12 things you should look out for before buying health insurance

A thread 🧵

You have to be a little wary of policies that come with co-pay. With co-pay, you need to pay a pre-decided amount from your own pocket whenever you make a claim.

The larger your expenses, the larger you’ll end up spending your own money, even with insurance.

This is something you need to be conscious of when making choices during hospitalization. Let’s deep dive into what will happen if your policy doesn’t have a room rent limit and when it does.

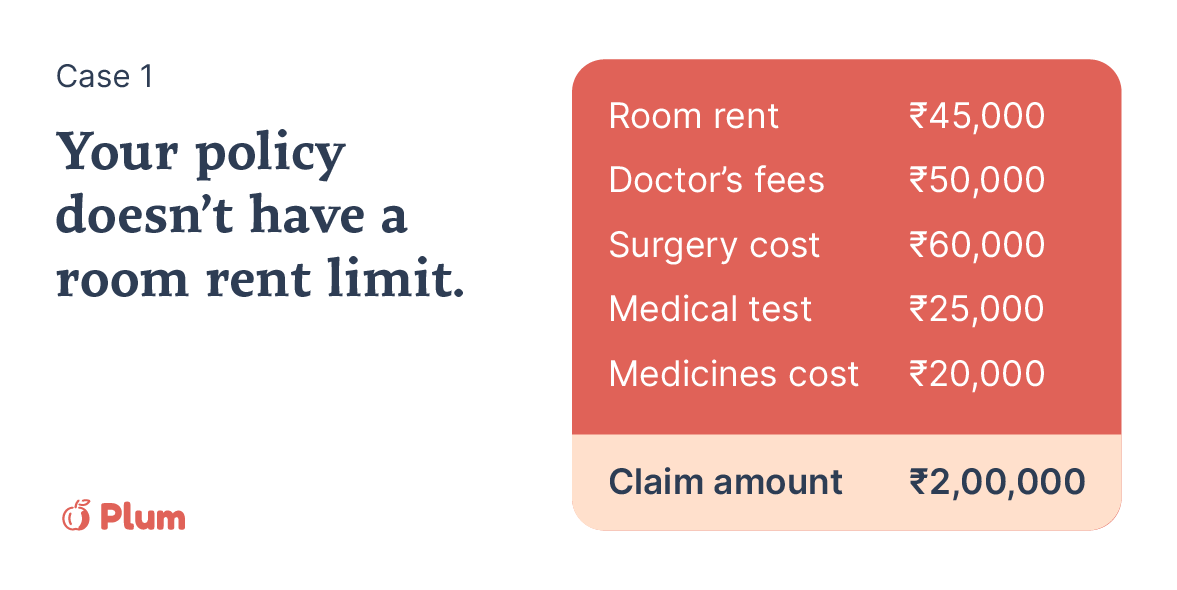

You have a health insurance cover of ₹15 lakhs, with *no room-rent limit*. You get treated for a condition that costs you ₹2 lakhs, and you paid ₹15,000 in room rent per day.

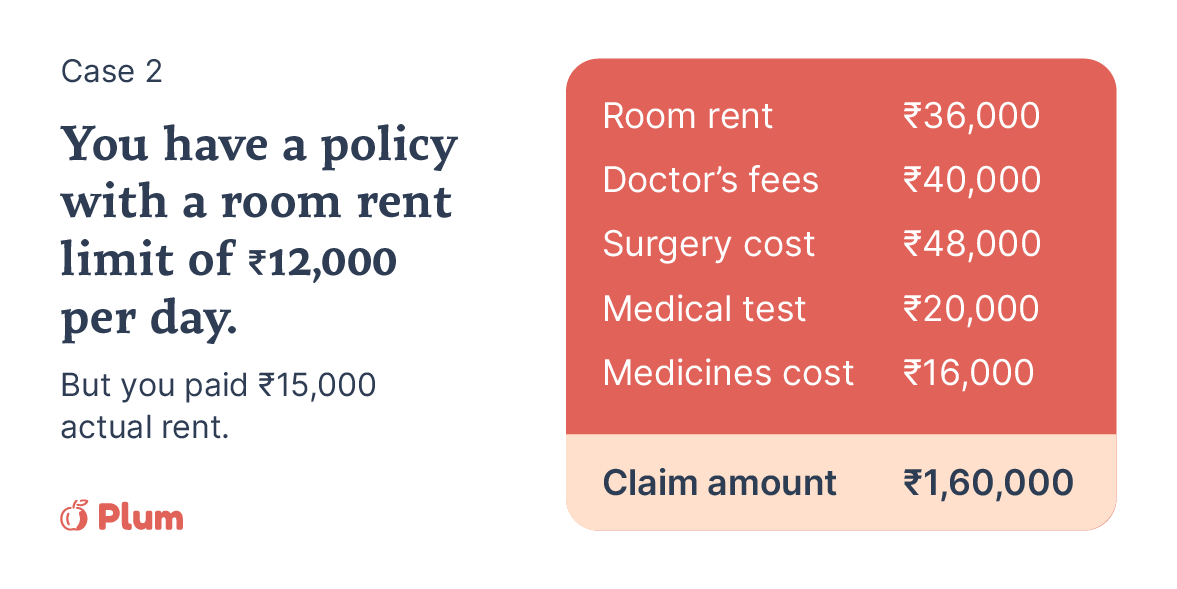

You have a health insurance cover of ₹15 lakhs, with a room rent limit of ₹12,000 per day. You get treated for a condition that costs you ₹2 lakhs, but you stayed in a room that costs you ₹15,000/day.

In this case, each component in your cost is proportionately deducted (12/15*cost), and therefore, you can only claim ₹1,60,000 of your total expenditure.

Check the attached image to understand how your claim amount gets reduced.

You might have thought the room rent doesn't matter as much - but it does.

During this period after you purchase a policy, you cannot make any claim. It’s typically between 30 to 90 days. This waiting period is waived in the event of an accident that leads to immediate hospitalization.

This applies to pre-existing diseases (like diabetes) present when a health insurance policy is bought. The insurer will accept your claims for treatment related to these diseases only if the waiting period you agreed upon has passed.

This means that the insurer applies a limit on the amount you can claim for treatments for specified conditions and diseases.

Save yourself that shock by going through the rest of this thread and also bookmarking it :)

After you buy a policy, you can cancel it within a certain free-look period, stating your reasons.

However, the insurer will not refund any medical tests, stamp duty charges done during this period.

The free-look period is typically 15 to 30 days.

This is the facility given by the insurer to you, for covering your pre and post-hospitalization expenses.

This will go a long way in saving you a lot of money (and stress!)

This means single-day treatments like eye surgery, etc. are covered by your health insurance policy.

Several common treatments require single day hospitalization, so you need to totally make sure that these are covered.

If you don't make any claim in a year, the insurer will reward you by increasing your coverage amount (with a max limit).

No claim bonuses are good-to-have on your policy.

If your policy has a domiciliary cover (quite some insurance-speak!), it means that you can claim money when you are treated at home.

This is great during these times because it’s really difficult to find hospital beds during the pandemic.

If you’ve completed 8 years of coverage, the insurer cannot reject an eligible claim, for any reason except for proven frauds and exclusions made in the policy documents.

If you spot these words, it means the insurance company provides you with a free health check-up.

More from Health

You May Also Like

These setups I found from the following 4 accounts:

1. @Pathik_Trader

2. @sourabhsiso19

3. @ITRADE191

4. @DillikiBiili

Share for the benefit of everyone.

Here are the setups from @Pathik_Trader Sir first.

1. Open Drive (Intraday Setup explained)

#OpenDrive#intradaySetup

— Pathik (@Pathik_Trader) April 16, 2019

Sharing one high probability trending setup for intraday.

Few conditions needs to be met

1. Opening should be above/below previous day high/low for buy/sell setup.

2. Open=low (for buy)

Open=high (for sell)

(1/n)

Bactesting results of Open Drive

Already explained strategy of #opendrive

— Pathik (@Pathik_Trader) May 27, 2020

Backtested results in 30 stocks and nifty, banknifty.

Success ratio : approx 40-45%

RR average 1:2

Entry as per strategy

Stoploss = Open level

Exit 3:15 PM Or SL

39 months 14 months -ve, 25 +ve

Yearly all 4 years +ve performance. pic.twitter.com/nGqhzMKGVy

2. Two Price Action setups to get good long side trade for intraday.

1. PDC Acts as Support

2. PDH Acts as

So today we will discuss two more price action setups to get good long side trade for intraday.

— Pathik (@Pathik_Trader) June 20, 2020

1. PDC Acts as Support

2. PDH Acts as Support

Example of PDC/PDH Setup given

#nifty

— Pathik (@Pathik_Trader) June 23, 2020

This is how it created long setup by taking support at PDC.

hopefully shared setup on last weekend helped. pic.twitter.com/2mduSUpMn5