It's the weekend!

Grab a cup of coffee, in this thread I will explain

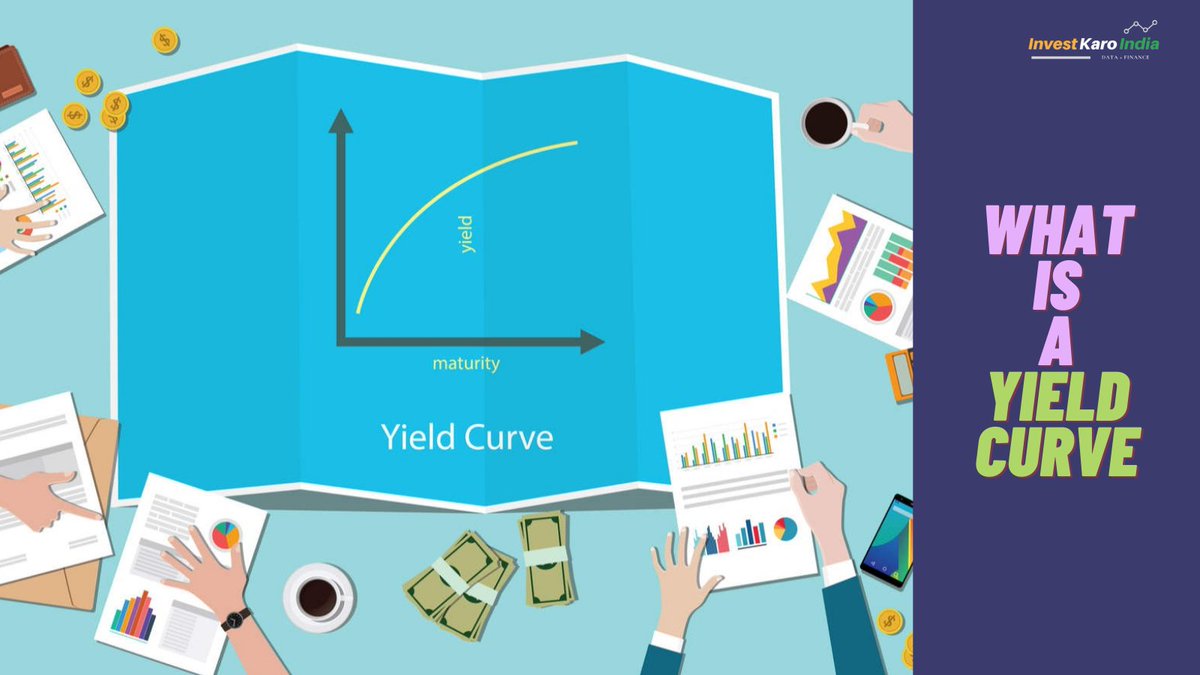

1. What is a Yield Curve?

2. Why is it an important indicator of Recession?

3. Is an Economic Recession around the corner?

Lets dive right in!

A bond is a fixed income financial instrument which represents a loan made by an investor to a borrower

The investor typically receives payment in the form of interest and a lumpsum (principal) on maturity

The interest rate on a bond is known as coupon rate.

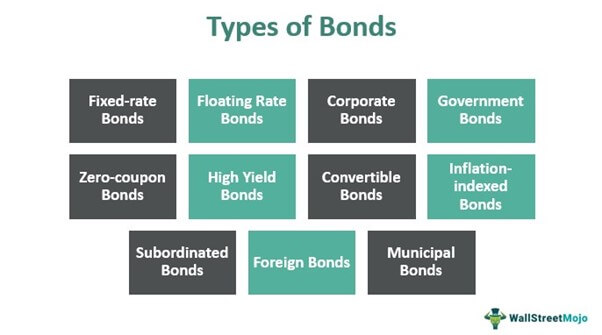

1. Zero Coupon : Pays both interest and principal at maturity

2. Sovereign Bonds : Issued by a Government or a Quasi Government Institution

3. Corporate Bonds : Issued by corporate like banks, established companies etc.

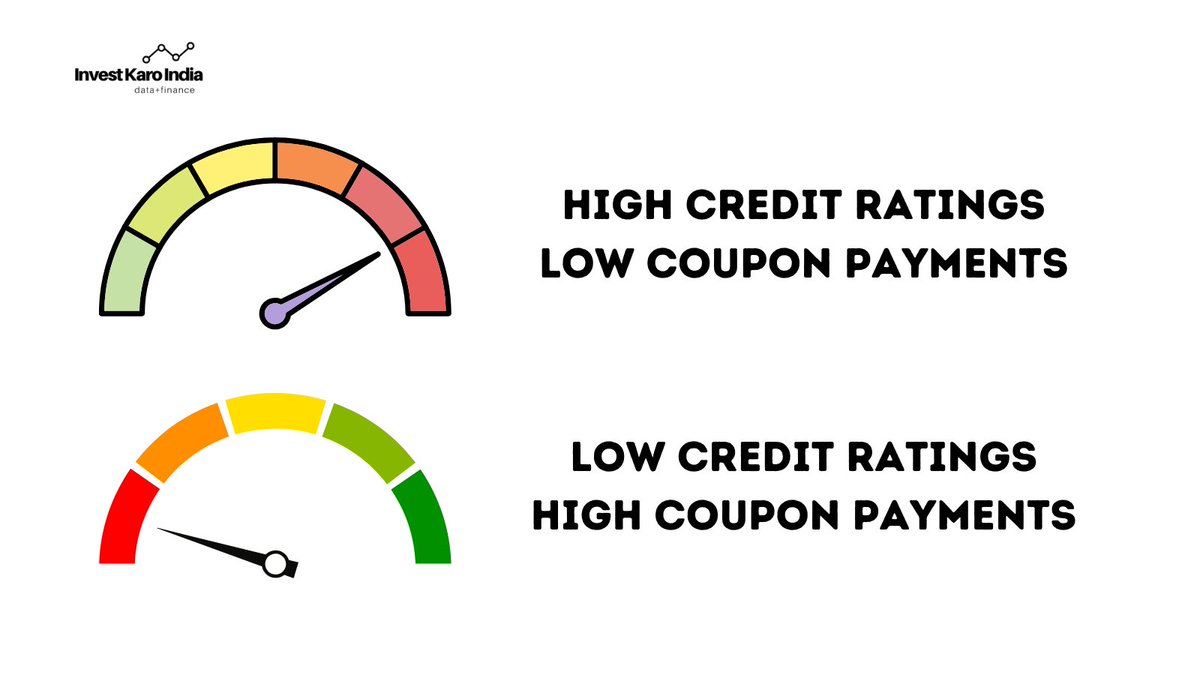

The higher the credit worthiness of the issuer, the lower the coupon rate

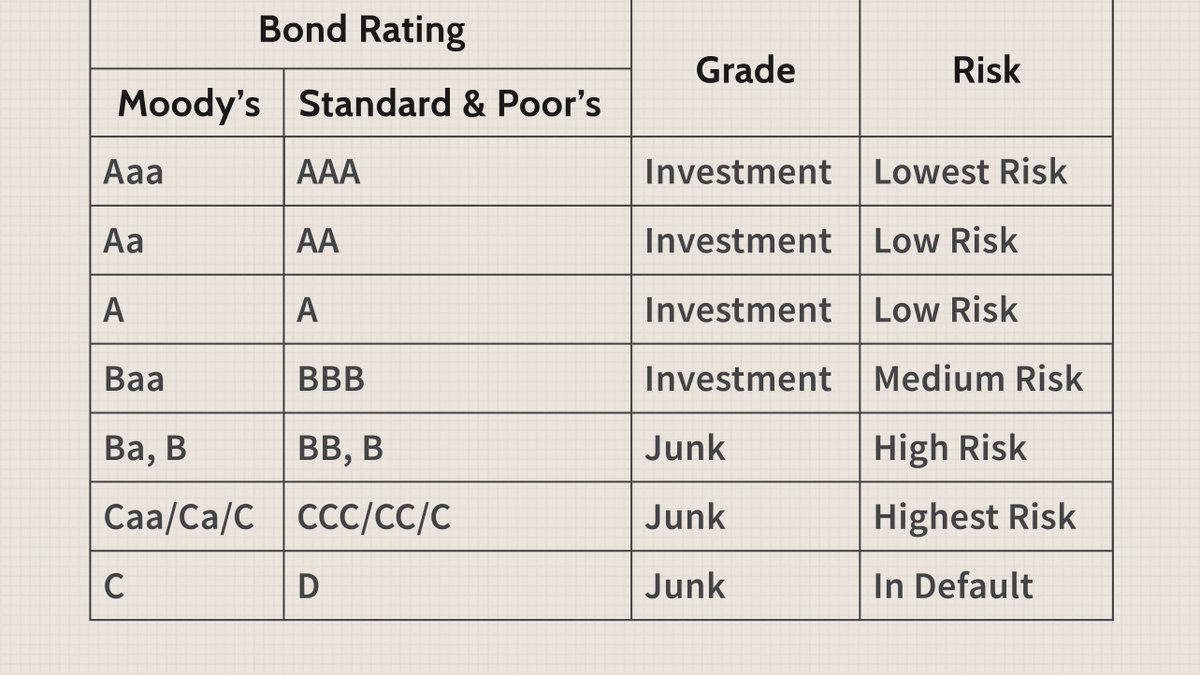

Credit Rating on a Bond is usually assigned by credit rating agencies like Moody's or Standard & Poor's (S&P)

Anything with a credit rating of BBB (Triple B) or lower is considered as 'junk bond' or a 'high yield bond' as they have high risk of default

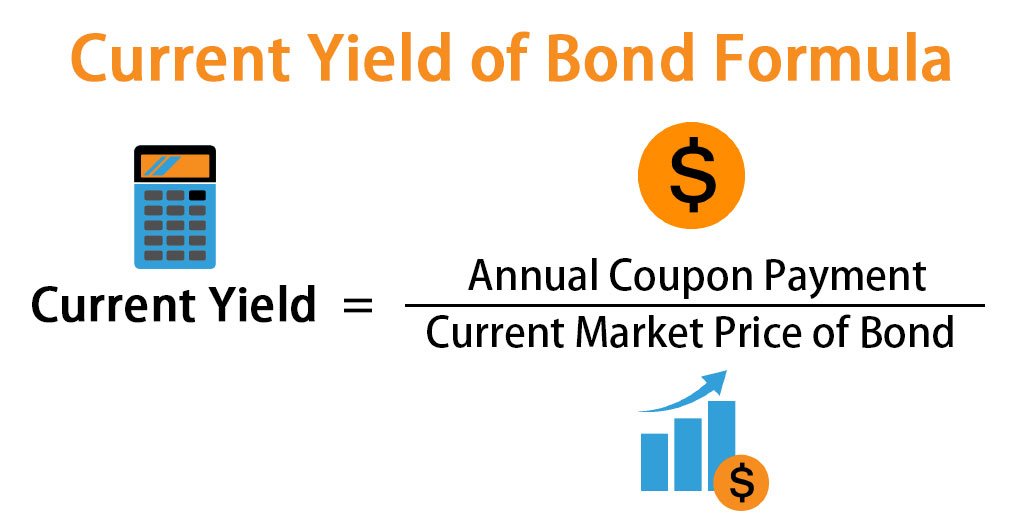

Yield is simply the return an investor of a bond realizes over the course of the bond holding period

Bond Yield = Interest Payments / Bond Price

Since, coupon (interest) payments on a bond along with tenure of a bond is fixed

your yield on a bond simply depends on the change in its price

The logic and concept followed for calculation and estimating a Dividend Yield can be directly applied to a bond yield as well.

ITC as per its policy issues out 85% of its profits as Dividends to its Shareholders, this comes to around ~Rs 10/share

When ITC was trading

at 180/share, the Div. Yield was 5.5%

at 254/share, Div. Yield is 3.93%

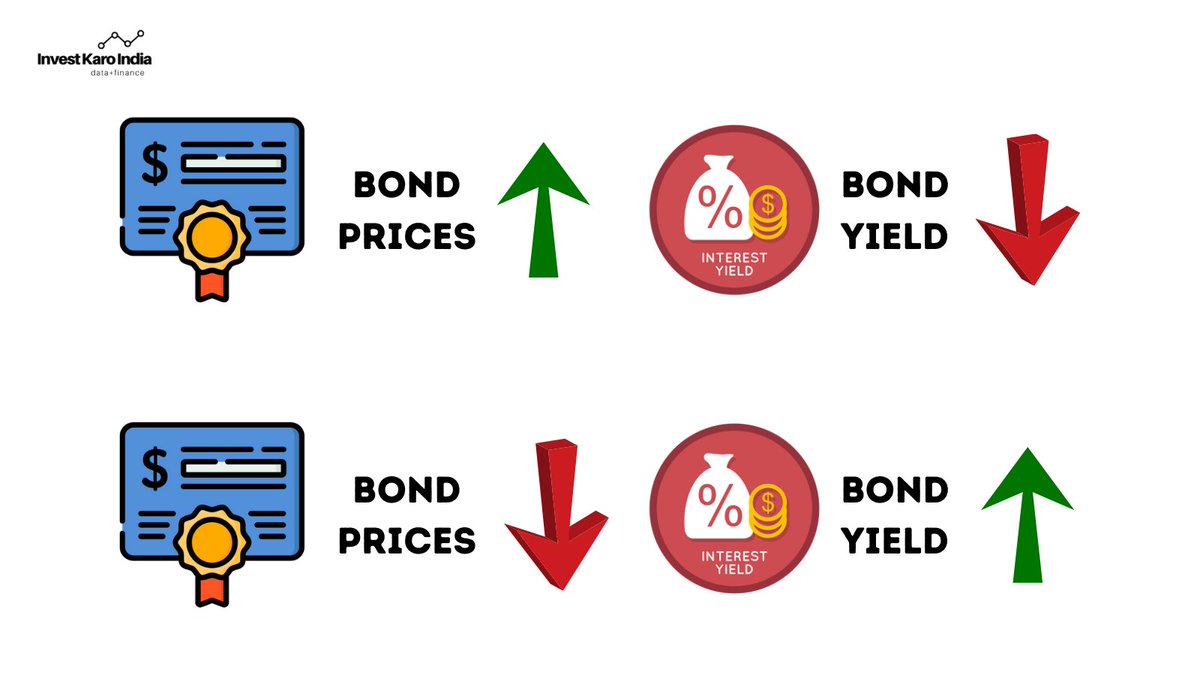

If Bond Price come down, the Yield on the bond will increase

Suppose if you buy a 10 year Govt Bond that pays 5% interest yearly for Rs 1000

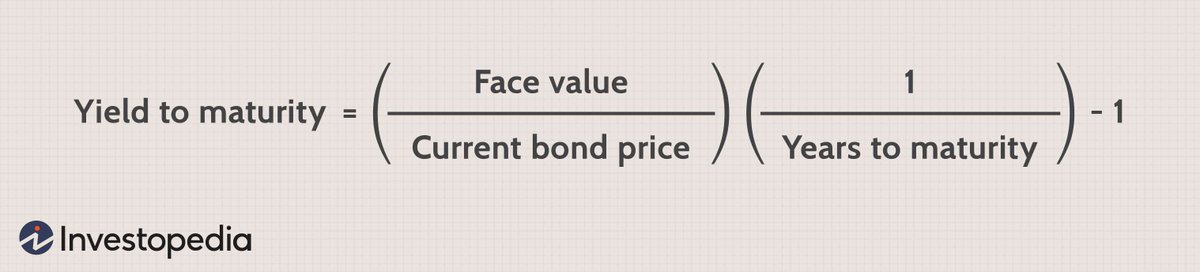

If instead of selling the bond when bond price rises to Rs 1100, you held on to your bond until its maturity date till end of 10 years

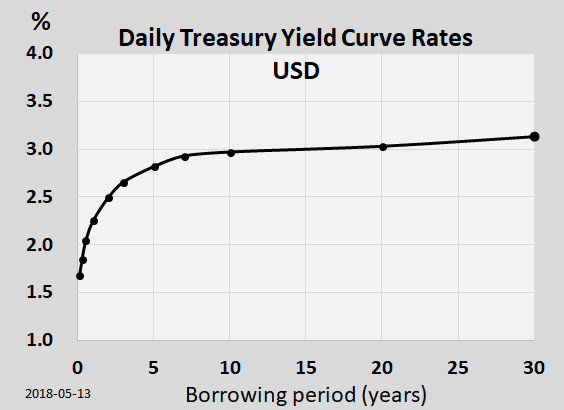

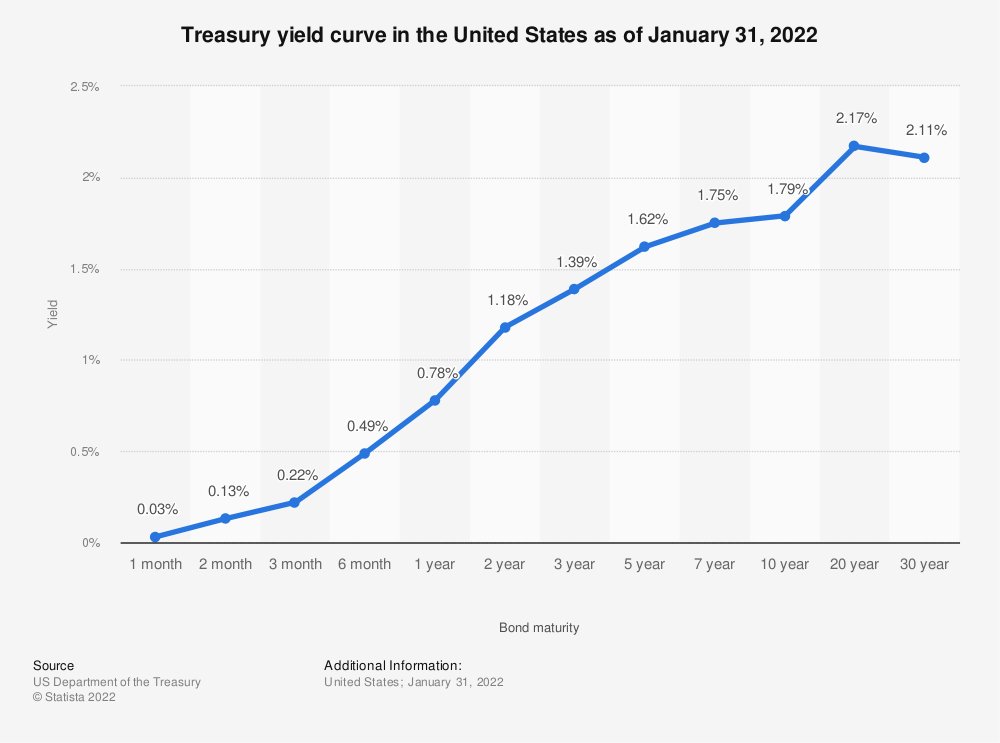

A Yield Curve is just a graphical representation of Yields of various bonds with similar credit rating but differing maturities

which depicts the Bond Yields on US Treasury Bonds for varying maturity dates ranging from 1 Month to 30 Years

Why is Yield Curve used to predict a Recession?

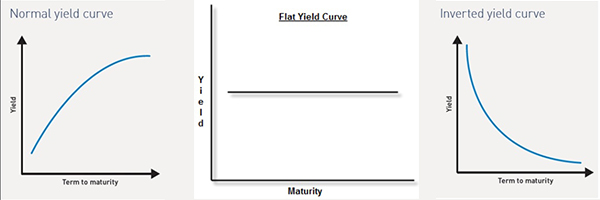

a. Upwards Sloping (Most of the Time)

b. Flat (Rare)

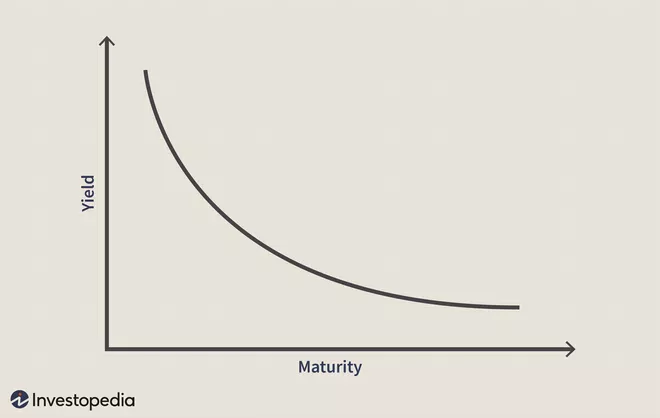

c. Inverted Yield Curve (Very Rare)

Yields on longer term bonds should be much higher compared to Yields on shorter term bonds

as

with longer term bonds you are taking more risk and hence need more interest as return

implying that near term risk in the economy is higher compared to long term

Bond Investors start dumping their short term bonds in favour for longer duration bonds

Demand for Short Term Bonds decreases, causing Bond Prices to collapse and Yields to Increase

While

Demand for Longer Term Bonds Increases, causing Bond Prices to rise and Yields to Decrease

Thus, creating the inverted Yield Curve.

Here are some of their publications on this subject

https://t.co/exRUKrkeYi

https://t.co/7dvY2PQOwE

https://t.co/iqxbeaqJg4

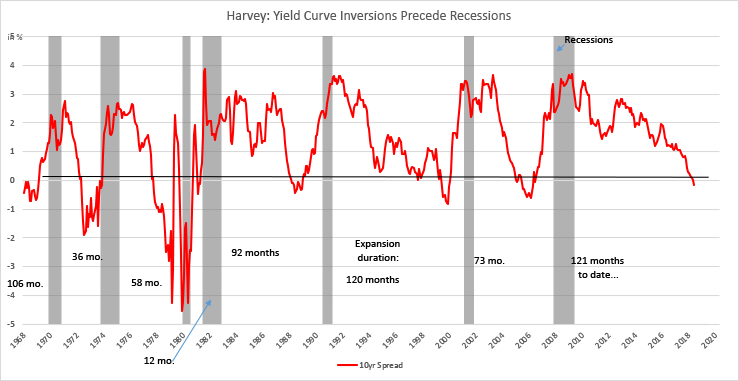

It even inverted right before the pandemic!

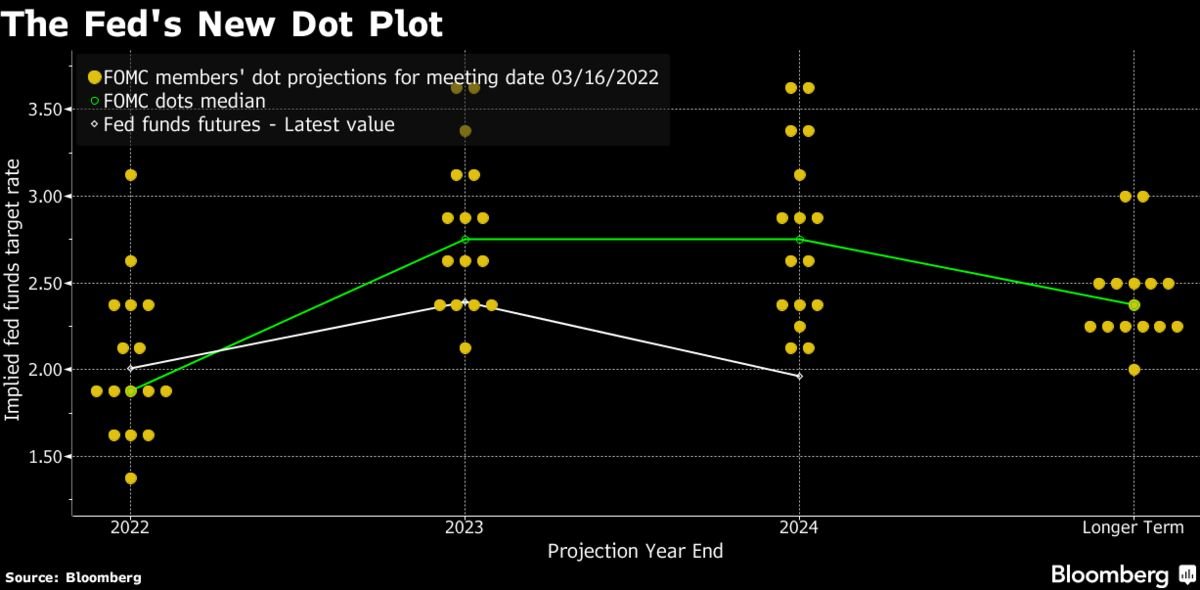

Most recently the US Treasury 2 and 10 yr Yield Curve Inverted on 29th March 2022

imply the onset of a recession anytime between end of 2022 to 2024.

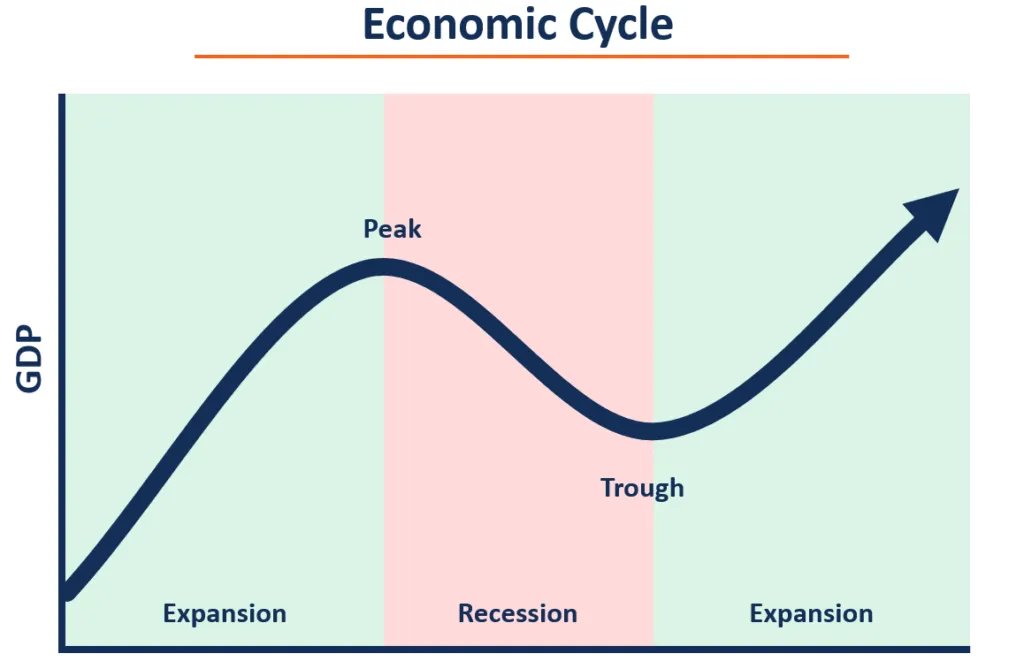

Without Recessions, we wouldn't have the opportunity to reset and economy would overheat and turn into a bubble which when popped could bring depression.

1. Slowing Economic Growth

2. High Unemployment Rate

3. High to Medium Fed Interest Rates

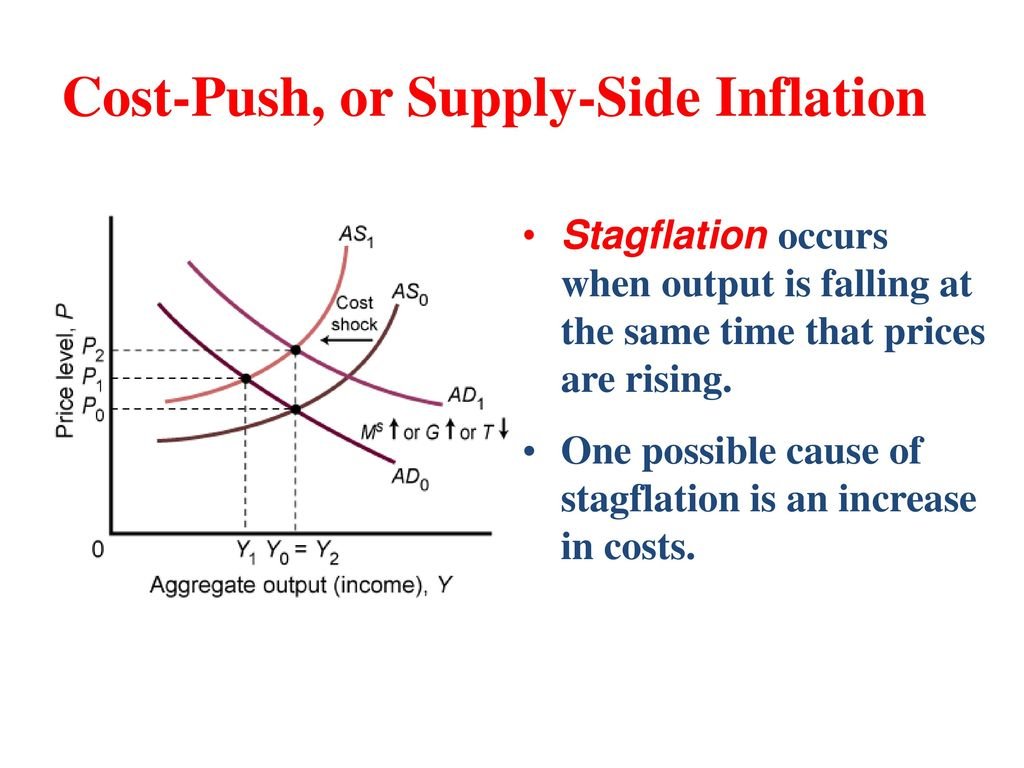

The inflation today is purely a result of supply side shortages cause by the onset of the pandemic

I don't know and I am not sure if anybody does.

I hope you've found this thread helpful. Follow me @itsTarH for more.

Please Like/Retweet the first tweet below if you can: https://t.co/2zDVPC7lus

It's the weekend!

— Tar \u26a1 (@itsTarH) April 2, 2022

Grab a cup of coffee, in this thread I will explain

1. What is a Yield Curve?

2. Why is it an important indicator of Recession?

3. Is an Economic Recession around the corner?

Lets dive right in! pic.twitter.com/7qrYbT6Scj

All my previous work, can be found here

https://t.co/LV5EyiqlCw

All my Threads so far \U0001f9f5 \U0001f447\U0001f3fc

— Tar \u26a1 (@itsTarH) June 5, 2021

https://t.co/3OwTRkY8BZ

Here is a 5 hour long webinar on Green and Renewable Energy ☀️

Lots of India, Chinese and US companies covered along with Global Demand and Supply scenario

https://t.co/rkiK2iHlS0

More from Tar ⚡

120: It's just a power exchange

250: Electricity in India won't grow

300: It just makes 4paise per trade

350: MBED will erode it's profitablilty

500: Maybe what @itsTarH said about IEX = NSE + Zerodha was right

570: Buys IEX

#JourneyOfAPessimist

250: Electricity in India won't grow

300: It just makes 4paise per trade

350: MBED will erode it's profitablilty

500: Maybe what @itsTarH said about IEX = NSE + Zerodha was right

570: Buys IEX

#JourneyOfAPessimist

Zerodha + NSE = IEX \U0001f4a1\u26a1\ufe0f

— Tar \u26a1 (@itsTarH) June 20, 2021