HDFC Bank - A Friend recently asked about HDFC Bank, I had posted this chart then. Can't find that old tweet now, updated one is here...

In a potential V shape recovery, Breakout is considered confirmed at 38.2% re-tracement from bottom.. #ProfGyan

More from Professor

Starting the Beginner’s Pathway thread for Fundamental Investing.

One Chadarmod on timeline posted that I’m giving gyan without having experience or expertise.

So I’ll begin with paying my portfolio performance tribute to these charlies.

https://t.co/GNM5SsNFNo

Fundamentals based investing can generate serious wealth as the most famous (rather infamous) Warren Buffett has shown.

In India also we have many success stories like @VijayKedia1 @Raamdeo R K Damani Rakesh Jhunjhunwala Late Chandrakant Sampat and many many more....

Though I can't stop mentioning that both Rakesh Jhunjhunwala and R K Damani were traders in their initial days.

Rakesh Jhunjhunwala still trades, he once said Traing is fun, its le fatafat, de fatafat

A lot of people (specially the beginners) buy stocks based on some friend's recommendation : XYZ le le, pukka chalega, maine bhi le rakha hai.

Few might have made money this way, but most do not. Why ?

There has to be a process.

Fundamentals based investing need thorough analysis of the Business & Company.

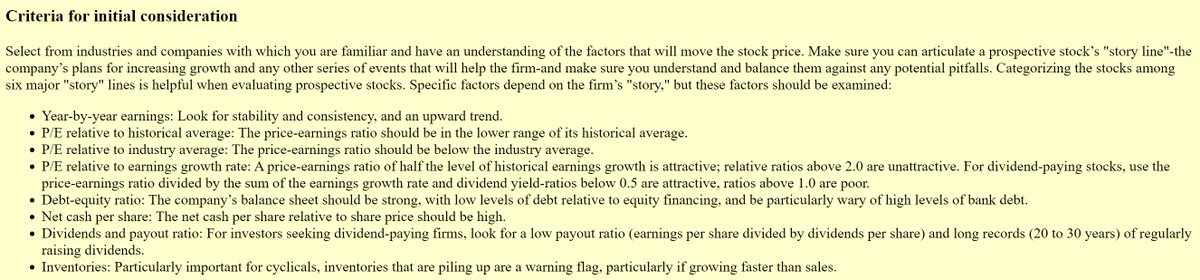

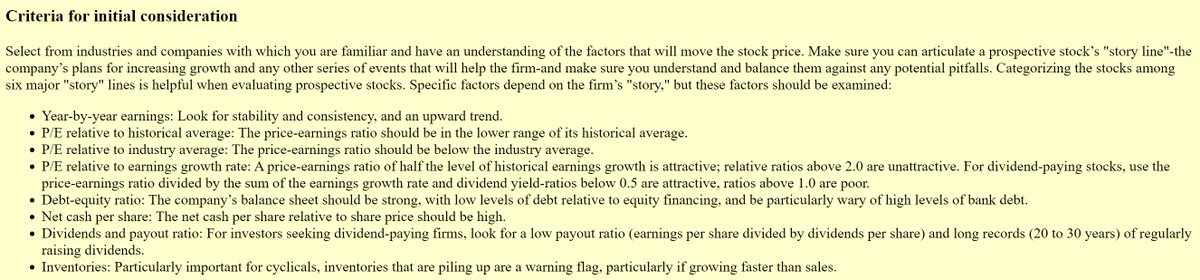

Here is a preliminary checklist by the legendary investor Peter lynch

One Chadarmod on timeline posted that I’m giving gyan without having experience or expertise.

So I’ll begin with paying my portfolio performance tribute to these charlies.

https://t.co/GNM5SsNFNo

Sadda Haqq ! Aithe Rakhh......... pic.twitter.com/IH5q3v2gw9

— Professor (@DillikiBiili) October 5, 2021

Fundamentals based investing can generate serious wealth as the most famous (rather infamous) Warren Buffett has shown.

In India also we have many success stories like @VijayKedia1 @Raamdeo R K Damani Rakesh Jhunjhunwala Late Chandrakant Sampat and many many more....

Though I can't stop mentioning that both Rakesh Jhunjhunwala and R K Damani were traders in their initial days.

Rakesh Jhunjhunwala still trades, he once said Traing is fun, its le fatafat, de fatafat

A lot of people (specially the beginners) buy stocks based on some friend's recommendation : XYZ le le, pukka chalega, maine bhi le rakha hai.

Few might have made money this way, but most do not. Why ?

There has to be a process.

Fundamentals based investing need thorough analysis of the Business & Company.

Here is a preliminary checklist by the legendary investor Peter lynch

IRCTC below 640 today !

Have no intention to enjoy the misery of fellow market participants but 'Maine Bola Tha' !

#ProfGyan - If a freak low gets made some day, Stocks/Indices always try to visit it at least once (seekh lo, mere mentorship course ka launch kuch pukka nahi hai) https://t.co/3B6e2nMx0y

Have no intention to enjoy the misery of fellow market participants but 'Maine Bola Tha' !

#ProfGyan - If a freak low gets made some day, Stocks/Indices always try to visit it at least once (seekh lo, mere mentorship course ka launch kuch pukka nahi hai) https://t.co/3B6e2nMx0y

Two prophecies about IRCTC:

— Professor (@DillikiBiili) May 1, 2022

1. It would touch 640 someday

2. It would get expelled from F&O https://t.co/qJ04hG0qFH pic.twitter.com/TPUBSQFW1y

More from Hdfcbank

IF #Nifty to go to 18850-19713 & more, heavy weights such as

#Hdfc (3190++)

#Hdfcbank (1724++)

#Reliance (2834++)

#ITC (274++) these are "just min. targets"

& many more would move up significantly

@rlnarayanan https://t.co/iVYE1F7l6v

#Hdfc (3190++)

#Hdfcbank (1724++)

#Reliance (2834++)

#ITC (274++) these are "just min. targets"

& many more would move up significantly

@rlnarayanan https://t.co/iVYE1F7l6v

#Nifty 3rd is sub-dividing as in chart:

— Van Ilango (JustNifty) (@JustNifty) October 13, 2021

[1]st: 16396 - 17793 = 1397

[2]nd: 17793-17948-17453 - Irregular flat

[3]rd: 17453+1397=18850 OR

: 17453+1928=19381 OR

: 17453+2096=19549 OR

: 17453+2260=19713 OR

Nothing wrong in projecting till holds "17990"