#INFY Daily

Connecting a series of LH's & a horizontal trend line along the series of lows.

The breakout needs a little more push on the volume front.

In Weekly; Price range buildup signaling that an extended upside is likely.

More from Gurleen

Midway resistances held up strong.

Once these are breached, It is poised for more towards 1950 followed by 2000.

#StockMarket #StocksInFocus https://t.co/kswtnvjQM8

#KOTAKBANK

— Gurleen (@GurleenKaur_19) August 8, 2021

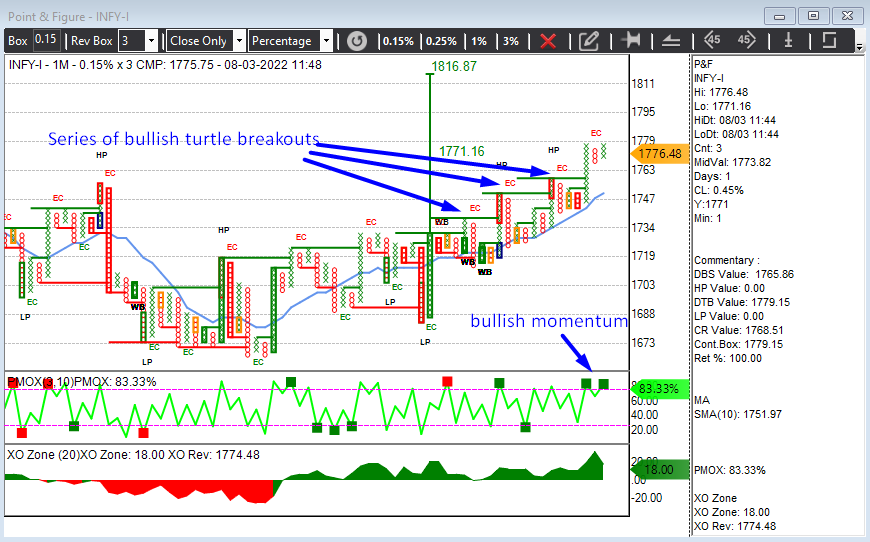

In daily; Trendline breakout along with price volume action.

Resistances midway at 1812.70 and 1856.75.

Once these are breached, It is poised for more towards 1950 followed by 2000.

In weekly as well; Setup looks quite bullish. #StockMarket #StocksToTrade pic.twitter.com/vfIjR7MuCE

Post the Harmonic reversal, Amongst the Pharma sector; #DRREDDY is 10% down.

Strong sell-off, There's a high probability of 4874.80 getting breached. Immediate support at 4700.20

#StockMarket https://t.co/J61wgJdzX7

#CNXPHARMA

— Gurleen (@GurleenKaur_19) July 27, 2021

Strong Breakdown but it continues to hold above a crucial support level of 14183.65

Support staying intact or A slip below this level would lead the Index either side. #StockMarket pic.twitter.com/qgBZKB4Cyo

A quick thread 🧵

Daily TF

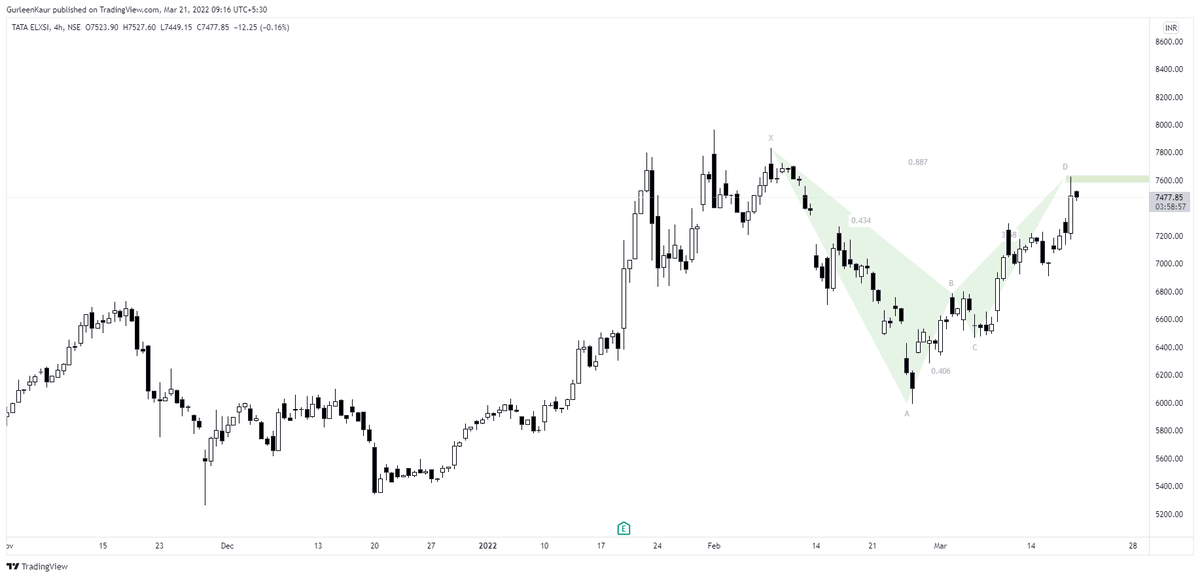

With the turn-around in price from the initial harmonic pattern, Consequent LH-LL's in place.

Below $101.56, We might catch sight of $87 followed by $78 https://t.co/nvzolftng6

$USOIL

— Gurleen (@GurleenKaur_19) June 6, 2022

With the inching up of reaction lows, the targets are placed at $125 and $134.

In a different case scenario, Let's not rule out the possibility- If the price continues to sustain above the level of $104, Might see a hit towards the level of $150 as well. #CrudeOil pic.twitter.com/p52TnRkBqC

On the Weekly TF, If the price slips and closes below $92.96, the target would be $70.

More from Infy

You May Also Like

Why is this the most powerful question you can ask when attempting to reach an agreement with another human being or organization?

A thread, co-written by @deanmbrody:

Next level tactic when closing a sale, candidate, or investment:

— Erik Torenberg (@eriktorenberg) February 27, 2018

Ask: \u201cWhat needs to be true for you to be all in?\u201d

You'll usually get an explicit answer that you might not get otherwise. It also holds them accountable once the thing they need becomes true.

2/ First, “X” could be lots of things. Examples: What would need to be true for you to

- “Feel it's in our best interest for me to be CMO"

- “Feel that we’re in a good place as a company”

- “Feel that we’re on the same page”

- “Feel that we both got what we wanted from this deal

3/ Normally, we aren’t that direct. Example from startup/VC land:

Founders leave VC meetings thinking that every VC will invest, but they rarely do.

Worse over, the founders don’t know what they need to do in order to be fundable.

4/ So why should you ask the magic Q?

To get clarity.

You want to know where you stand, and what it takes to get what you want in a way that also gets them what they want.

It also holds them (mentally) accountable once the thing they need becomes true.

5/ Staying in the context of soliciting investors, the question is “what would need to be true for you to want to invest (or partner with us on this journey, etc)?”

Multiple responses to this question are likely to deliver a positive result.