Corrected my mistake today, bought #Mastek

First identified it at 1100, by the time I finished researching it went to 1800 Thought will wait and invest at pull back. Soon it was at 2800+

Bought today at 2375

15% of PF

More from Tar ⚡

Market is short sighted and loves to buy high and sell low

Sequent is a long gestation stock, it won't deliver it's real earnings until FY23-25

Not suitable investment for those who want 100% return/yr

@itsTarH hey Tariq, any idea why is Sequent falling?

— Vivek (@pa_stock) September 27, 2021

https://t.co/7ytUeSd7gg

Don't expect the earnings to go anywhere till FY23.

— Tar \u26a1 (@itsTarH) August 10, 2021

Real growth will only come post FY24.

I expect the stock to either correct or stay muted till then. https://t.co/lUQfzxojTO

More from Itsthlearnings

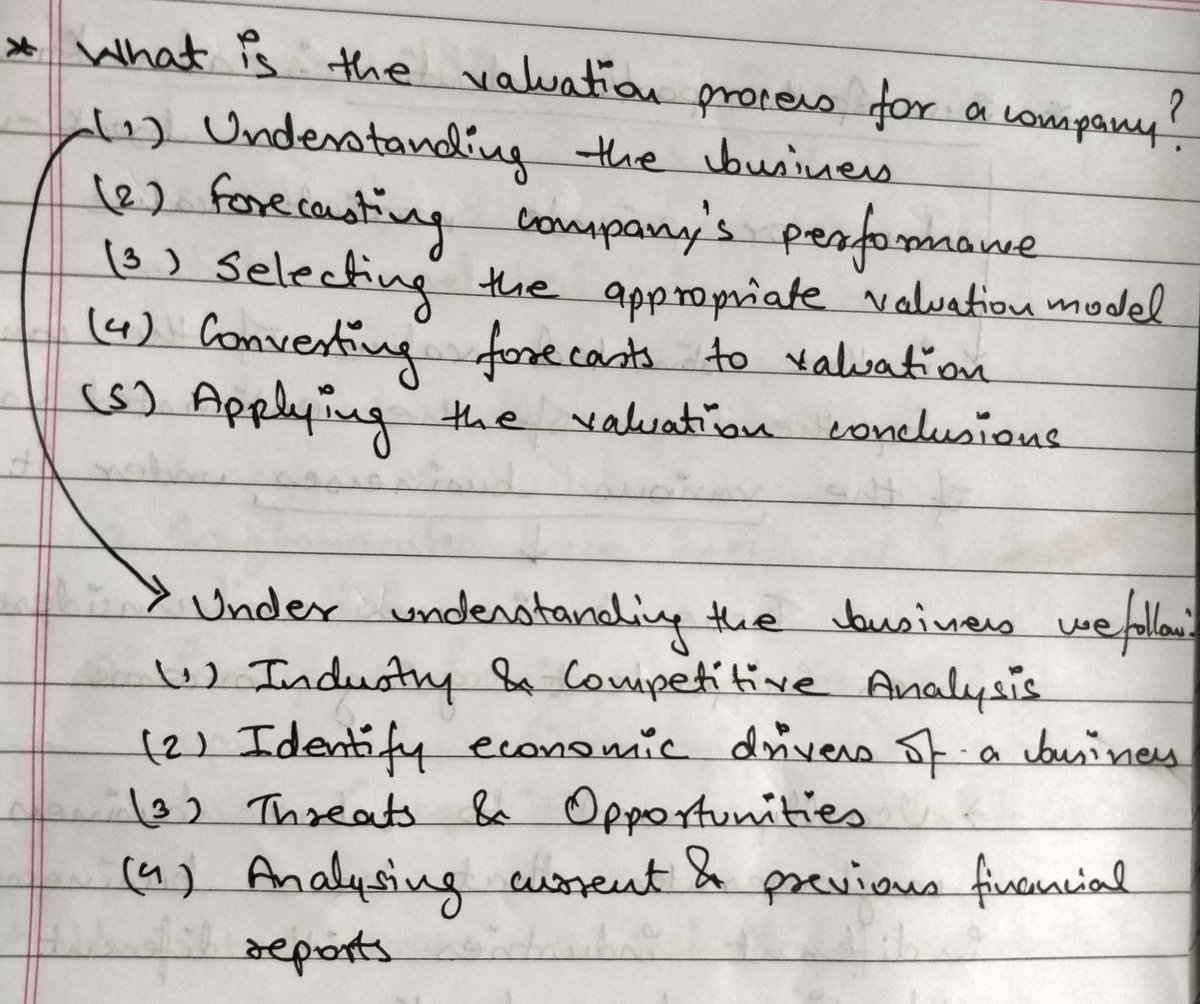

The One with the Cash Flow Explained

It's the weekend!

— Tar \u26a1 (@itsTarH) May 15, 2021

Grab a cup of coffee, in this thread I will explain

1. What a cash flow statement is?

2. What does it tell you about a business?

3. How to analyze one?

Examples included various Indian companies.

Let's dive right in. pic.twitter.com/c8tNP26Z8K

The One with Free Cash Flow Explained

Its the weekend!

— Tar \u26a1 (@itsTarH) May 22, 2021

Grab a cup of coffee, in this thread I will explain

1. What is Capex?\U0001f4b0

2. What is Free Cash Flow? \U0001f4b8

3. What does Cash Flow from Investing and Cash Flow from Financing tells us? \U0001f4a1

Examples includes some famous companies.

Lets dive right in. pic.twitter.com/HDJgUvE8f8

The One with Mutual Funds

Its the weekend!

— Tar \u26a1 (@itsTarH) May 29, 2021

Grab a cup of coffee, in this thread I will explain

1. How to select a Mutual Fund?

2. Common and costly mistakes people make while choosing a Mutual Fund

3. Some tools and tips to help you while selecting a fund

Lets dive right in. pic.twitter.com/teelsojtn9

The One on Laurus Labs

Laurus Labs : A Visual Story

— Tar \u26a1 (@itsTarH) May 30, 2021

I am a Data Science / Machine Learning developer by profession and data along with finance are my two areas of competence.

I realize how powerful combining both of them can be, so here is a visual analysis for Laurus Labs.

You May Also Like

RT-PCR corona (test) scam

Symptomatic people are tested for one and only one respiratory virus. This means that other acute respiratory infections are reclassified as

4/10

— Dr. Thomas Binder, MD (@Thomas_Binder) October 22, 2020

...indication, first of all that testing for a (single) respiratory virus is done outside of surveillance systems or need for specific therapy, but even so the lack of consideration of Ct, symptoms and clinical findings when interpreting its result. https://t.co/gHH6kwRdZG

2/12

It is tested exquisitely with a hypersensitive non-specific RT-PCR test / Ct >35 (>30 is nonsense, >35 is madness), without considering Ct and clinical context. This means that more acute respiratory infections are reclassified as

6/10

— Dr. Thomas Binder, MD (@Thomas_Binder) October 22, 2020

The neither validated nor standardised hypersensitive RT-PCR test / Ct 35-45 for SARS-CoV-2 is abused to mislabel (also) other diseases, especially influenza, as COVID-19.https://t.co/AkFIfTCTkS

3/12

The Drosten RT-PCR test is fabricated in a way that each country and laboratory perform it differently at too high Ct and that the high rate of false positives increases massively due to cross-reaction with other (corona) viruses in the "flu

External peer review of the RTPCR test to detect SARS-CoV-2 reveals 10 major scientific flaws at the molecular and methodological level: consequences for false positive results.https://t.co/mbNY8bdw1p pic.twitter.com/OQBD4grMth

— Dr. Thomas Binder, MD (@Thomas_Binder) November 29, 2020

4/12

Even asymptomatic, previously called healthy, people are tested (en masse) in this way, although there is no epidemiologically relevant asymptomatic transmission. This means that even healthy people are declared as COVID

Thread web\u2b06\ufe0f\u2b07\ufe0f

— Dr. Thomas Binder, MD (@Thomas_Binder) December 16, 2020

The fabrication of the "asymptomatic (super) spreader" is the coronation of the total nons(ci)ense in the belief system of #CoronasWitnesses.

Asymptomatic transmission 0.7%; 95% CI 0%-4.9% - could well be 0%!https://t.co/VeZTzxXfvT

5/12

Deaths within 28 days after a positive RT-PCR test from whatever cause are designated as deaths WITH COVID. This means that other causes of death are reclassified as

8/8

— Dr. Thomas Binder, MD (@Thomas_Binder) March 24, 2020

By the way, who the f*** created this obviously (almost) worldwide definition of #CoronaDeath?

This is not only medical malpractice, this is utterly insane!https://t.co/FFsTx4L2mw

1. LWJ’s sword Bichen ‘is likely an abbreviation for the term 躲避红尘 (duǒ bì hóng chén), which can be translated as such: 躲避: shunning or hiding away from 红尘 (worldly affairs; which is a buddhist teaching.) (https://t.co/zF65W3roJe) (abbrev. TWX)

2. Sandu (三 毒), Jiang Cheng’s sword, refers to the three poisons (triviṣa) in Buddhism; desire (kāma-taṇhā), delusion (bhava-taṇhā) and hatred (vibhava-taṇhā).

These 3 poisons represent the roots of craving (tanha) and are the cause of Dukkha (suffering, pain) and thus result in rebirth.

Interesting that MXTX used this name for one of the characters who suffers, arguably, the worst of these three emotions.

3. The Qian kun purse “乾坤袋 (qián kūn dài) – can be called “Heaven and Earth” Pouch. In Buddhism, Maitreya (मैत्रेय) owns this to store items. It was believed that there was a mythical space inside the bag that could absorb the world.” (TWX)