The regular purchases occur regardless of price, volatility, or economic conditions.

Dollar Cost Averaging 101

Many of the brightest minds in the investing world share one common trait: they recommend dollar cost averaging as an investment strategy.

But what is dollar cost averaging and how does it work?

Here's Dollar Cost Averaging 101!

👇👇👇

The regular purchases occur regardless of price, volatility, or economic conditions.

Its simplicity removes behavioral and psychological biases from the equation.

Let's look at an example.

You aren't sure if it will go up or down in the near-term, so you decide to dollar-cost average.

Great decision! How will you do it?

You decide on a weekly DCA, so every Monday, you buy $500 of $BTC, regardless of price. After 20 weeks, you have built your desired $10,000 cost basis position.

You know you believe in the long-term story for $BTC, but you aren't sure about near-term movements.

You are confident it's going (much) higher eventually, but with likely volatile swings between now and then.

This is an excellent approach for high-conviction, long-term investments.

(Note: Perpetual DCA is the backbone of my personal strategy.)

DCA + Compounding = All You Need

The best part? It's easy. Anyone can do it. https://t.co/CxhVg0WxsO

Compounding 101

— Sahil Bloom (@SahilBloom) September 17, 2020

Albert Einstein famously said, "Compound interest is the eighth wonder of the world. He who understands it, earns it; he who doesn't, pays it."

But what is this great wonder and how does it work?

Here's Compounding 101!

\U0001f447\U0001f447\U0001f447 pic.twitter.com/gYdCWOeNuy

For equities, robo-advisors such as @wealthfront and @betterment offer automated DCA plans. @M1_finance allows for a more user-controlled strategy and experience.

@RoundlyX allows you to invest your spare change in bitcoin. A neat, seamless way to DCA. It is the @acorns of cryptocurrencies.

In investing, as in life, keep it simple!

Dollar-cost averaging + compounding = all you need.

So that was Dollar-Cost Averaging 101! I hope you found it useful.

And for more educational threads on money, finance, and economics, check out my meta-thread below. https://t.co/Jyqunbg8uM

1/ An Allegory of Finance

— Sahil Bloom (@SahilBloom) July 18, 2020

I have been posting a lot of educational (and humorous!) threads on finance, money, and economics.

My mission is simple: to demystify these concepts and make them accessible to everyone.

All of the threads can be found below. Enjoy and please share!

More from Sahil Bloom

How to Win (without talent or luck)

20+ principles compiled from the most impressive leaders and thinkers in the world.

How to Win (without talent or luck):

— Sahil Bloom (@SahilBloom) October 16, 2021

20 Ways to Stand Out in a Hiring Process (that don’t involve your resume)

You can stand out without fancy degrees or credentials—learn how.

The hiring process is ultra-competitive.

— Sahil Bloom (@SahilBloom) May 31, 2021

But you\u2019ve incorrectly been told that the only way to stand out is by having fancy degrees and credentials.

THREAD: 20 ways to stand out in a hiring process (that don\u2019t involve your resume):

Common Interview Questions (& how to nail them)

Interviews suck—proper preparation makes them suck slightly less.

The interview process is ultra-competitive.

— Sahil Bloom (@SahilBloom) August 7, 2021

But with proper preparation, it is possible to stand out.

THREAD: 20 common interview questions, what they really mean, and how to nail them:

How to Write Cold Emails (or DMs)

Because one lucky break can make all the difference…

One cold email can change your life.

— Sahil Bloom (@SahilBloom) October 24, 2021

Here's how to write a great one:

More from Investing

- Everything you need to know

- One-stop-shop for all things smart/connected home

- Higher growth & revenue than closest public competitor $LMND/@Lemonade_Inc

Time for a thread 🧵⬇️

Hippo was founded in 2015 by Assaf Wand, an ex-McKinsey consultant and Eyal Navon, serial entreprenuer and software engineer.

Wand's interest in insurance was inspired by his father's lengthy career in the "antiquated" insurance industry. $RTP

After two years of R&D, fundraising, and product development, Hippo launched in April 2017 in California.

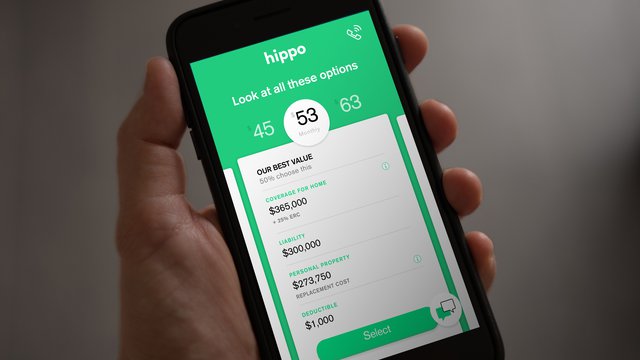

The company's marketing was centered on the delivery of a 60-sec quote for insurance policies, transparent process, and smart home integration.

https://t.co/msy9u2ZpST $RTP

By March 2019, with Hippo insurance available to more than 50% of the homeowners in the US, the company reported a 25% month-over-month sales growth and total insured property value of more than $50 billion, with a 93% customer retention rate.

https://t.co/D5AyWgonVp $RTP

Hippo is going after a slightly different market. Most of the new insurance companies have pitched services to renters and city dwellers made up of the mostly millennial demographic, while Hippo is aiming its services squarely at homeowners. $RTP

https://t.co/MYo9HWDmdV

Rather, I learned 10x more about investing from Twitter University.

🧵 Here are 5 threads from world-class Fintwitters.

What you learn: Build an investing checklist.

From: @BrianFeroldi, writer at Motley

1/ How to create an investment checklist (thread)

— Brian Feroldi (@BrianFeroldi) December 8, 2020

Checklists are an amazing, FREE, underutilized investing tool

Here's the step-by-step process for how to create your own

\u2b07\ufe0f\u2b07\ufe0f\u2b07\ufe0f\u2b07\ufe0f\u2b07\ufe0f\u2b07\ufe0f\u2b07\ufe0f\u2b07\ufe0f\u2b07\ufe0f

What you learn: Read 10Ks like a Hedge Fund

From: @FabiusMercurius

\U0001f9d0How to Read 10Ks Like a Hedge Fund\U0001f9d0

— Ming Zhao (@FabiusMercurius) May 7, 2021

\u201cFundamentals don\u2019t matter anymore!\u201d I\u2019ve heard this a lot lately on Fintwit.\U0001f644

But, for those who\u2019ve diversify beyond $GME and $DOGE, here\u2019s a primer on what metrics fundamental buy-side PMs look at and why:

(real examples outlined)

\U0001f447 pic.twitter.com/tLlNRvpnDK

What you learn: Perform a DCF analysis.

From: @10kdiver

1/

— 10-K Diver (@10kdiver) August 8, 2020

Get a cup of coffee.

In this thread, I'll show you how to do a DCF analysis.

For those unfamiliar, DCF = Discounted Cash Flow.

What you learn: When to sell your stocks

From: @borrowed_ideas, founder at

You May Also Like

(I am forced to do this due to continuous hounding of Sikh Extremists since yesterday)

Rani Jindan Kaur, wife of Maharaja Ranjit Singh had illegitimate relations with Lal Singh (PM of Ranjit Singh). Along with Lal Singh, she attacked Jammu, burnt - https://t.co/EfjAq59AyI

Tomorrow again same thing happens bcoz fudus like you are creating a narrative oh Khalistan. when farmers are asking MSP. (RSS ki tatti khane wale Kerni sena ke kutte).

— Ancient Economist (@_stock_tips) December 5, 2020

U kill sikhs in 1984 just politics. To BC low IQ fudu Saale entire history was politics.

Hindu villages of Jasrota, caused rebellion in Jammu, attacked Kishtwar.

Ancestors of Raja Ranjit Singh, The Sansi Tribe used to give daughters as concubines to Jahangir.

The Ludhiana Political Agency (Later NW Fronties Prov) was formed by less than 4000 British soldiers who advanced from Delhi and reached Ludhiana, receiving submissions of all sikh chiefs along the way. The submission of the troops of Raja of Lahore (Ranjit Singh) at Ambala.

Dabistan a contemporary book on Sikh History tells us that Guru Hargobind broke Naina devi Idol Same source describes Guru Hargobind serving a eunuch

YarKhan. (ref was proudly shared by a sikh on twitter)

Gobind Singh followed Bahadur Shah to Deccan to fight for him.

In Zafarnama, Guru Gobind Singh states that the reason he was in conflict with the Hill Rajas was that while they were worshiping idols, while he was an idol-breaker.

And idiot Hindus place him along Maharana, Prithviraj and Shivaji as saviours of Dharma.

Here I will share what I believe are essentials for anybody who is interested in stock markets and the resources to learn them, its from my experience and by no means exhaustive..

First the very basic : The Dow theory, Everybody must have basic understanding of it and must learn to observe High Highs, Higher Lows, Lower Highs and Lowers lows on charts and their

Even those who are more inclined towards fundamental side can also benefit from Dow theory, as it can hint start & end of Bull/Bear runs thereby indication entry and exits.

Next basic is Wyckoff's Theory. It tells how accumulation and distribution happens with regularity and how the market actually

Dow theory is old but

Old is Gold....

— Professor (@DillikiBiili) January 23, 2020

this Bharti Airtel chart is a true copy of the Wyckoff Pattern propounded in 1931....... pic.twitter.com/tQ1PNebq7d