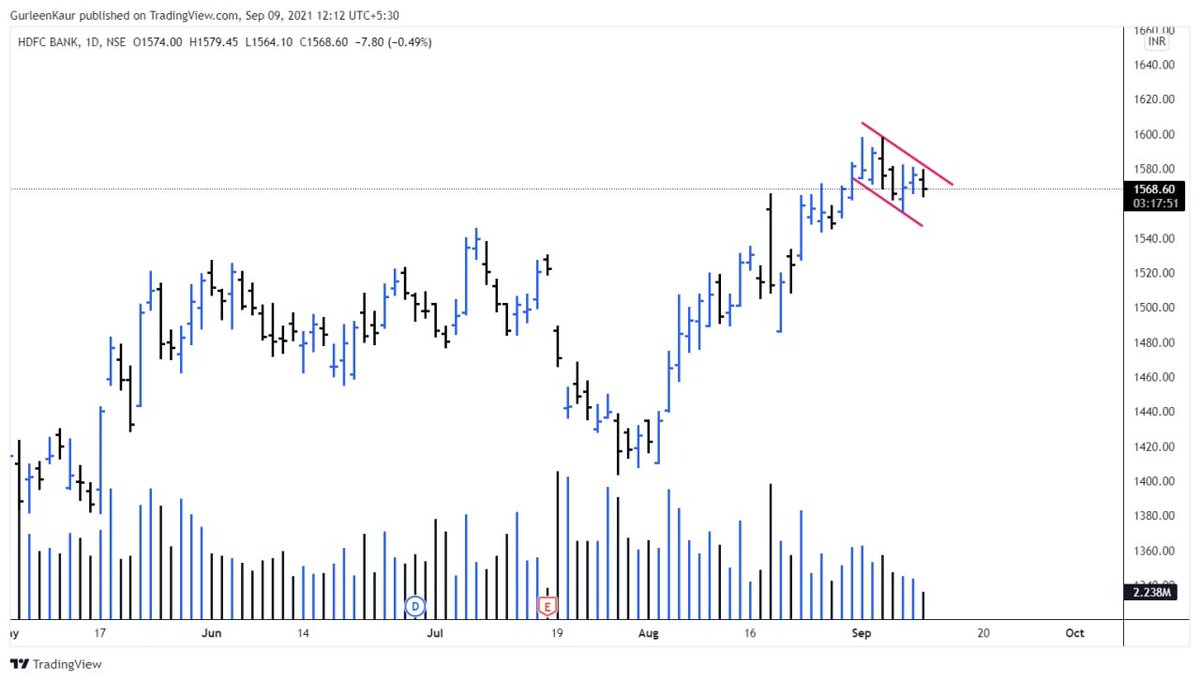

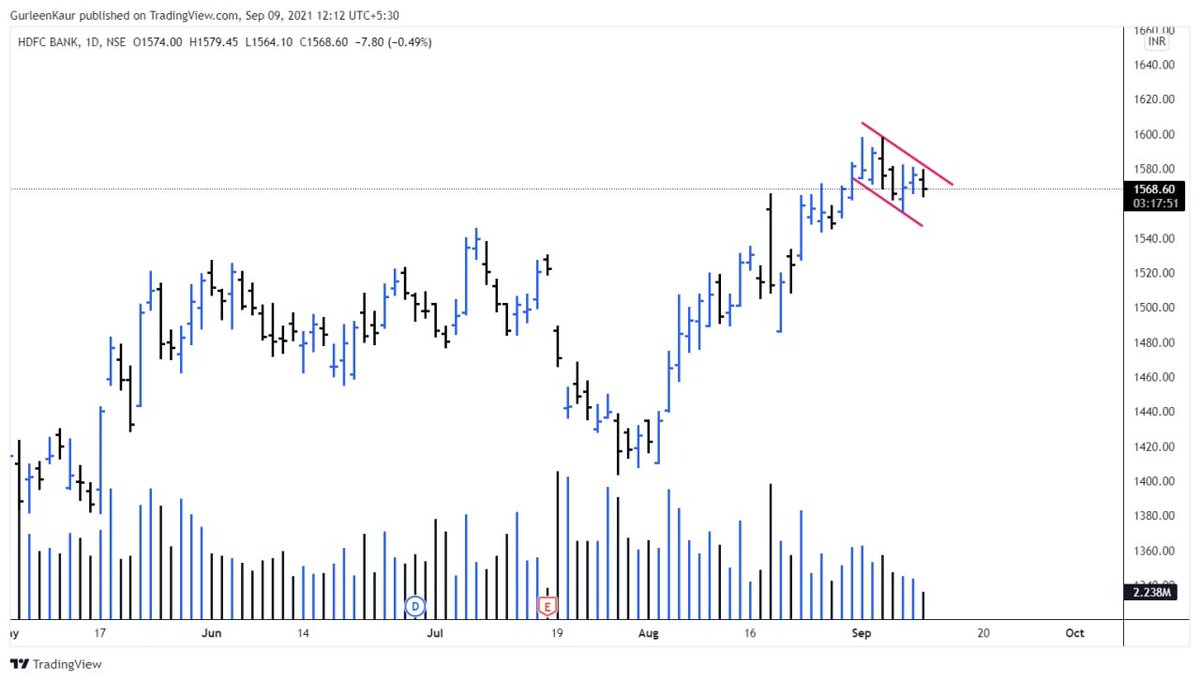

Rejection level at 1579.35 which needs to be breached for extended upside.

Both Weekly and daily charts are indicating the resumption of the prior trend.

+

#HDFCBANK

— Gurleen (@GurleenKaur_19) August 10, 2021

The setup looks favorable above 1531 for target's of 1640+#StockMarket #StocksToWatch pic.twitter.com/jbQrbjuYHy

#LTI

— Gurleen (@GurleenKaur_19) July 14, 2021

Strong positive move with above average volume almost after 4 weeks.

A breakout here would trigger 4242. #StockMarketindia #StocksToWatch pic.twitter.com/G0fWGyNhLT

#BAJFINANCE

— Gurleen (@GurleenKaur_19) July 29, 2021

Breaking past the previous ATH;

Sustenance above 6342.80 would bring in new highs towards the channel top. #StockMarket #StockToWatch pic.twitter.com/ID8Q3QdFEf