https://t.co/2UzelIpQa7

Due to @asadowaisi's political expansion, question asked nowadays is whether or not Muslims voting for AIMIM is a communal phenomenon

But nobody has answers for

Majoritarian politics, which already divides voters along religious identity

Ajay

https://t.co/2UzelIpQa7

https://t.co/2UzelIpQa7

https://t.co/2UzelIpQa7

https://t.co/2UzelIpQa7

https://t.co/2UzelIpQa7

https://t.co/2UzelIpQa7

https://t.co/2UzelIpQa7

The point that Muslims have and do vote for non-Muslim parties gets waylaid. Besides, Hindus could legitimately counter that they, too, vote for non-BJP parties.

It could also be argued that the @aimim_national looks sectarian because Hindus would not vote for a party that is committed to uniting Muslim.

https://t.co/2UzelIpQa7

Muslims could well wonder why secular parties have not come together to defeat the BJP and why doing so is seen as a concern of only the Muslims and @aimim_national

https://t.co/2UzelIpQa7

What is the track-record of the AIMIM in bringing about positive changes in the lives of Muslims in Hyderabad, leave alone Telangana?

https://t.co/2UzelIpQa7

More from India

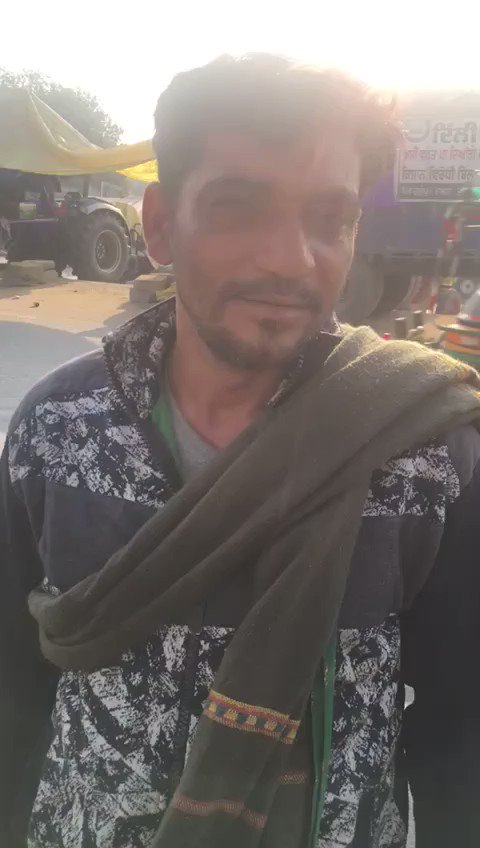

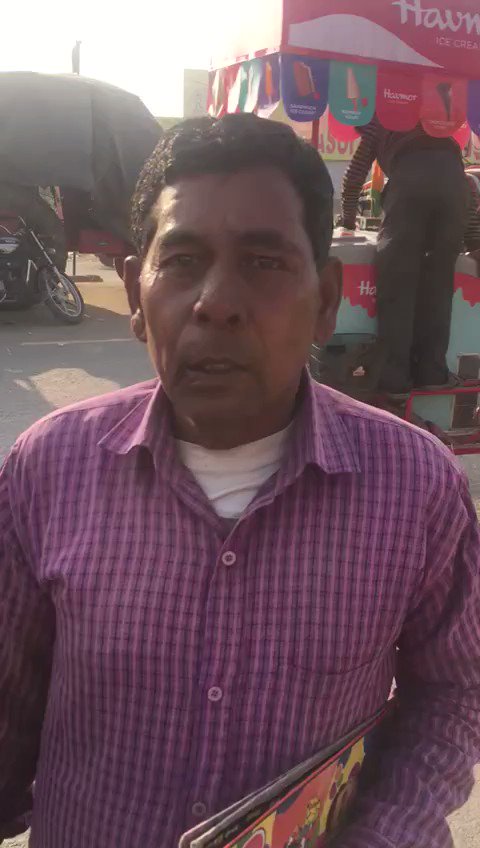

People you're seeing in TV posing as locals of #SinghuBorder are NOT locals. Infact, locals are extremely warm with the protestors. This is what real locals have to say!

No one has a problem with protestors at #SinghuBorder. Who were the ones who came to protest??

https://t.co/l3xWK8z0m7

#IndiaStandsWithFarmers

Sweeetestt ❣️❣️❣️

No one has a problem with protestors at #SinghuBorder. Who were the ones who came to protest??

https://t.co/l3xWK8z0m7

#IndiaStandsWithFarmers

Sweeetestt ❣️❣️❣️

You May Also Like

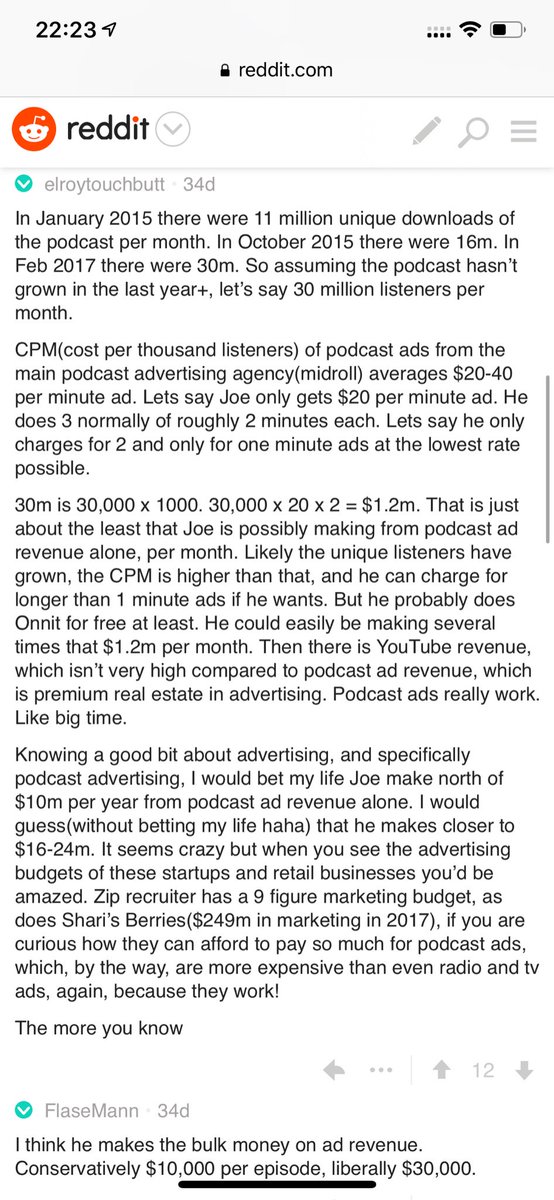

Joe Rogan's podcast is now is listened to 1.5+ billion times per year at around $50-100M/year revenue.

Independent and 100% owned by Joe, no networks, no middle men and a 100M+ people audience.

👏

https://t.co/RywAiBxA3s

Joe is the #1 / #2 podcast (depends per week) of all podcasts

120 million plays per month source https://t.co/k7L1LfDdcM

https://t.co/aGcYnVDpMu

Independent and 100% owned by Joe, no networks, no middle men and a 100M+ people audience.

👏

https://t.co/RywAiBxA3s

Joe is the #1 / #2 podcast (depends per week) of all podcasts

120 million plays per month source https://t.co/k7L1LfDdcM

https://t.co/aGcYnVDpMu