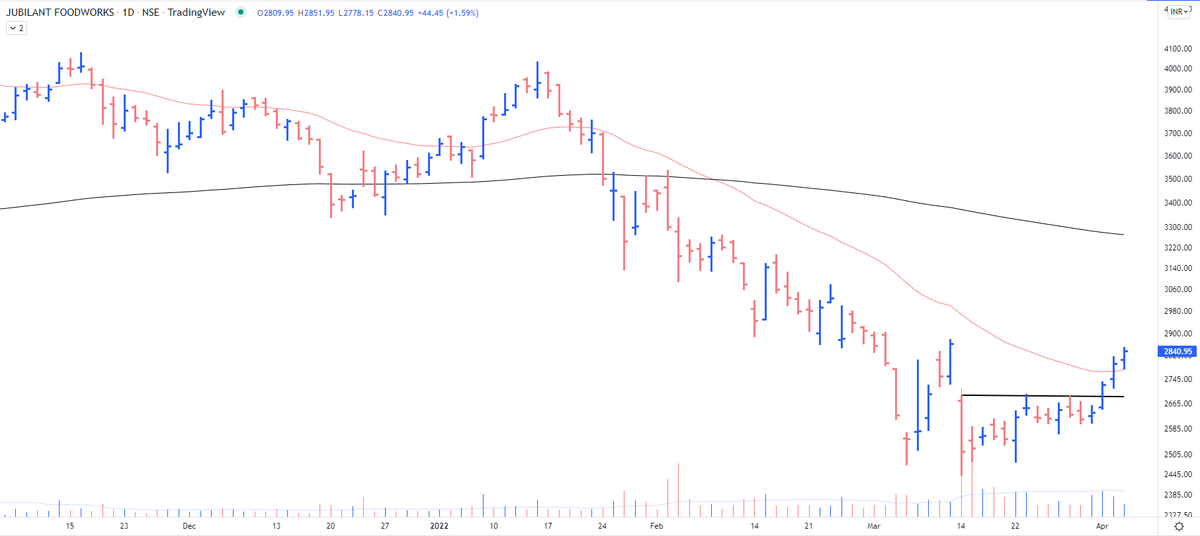

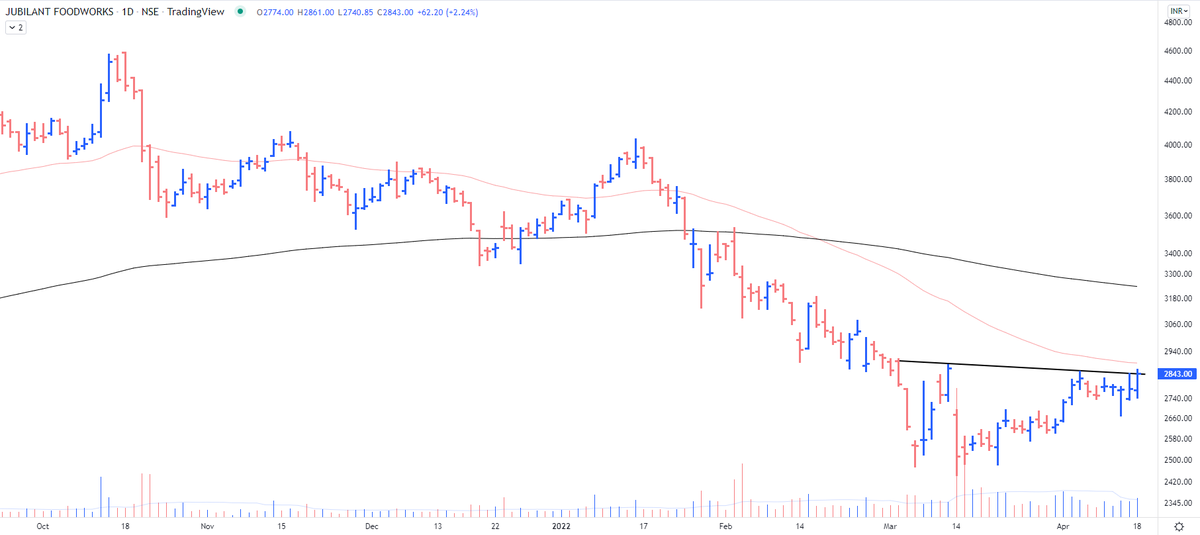

Reasons for taking this trade violating the stock price < 200MA were:

~ capitulation move

~ no further selling left

~ a major TL validated on a weekly scale

~ highest R:R ratio

With such capitulation & tight SL = capital put in was 30%

Risk = 50, Reward = 350

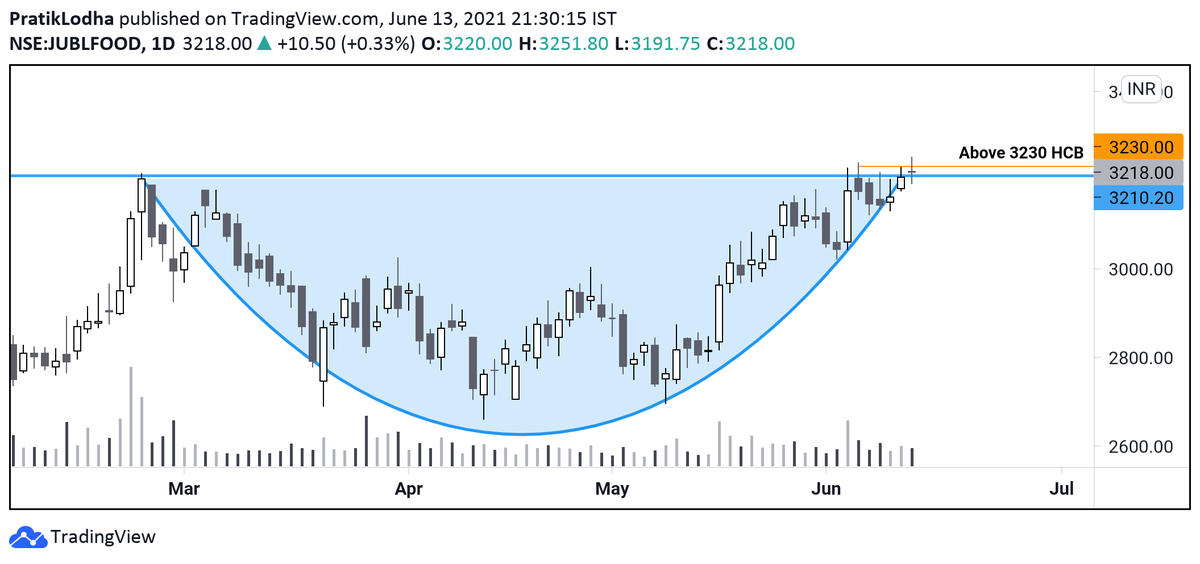

Jubilant Food https://t.co/M1vLYEsngf

The selling climax is accompanied by volume bars of such magnitude that I highlighted in the chart. In almost all cases, they signify that even the last bull has thrown in the towel & there is no further selling left. Will observe in this case.

— The_Chartist \U0001f4c8 (@charts_zone) March 15, 2022

Jubilant Food pic.twitter.com/j7bGSdhkRW

More from The_Chartist 📈

I believe 5-10 stocks are enough for a retail investor to achieve super performance. And with small capital, there is no point in buying 20/30 names which doesn't even get appropriate initial capital.

Stock: CDSL

— Steve Nison (@nison_steve) December 16, 2020

CMP - 516.95. Low risk setup. Weak below 500. Target open. Stock retesting the ascending triangle BO line. Kindly check please. @nishkumar1977 @Rishikesh_ADX @VijayThk @kuttrapali @Thekalal @PAVLeader pic.twitter.com/PlcpOMsdnz

More from Jublfood

Holding this from lower levels - the reason being capitulation.

Jubilant Foodworks https://t.co/M1vLYEbkef

The selling climax is accompanied by volume bars of such magnitude that I highlighted in the chart. In almost all cases, they signify that even the last bull has thrown in the towel & there is no further selling left. Will observe in this case.

— The_Chartist \U0001f4c8 (@charts_zone) March 15, 2022

Jubilant Food pic.twitter.com/j7bGSdhkRW

You May Also Like

==========================

Module 1

Python makes it very easy to analyze and visualize time series data when you’re a beginner. It's easier when you don't have to install python on your PC (that's why it's a nano course, you'll learn python...

... on the go). You will not be required to install python in your PC but you will be using an amazing python editor, Google Colab Visit https://t.co/EZt0agsdlV

This course is for anyone out there who is confused, frustrated, and just wants this python/finance thing to work!

In Module 1 of this Nano course, we will learn about :

# Using Google Colab

# Importing libraries

# Making a Random Time Series of Black Field Research Stock (fictional)

# Using Google Colab

Intro link is here on YT: https://t.co/MqMSDBaQri

Create a new Notebook at https://t.co/EZt0agsdlV and name it AnythingOfYourChoice.ipynb

You got your notebook ready and now the game is on!

You can add code in these cells and add as many cells as you want

# Importing Libraries

Imports are pretty standard, with a few exceptions.

For the most part, you can import your libraries by running the import.

Type this in the first cell you see. You need not worry about what each of these does, we will understand it later.