Justice Anand Venkatesh of Madras HC in an elaborate and detailed order, 2/n

Long THREAD :

Sources : A litigant named Dr. M. Geethanjali, approached the Madras HC, to redress her grievance wherein, she was denied an MD Opthalmology seat in PSG medical college whereas a candidate who got lesser rank than her was given the same seat. 1/n

Justice Anand Venkatesh of Madras HC in an elaborate and detailed order, 2/n

Finding serious infirmities in the admission process, Hon’ble Justice Anand Venkatesh, directed a CB CID probe into the happenings during this year’s medical admission. 7/n

CB CID Pradheep Phillip, for reasons that are not clear, chose a DSP named Gunavarman who was caught into allegations of IPL 8/n

The CB CID probe is on. As part of the probe, one Dr. G. Selvarajan, MS, DLO, Secretary / Addl Director of Medical Education Selection Committee 9/n

He was examined by one Maheswari, an Addl SP in CB CID. The said Selvarajan played ‘dalit card’. Addl SP Maheswari, was firm and said, the probe is nothing to do with caste. 10/n

Highly placed sources say, the said Vijayakumar IAS, as Secretary II to CM does all the dirty works of EPS. 12/n

The said Vijayakumar is a dalit and using this dalit card, he has formed a closed group of Dalits among 13/n

Long back, Junior Vikatan, published a cover story, describing a power broker, “Delhi Murali” 15/n

This façade was exposed by us, following which, Junior Vikatan, did a balancing story against this Delhi Murali. 17/n

https://t.co/nBDzBq03zd

More from Savukku_Shankar

More from Health

You May Also Like

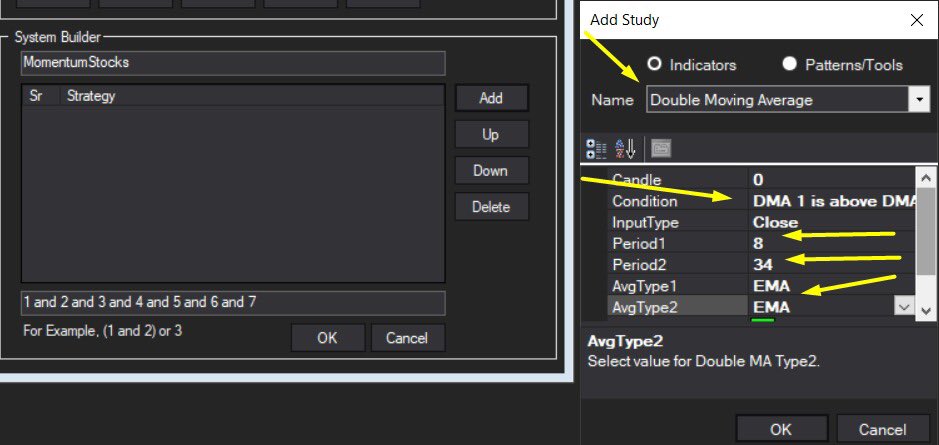

Decoded his way of analysis/logics for everyone to easily understand.

Have covered:

1. Analysis of volatility, how to foresee/signs.

2. Workbook

3. When to sell options

4. Diff category of days

5. How movement of option prices tell us what will happen

1. Keeps following volatility super closely.

Makes 7-8 different strategies to give him a sense of what's going on.

Whichever gives highest profit he trades in.

I am quite different from your style. I follow the market's volatility very closely. I have mock positions in 7-8 different strategies which allows me to stay connected. Whichever gives best profit is usually the one i trade in.

— Sarang Sood (@SarangSood) August 13, 2019

2. Theta falls when market moves.

Falls where market is headed towards not on our original position.

Anilji most of the time these days Theta only falls when market moves. So the Theta actually falls where market has moved to, not where our position was in the first place. By shifting we can come close to capturing the Theta fall but not always.

— Sarang Sood (@SarangSood) June 24, 2019

3. If you're an options seller then sell only when volatility is dropping, there is a high probability of you making the right trade and getting profit as a result

He believes in a market operator, if market mover sells volatility Sarang Sir joins him.

This week has been great so far. The main aim is to be in the right side of the volatility, rest the market will reward.

— Sarang Sood (@SarangSood) July 3, 2019

4. Theta decay vs Fall in vega

Sell when Vega is falling rather than for theta decay. You won't be trapped and higher probability of making profit.

There is a difference between theta decay & fall in vega. Decay is certain but there is no guaranteed profit as delta moves can increase cost. Fall in vega on the other hand is backed by a powerful force that sells options and gives handsome returns. Our job is to identify them.

— Sarang Sood (@SarangSood) February 12, 2020