Prof. Damodaran is the OG.

Here is a playlist of his valuation class he teaches at NYU Stern.

The same lectures are recorded and uploaded for free for anyone to learn.

https://t.co/fraTT0gUUM

Education and Knowledge is freely available, just need to know how & where to look.

More from Tar ⚡

To see the bull case for #IEX one needs a bit of imagination on their side :)

Market always moves to the cheaper alternative, slowly at first, then all of a sudden.

Market always moves to the cheaper alternative, slowly at first, then all of a sudden.

As more and more companies look towards the ESG factors, IEX would be a potential beneficiary.

— Kharanshu Parikh (@Kharanshu) August 7, 2021

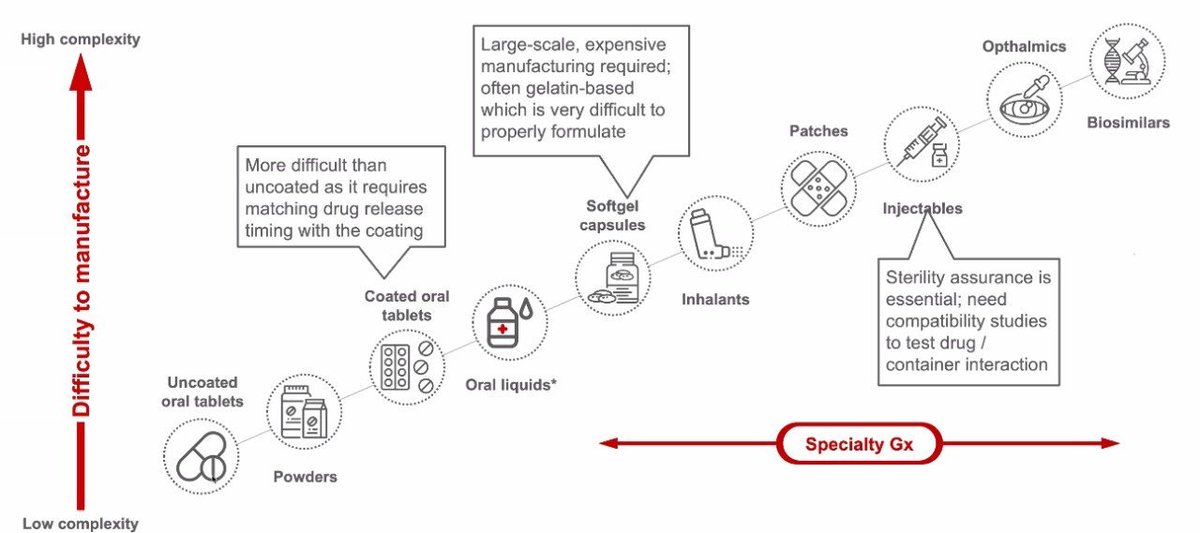

Source: Suven Pharma\u2019s Annual Report

\u2066@itsTarH\u2069 pic.twitter.com/sRdMIAMaVP

Case Study: Bharat Electronics Ltd

OPM: 23%

Free Float: <5%

QoQ continuous increase in ownership by institutions

ROE: ~20%

ROCE: ~28%

EV by EBITDA: 15

Leading developer of Indigenous Military Drones

Exports are prime focus for the company

D: Invested, not a recommendation

OPM: 23%

Free Float: <5%

QoQ continuous increase in ownership by institutions

ROE: ~20%

ROCE: ~28%

EV by EBITDA: 15

Leading developer of Indigenous Military Drones

Exports are prime focus for the company

D: Invested, not a recommendation

Lots of under owned stocks with robust financials within Defense Sector \U0001fa96\U0001f396\ufe0f

— Tar \u26a1 (@itsTarH) April 12, 2022

You don't even have to try looking very hard to find something interesting

More from Genericlearnings

Perhaps you have the idea that calling me " 1 lot Nandy" is somehow derogatory and a easy poke at me. Allow me to explain why I look at this moniker as a badge of honour

I have traded 1 lot continuously twice in my life. The first in 2003 after I blew up on my INFY trade. I traded 1 lot ACC fut consistently and made 50k in a month

The 2nd time in 2013. When I suffered continuous losses for 5-6 months due to a variety of psychological issues. Then I traded 1 lot Nifty options consistently for 3 months. After that 2 lots for next 1 month and slowly increased

I have shared these two incidents on my various interveiws and regularly share this in detail with my handholding students when I talk about trading psychology.

This logic of trading 1 lot to iron out trading issues I learnt from the interview of Anthony Saliba, who traded 1 lot in options for 6 months. BTW, Saliba was the only options trader to have been profiled on the original Market Wizards ( I read his interview and used his logic)

Sir itseems people call you as "one lot Nandy".. Is it true?

— Bittu (@nanoobittu) July 16, 2021

I have traded 1 lot continuously twice in my life. The first in 2003 after I blew up on my INFY trade. I traded 1 lot ACC fut consistently and made 50k in a month

The 2nd time in 2013. When I suffered continuous losses for 5-6 months due to a variety of psychological issues. Then I traded 1 lot Nifty options consistently for 3 months. After that 2 lots for next 1 month and slowly increased

I have shared these two incidents on my various interveiws and regularly share this in detail with my handholding students when I talk about trading psychology.

This logic of trading 1 lot to iron out trading issues I learnt from the interview of Anthony Saliba, who traded 1 lot in options for 6 months. BTW, Saliba was the only options trader to have been profiled on the original Market Wizards ( I read his interview and used his logic)