#mukeshambani #SEBI #RIL #Reliance

Why did SEBI fined Mukesh Ambani?

A detailed thread. 🧶

#mukeshambani #SEBI #RIL #Reliance

The12 agents decided to bet against RPL using what is called a futures contract.

Rs447 crores according to the regulator!

Protecting their downside.

“Hedging,” their bets so to speak.

But SEBI notes that there is no documentary evidence to support this claim.

More from India

William Carey landed on the Indian soil in the year 1793. He spent the remaining years of his life in India. He was a British missionary, a translator and a social reformer who is best known for having the practice of Sati abolished in India. https://t.co/kRiPwgjwcP pic.twitter.com/JqO3A7cCsX

— Tanvangi (@Tanvangi17) December 18, 2020

It is entirely possible that,Carey in his arrogance of being the white man and hence more civilized,his inability to under the Hindu scriptures and his natural disdain for the learned community coupled with his inherent hatred for the idolaters may have exaggerated the incidents.

In fact, considering the venom with which he has spoken about Hinduism and it's practices, it's likely that he has exaggerated these incidents. But it cannot be denied that these incidents did happen even if they may not have been on scale at which Carey has described.

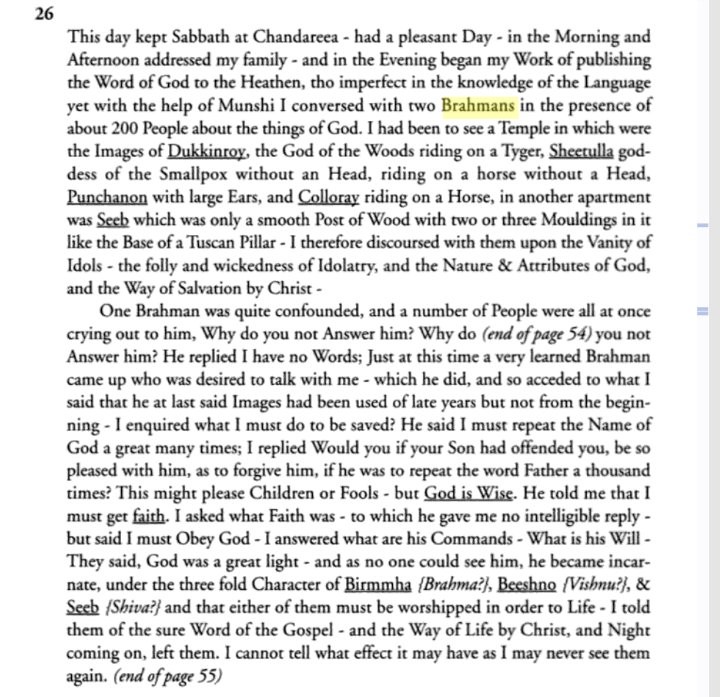

One of his journal entry mentions a debate which happened in a temple in front of around 200 people. Carey describes having debated with two learned men and goes on to say when both learned men failed to answer his questions, he went on to preach the gospel to the assembled crowd

In a letter dated 30th June,1795 he goes on to gleefully narate how Hindus were unaware of their own scriptures and how an supposed expert named a grammar book when he was questioned as which scripture said that the Murti is God.

You May Also Like

Decoded his way of analysis/logics for everyone to easily understand.

Have covered:

1. Analysis of volatility, how to foresee/signs.

2. Workbook

3. When to sell options

4. Diff category of days

5. How movement of option prices tell us what will happen

1. Keeps following volatility super closely.

Makes 7-8 different strategies to give him a sense of what's going on.

Whichever gives highest profit he trades in.

I am quite different from your style. I follow the market's volatility very closely. I have mock positions in 7-8 different strategies which allows me to stay connected. Whichever gives best profit is usually the one i trade in.

— Sarang Sood (@SarangSood) August 13, 2019

2. Theta falls when market moves.

Falls where market is headed towards not on our original position.

Anilji most of the time these days Theta only falls when market moves. So the Theta actually falls where market has moved to, not where our position was in the first place. By shifting we can come close to capturing the Theta fall but not always.

— Sarang Sood (@SarangSood) June 24, 2019

3. If you're an options seller then sell only when volatility is dropping, there is a high probability of you making the right trade and getting profit as a result

He believes in a market operator, if market mover sells volatility Sarang Sir joins him.

This week has been great so far. The main aim is to be in the right side of the volatility, rest the market will reward.

— Sarang Sood (@SarangSood) July 3, 2019

4. Theta decay vs Fall in vega

Sell when Vega is falling rather than for theta decay. You won't be trapped and higher probability of making profit.

There is a difference between theta decay & fall in vega. Decay is certain but there is no guaranteed profit as delta moves can increase cost. Fall in vega on the other hand is backed by a powerful force that sells options and gives handsome returns. Our job is to identify them.

— Sarang Sood (@SarangSood) February 12, 2020