More from MaRkET WaVES (DINESH PATEL ) Stock Market FARMER

More from Hdfcamc

#HDFCAMC

The price picked up towards crossing the horizontal level of 3290 but couldn't hold up.

Got rejected from the wick at 3365; Now the range of 3290-3365 must be broken to head higher towards 3500+

If it fails to do so; We might just see range-based action.

#StockMarket https://t.co/aRKvpy5Eyl

The price picked up towards crossing the horizontal level of 3290 but couldn't hold up.

Got rejected from the wick at 3365; Now the range of 3290-3365 must be broken to head higher towards 3500+

If it fails to do so; We might just see range-based action.

#StockMarket https://t.co/aRKvpy5Eyl

#HDFCAMC

— Gurleen (@GurleenKaur_19) September 6, 2021

Broken past the negative slope of lower highs. Observing the price structure, even the volumes have started picking up and are an increasing pace.

Going further; The script looks good for heading higher. #StockMarket #StocksInFocus pic.twitter.com/OiVwXGh9ee

You May Also Like

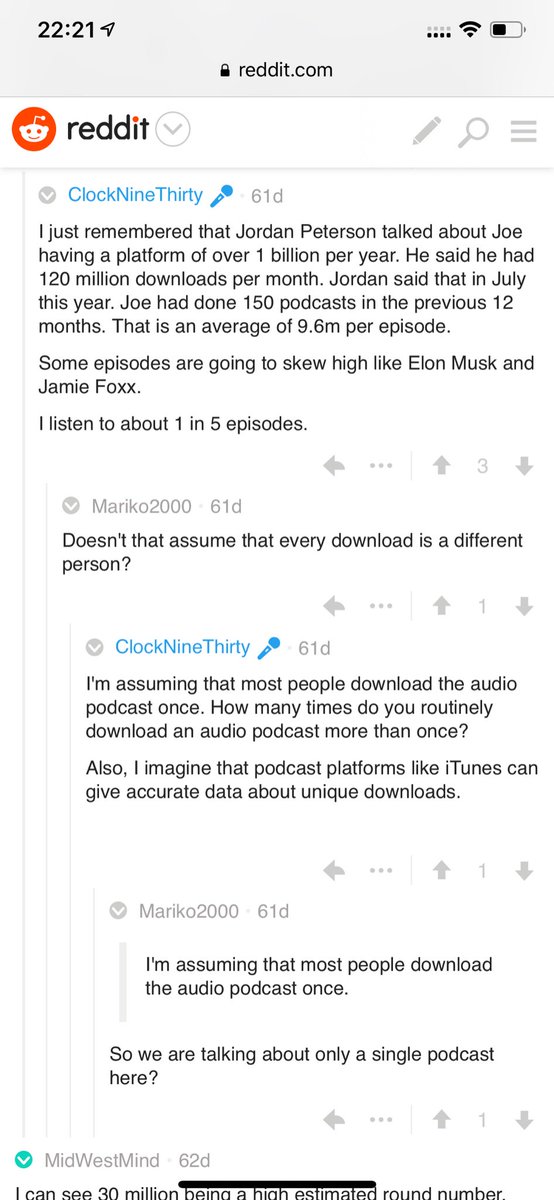

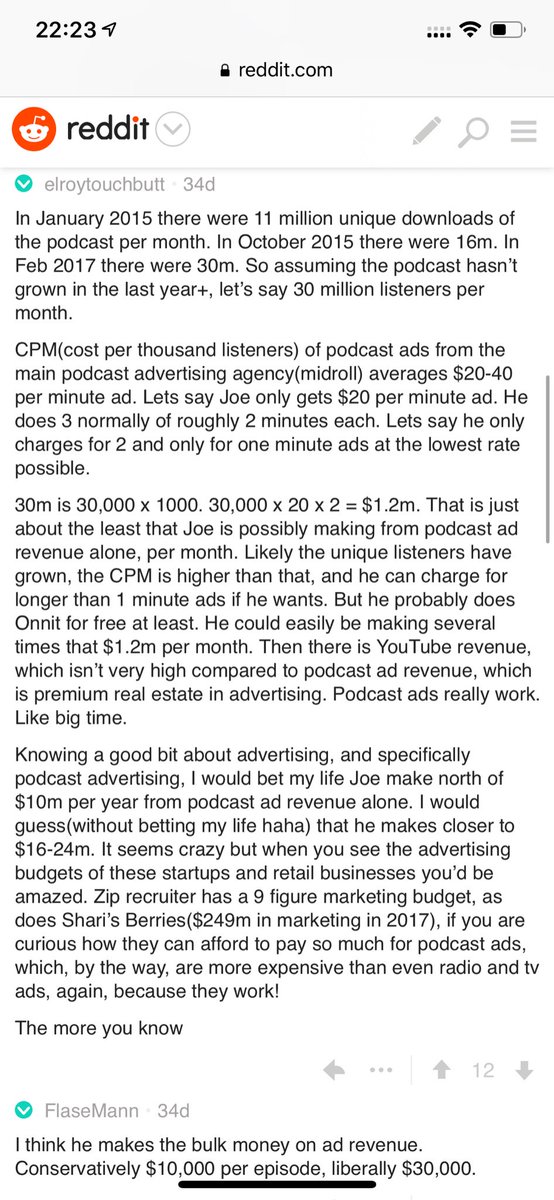

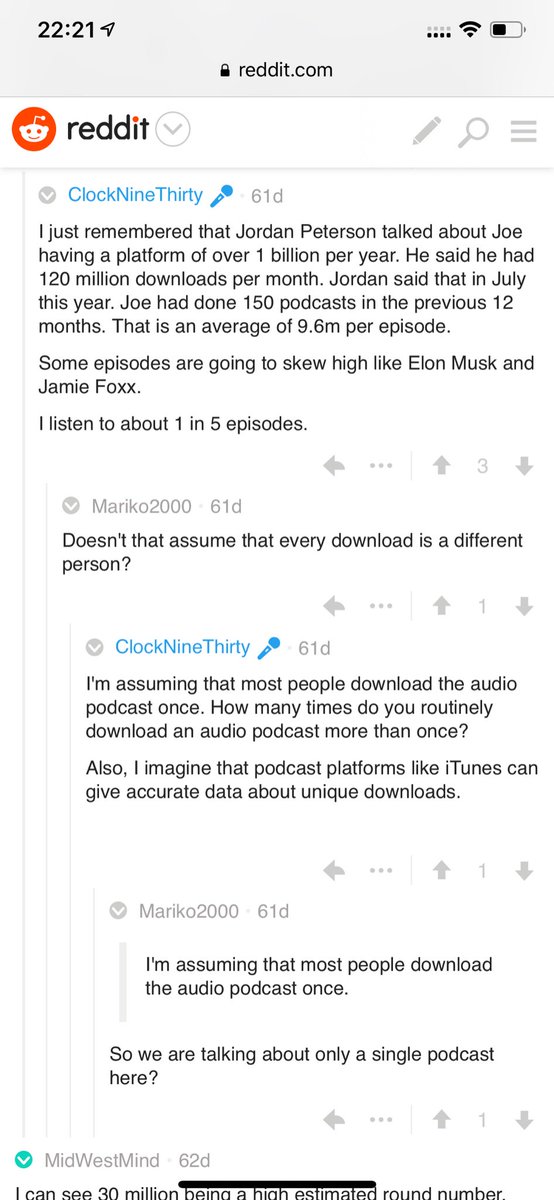

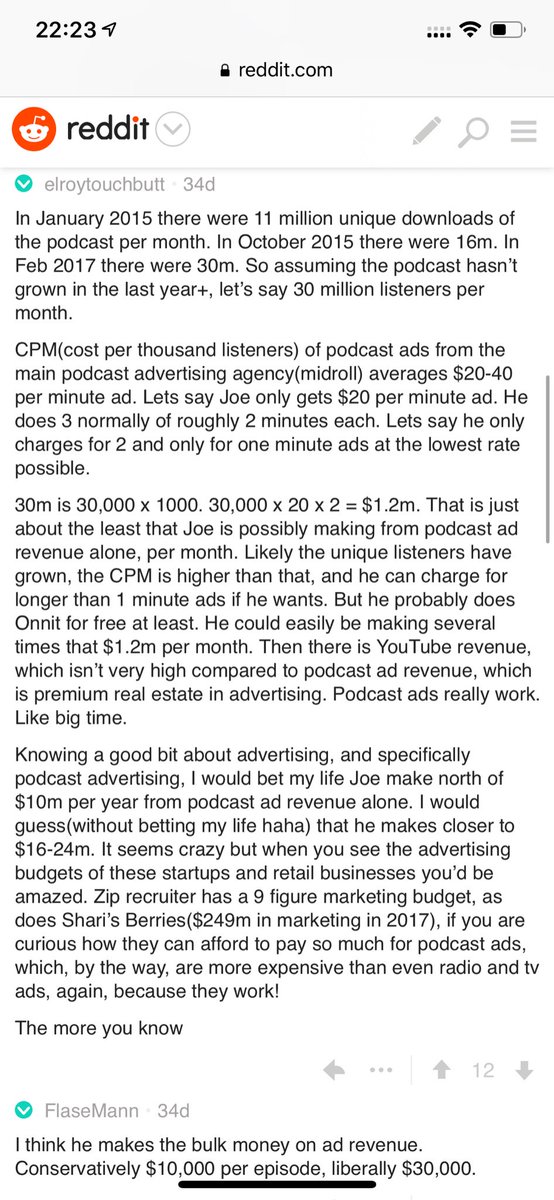

Joe Rogan's podcast is now is listened to 1.5+ billion times per year at around $50-100M/year revenue.

Independent and 100% owned by Joe, no networks, no middle men and a 100M+ people audience.

👏

https://t.co/RywAiBxA3s

Joe is the #1 / #2 podcast (depends per week) of all podcasts

120 million plays per month source https://t.co/k7L1LfDdcM

https://t.co/aGcYnVDpMu

Independent and 100% owned by Joe, no networks, no middle men and a 100M+ people audience.

👏

https://t.co/RywAiBxA3s

Joe is the #1 / #2 podcast (depends per week) of all podcasts

120 million plays per month source https://t.co/k7L1LfDdcM

https://t.co/aGcYnVDpMu

So the cryptocurrency industry has basically two products, one which is relatively benign and doesn't have product market fit, and one which is malignant and does. The industry has a weird superposition of understanding this fact and (strategically?) not understanding it.

The benign product is sovereign programmable money, which is historically a niche interest of folks with a relatively clustered set of beliefs about the state, the literary merit of Snow Crash, and the utility of gold to the modern economy.

This product has narrow appeal and, accordingly, is worth about as much as everything else on a 486 sitting in someone's basement is worth.

The other product is investment scams, which have approximately the best product market fit of anything produced by humans. In no age, in no country, in no city, at no level of sophistication do people consistently say "Actually I would prefer not to get money for nothing."

This product needs the exchanges like they need oxygen, because the value of it is directly tied to having payment rails to move real currency into the ecosystem and some jurisdictional and regulatory legerdemain to stay one step ahead of the banhammer.

If everyone was holding bitcoin on the old x86 in their parents basement, we would be finding a price bottom. The problem is the risk is all pooled at a few brokerages and a network of rotten exchanges with counter party risk that makes AIG circa 2008 look like a good credit.

— Greg Wester (@gwestr) November 25, 2018

The benign product is sovereign programmable money, which is historically a niche interest of folks with a relatively clustered set of beliefs about the state, the literary merit of Snow Crash, and the utility of gold to the modern economy.

This product has narrow appeal and, accordingly, is worth about as much as everything else on a 486 sitting in someone's basement is worth.

The other product is investment scams, which have approximately the best product market fit of anything produced by humans. In no age, in no country, in no city, at no level of sophistication do people consistently say "Actually I would prefer not to get money for nothing."

This product needs the exchanges like they need oxygen, because the value of it is directly tied to having payment rails to move real currency into the ecosystem and some jurisdictional and regulatory legerdemain to stay one step ahead of the banhammer.